This “new” producer in the mining space is a spin-off of the Nevada assets from Gold Resource Corp. So far, this has turned to unlock value for shareholders as the sum-of-the-parts are greater than the whole. The management team looks to replicate its success at Gold Resource Corp., but this time as a gold-focused producer in Nevada. A brief overview of management:

- Jason Reid (President & CEO): He joined Gold Resource Corp in 2006 while still private. He helped take the company public and has served as the CEO, President, and director over his 14-year career with the company. Gold Resource Corp was known for near-continuous profitability (10 consecutive years), including the lean years from 2013-2015 and returning a significant amount of capital back to shareholders ($115m) relative to the company's size.

- Barry Devlin (VP Exploration): Mr. Devlin is an experienced mining industry executive with over thirty-nine years of exploration experience. He previously held positions at Gold Resource Corporation, Endeavor Silver, and Hecla Mining Company. He has extensive experience in epithermal gold-silver (high and low sulfidation) systems and porphyry copper-gold skarns. He has several publications concerning epithermal systems.

Fortitude is still in the process of putting together the right people and currently doesn’t have an official COO as it started trading OTC on March 4th and changed its ticker to FTCO later that month. Like Gold Resource Corp, it initiated a dividend policy shortly after it began trading as it has one small mine in production.

Fortitude's strategy includes targeting projects with relatively low operating costs with high margins and high returns on capital. It has a suite of assets in Nevada from which to grow organically and distribute meaningful dividends with the goal of maintaining a very tight capital structure. I’ve been to one of Gold Resource’s operations (in Mexico) and was thoroughly impressed. We fully expect the same management team has done the same thing here, albeit on a smaller scale, at least for the time being.

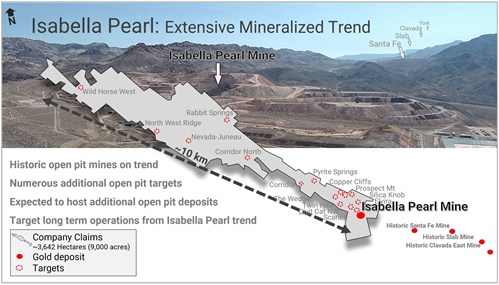

Isabella Pearl (Producing, Nevada): The Isabella Pearl open-pit heap leach mine achieved its first gold pour in early Q2 2019, ramping up production in 2020 and again in 2021. It is located along the historic mining trend within the Walker Lane mineral belt, Nevada. Gold Resource Corp. was initially mining the lower grade portion of the mine 'Isabella,' which resulted in lower production at higher costs. With the spin-off of Fortitude by Gold Resource Corp, the company can give full attention to its Nevada assets.

Gold Resource Corp and now Fortitude gold began mining the higher-grade Pearl part of the mine during the 2H 2020. 2019 production totaled 10.88k oz. Au, increasing to 29.4k oz. Au in 2020, and targeting 36-40k oz. Au from 2021-2023 and possibly 2024 and beyond. The lower-grade Isabella zone average grade was low (~ 1 g/t Au), which it mined in 2019, reaching the higher-grade Pearl zone (~ 3.7 g/t Au), with the Pearl pit core having an average grade of 5.0 g/t Au.

Fortitude acquired 10 km’s (6 miles) of prospective mineralized trend adjacent to Isabella Pearl. There are numerous additional open-pit targets, which the company believes will allow for long-term operations from the Isabella Pearl Trend. Fortitude will focus on identifying and developing new satellite deposits around Isabella Pearl to fund the advancement of its other projects in its development pipeline.

The operation has a reasonable cost structure with cash costs and AISC of $650/oz. and $825-$900/oz. In the most recent quarter, the Nevada Mining Unit of Gold Resource Corp (now Fortitude) saw the Isabella Pearl mine produce 12k oz. Au (record quarterly gold production) and 29k oz. Au. over the full year. AISC was $952/oz., which will trend lower in 2021. The project also generated over $18.5m in operating cash flow (before changes in non-cash working capital) and approx. $12.5m in free cash flow. Similar to production, the majority of this cash flow was generated in Q4 2020.

Fortitude is in good financial shape with $27m in cash and minimal debt. With its cash position and ongoing cash flow, Fortitude is well-positioned to advance its other projects, continue to drill at Isabella Pearl to extend its mine life and pay an attractive dividend. Should the company need to raise additional capital, it could do via equity and maintain a very tight share structure (24m shares currently outstanding). The company declared its inaugural dividend equal to $0.02/share per month ($0.24/share annualized). It has laid out potential dividends, which is likely a function of how cheaply or not it can advance its development projects and the gold price.

