The following analysis and commentary is an excerpt from the latest issue of the Mining Stock Journal. You can learn more about this newsletter here: Mining Stock Journal Information

It’s starting to look, smell and feel like a sustainable bull market may be unfolding. For the first quarter, gold rose 8.2% and silver was basically flat for the quarter but rose 15.6% in March. The mining stocks, generically using the GDX ETF as a proxy, rose 12.2%.

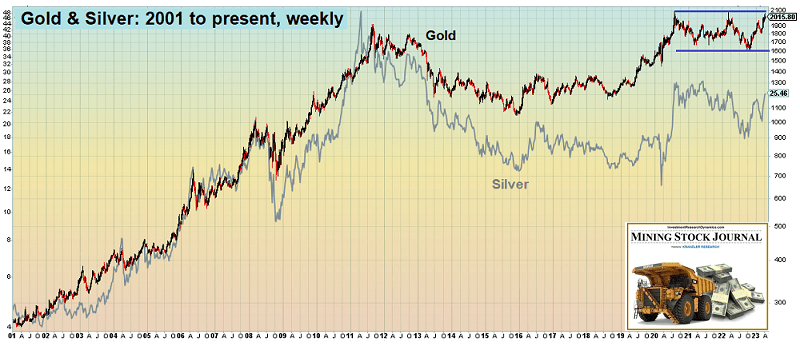

The chart above shows the price of gold and silver priced in U.S. dollars from 2001 to present. That is the chart of a secular bull market punctuated by cyclical ebbs and flows. The first bull cycle lasted from 2001 to 2011. It was followed by a bear cycle from 2011 to the end of 2015. In my view, the sector has been in a lateral “tug of war” that will be resolved by a historical move higher.

Several fundamental factors underlie the current – and my expected – performance of the precious metals sector, not the least of which is the continued massive accumulation of physical gold by non-western Central Banks (per the World Gold Council data). Eastern hemisphere Central Banks, including the CBs in countries that make up the BRICs alliance (Brazil, Russia, India, China) hoovered physical gold bars at a record pace in 2022 going back to when the records began in the 1950’s. The pace of buying continued in Q1 2023 per a recent report from the World Gold Council.

It would appear that the accumulation of gold reserves is part of a plan by the non-western Government geostrategic and economic alliances to reincorporate gold into the monetary system by using gold to back a new reserve currency that will be an alternative to the use of the dollar as the only reserve currency. Indications of this have been surfacing for a few years, but intensified and accelerated after the U.S. froze Russian dollar-based assets held in western Central Banks. In fact, earlier this month, Brazil’s President, Luiz Lula da Silva, joined Beijing in calling on “developing countries to work towards replacing the US dollar with their own currencies in international trade…” (The Financial Times).

As significant, if not more significant, after a recent trip by China’s Xi Jinpin to Saudi Arabia, where he was greeted by the Crown Prince of Saudi Arabia (Mohammed bin Salman Al Saud, or “MBS”), it appears as if China and MBS struck an agreement to start settling oil trades between the countries using the Chinese yuan. The significance can not be understated. The exclusive use of dollars to settle oil trades globally – the “petrodollar” – has been the basis of U.S. global economic dominance and the foundation of the dollar as the sole reserve currency since the early 1970’s. India has also been buying oil from the UAE and settling the trade in dirham (the UAE’s currency). Interestingly, in late March France’s Total Energy sold LNG (liquid national gas) and settled the trade using yuan.

As the world shifts away from using the dollar as a reserve currency, I believe a competing reserve currency will be used. A transition of the global monetary system away from the dollar and toward a new reserve currency is extraordinarily bullish for the price of gold and silver, particularly the price of each metal priced in dollars.

Another development that is exceptionally bullish for the precious metals sector is the emerging bank crisis in the United States and Europe. The sudden collapse of Silicon Valley Bank and Signature Bank was presented in the mainstream media as a limited bank crisis confined to regional banks. But SVB was the 16th largest U.S. and Signature was the 29th largest bank. What was particularly shocking was the suddenness and swiftness of the collapse of these two banks. The demise of these two banks drew attention away from the collapse of Credit Suisse, which was one of the largest banks in the world and a designated GSIB (global systemically important bank).

Because of the inter-connectivity of big banks globally via derivatives, GSIB accidents do not occur in isolation. I expect more big bank blow-ups will occur. But what stands out to me was the alacrity with which the Fed printed more money to bail out the uninsured depositors of SVB and Signature in an effort to prevent a run on the banks in general. While not termed “QE” or “a bailout,” that is exactly what occurred. The Fed’s balance sheet jumped in size by $400 billion over a two week period.

Similarly, the Swiss Government gave UBS a $100 billion safety net to absorb Credit Suisse. While these official monetary inventions may have temporarily stalled the onset of a bigger crisis, they invariably did not fix the underlying systemic problems. The point here is that I expect several more large banking system accidents and a correspondingly massive quantity of Central Bank money printing to prevent a western hemisphere financial system collapse. This will be extraordinarily bullish for the precious metals sector.

Along the same lines, I also expect that the Fed will be forced to pause hiking interest rates before autumn and, probabilistically, will have to start cutting the Fed funds to address the severe economic recession emerging. The Fed has yet to raise interest rates high enough to pull the negative real interest rate (Fed funds minus the rate of inflation) into positive territory. Negative rates are one of the primary drivers of the price of gold (and silver). If the Fed is forced to cut rates, I believe that the ensuing bull move in the precious metals sector will dwarf the bull move in the sector that occurred between late 2008 and mid-2011.

The sector is extremely over-extended technically per the charts and the HGNSI. The banks have built up a big short position in gold contracts and I think the markets are going into another “risk-off” down-cycle. Hedge funds and other short-sighted traders treat paper gold/silver and mining stocks like a risk-on trade. If the big banks are unable to engineer a material pullback in the prices of gold and silver, a possibility that not beyond consideration, the signal sent to the market could trigger a move in the sector that takes everyone, even the staunchest of long-time gold bugs, by surprise.