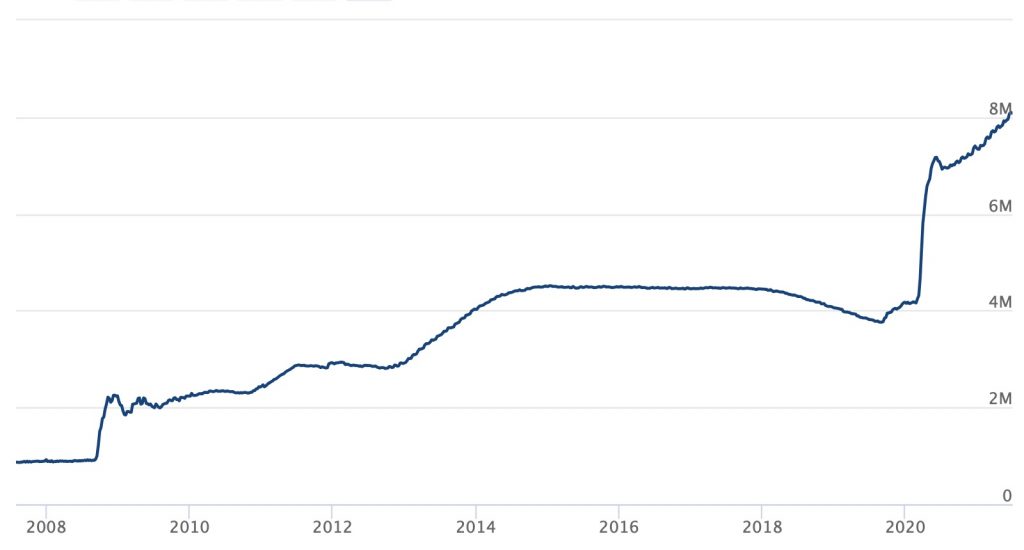

While the Fed’s current tightening is not exactly a well-kept secret, stock and bond markets seem willing to ignore what the Fed’s left hand is taking away as the right hand is giving. Reverse repurchase agreements, which I have been tracking here, have exploded to a trillion dollars in money that the Fed is sucking out of the financial system.

According to John Mason at Seeking Alpha, total reverse repos on the Fed’s balance sheet actually just hit $1.26 trillion this past week:

Factors Affecting Reserve Balances of Depository institutions and Condition Statement of Federal Reserve Banks) had increased by $847.0 billion. This past week, the Fed added an additional $205.0 billion more in reverse repos to the account, bringing the total reverse repurchase agreements on the balance sheet to $1.261 trillion!… this is more than the whole balance sheet of the Fed before the beginning of the Great Recession.

I haven’t seen the $1.26 trillion show up in the Fed’s charts yet so I cannot confirm that statement. The highest I have seen as of today’s date is $920 billion being rolled over. Still, that is a record beyond all records. A trillion here and a trillion there, and before you know it we’re going to be talking about real money!

The Fed’s dizzy feedback loop

The Fed is effectively being forced by interest rates within the intra-banking system to take as much cash out of bank reserve accounts as it is adding via its purchases of government debt at the other end of the spectrum, thus neutralizing all of its own QE. Now, why would it do that?

First, imagine the negative interest rates we’d be seeing between banks due to the Fed’s continued easing if the Fed were not providing these unlimited reverse repos, now reaching a trillion dollars (and remember how I said this reverse repo crisis was going to keep building just like the repo crisis did in the opposite manner in 2019 when the Fed was tightening). The Fed is being forced to engage in these large transactions in order keep its “Fed funds rate” on target as it continues to supply all the money the government needs for its massive deficit-based programs.

