Anyone who does not admit that the Central Banks actively manage the price of gold is ignorant of the facts. If they are ignorant of the facts, they are too lazy to look for the truth. But GATA makes it easy. Robert Lambourne is a GATA consultant who scrutinizes everything published by BIS.

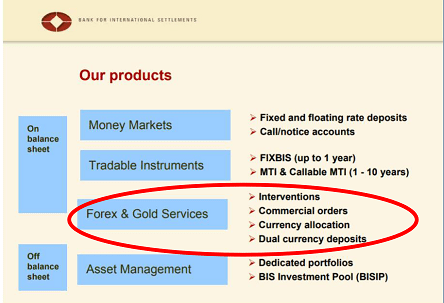

(the graphic is from a BIS presentation to Central Banks that advertised the BIS’ services)

“As far as we can determine, only one person in the world outside central banking — GATA’s consultant Robert Lambourne — reviews the BIS monthly reports and does the calculations necessary to discover what is happening. The interventions, accomplished in large part through gold swaps and leases, are not stated plainly in the BIS monthly reports, though they easily could be. The interventions are stated plainly, if obscurely, only in the bank’s annual report. But recent BIS annual reports have confirmed the stunning accuracy of Lambourne’s monthly calculations.” – Chris Powell, GATA

From Lamourne’s dissection of the latest BIS monthly report:

The BIS’ gold swaps had fallen to zero as of December 31, 2022, and reached their peak for 2023 so far of 188 tonnes as of May 31.

It remains likely that the BIS has entered these swaps on behalf of the U.S. Federal Reserve. There is no evidence to suggest that any other major central bank is actively trading this much gold, and so far in 2023 many central banks have been accumulating physical gold.

The basic transaction that the BIS is believed to undertake is to swap dollars for gold transferred from a bullion bank, then to deposit this gold in a gold sight account at a central bank, presumed to be the Fed but almost certainly being the central bank that is using the BIS to execute the gold swap on its behalf.

The basic transaction that the BIS is believed to undertake is to swap dollars for gold transferred from a bullion bank, then to deposit this gold in a gold sight account at a central bank, presumed to be the Fed but almost certainly being the central bank that is using the BIS to execute the gold swap on its behalf.

Given the recent volatility in the levels of BIS gold swaps, it seems likely that most are of short duration. Why a central bank needs the BIS to undertake gold swaps isn’t clear, but the swaps are likely connected with short-term trading needs, which could include suppressing the gold price.