The ancient Greeks had a word κάθαρσις, which in English we now spell as “catharsis,” although it’s pronounced basically the same. It originally referred to purifying religious ceremonies, medical treatments, and so on.

Aristotle was the first we know to have used the word in a non-physical sense. He compared the emotions felt by spectators of Greek tragedy to a bodily catharsis. Tension builds until the audience feels the same intense emotions actors portray on stage. All this is released at a climactic moment, called the catharsis.

Our modern-day debt situation is a kind of Greek tragedy. A dramatic tension is certainly building. But a catharsis will come only when we, the audience, all become part of the story. We have to feel it. As of now, most of us aren’t.

After last week’s Supercycle of Debt letter I had a nice email conversation with the now-retired Martin Barnes, who as editor of The Bank Credit Analyst helped develop the debt supercycle theory. He believes the cycle changed after 2008 when focus shifted from the private sector to government. Martin expects markets to force a resolution, but not for a few more years.

On one level, delay is good. It gives us more time to prepare. The problem is “a few more years” will bring us to the late 2020s/early 2030s when the other cycles we’ve discussed (especially Neil Howe’s Fourth Turning but all the others as well) will be near their peaks, intensifying the pain.

Now, we could avoid that by getting the government debt under control sooner. That’s extremely difficult, though. Today I will show you why.

Fiendishly Hard

I have tried in various ways over the years to explain how balancing the budget, which sounds like it should be easy, is fiendishly hard—to the point even “fiscal conservatives” have mainly given up trying. They want to do it with mostly cuts in spending and progressives want to do it with mainly increased taxes. Inability to compromise (on both sides) means everyone just looks for ways to keep it from getting worse. And usually fails.

There IS a middle group that would do both (basically the Problem Solvers Caucus in the House launched in 2017, part of the No Labels movement, but they are 20% of Congress).

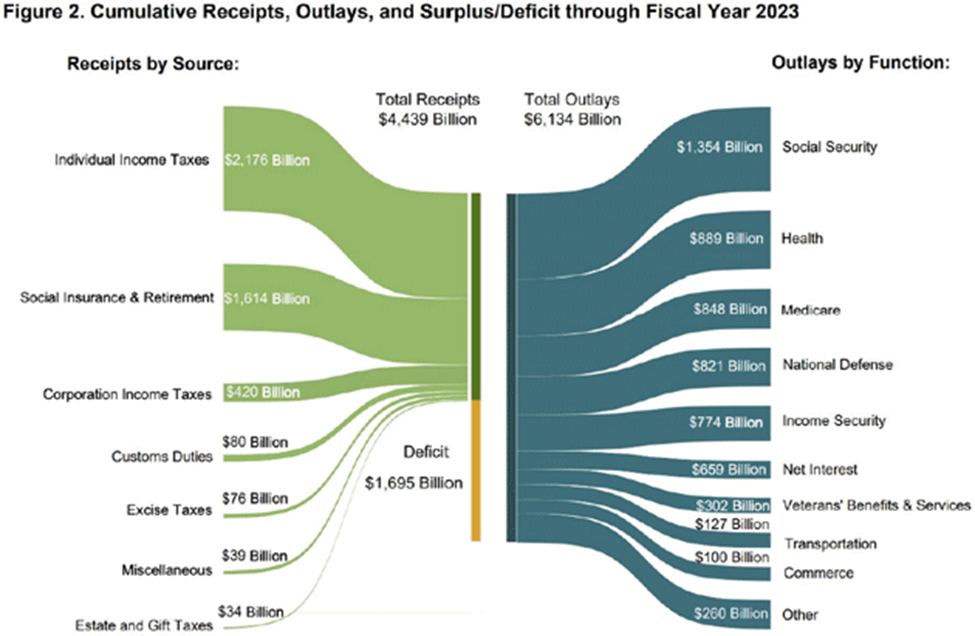

Here’s a graphic I think shows the problem. You see the different categories of tax revenue flowing in on the left and then spending categories on the right. The yellow portion of the middle bar—where there is spending but no revenue to cover it—represents the deficit.

(By the way, don’t quibble with the precise numbers shown. Their relative size is what counts. These numbers change slightly all the time. And after adjusting for the recent student loan rulings, my sources say the deficit is over $2 trillion! Lots of ways to look at this and play with the numbers.)

