The Fed candidly admitted today’s soaring inflation is not what it had in mind, though it certainly is exactly what I’ve had in mind:

At a news conference after the Fed’s statment [sic.] was released, Chairman Jerome Powell said he expects that inflation will be short-lived but acknowledged that it has run hotter than the Fed anticipated and could remain persistently hot.

Furthermore,

The [resulting market] decline put the Dow Jones Industrial Average … on track to close below its 50-day moving average for the first time since March 3.

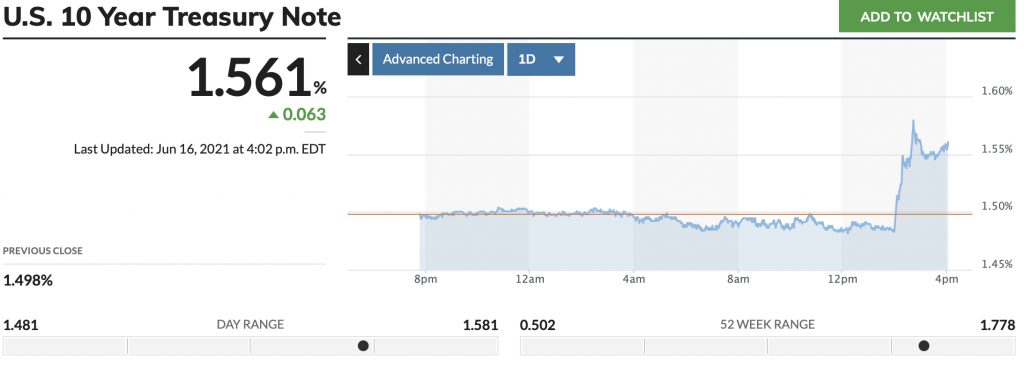

Meanwhile, the S&P remains hunkered near that 4200 level that has acted like a magnet to its highs and lows; while the bond market decided perhaps it should take inflation seriously again after all, with yields immediately spiking six basis points post-Powell, which put yields ten basis points above where the 10-year started the week:

Of course, the Elliott Wave people will say the market’s plunge within minutes of Powell’s comments had nothing to do with what Powell said or specifically with his admission that inflation may be just a tad more exciting than what the Fed anticipated and may be just, well, “persistent” — the new word that quickly replaced “transitory.” Because, by Elliott Wave Theory, market sentiment does not respond to the economic and monetary realities around it.

Nevertheless, as anticipated, the Fed said it will be holding its accelerator foot down to the floor for many months ahead (Fed dot plot says into 2023), apparently to see if it can get that inflation to run hotter still because surely the Fed could not be doing all this “money printing” (a.k.a. quantitative easing) just to fund the federal government’s massive debt rollover requirements or just to keep utterly dependent stock and bond market bubbles floating.

Whatever the Fed’s reasons, we know it certainly is not burning up the money presses because banks need more money in their reserves in order to build up a hotter reverse-repo crisis now that the economy is failing to soak up all the liquidity the Fed is creating.

Or, as ZH put it more precisely,

[The] Fed is holding rates at zero and buying $120 billion in bonds every month in the face of 17.4% export price inflation, 11.3% import price inflation, 6.6% producer price inflation, 5% consumer price inflation, [with] over 15 million Americans on government dole, over 9 million job openings for Americans, record high stock prices, record low homebuyer sentiment, [while] banks are puking excess cash back to The Fed at record levels.

What could go wrong with keeping the accelerator floored for many more months as we fly through those curves in the road? Makes sense to everyone, right?

Fed Fail

The Fed, as I’ve said it would do for the past year, has trapped itself between a rock and a hard place, and it is just now starting to see that, once again, this is not quite the situation it believed it would find itself in. (Just as the Fed once believed tightening would be as boring as watching paint dry (then, oops, stock crash and repo crisis). Tightening was supposed to leave us in a world that would never have another financial crisis during the Fed Head’s lifetime. (Oops again. Maybe Yellen meant her life as Fed Chair; she now has a different life as US treasurer.) Maybe Gramma Yellen just thought she wouldn’t live long enough to see the roaring 20’s for a second time.) The Fed never seems to have a workable end game for any of its big-think programs. Yet, people keep trusting it and thinking it is smart.

