More manufacturing will boost the demand for copper. Jeff Currie noted that of all metals, copper has the most scope for gains.

Robert Friedland, the billionaire founder of Ivanhoe Mines, agrees, forecasting the base metal will hit $9,500 a tonne this year, up from about $8,400 currently. His bullish prediction is based on lower interest rates and a ramp-up in demand from China.

Peru, which accounts for 10% of world copper supply, has been racked by protests since its former president, Pedro Castillo, was ousted a year ago.

A strike is currently underway at the Las Bambas mine owned by China’s MMG Ltd.

At the same time, Panama’s top court ruled that First Quantum Minerals’ contract to operate the Cobre Panama mine is unconstitutional. The government then ordered First Quantum to end operations at its $10-billion copper mine, which has only been operating for four years.

Between those two mines, the copper industry has lost nearly 600,000 tonnes of production.

Friedland told Bloomberg TV that, contrary to consensus thinking, China has not slowed its copper consumption. In fact, the country set a record in 2023, importing 27.54 million tons.

“Everybody knows about the weak real estate market in China… but military demand, national security demand, [and] demand for militarization is very high,” the mining tycoon said.

Reuters reported recently that the country’s property sector is showing signs of recovery, including new home prices rising and government land sales turning positive after nearly two years. Nikkei Asia said China’s move to pump about a trillion yuan (USD$140 billion) will act as a further catalyst, boosting copper demand.

“So, really, this is like a power keg ready to explode as soon as the Fed cuts in the second half,” Friedland said separately.

Goldman Sachs reported the shutdown of Cobre Panama last year, combined with lower grades in Chile, has left the copper market prematurely tight. The influential bank is calling for $9,000 a tonne this year. Truth is, today’s copper price is too low for new mines to be economical. Incentive pricing in the copper industry is considered to be US$11,000 a tonne — much higher than the current ~$8,200/t. Friedland says even $11,000 is too low to incentivize new mines. For that, the market needs $15,000, he said.

From a 2021 report by Goldman Sachs titled ‘Copper is the new oil’ encapsulates the situation:

Copper on a necessary path to $15,000. To capture the precise dynamics of this process we construct long-run models of scrap supply and substitution, as well as extend our balance out to 2030. The immediate conclusion is that current copper prices ($9,000/t) are too low to prevent a near-term risk of inventory depletion, while our current long-term copper ($8,200/t) is not high enough to incentivise enough greenfield projects to solve the long-term gap. If copper remains at $9,000/t through the next two years, then we estimate the resultant deficits would generate a depletion of market inventories by early 2023. Based on our scrap and demand modelling, we believe that the most probable path for copper price from here – that both avoids depletion risk and as well as a sharp surplus swing – is to trend into the mid-teens by mid-decade.

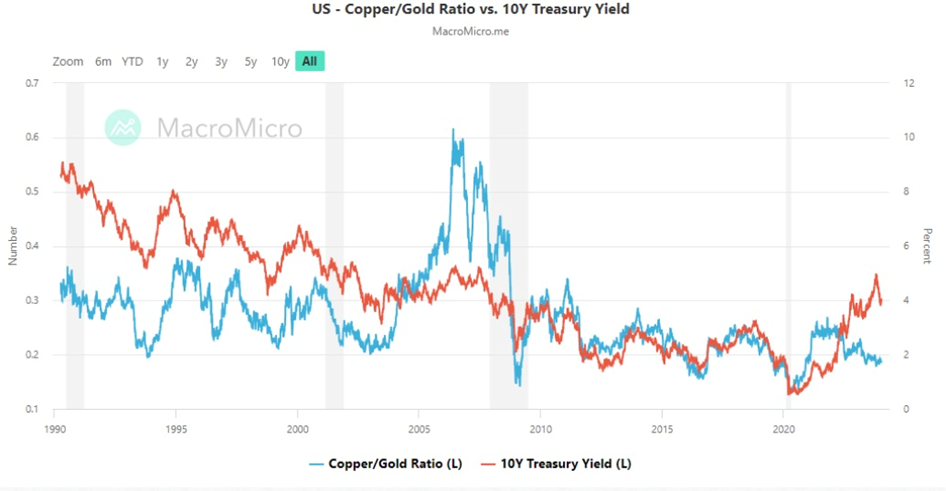

One way to make an educated guess as to the direction of the copper price is to look at the copper-gold ratio. To find the ratio, simply divide the price of a pound of copper by the price of an ounce of gold. While some prefer to calculate it on an ounce-vs.-ounce basis, the absolute value of the ratio is not the primary focus. What truly matters is the direction of the ratio and its divergence or convergence with Treasury yields. The current ratio is 0.0019, which is meaningless unless we know the direction it’s taking.