Source: The Kobeissi Letter

Eliminating the annual deficit—a necessary step to reducing debt growth—requires some combination of higher revenue and lower spending. And I stress “combination” because we simply aren’t going to do it with just tax increases or just spending cuts. Much of the spending is functionally off-limits, at least in the near term. Social Security and Medicare reforms might save some money over time, but they won’t do it next year. Net interest is untouchable. And is now a good time for defense cuts? Probably not.

Higher revenues are elusive, too. On paper, it may look like raising individual and corporate tax rates would close much of the gap. But not if it triggers a recession. And even without recession, taxpayers (wealthy or not) can modify their behavior. The wrong kind of tax changes could actually reduce revenue and enlarge the deficit. This has happened in the past. Incentives matter.

We Owe It to Ourselves

In less than four years total US debt will be north of $40 trillion. At 3% interest that is $1.2 trillion a year of interest payments, and at 4% that would be $1.6 trillion. Of course, debt that is owned by various government agencies of the Fed end up paying that interest to the government, so everyone focuses on net interest. Perhaps it is time to do a sidebar and talk about what I feel is the silliness of talking about debt held by the public as if that is all that matters.

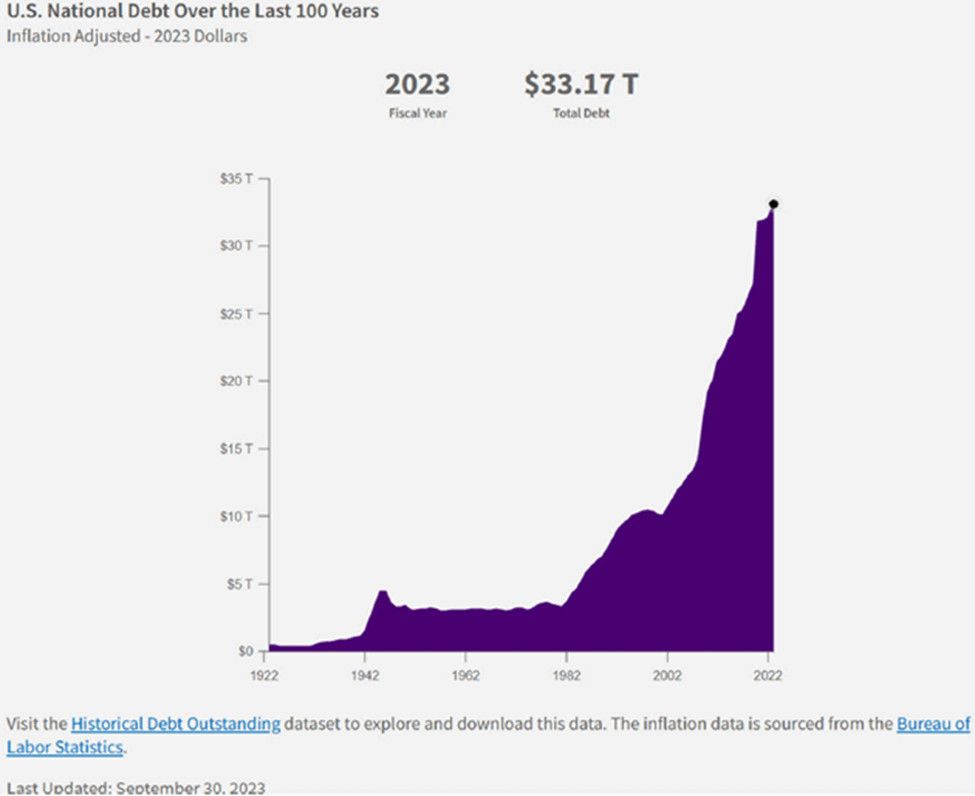

First, let’s look at the official total US debt data from the Treasury.

Source: US Treasury Department

The debt is now $33.7 trillion according to the wonderful data mavens at USdebtclock.org, or 124.4% of GDP. That number closely matches the official debt from Treasury when measured in real time. (You can see it at the top of the page on the link to the official Treasury website.)

Many economists prefer to talk about “debt held by the public,” now roughly $26 trillion, which is by definition smaller, and I assume they feel not as scary?

Debt held by the public “consists of all national debt held by any person or entity that is not a US federal government agency.” The publicly held debt does NOT include the $7 trillion that the government owes to itself, such as money diverted by Congress from the Social Security trust funds.

