Gold may not have managed to sustain the record high from the start of the week but it has remained firmly above $2,000. At the time of writing it is trading just below $2,050, a key resistance level. The price has shown very little interest in the usually much anticipated US jobs report, which came in below expectations. Nor did it indicate much interest in the Bank of Canada’s interest rate decision, on Wednesday.

One wonders if an increasing number of gold market stakeholders are beginning to take a longer-term view and realising that central bank announcements or economic data can do very little to dispel the growing concerns that the current state of play for both global debt and global stability is no longer sustainable.

If you’re wondering what caused Monday morning’s pop-up in gold, or what the rest of the month may hold then have a look at our quick chat with technical analyst Chris Vermeulen.

Gold Outlook 2024

The World Gold Council has today released its much revered Gold Outlook 2024 report. As we have seen in 2023 the WGC expects central bank interest rate decisions and global economic performance to be the main focus for the gold market and therefore (based on historical performance) we may see ‘a flat to slightly weaker’ gold price. However, the WGC points out that there are two very significant factors which may drive gold higher.

World War III?

The first of these is ‘Geopolitical risks’ which ‘abound’, according to the WGC. And we couldn’t agree more. Looking at the map of the world today is akin to looking at a series of interconnected cinder kegs, each of which could represent a push towards a new era of conflict and a fight to be the next superpower. Battles which had previously calmed down or at least not drawn the attention of the global media seem to have now reemerged. Governments are scrambling to protect their own interests whilst seeking out alliances who of course have their own agendas.

Chris Vermeulen on Gold: This Is A Super Cycle At Play

The surprise talks between Putin and Saudi Arabia’s Crown Prince Mohammed bin Salman reportedly involved discussions regarding OPEC+, cooperation over oil and the situation in the Middle East. This comes a week after OPEC+announced it would be cutting supply and one day after China’s oil imports were revealed to be down for another month.

Meanwhile, the US continues to support the fight against Russia, by Ukraine, and the battle against Hamas by Israel. The US and her allies’ allegiance to Israel and Ukraine is pushing the Middle East and Russia closer together. All whilst the West watches on and tries to fight its own moral and economic battles.