Or is it being forced? The Fed actually seems to want to do a lot of reverse repos to extract money from the system. The Fed created a massive increase in reverse repo operations, which were already running amok, when it announced as the sole big decision at its last FOMC meeting that it was going to solve the reverse repo problem by increasing the interest it pays on such transactions. That’s an odd way of solving the problem, as clearly paying more interest will entice more banks into using reverse repos, which is what immediately happened. That leads me to think the Fed is either far dumber than all of us for not realizing that higher interest paid to banks would result in higher usage of the facility, or the Fed actually wanted to expand use of the facility to drain money out of reserves more quickly. Hmmm. Why would it want to drain money out of reserves more quickly when it claims banks need more money to lubricate the economy?

On the one side, the Fed continues to add $120 billion in QE per month, which is adding huge inflows to bank reserves as follows: The government is spending the money created through its bond issuances (which the Fed funds by purchasing those bonds from banks with newly created money to establish a bottomless market for the banks to resell government bonds into). That money the government raises with those bonds then gets deposited by the government’s numerous vendors into bank accounts where it adds to bank reserves when the government checks clear via its banker, the Fed. The government also transfers money into bank reserves when the treasury issues stimulus checks as well as unemployment bonuses to ordinary people via state unemployment offices that distribute those federal stimulus funds.

On the other side, the Fed is sucking that much money back out of reserves each month by trading its vast hoard of government bonds back to banks as collateral in exchange for their cash “loans” to the Fed from their reserves. (Banks need to get rid of the excess cash that is piling up in their reserve accounts as they are required by the Fed to raise additional capital if their reserves expand.)

This is a bizarre picture in which the Fed seems to be creating its own problems. We have to ask why the Fed would buy government bonds from banks initially just to loan them back to banks in exchange for loans from the bank reserves to the Fed in order to reduce the cash held in bank reserves.

Clearly the Fed is not engaging in QE due to banks needing more cash in their reserves, or it would not be hosing the money back out of reserves as quickly as it is creating it. It seems to me the Fed is openly talking about not backing off of QE while it is silently taking away all of its QE with the other hand in order to provide markets with the illusion they need to keep going up (the belief that the Fed is still expanding money supply) and provide the cash that markets need to keep going up as the government doles out the new money to average citizens who invest it in stocks as retail investors via Robinhood, etc., while eliminating the plunge into negative interest the excess cash would create.

It is a “Keep looking at what my right hand is doing (doling the money) so you don’t see what my left hand is doing (taking away the money)” kind of sleight of hand. The reverse repos are temporary, but they keep getting rolled over in ever greater amounts as repos kept getting rolled over in greater amounts during the Repo Crisis. So, they effectively become longer-term tightening without calling it that, just as I pointed out in 2019 that the Fed’s repos were effectively becoming long-term QE without the Fed having to admit it was forced to end tightening and go back to QE. Thus, we called this new form of QE “not QE” because the Fed kept insisting it was not QE. It was enabled to give up that charade when COVID gave it excuse to go to outright QE. Now it is forced to end QE without admitting it.

The only explanation I can think of for deliberately creating this bizarre loop is that the Fed has to keep funding the federal government and is trying to manage the now perilous side effects that massive funding is creating.

The Fed giveth and the Fed taketh away

Another way the Fed is tightening more than it is easing can be seen in the fact that, while it continues its government bond purchases at the same rate, it is backing off of its purchases of mortgage-backed securities. In the last week of June, for example, the Fed added $20 billion in government securities to its balance sheet while it sold off $35 billion in MBS. If this pattern continues, the the Fed is clearly reducing its balance sheet already. That only reveals how the Fed is trapped into continuing to buy government treasuries. It cannot back off from those without causing the government major financial troubles, but it can start rolling of MBS.

Overall, total Fed assets on its balance sheet have continued to expand through the end of June, even as bank reserves are dropping because moving money out of bank reserves via reverse repos doesn’t reduce the Fed’s balance sheet; it just changes where the money is accounted for and keeps banks from having to raise capital). It may be that latest roll-off of MBS, not shown in the graph below, will be replaced in July to continue the expansion, as there is no sign of total balance-sheet expansion stopping yet:

As you can see, anytime the Fed has attempted a dip in its balance sheet during the past decade, it hasn’t made it far before it has had to return to more QE. It has no end game for getting out of the government dependency it has fostered by enabling profligate government spending with cheap interest (as well as stock market dependency and bond market dependency) because, above all else, the Fed’s main client, the US government, must be Fed.

