The White House warned us the payrolls print would be low due to Omicron. Bank economists ranged from low to sub-basement negative numbers for today’s expected payroll print. Then the number came out massive beyond belief … and self-contradictory beyond belief as well.

467,000 jobs added to the economy in January — four times higher than what economists expected on average and even double the highest guess by economists, many of whom had joined the White House in expecting a negative print!

Bond yields busted through a ceiling that had held in place for two years because wages were also reported as being way up (+0.7% MoM / +5.7% YoY) — a one-two combination punch when combined with the soaring employment numbers, meaning inflation should still face considerable upward pressure, forcing the Fed to stay on track with tapering and then tightening.

Stocks bounced all over the place — up then down then way up then way down (as of 11:15 AM EST). Facebook/Meta, however, managed (so far today) to actually deepen the all-out biggest plunge in market value for any company on the face of the earth in the entirety of market history! It crashed an absolutely breathtaking 26% yesterday and is still falling this morning! (Gee, you would think changing how they identify by coming out with a sassier, trans-metasexual name would have improved their performance or, at least, brought them more community sympathy.) After such a spectacular crash, one would also have thought the market would catch its balance the next day to correct what it might perceive as an overreaction, but NO. Instead, it is taking Faceplant down further into the dirt it deserves.

Zuck: The Face of Facebook

Think about the baloney level in a market that ever raised the always-smirking Zuckerberg’s bluish, lumpish, boy Face so high above the business the company would actually be reporting in the first place? There is no way a company can lose, at the moment of this writing, almost 28% percent of its entire value, accumulated over YEARS, in just 24 hours, except that all of that excess value was obscene speculative hot air (as believed here) in the first place.

The build-up of this kind of abject nonsense in the stock market is why the market is going to crash spectacularly as I’ve said. We see how unexpectedly such a failure can happen by the sudden pallor that was revealed on Meta’s Face and then its rapid retreat from being one of the market’s top-five generals. As I noted here ever so briefly again after Wednesday’s market rise, the blow-off top was already clearly here (just as Facebook’s fail was already baked into its performance before the numbers were known). Some people have such dim eyes they cannot see the top to save their sorry souls to where they are still asking, “When will the market rise to a blow-off top?” As if it needed to go higher or more insane! Unbelievable.

Fantasy value gets knocked out when the economy goes into recession, so reality finally starts to sink in, and the market prices back down to reality. Reality always trumps economic denial in the end, but it may take awhile. The total testosterone crowd can keep things up for awhile, but sooner or later fatigue sets in. Investors are forced to look over the edge of the precipice and see they are on a thin shelf overhanging NOTHING. They suddenly realize it wasn’t that the top was too far away to see. They couldn’t see it because they were standing on it, still ridiculously thinking a top should be something they have to look up to find. It was the bottom that they couldn’t see! They even miss the point every single time that this is exactly how all blow-off tops formed in the past and were experienced by those who got taken in by them because they were still looking up when the only way forward was down on all sides.

Fortunately, people seem to have somewhat seen through Amazon’s blaze of numbers that came in after the market closed yesterday, sending Amazon up 20% in futures overnight. That, too, I thought was completely the euphoric response of blow-off insanity. (Of course, who knows if the smidgeon of restored sanity will hold through the day.) What I saw yesterday afternoon was good headline numbers and some really lousy numbers below the hood that I commented on at Zero Hedge, but cooler heads seem to have gained a little sanity about that this morning, bringing Bezos’ 20% rocket ride halfway back toward earth at one point. Looks like his rocket ship might not singlehandedly save the NASDAQ from Faceplant after all. But who knows? Stupidity is still being priced in everywhere from one day to another. Overall, though, this bear-market rally appears to have hit a snag.

How do you explain the soaring payroll numbers in light of your recession prediction, Dave?

First, note that the actual payroll numbers FELL OFF A CLIFF! I’m putting reality in large bold print there because most financial reporters will probably miss that entirely. That’s right: the real count — the unadjusted numbers — actually FELL by 2.8 million! Whoa!

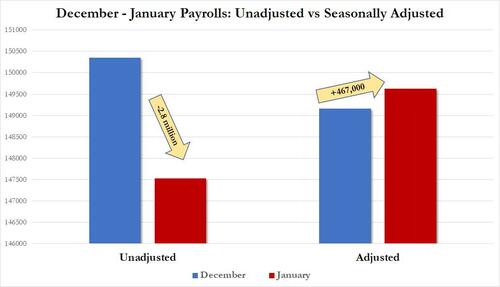

The numbers on the left in the graph below are the actual total numbers that came in as reported in December (blue) and now January (red). You can see January’s actual numbers dropped 2.8 million from December’s. The numbers on the right are the official reported totals as adjusted by the BLS:

You can see, December’s total payroll (numbers in thousands) got adjusted way down (blue bar on the left side of the graph compared to blue bar on the right) while January got seasonally adjusted way up (red bar on the left to red bar on the right), resulting in an apparent rise from December to January in the final adjusted numbers of +467,000 jobs. That means the entire unexpectedly large job gain happened due to absolutely massive seasonal adjustments created by the BLS that turned a jaw-dropping plunge into a nice, healthy rise.

