Calibre Mining continues to execute on its hub-and-spoke strategy through successful exploration results. The company released new drill intercepts from its on-going 80,000m resource infill, expansion and exploration drilling programs at the Limon and Libertad mines. Highlights include:

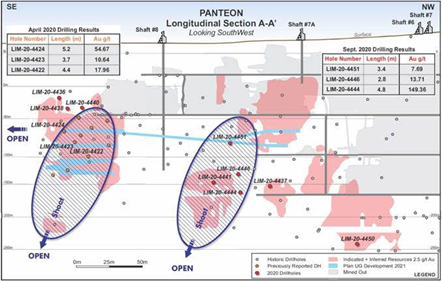

- The highest-grade intercept reported to date at the Panteon deposit of 4.80m @ 149.4 g/t Au.

- Drilling at Panteon has outlined two distinct, high-grade ore-shoots that are open along strike and to depth. See April 9th 2020 drill results, highlights include: 5.2m @ 54.67 g/t Au, 10.8m @ 17.77 g/t Au, and 4.4m @ 17.96 g/t Au, in addition to the drill hole from this news release.

- There are 14 drills active on Calibre projects, and the company expected to drill 12,000m before the end of the year.

- The company has only released 10% of its expected drill assays from this drill program.

- The company continues underground development, putting the company in position to begin mining from the Panteon deposit in Q1 2021.

- 2021 should mark an important year for production growth and greatly increased profitability as Panteon contributes high-grade mill feed as well as production commencing from the recently permitted Norte open-pit deposit, also in Q1 2021.

Calibre continues to remain cheap but this should change in 2021 as it will illustrate the success (thus-far) of its hub-and-spoke strategy. Beyond 2021, I fully expect the company to continue to grow production until is can feed both its mills at or near capacity. There are other catalysts on the horizon such as the reporting of assays from the on-going drill program.

Disclosure: Myself and other Goldseek employees’ own shares of Calibre.