This time, the Fed has, on one side, created so much dependency on FedMed throughout the economy, including just about every market out there — stocks, bonds, housing, you name it — that it cannot end the drugs without creating massive withdrawal in all markets at the same time — the catastrophic collapse of the Everything Bubble. On the other side, the Fed’s Big Giant Head now has to admit he didn’t expect inflation to run this hot and that the intensity of the heat and the rate at which it is rising indicates inflation may run hotter and longer than the Fed’s earlier “transitory” guess. That means, if the Fed keeps pouring on the fuel, it risks cooking the everything bubble until everything explodes.

We’ve never experienced what that looks like either. (I would suggest likely a lot worse than the inflations of the seventies when there was no Everything Bubble to burst into tiny bubbles as we whine.)

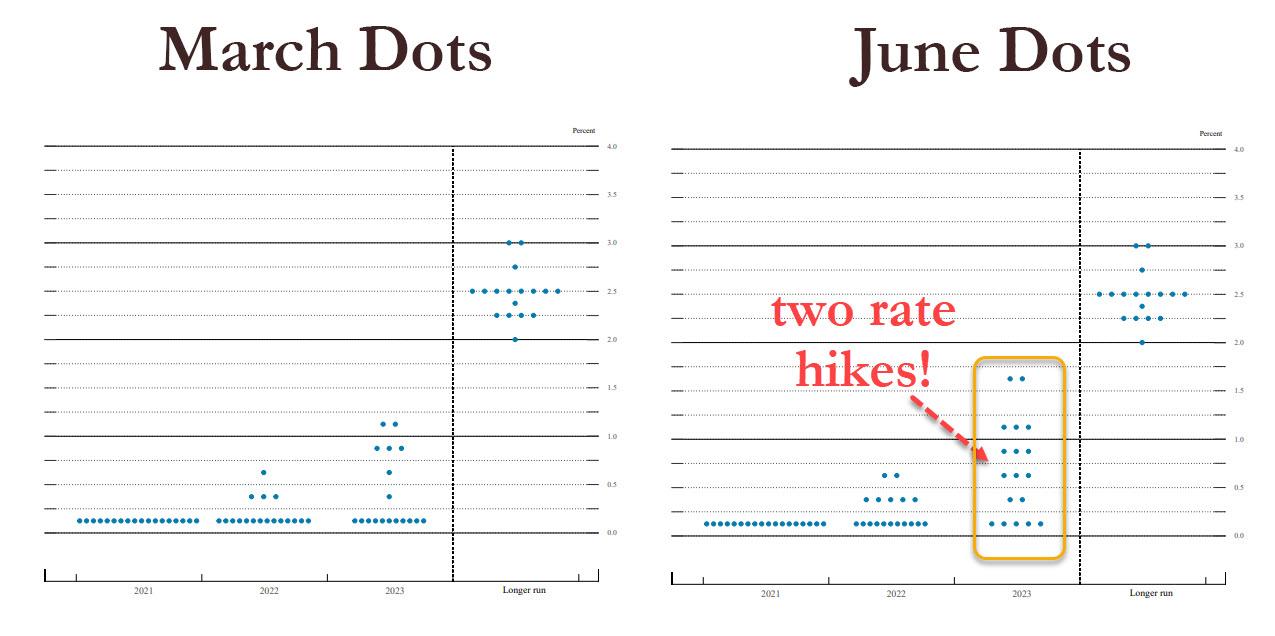

To what degree are Fed FOMC members changing their minds as to how hot inflation is running? Here is the “dot plot” that shows when those with a vote on the FOMC believed the Fed would make its adjustments in interest rates back in March, and where they placed the likelihood of adjustments now. Each dot represents the view of one committee member as to what level the Fed’s interest target will have to reach in each year on the chart:

You can see that what has happened with consumer inflation since March has significantly changed where voting members believe interest targets will have to be set in 2023. The median dot in June is now two typical rate hikes above where March’s median dot was. The unusual and widening dispersion of dots also indicates there is now a lot less certainty between members as to where the Fed needs to be or what is going to happen with inflation. (Won’t they be surprised when the hot inflationary summer ahead puts even more heat beneath their feet?)

Nevertheless, the Fed is still not planning to raise interest rates before 2023. So, that means two more years of running pedal to the metal. The Fed obviously is a little slow on the uptake to realize their antiquated steamer is already careening over the edge of every inflation curve. Why? Because they dare not admit it. Admitting it and backing off on the fuel would crash all markets.

(Reminder that I’ll be covering my many reasons for thinking inflation is not going to be anywhere near as transitory as the Fed needs it to be in my upcoming Patron Post.)