The federal government does not have a legal obligation to pay Social Security or other government benefits. These aren’t legal liabilities; they are simply political promises. I don’t doubt the government will by and large honor Social Security payments, but I am willing to bet that the terms of those payments will change. They can do things like increase the retirement age, means test benefits, and change the inflation adjustment formula.

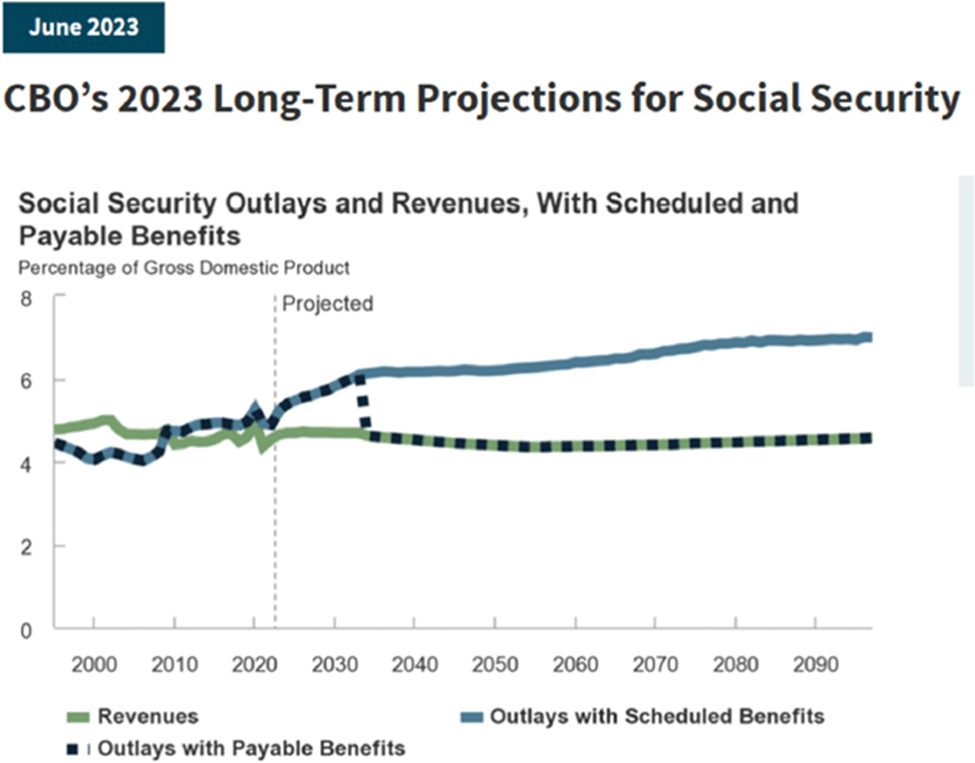

The CBO projects that the (currently depleting) Social Security “Trust Fund” will be empty as of 2033. Some analysts say much sooner. Under current law, benefits would then fall to whatever payroll tax revenue allows and everybody (I assume) would get a pro rata cut. The next graph shows what Treasury thinks that will look like.

Source: US Treasury

That amounts to a 23% decrease in benefits across the board to the then 70 million recipients.

There will of course be new legislation enacted to fix this. But it should remind us that debt “owned by the government” still has to be paid, if we are going to honor our Social Security and pension commitments. Not to mention trillions in other unfunded liabilities not in the budget or part of the official debt.

No other country I know of analyzes its debt in terms of “owned by the public.” I think it is safe to say that retirees who gets Social Security, government pensions, Medicare, and so forth consider those to be debts owed to them, whether or not the government “technically” has an obligation to pay them.

Again, future congresses can do whatever they want to do. They could (and I think will) alter the terms of the commitments. But that is only going to happen with a lot of weeping and wailing and gnashing of teeth. And probably tax increases as well.

Now back to our original plot line.

Debt Fixers

“Balancing” the budget is a good term because it really is a balancing act. Congress has thousands of knobs it can turn to adjust different tax and spending provisions. Some have little impact while others have gigantic consequences. In theory, the right combination of changes would balance the budget. In practice, it’s not that easy.

To illustrate, I’ll use an interesting online “Debt Fixer” from the Committee for a Responsible Federal Budget. It is a simulation that lets you choose from a long menu of spending and tax changes, then shows you how it changes the debt outlook over the next 10 years. It has limitations but is still useful, for today’s exercise, in framing the challenge.