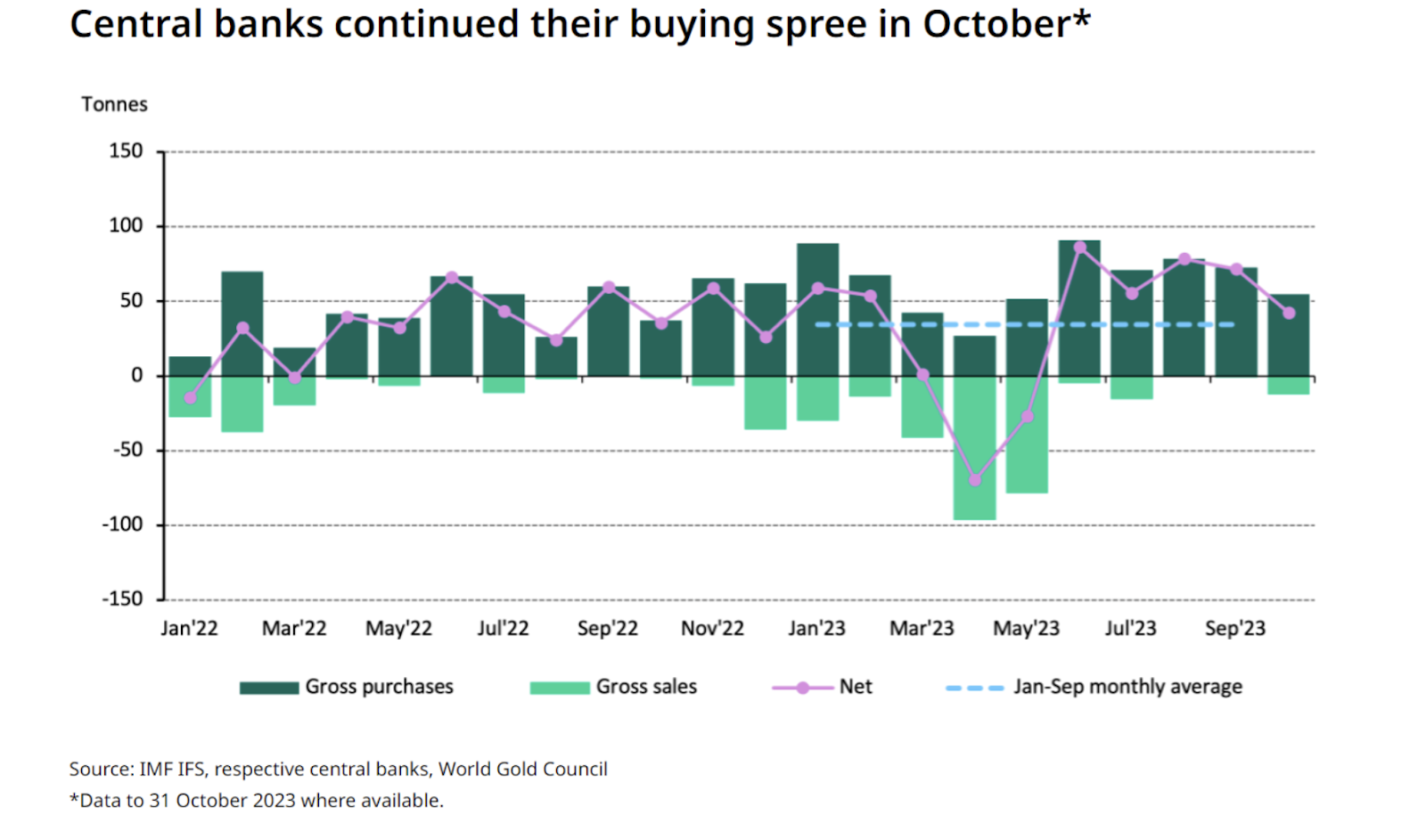

Fact Two: Central Banks Can’t Get Enough Gold

The second factor which will continue to have a positive effect on the price of gold is central bank demand. In October alone central banks added a net total of 42 tonnes of gold, with the People’s Bank of China being the biggest buyer. Year-to-date gold buying heavily outweighs sales, a trend that the WGC expects to continue for the rest of the quarter. Overall gold purchases by central banks in 2023 is expected to have added a 10% boost to the yellow metal’s price, according to the latest Outlook report.

Headline space has also been taken up by news of Poland’s gold purchases. The central bank now holds around 300t of gold. It is believed to be looking to add gold to its reserves to bring its gold-to-GDP ratio in line with that of other eurozone members.

A recession off the table?

Geopolitics and central bank buying aside, we do still have the matter of the global economy to contend with, specifically the United States. US government debt now represents more than one-third of total global government debt which means all eyes are on the country to see just how its economy is doing and how it can service the debt.

For the majority of 2023 markets have been highly sensitive to moves being taken by the Fed. So far the FOMC has impressed in its management of inflation and avoiding a recession. Consensus seems to be that a recession will be avoided, instead, Jay Powell has steered the country towards a ‘soft landing’. But, this is not guaranteed and it does not mean that the impact of higher interest rates has been fully realised.

So whilst soft landings have not always been good news for the gold price, we would posit that the latent impact of increased rates on the US economy combined with geopolitical events and central bank buying will set gold up for a stellar 2024.

GOLD PRICES ( AM/ PM LBMA FIX– USD, GBP & EUR )

|

USD $ |

USD $ |

GBP £ |

GBP £ |

EUR € |

EUR € |

|

|

06-12-2023 |

2021.40 |

2026.40 |

1603.98 |

1609.57 |

1873.84 |

1877.66 |

|

05-12-2023 |

2023.45 |

2023.35 |

1601.56 |

1600.27 |

1867.04 |

1867.75 |

|

04-12-2023 |

2066.95 |

2049.05 |

1632.68 |

1622.03 |

1902.83 |

1890.45 |

|

01-12-2023 |

2044.55 |

2045.40 |

1615.19 |

1618.53 |

1875.87 |

1883.81 |

|

30-11-2023 |

2037.85 |

2035.45 |

1611.94 |

1611.67 |

1866.47 |

1865.49 |

|

29-11-2023 |

2037.60 |

2046.95 |

1606.04 |

1611.15 |

1857.27 |

1863.75 |

|

28-11-2023 |

2014.00 |

2025.65 |

1593.68 |

1601.07 |

1838.98 |

1845.37 |

|

27-11-2023 |

2011.70 |

2013.70 |

1595.08 |

1595.45 |

1837.29 |

1841.93 |

|

24-11-2023 |

1995.20 |

2000.85 |

1588.18 |

1587.87 |

1829.00 |

1829.38 |

|

23-11-2023 |

1992.60 |

1992.85 |

1588.10 |

1590.10 |

1825.02 |

1828.64 |

|

22-11-2023 |

1999.90 |

1997.55 |

1596.72 |

1601.84 |

1834.91 |

1839.34 |

Buy gold coins and bars and store them in the safest vaults in Switzerland, London or Singapore with GoldCore.

Learn why Switzerland remains a safe-haven jurisdiction for owning precious metals. Access Our Most Popular Guide, the Essential Guide to Storing Gold in Switzerland here

Receive Our Award Winning Market Updates In Your Inbox – Sign Up Here