We can see that in the chart below, re-printed by Schiff Gold. The copper-gold ratio is a key indicator for the 10-year Treasury yield. The two variables are graphed on the chart. The ratio gives insight into the market’s risk appetite versus the perceived safety of Treasuries.

Historically, when the copper-gold ratio and the 10-year yield diverge, the 10-year tends to follow the ratio. For example in the third quarter of 2022, yields moved higher while the copper-gold ratio moved lower.

This trend continued in 2023, with the current divergence implying a potentially significant downward move in Treasury yields within the next six to 12 months, according to Schiff Gold.

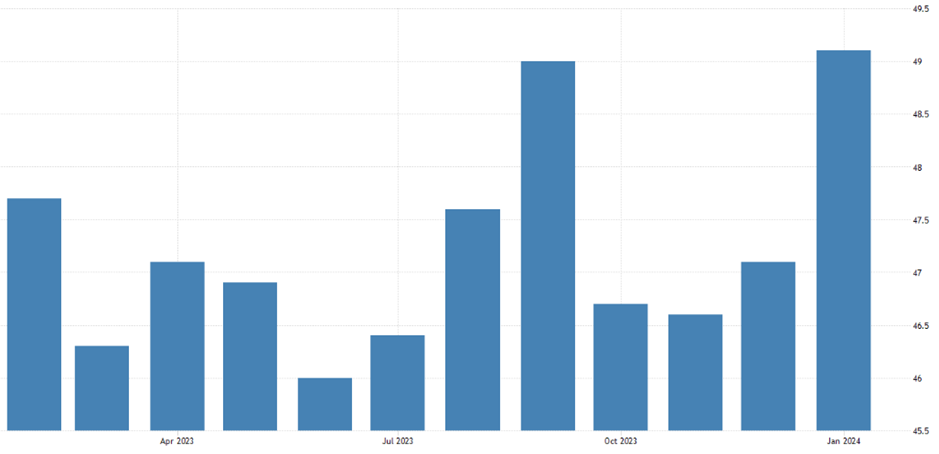

“The Li Keqiang index dominates China’s official GDP in its importance to commodity and currency investors. The official growth rate of China is of intense interest to economists and investors worldwide. The gross domestic product of the world’s second largest economy is also subject to a certain degree of skepticism. Observers ponder over its unusual stability and unfailing ability to fall within the consensus estimate. Among the skeptics is none other than Li Keqiang, the Premier of the People’s Republic of China. His remarks to a U.S. diplomat a decade ago describing the official GDP as “man-made,” inspired The Economist to create an index of his three preferred measures of economic growth in China that now bears his name: the Li Keqiang index.

The index, which comprises the annual growth rate of outstanding bank loans (40%), electricity consumption (40%) and rail freight (20%), shows a significantly more volatile trajectory for China’s growth than the official GDP.

The most important point, however, is that copper prices demonstrate a much higher correlation to the Li Keqiang index (as much as +0.55, four quarters, or one year, later) than it does with China’s official GDP. The latter achieves a peak correlation of only around 0.25, with a lag of 1-3 quarters.”

Let’s take a look at Li Keqiang’s three preferred preferred measures of growth:

New bank loans in China jumped by more than expected to an all-time high in January, as the central bank moved to shore up the sputtering economy, reinforcing expectations for more stimulus in the coming months. January lending more than quadrupled from December’s 1.17 trillion and exceeded the previous record of 4.9 trillion yuan in the same month a year earlier.

China had a total electricity consumption of around 9’220 terawatt hours in 2023. This was a notable increase compared to the previous year, when consumption amounted to approximately 8,640 terawatt hours.

In the year 2023, the China-Europe freight train has reached 17,000 trips, transporting 1.9 million TEUs, marking a notable increase of 6% and 18% year-on-year, as per the statistics released by the China State Railway Group.

More precise data from China Railway Container Transport (CRCT) reveals that there were 17,523 trips and 1,901,949 TEUs in 2023. Among these, 9,343 trips were westbound, while 8,180 trips were designated for eastbound transportation.

A couple of factors identified by us at AOTH indicate that 2024 will be much better for copper, with the metal potentially knocking on the door of $4 a pound or higher. Most important is supply failing to keep up with demand. The second factor is a weakening of the US dollar if market expectations of monetary easing come to pass.