So, excuses must be made and work-arounds figured out in order to keep that government-funding mechanism revved up while claiming the Fed is not funding the government but just performing essential monetary transactions to achieve its monetary goals — self-destructive as those “monetary goals” now appear to be in terms of creating a glut in bank reserves and destructive as they appear to be from a purely monetary perspective where inflation looks to be running rapidly out of control.

How long can the charade continue?

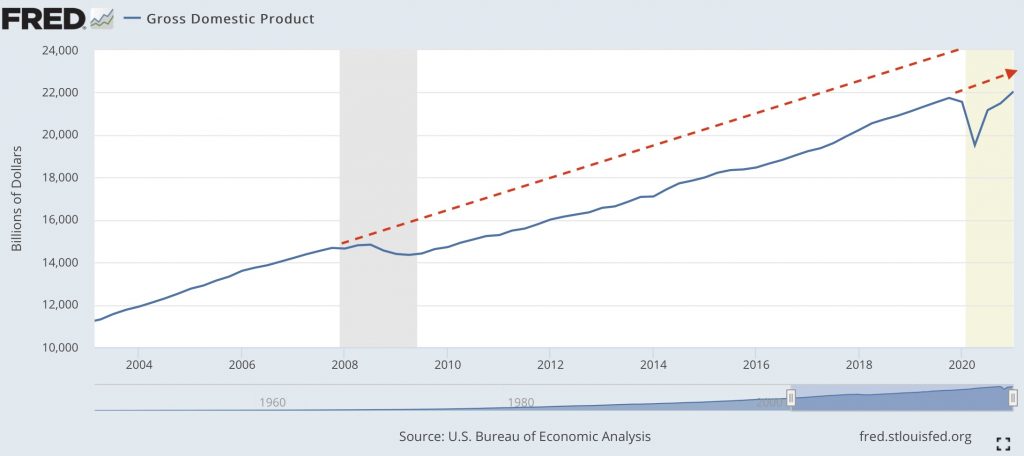

The Fed’s action in reverse repos has done nothing to tamp down inflation, which keeps rising. They are sucking money out of bank reserves, but that seems to be affecting only interbank interest. Inflation will be the only timer likely to force the Fed’s hand here. So long as the government keeps turning the QE into payments that go to average Joe or Josephine citizen, inflation will be fueled by the little person having the buying power to pay more in order to get his or her share of products that are now in short supply because the nation’s production (measured as total GDP, not as GDP growth; see graph below) has been perennially lowered.

In my last Patron Post I showed the following graph of the permanent drops in the nation’s production trend lines that have resulted from each of the last two major economic crises:

And then I wrote about how it has taken more and more Fed stimulus after each economic breakdown to keep the economy functioning along a lower trend line than it had been proceeding along before and what that means:

As the graph above shows, there has been no full recovery out of either the Great Recession or the COVIDcrash. We are weaker in terms of being able to produce [the “P” in GDP] at a level that keeps up with our population growth than ever. That is why prices will rise due to scarcity. That is why it takes endlessly greater amounts of Fed stimulus and government stimulus to keep powering us along. But that path of greater and greater money printing with ever lower production has its own dead end, which is high inflation. If it gets far enough out of control, we’ll call it “hyperinflation,” which I would define as anything over 100% a year. (Others might define it higher, and I’m not saying, so far, we will even see anything like 100% annual inflation overall, though we have seen a lot more than that in a few commodities already. I am saying the Fed is either wishfully blind or lying; but what else can it do? Tell you inflation will skyrocket, and thereby assure it to happens more quickly? It could, of course, lift its foot off the accelerator, but that would crash all markets in a hurry.)