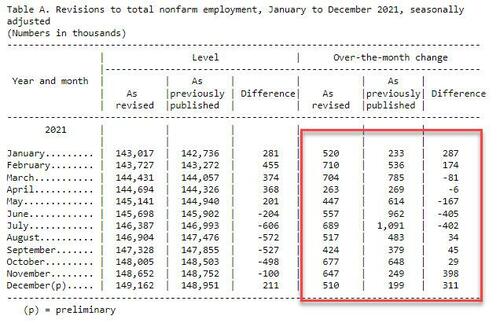

To add to the confusion, the BLS reports that December’s original adjusted month-on-month change from November just got revised at the end of the year from rising 199K (as originally reported) over November’s adjusted total to rising 510K, while November’s month-on-month rise from October also got revised up from 249K to 647K!

So, everything is suddenly roses for the economy and in line with the Fed’s need to tighten harder based purely on adjustments and revisions. Of course, we have to remember that presidents oversee the BLS, so ….

Thus, the huge gains in payrolls came entirely from seasonal adjustments plus these end-of-the-year revisions. The revisions floated the past five months of the year way, WAY up by more than 800K jobs while months before that, which no one cares about any more, were adjusted down by even more than that, making room for the shift on the recent end.

I’ve asked in years past with end-of-year revisions this size, why do we trust any of the adjusted numbers because up can be turned into down with just the revisions to the formerly seasonally adjusted numbers. Then greater finalized revisions to the adjusted numbers usually come in after March. And those revised adjusted numbers typically get another final revision a year later. There seems to be a lot of room for goal seeking in so many highly adjusted, then revised and then re-revised numbers. And that’s why I routinely call it the Bureau of Lying Statistics or just the BS Dept. for short.

The official number of unemployed people bumped up a fraction (0.1 percentage point) from December to January at 6.5-million, but 6.5-million is a decline of 3.7-million year-on-year, though it is still 800,000 higher than it was just before the pandemic hit the US. In addition, the number of people who are not counted as “unemployed” but who want a job remains locked at 5.7-million. These are the people who dropped off the official unemployment rolls because their benefits expired or because they didn’t fulfill their duty of looking for a job in the last four weeks. That number is only down by 1.3 million from a year ago, and remains 700,000 higher than just before the pandemic.

How does it happen, though, with all those whose upward revisions and adjustments in the January payroll number, the unemployment rate ROSE, too, even if just a tiny fraction? How do you get a rising unemployment rate and rising total number of unemployed people in the face of significantly RISING payrolls??? That further indicates to me the rising payroll numbers don’t add up, given the entire rise was due to adjustments and would have been a massive plunge without those adjustments, and one would normally expect a drop in payrolls would coincide with a rise in the total number of unemployed on benefits because they had a job and are now looking for work.

What the heck?

This is a “what the heck” number that really makes me wonder more than any other time (and I’ve always wondered) just how rigged these jobs numbers always are by these seasonal adjustments. Several years ago I reported on how the December jobs number was up month-on-month something like half a million after seasonal adjustments, even though the raw number had dropped month-on-month by about half a million. The massive trend-changing adjustment, the BLS reported, was necessary due to the month being unseasonably cold so the Bureau of Lying Statistics had to adjust their reported number up to compensate for the unusually cold weather. When the next December was unseasonably warm, the raw number again fell by about half a million, but the BLS adjusted number was again an improvement by about half a million, and the BS Dept. claimed they needed to adjust their reported number up to compensate for the unseasonably warm weather.

Apparently, there is only one precise degree point at which job reports do not have to be adjusted up and no temperature at which they can ever be adjusted down until revised down months after anyone cares. I’ve always wondered, why do we adjust for weather at all? The weather is what it is; if it impacts jobs, it impacts jobs. If it impacts the economy, that is just economic reality. Just add a footnote that jobs may have gone up or down x amount because of extreme weather since that purported cause is nothing more than a guess anyway.

Why EVER even give a grain of salt to these numbers when the source of the numbers admits their “adjusted” numbers were so drastically off throughout the previous half year that they had to revise the last five months up by an average of 163,000 jobs each month? That revision is the same size as the total actual growth economists were expecting on average for this month. If you were that far off for that many months WHY DOES ANYONE EVER EVER LISTEN TO A WORD YOU HAVE TO SAY? It is as if the weather person forecast thunderstorms with massive winds and pouring rains every day for half a year, and every day was sunny with a nice breeze.

Does anyone wonder how there can be historically significant improvements in the number of jobs on payroll and in the labor-participation rate, yet unemployment RISES??? There is nothing even REMOTELY believable about these numbers.

So, what the heck?

Do you suppose the financial media is going to show evidence of a single living brain cell and grill the sources of this information to death, as they should? Heck no! They’ll just muse about what it means like they always do, as if numbers like this mean anything other than error, when they should be taking the BLS to the mat over how it can possibly be so completely wrong based on its own revisions and over how the numbers do not even appear to add up logically! Instead, the sleepful, watchless financial media will probably slumber right through this upset and report the numbers as if they are all facts without evidence of a thought in their heads.

I had planned to write part two of “The Everything Bubble Bust” for my patrons today, and maybe I’ll still get to that; but sometimes the nonsense just flies up out of nowhere like a malfunctioning retractible barrier that you run smack into. It is particularly hard to sit quiet when the supposed experts just regurgitate it all year after year as if “the BLS said it, so it must be accurate,” even though the BLS routinely shows us via its revisions it is almost never even close to accurate!

Liked it? Take a second to support David Haggith on Patreon!