If the Fed cuts rates, the dollar will weaken, as it has done in the past, and will do so again.

AOTH Top Metals of 2024 Part 1 — Copper

Benchmark Mineral Intelligence (BMI) forecasts global copper consumption to grow 3.5% to 28 million tonnes in 2024, and for demand to increase from 27 million tonnes in 2023 to 38 million tonnes in 2032, averaging 3.9% yearly growth.

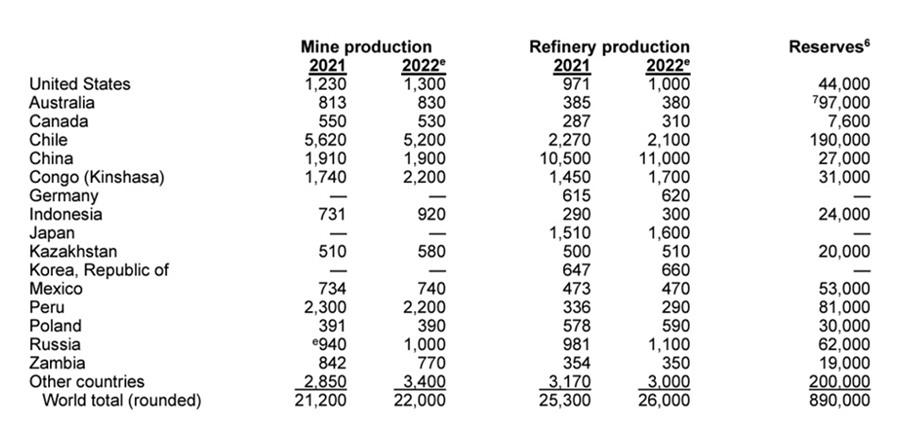

Yet, the US Geological Survey reports supply from copper mines in 2022 amounted to only 22 million tonnes. The 2023 figures aren’t in yet.

Chile is the world’s largest copper producer, outputting 5.2 million tonnes in 2022 according to the USGS. The country also has the biggest copper-mining company, state-owned Codelco.

Bloomberg wrote that Codelco’s production in 2023 was the lowest in 25 years, following a series of setbacks at projects and mines that exacerbated the impact of declining ore quality after decades of underinvestment.

Production for the last three months of 2023 was 358,000 tonnes, less than the 384,000 tonnes produced in the fourth quarter of 2022 alone. Full-year production was 1.324 million tons.

Chile’s copper output has been dented by a long-running drought in the country’s arid north. Cochilco estimates the use of desalination at mines to increase 156% through 2030, with 90% of the desalinated seawater used for copper processing.

Neighboring Peru, which accounts for 10% of world copper supply, has been racked by protests since its former president was ousted in 2022. In November, a strike at Las Bambas, a copper mine owned by China’s MMG Ltd., threatened ~250,000 tonnes of annual production.

Last year 400,000 tonnes of global copper production was lost when the Panamanian government abruptly ordered First Quantum Minerals to end operations at Cobre Panama.

Goldman Sachs, via Oilprice.com, has said it predicts a deficit of over half a million tonnes in 2024 due to mining disruptions. “The supply cuts reinforce our view that the copper market is entering a period of much clearer tightening,” analysts at the bank wrote.

Major copper producer Anglo American plans to reduce output in 2024 and 2025 to cut costs.

Some of the world’s largest mining companies, market analysis firms and banks are warning that by 2025, a massive shortfall will emerge for copper, which is now the world’s most critical metal due to its essential role in the green economy.

(On July 31, 2023, the US Department of Energy officially put copper on its critical materials list, marking the first time a US government agency has included copper on such a list, following the examples set by the EU, China, Canada, and other major economies.)

The deficit will be so large, The Financial Post stated, that it could hold back global growth, stoke inflation by raising manufacturing costs, and throw global climate goals off course.

To achieve net-zero emissions targets, annual copper demand is likely to double to 50 million tonnes by 2035, according to a study by S&P Global.

Simply put, electrification doesn’t happen without copper, the heartbeat of the global energy economy.

Along with the usual applications in construction wiring and plumbing, transportation, power transmission and communications, there is now added demand for copper in electric vehicles, EV charging stations, and renewable energy systems.

How much red metal actually becomes available is seriously in doubt, as we have outlined above. And China, THE player in demand, seems like its going to continue it’s record copper demand in 2024.