“Why “Persistent Inflation” Will Become an Intense Fire Tornado, Greater Than the Fed Even Imagines“

The current shortage problem, however, goes well beyond a drop in the nation’s own production trends. Supply constraints, which the Fed hopes are just transitory, are global. They won’t go away as quickly as the Fed needs them to because they are caused by such a wide combination of factors in addition to what appears to be permanently lowered US GDP trend lines. Supply chains have been badly broken by international trade wars, COVID lockdowns, global and US transportation bottlenecks and labor shortages in many nations as people refuse to return to work for various reasons. (In some nations, COVID is still active at levels that result in legal mandates that keep people away from work or that cause them to fear returning to work, causing shipping and supply problems for the US.)

Some of the United States’ own labor shortage problem may end in September IF the government stops enhanced unemployment as it says it will, but that termination of enhanced benefits may be offset by the government’s statement that it will begin this month to provide families with $300 per month per child in direct government stimulus payments through the end of the year. So, even the labor shortage may not go away because US workers will be empowered to continue to hold out for higher wages in order to be enticed back into the market.

As the Fed funds this government largesse, it is also creating its own monetary death spiral.

It won’t take many more months before inflation creates its own self-reinforcing feedback loop. That happens when businesses price up their goods and services in anticipation of future inflation. For example, a housing contractor decides she needs to pad her bid by an additional 10% to be safe because she fears the cost of material will rise that much before construction even begins (due to time delays in getting permits, etc.). In such cases, prices rise before costs rise simply because of beliefs about what inflation is going to do. We’re not used to thinking that way because we’ve lived in a low-inflation environment for so long; but inflation doesn’t need to run hot for long before people start pricing it in in advance.

The Fed has to get this under control before that feedback loop gains any momentum, or it will become impossible for the Fed to stop inflation without taking drastic action. I think the loop is already beginning in housing and will spread quickly to other areas as people start to believe inflation is the new economic regime.

While the Fed’s charade may be resolving some of the internal banking interest problems its overstuffing of reserves is causing, it is doing nothing to stop inflation, and the Biden government is determined to up the dole, not drop it. Even if the US government does curtail enhanced and extended unemployment benefits in September, it’s adding more stimulus to consumers in other ways that will keep fueling inflation. I don’t think the Fed has the guts to crash markets and significantly raise interest on the government debt by telling the government and the world it is going to stop buying up the 50% share of government bond issuances it now purchases, so it is going to have even wilder problems in bank interest rates and inflation to manage. Those already appear to be spiraling out of control far outside of historic records.

I can’t put an exact time on when the game is up, but I can see that reserve problems and internal banking interest problems are mounting, and inflation is rapidly running hotter than the Fed intends and that inflation isn’t about to cool anytime soon, as I laid out numerous reasons for in my last Patron Post.

I also gave the following warning in that post about now being in the perfect environment for sustained high inflation:

As we now enter a summer of searing droughts, we are entering a new superheated economic climate, ripe for consumption because of the massive financial intervention taken to shoot us out of the instant recession, but badly weakened in production. That hot and cold contrast is the perfect climate of supercells for a destructive inflation vortex. This is not your father’s inflation. This has the ingredients to be the seventies on steroids. (We are actually already as bad off as the seventies if we measured inflation the same way it was measure back then when it hit double digits.)

We have experienced an economic regime change just as we did from the Great Recession. As a result of these permanent changes (in some cases, mid-to-longterm in others), which that Patron Post laid out in detail, the Fed is not going to catch a break from this inflationary cycle. The Fed’s obscured tightening isn’t going to do the job any better than “not QE” ended the Repo Crisis. Now that reverse repos have hit the trillion-dollar threshold, we are witnessing how the Reverse Repo Crisis is increasingly going out of control just as the Repo Crisis did.

I want to close by thanking those patrons who have kept me at this. I hope people are finding it helpful, as I don’t think this analysis of the Fed’s actions or its lack of an end game is covered well in mainstream financial media, which seems endlessly willing to keep believing the Fed has everything under control and to keep parroting what the Fed tells it, even though we’ve seen the Fed fail several times before, and this fail could be its worst.

Liked it? Take a second to support David Haggith on Patreon!

![]()