My main critique of their models is that they: 1) offer static fixed solutions rather than allowing a sliding scale on spending cuts and taxes and 2) is not dynamic. It assumes, for instance, a 50% increase in income taxes will produce an actual 50% increase in revenue. That is certainly not the case.

I should also note CRFB’s tool defines “success” as stabilizing the debt (held by the public, which is already somewhat misleading) at 98% of GDP by 2033 and on track for 60% by 2050. That would be an improvement but still too much, in my opinion. As you’ll see, though, passing even that low bar will require big, painful changes.

Can we stabilize the debt by only raising taxes or only cutting spending? If so, how?

We’ll start on the tax side. I went into the Debt Fixer, ignored the spending options and checked off every possible tax increase. Result? Over 10 years it would raise $13.7 trillion more than current law, bringing the 2033 debt down to 80% of GDP and 58% of GDP in 2050.

Now, would raising taxes really do that? Probably not. The simulation achieves this only by, among other things…

-

Repealing the 2017 tax cuts (not dynamic, but theoretically saves $850 billion)

-

Applying the 12.4% Social Security Taxes on incomes over $250,000, which has the effect of raising total Federal income taxes to well over 55% (including Medicare). Then add state and local taxes to your tax bill. Some wealthy state residents would be paying an actual 70% in total taxes. Think that will change behavior? But it does raise over $1.5 trillion by 2033. Raising total payroll taxes by 1% raises $670 billion.

-

Raising capital gains and dividend taxes (this option would tax capital gains and dividends as ordinary income for taxpayers with more than $1 million of income. The maximum rate would be 37 percent (40.8 percent including the NIIT). It would also tax unrealized capital gains at death, with an exemption of $5 million per person.

-

Levying a wealth tax on ultra-millionaires (an annual wealth tax of 2 percent on all net worth above $50 million and a 3 percent wealth tax on all net worth above $1 billion)

-

Limiting or eliminating many popular deductions (Mortgage interest deductions “cost” $330 billion. Eliminating state and local tax deductions would save $1.5 trillion. It goes on and on. Much weeping and wailing ensues!)

-

Enacting a financial transactions tax (0.1%) and a carbon tax ($1.85 trillion)

-

Imposing a 5% nationwide value-added tax on most retail sales ($2.5 trillion)

-

You can look at the other revenue increase options. Just ugly. No good choices, but we are going to have to make some choices, no matter how ugly.

Any of those tax changes alone would have major economic effects. All of them at once would certainly trigger recession. (Note: If you do the simulation and want to see the underlying assumptions, click on the very small circle with an “I” in it next to the choice.)

Next, I tried the opposite approach: No tax increases but cutting spending every way possible.

Here are some of the biggest changes:

-

Devolve K-12 education to the states.

-

Repeal Biden’s student debt cancellation plan.

-

Limit annual defense and nondefense spending growth to 1%.

-

Means-test certain veterans benefits.

-

Raise Social Security full retirement age to 70

-

Means-test Social Security benefits for high-earning seniors.

-

Replace Obamacare with state grants.

-

Replace Medicaid with block grants.

-

Require states cover 25% of food stamp costs.

-

Expand Medicaid work requirements.

-

Eliminate farm subsidies.

-

Reduce federal worker retirement benefits.

-

There are more.

Tough Compromise

So, for different reasons it looks like we will need both spending cuts and tax increases to solve the problem. Is there a politically feasible middle-ground plan that would work?

I went through the debt fixer a third time, trying to imagine what changes could actually pass Congress as part of a grand bargain. Frankly, I think that’s the only hope. Any piecemeal approach would be sliced to pieces. They will have to hold hands and jump together.

So, thinking about which provisions each party might accept, I went through the options and picked what I could. As expected, it was difficult. My first pass didn’t even come close. I went back and reconsidered the changes I initially rejected. That was even more difficult. Anyone walking by my office at that moment would have heard my frustration. The only consolation was in choosing some things I knew my Democratic friends would hate, too.

My final compromise—and that’s very much what it is—would reduce the debt to 89% of GDP in 2033 and 59% in 2050. Some highlights:

-

Raise gasoline tax 15 cents per gallon, then index it to inflation.

-

Limit defense and non-defense spending growth to 1%.

-

Raise Social Security full retirement age to 70 for workers born in 1978 or after.

-

Raise the payroll tax rate by 1%.

