I started off this weekend’s Deeper Dive with the following summary of stock-and-bond-market lunacy:

This week saw a tiny drop in CPI that stock and bond markets instantly took to be solid evidence that inflation was done rising for 2024. It took them almost half a year to accept repeated evidence that inflation was rising and, therefore, start to price out Fed rate cuts; and they completely ignored half a year of evidence before that, which presented indicators that pressure beneath the surface was rising; however, it only took one report this week to convince them that inflation was done rising and, so, off to the races!

Pardon me, then, if I’m a little slow to take a single report of a minute dip in CPI as enough to say the rise in inflation is finished. (I’m sure that even the Fed won’t take it that way, though Powell continues to hope that this year’s resurgence in inflation is transitory, while studiously avoiding that particular word by calling it “just a bump.

And in the headlines below, we read the Fed is already pushing back on the market’s enthusiastic leap into thinking rate cuts are on their way by September, and the market’s enthusiasm may already shrinking.

The post-CPI jubilation had clearly begun to wane at the end of last week as a number of Fed speakers took turns watering down the proverbial punch bowl. Mester, Williams and Barkin all talked down the prospects for rate cuts, suggesting that possibly, maybe, it might be appropriate to cut rates before the end of the year. Or it might not.

So, NO, the Fed does not see last week’s little waver in CPI the way markets, slavering for anything to run with, took it. Specifically,

Bowman (perhaps the FOMCs most hawkish member) said that progress on labour market re-balancing has slowed, the Fed is monitoring to see if policy is sufficiently restrictive, and she is willing to hike again if inflation rises….

Last week’s CPI – while welcome - was the first release in three months that didn’t surprise to the upside. After the Powell pivot late last year sparked frenzied speculation of the timing and quantum of rate cuts, it only seems wise to be a little more circumspect this time around when the data falls the Fed’s way.

The Fed is a lot more circumspect about making anything out of last week’s tiny waver in CPI than greedy markets are, as traders prove they will run with any breath of hope they get. It’s hard not to join the market when it runs relentlessly upward on nothing, but one never knows when nothing will give way.

So, I used the Deeper Dive to lay out in detail why the blip in CPI was far from being an indicator of a change in trend for inflation. (Sure, it could eventually become part of a change in trend if such minor dips keep happening, but there is no reason to think that will happen and several reasons that I laid out that make it very unlikely to happen.) For now, the rising trend for inflation remains solidly in place based on just about any chart of inflation one can present, and I presented several.

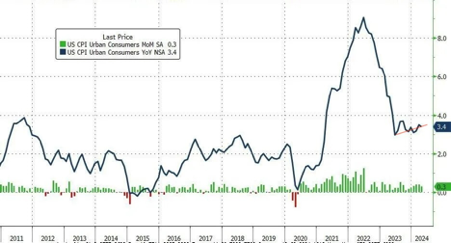

I’ll share one of those graphs here because it shows in the simplest terms how truly meaningless the dip in CPI was:

As you can almost see (if you have a magnifying glass), this dip’s bottom is clearly higher than all the bottoms of the other dips along that slowly rising trend line we’ve been on for almost a year, and it is hardly like it is the first dip since CPI started that new rising trend. In fact, it is the smallest of all the downticks since last summer. Yet, that nearly invisible dip is all it took to get markets to center their bets on a Fed rate cut in September. (Ridiculously out of touch with reality.)

While the blue line is YoY, so it’s not going to show as much as MoM when a change begins, you can see that even the green bars for MoM changes show the last dip as being a higher rate of inflation than about half of the other bars over the past year. So, markets made much adieu about nothing, and the rest of my Deeper Dive lays out many reasons we can expect more upward pressure in most measures, other than housing for now, but then with substantial upward pressure from housing about six months down the road due to the lag at which actual housing price changes work their way into CPI reporting.

And, if you look at super core services CPI, which takes out housing as well as energy and food (the Fed’s favorite metric to watch), the picture looks the worst of all the graphs. Instead of a dip, you see another rise in April, which is certainly not what the Fed wants to see in the metric it considers most reliable and stable.

As Wolf Richter wrote,

Core services CPI – which accounts for about 60% of total CPI – increased by 5.3% year-over-year in April, roughly the same hot pace for the seventh month in a row, and seems to have gotten stuck there

In fact, this report for April put in the biggest increase of all them!

The Deeper Dive shows clearly why housing inflation is likely to fall in the short term but will then shoot up over the longer term. It reminds everyone that soaring PPI will soon feed into CPI, and it shows how the Fed has undone its tightening with Powell’s dovish tones to such extent that the market’s reduction in financial tightening alone is almost certain to push inflation back up. It mentions other forces as well. Powell has done this to help his friend J. Yellen out at the Treasury because the government could not manage its debt without Powell pretending to stay tight with policy while loosening everything with his lips.

While Powell has been hoping the past year of rising inflation would turn out to be a blip, the only “blip” was the slight return to falling inflation in April. His new hope that inflation’s extended rise is transitory is not going to end well for any of us; however, it made markets happy enough to loosen actual financial conditions even more, almost guaranteeing inflation gets worse.

That’s why the article starts with a picture showing people pushing huge bags of coins up a hill like Sisyphus and his rock, only the coins aren’t gold as referenced in that illustration from Dante’s Inferno. That’s the problem. They're US government coins, and you’re going to have to move bigger and bigger bags of them just to buy your monthly groceries if Powell’s lips don’t stop flapping so loosely. (No wonder gold is on a tear, and, no, I haven’t got an ounce to sell you.) By trying to help Janet Yellen, Powell is now seriously risking a major new rise in inflation (just like he did with this game of pretend the back in 2021).