The financial media appear to once again be leading the public astray about the Yield Curve situation

The media pounded and pounded the yield curve’s inversion as a signal about an imminent economic recession. We have noted again and again that it is not the yield curve flattening to inversion that brings the pain, but instead, the subsequent yield curve steepener and un-inversion. From the September 17 post on the matter:

It is funny how the media are not making any sort of deal about this [un-inversion] after sounding all kinds of recession alarms in 2022 and 2023 as the inversion took hold and dug deep. Now they go quiet? Well yes, they are the media, after all. They are not going to get you a straight deal, market management wise. They harvest eyeballs for ad revenue and for whatever reason, the “INVERSION” tout is the eyeball grabber.

The straight deal is that a curve flattening to inversion tends to run with an economic boom and a steepener tends to trigger an economic bust

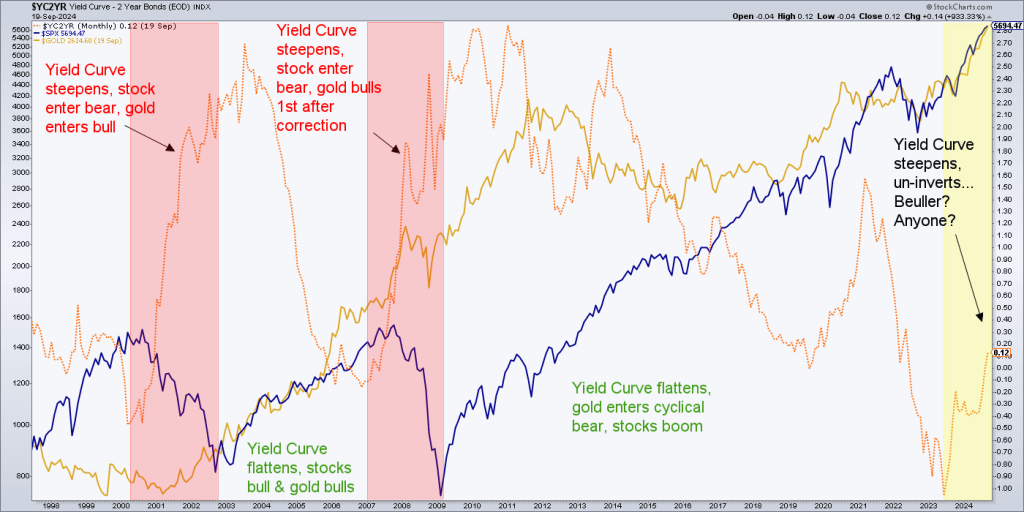

The long-term chart below advises that the last two real bear markets in stocks, in 2000 and 2007 (2020 was not a bear market, it was a flash crash and recovery, and 2022 was not a bear market, it was a correction within a long-term uptrend), were attended by a steepening 10-2yr yield curve (red shaded areas on the chart). In each case the bear markets bottomed out months before the yield curve steepeners topped. But we are far away from managing that situation. The steepener is only a baby, as yet.

Before getting to the current situation in the 10-2yr yield curve, let’s take another snip from the post linked above to explain why the 10yr-3mo. yield curve has lagged the 10-2yr:

First I’d like to clear something up after a mild debate with a fund manager friend of mine. He questioned why I don’t use the 10yr and T-bill (a tighter Fed Funds proxy) rather than the 10 and the 2yr. My answer is that we are looking for forward direction, and so I want to view the thing (2yr yield) that is leading the T-bill (and thus, the Fed), not the tardy Fed itself. I want to see where the Fed is being compelled to go, not where it has squatted to this point. Look no further than the interminable “transitory inflation” stance the Fed asked us to buy into before they finally got off their dovish ass and began to fight the inflation problem they primarily enabled, if not outright manufactured.

In my strong opinion, the 10-2yr matters more than the 10yr-3mo. because it is the guide to the latter, which is subject to the Fed’s decisions on the timing (and my tin foil hat tells me, their potential effect on certain political outcomes) of its rate moves.

Moving on, I find this mainstream financial media headline to be ridiculous (and ridicule it I shall):

Bond market ‘yield curve’ returns to normal from inverted state that had raised recession fears

From the article:

The relationship between the 10- and 2-year Treasury yield briefly normalized Wednesday, reversing a classic recession indicator.

Are you kidding me, MSfM? Well, right there is the wrong-headed pap that the public will be dining on in the interim to the next bear market. A more accurate quote would be “The relationship between the 10 and 2 un-inverted, and continued steepening, signaling an oncoming recession.”

This long-term view of the 10-2yr, the S&P 500 (blue) and gold carries several messages, as bulleted below.

- Using the 2000 and 2007 market tops as examples, the bear would begin either concurrent with, or many months after an inversion bottoms, turns up and un-inverts. T-minus…

- The 2020-2021 steepener and bull phase in stocks were different. They featured an inflationary steepener (as opposed to the deflationary steepeners of the two major bear markets), as monetary and fiscal policymakers’ inflationary operations of 2020 kicked in to temporarily bolster the economy.

- The above happens to fit well with our ongoing macro view for risk-on, cyclical markets: “to or through the election.”

- Where gold is concerned, a steepening yield curve is historically beneficial, as in the 2000-2003 phase and more often than not, from 2007 to 2011. This is in line with several other of our indicators used in NFTRH, showing an improving macro backdrop for gold and especially its miners, which would leverage gold’s standing among other assets/markets.

- However… the main caveat for gold is and has been its positive correlation with stocks, especially since 2022.

- The hope for gold bugs would be that gold is righteous with the yield curve, and is looking ahead while stocks are off-sides.

- The dashed hope for gold bugs – at least on an interim basis – would be that gold would be punched in the mouth for its macro correlation when the cyclical, risk-on markets take it on the chin.

Bottom Line

In keeping with a US presidential election year filled with disinformation (on both sides), desperation and emotion, the financial media are keeping the public hopped up on its own brand if disinformation. This dovetails well with our plan for the broad asset market party (of which gold is an attendee) to run “to or through the election.”

My tin foil hat instructs me to at least consider the latest lie (and folks, this is no partisan commenter here; both sides have been lying their asses off this contentious election year that is for all the marbles).

Historically speaking, the last two real, legitimate stock bear markets and economic busts began after the 10-2yr yield curve had finished flattening at inversion, un-inverted and turned up to a clear steepening trend. This has been much less destructive and often beneficial to gold’s price.

Regardless of whatever degree of pressure comes upon the gold price when broad markets top out, its ratio to those markets should go bullish, and that will signal a macro that continues to improve for the gold mining industry.