I wrote the following commentary for Kinesis Money – you can read the source article here: Kinesis Money Blog

I argue that a new bull cycle for the precious metals sector began in late October 2022 – when it appears that gold and silver had bottomed and turned higher, after a downtrend since August 2020.

I believe that the precious metals sector will soon begin a cyclical, sustained move higher that will see gold surpass $2,000 and silver trade up to $30, for starters.

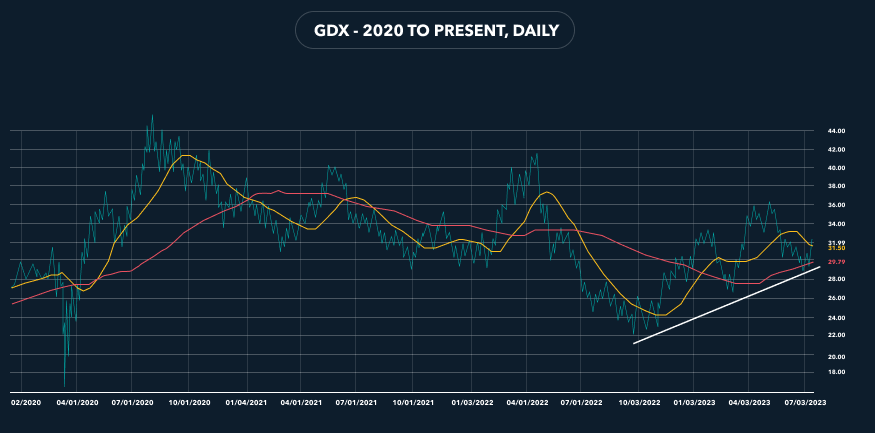

The chart above shows the GDX mining stock ETF from the beginning of 2020 to the present. GDX does well to illustrate my point because often stocks will begin to price in an event or trend in the market ahead of the other areas in the financial markets.

Since hitting that post-August 2020 low at the end of October 2022, the mining stocks have traded in a steady uptrend for nearly nine months in a trend pattern characterised by higher highs and higher lows – a pattern that often occurs when a market is a bull trend.

This conclusion is based on several signals that have marked the bottom of similar painful cyclical precious metals sector declines in the past. In no particular order of significance, the indicators to which I refer include sentiment, trading action, demand for physical silver and gold and, last but not least, fundamentals.

As precious metals sector investors understand, investor sentiment toward the precious metals sector could affectionately be described as approaching the bottom of the Mariana Trench (the lowest point on the ocean floor). Last week, the Hulbert Gold Newsletter Sentiment Index hit one of its most negative readings in the last several years. This index has been a remarkably reliable contrarian indicator, meaning that extreme negative readings are associated with impending large moves higher in the sector.

Retail investor investing patterns also tend to be another accurate contrarian signal. Precious metals mining stock funds have been experiencing large outflows, likely primarily coming from retail investors. Based on historical patterns, the majority of retail investors are prone to chasing momentum in either direction but don’t usually introduce their cash until the late stages of a move.

Based on the flow of funds data, over the past four weeks, a record amount of retail funds for that time period has flooded into tech funds, individual tech stocks and single-stock call options. Conversely, volume in the gold and silver mining stocks until the last week or so has been quite low, particularly in the highly speculative, micro-cap junior exploration stocks.

The demand for physical gold and silver has been well-publicised and the record rate of gold buying in 2022 by eastern hemisphere central banks has continued into 2023. As reported in Bloomberg, according to the World Gold Council, China “officially” increased its gold holdings for the eighth month in a row in June.

These central banks are increasingly repatriating their gold bars to further ensure the security of their gold holdings. This is bullish because it removes the repatriated bars from the LBMA and COMEX custodial vaults, which thereby reduces the visible supply of gold. This, in turn, reduces the amount of bars available for hypothecation activities like lending and leasing.

From the Reuters article:

“One central bank, quoted anonymously, said: ‘We did have it (gold) held in London… but now we’ve transferred it back to own country to hold as a safe haven asset and to keep it safe.’”

The fundamentals that support higher valuation levels for gold, silver and mining stocks are as strong, if not stronger than at any time in the last 22 years. Despite the Fed’s “hawkish” rhetoric, real interest rates are still negative, if you use a realistic measure for inflation rather than the “highly massaged” government CPI.

The Fed has made very little progress in reducing its balance sheet. Also, the amount of debt issued and outstanding by the U.S. government, while existentially beyond management, is about to go much higher. This is highly bearish for the dollar and bullish for precious metals.

The US dollar has declined 13% from its recent high in September 2022. Since the beginning of July, the dollar appears to have gone into free fall. This could reflect the fact that the market is anticipating a “pivot” by the Fed on its rhetorically hawkish monetary policy.

This also reflects the anticipation that the Fed could start printing more money to support the financial system. This is primarily why I believe that the precious metals sector has begun a new bull move in which gold is poised to make a run for a new all-time high and silver could run up to over $30.