Some of these are pretty harsh. The entire package, if enacted, would reduce debt to 90% of GDP in 2033 and 76% in 2050 (again, with a bunch of assumptions). Savings in the first 10 years would total $7.8 trillion.

But as with tax changes, what would really happen? These changes would have big effects on some large industries, including healthcare and agriculture. That would have economic consequences and probably reduce tax revenue. How it would all settle out is hard to say.

-

Subject earnings over $250,000 to payroll tax (This is truly draconian. And a very bad choice. I prefer consumption taxes!)

-

Means-test benefits for high-earning seniors.

-

Increase Medicare premiums for all beneficiaries.

-

Eliminate farm subsidies.

-

Raise capital gains and dividend taxes.

-

Eliminate mortgage and state/local tax deductions.

-

Limit charitable donation deduction.

-

4% tax on corporate share buybacks.

-

5% national VAT tax.

I also included some provisions that actually raise spending or reduce taxes, since that would likely be necessary to gain enough support.

-

Tighten border security and build a border wall.

-

Extend 2017 tax cuts only for taxpayers earning less than $400,000.

To be clear, I don’t like much of this plan. I know it’s far from balancing the budget. But I am working within the limits of CRFB’s simulator, which is at least a starting point for discussions.

Those last two sweeteners aside, this package would make pretty much everyone scream bloody murder… and it still doesn’t solve the problem. And (as CRFB admits) these numbers are not “dynamically scored,” which means they ignore any macroeconomic effects the policy changes would cause. We can’t know what those would be, but I suspect not good.

In making these choices I was trying to think not of what I want, but what could pass the currently divided Congress. Frankly, I don’t think anything like this could pass. And it’s not so much because the politicians are gutless, but because their voters demand the impossible.

If the House and Senate were to actually debate a serious compromise, it would be high drama like the Greek tragedies I mentioned earlier. But it wouldn’t end in catharsis because the problem would stay unresolved. Nonetheless, the problem will be resolved, one way or another.

That will be the real catharsis.

We Need a Better Model

I am sure you have better ideas. I certainly do. Congress can get the CBO to “score” any proposed legislation as to how it would affect the budget. You and I don't see that process. It is all behind the curtain.

What we really need is a model that the public can use that is both dynamic and allows sliding scales on both revenues and expenses. For instance, rather than simply saying capital gains should be taxed at 28%, or seen as ordinary income, what if you could see the effect of each 1% increase in capital gains taxes? At what income level should we means test Social Security or Medicare? What happens if we eliminate some programs?

I am hoping to do a little crowdsourcing here. Surely there is a more dynamic model out there somewhere? Can someone point me to it? I literally have no idea how much it would cost but it would be a great way for people to understand the difficult choices we must make. Plus, if hundreds of thousands of people actually went through the exercise you would begin to see where compromise might be possible.

I don't think a compromise will happen before we're forced into a crisis by the bond market, and at some debt level we will get that crisis. If it happens while we are having a global geopolitical crisis (wars and rumors of war), a global crisis of some sort, then what? Rather than go into that crisis with no ideas, we would at least have some clues.

Dallas, Austin, and Old Friends

My plan right now is to be in Dallas for Thanksgiving week to be with my kids and of course friends and business partners.

As I was writing this section, I got a call from one of my oldest and best friends, Gary Halbert. He has been struggling with prostate cancer but was getting advanced treatments and sounded optimistic, as he always does. This call, however, came from the hospital where he and Debi just learned that they are out of medical options and, well, he is going home to hospice care.

Readers who have been with me a long time will remember Gary, as we were partners in a company called ProFutures throughout the 1990s. It was my first foray into the actual investment management business. Gary and I talked multiple times a day every day for 10‒12 years, even though I was based in Arlington (Texas) and he was in Austin. We mutually watched our children grow up, and my kids loved visiting Gary and Debi’s lake house. They had all the cool lake toys and a fabulous cabin for guests.

The business was quite successful. Gary eventually bought me out, very amicably, and we remained close friends. I can't imagine where my life would be without our relationship. But then, he has that effect on many of his friends and relationships. Truth be told, I literally learned about the power of newsletter writing watching him do it back when we still printed newsletters. He inspired me to launch my own.

I can't say enough positive things about Gary, and will likely do so later, but right now I am still processing, as I’m sure he and Debi are.

And with that I will hit the send button. Have a great week and stay in touch with your friends.

Your thinking life is too short analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.