Fortitude has put a solid foundation in place, generating positive cash flow to fund exploration and development of assets on its Nevada land package. Gold Resource Corp was one of the few junior producers that paid dividends during the bear market from 2H 2012-2015. The spin-off of Fortitude was perfectly timed as it has started mining the high-grade portion of the Pearl mine zone of the Isabella Pearl mine, which has an average grade of 3.70 g/t Au. To put this into a better perspective, during 2019, Gold Resource Corp was focused on the Isabella deposit with an average grade of 1.0 g/t Au, followed by an increase in gold grades in 2020, which saw production increase 10.3k oz. Au to 29.48k oz. From 2021-2023, the average annual production is estimated at 36-40k oz. Au.

The increase in production at lower costs at Pearl is just the beginning as the company has built up a portfolio of development assets, including Golden Mile and Mina Gold, two high-grade deposits currently being delineated, and two exploration projects, East Camp and County Line.

Golden Mile (Exploration, Nevada): Isabella Pearl will remain a focus for the company for the foreseeable future, but Fortitude is advancing both Golden Mile and Mina Gold. Gold Resource Corp was able to bring Isabella Pearly from discovery to production in just a couple of years, which it plans to do with its development projects should the economics warrant such. The company commenced a delineation drill program in Dec 2020, which was the first drill campaign at the project. Initial drill results confirm the historic third-party high-grade drill results. The property was acquired in summer 2020 and contained two known zones of mineralization, the "Golden Mile" and "Springs" areas. Recent drill highlights include:

- 20.1m @ 3.60 g/t Au

- 3.05m @ 13 g/t

- 9.14m @ 3.99 g/t

- 18.29m @ 1.03 g/t

- 13.72m @ 1.68 g/t

- 10m @ 1.73 g/t

- 9.14m @ 2.82 g/t

- 21.21m @ 2.77 g/t

Select historic third-party drill highlights include:

- 6.1m @ 46.5 g/t Au

- 36.6m @ 10.26 g/t

- 7.62m @ 9.34 g/t

- 10.7m @ 8.76 g/t

- 10.67m @ 8.35 g/t

- 16.7m @ 6.04 g/t

Drill Highlights include: 36.6m @ 10.26 g/t Au (from 15m)

Mina Gold (Development, Nevada); This asset has a historic third-party resource estimate of 1.6m tons @ 1.88 g/t Au. In 2021, the Company plans to evaluate the known mineralized zone among a much larger conceptual plan of multiple open pits along trend to the southeast onto the Golden Mile property whereby feeding ore to a strategically located heap leach and process facility. This asset has open-pit heap leach potential will recovery rates of 70-80%.

East Camp (Exploration, Nevada): An earlier stage asset located in Nevada's Walker Lane mineral belt. Prior exploration by several mining and exploration companies has established modest gold resource potential in five separate areas on the property, with over 3,000 meters of drill core and a large exploration database. The company believes this large property has numerous untested gold targets with open-pit heap leach potential warranting an extensive exploration program. Historic drill results include:

- 22.86m @ 13.55 g/t Au

- 4.57m @ 4.39 g/t

- 13.72m @ 2.88 g/t

- 7.62m @ 2.86 g/t

- 18.29m @ 2.42 g/t

- 23.86m @ 1.99 g/t

- 18.8m @ 1.91 g/t

County Line is another earlier stage exploration asset, located on the same mineral belt as its other assets, Walker Lane. The County Line property is part of the Paradise Peak collection cluster of high sulfidation epithermal deposits. The County Line open pit historically produced approximately 81k oz. of gold and 760k oz. of silver. Historical third-party drill intercepts and channel samples include;

- 9.15m @ 3.86 g/t Au

- 7.62m @ 3.03 g/t

- 15.24m @ 1.26 g/t

- 23.7m @ 3.86 g/t (channel sample)

- 33.50m @ 3.76 g/t (channel sample)

- 27m @ 1.34 g/t (channel sample)

Fortitude is an excellent junior producer in Nevada with material upside. It also pays what is currently equivalents to a >4% dividend yield. For more detailed analysis, please visit Goldseeker.com.

Disclosure: GoldSeek Employees Hold a long position in Fortitude Gold.