Weak gold prices and rising costs have been placing pressure on the margins of major mining companies, depressing equity prices and the mood of gold investors. However, it is times like these when the strong performers stand out.

Fortitude Gold (OTCQB: FTCO) has shown…well..its fortitude, delivering a profitable third quarter in 2022 despite market headwinds, building on its ramp-up success at its 100% owned Isabella Pearl operation in Nevada’s Walker Lane Trend.

On Nov. 1, Fortitude reported its production and financial results for the third quarter of 2022 with a total of 9,419 gold and 12,497 silver ounces sold at a total cash cost of $613 per ounce (after by-product credits), realising metal prices during the quarter of $1,719 per ounce gold.

The company recorded net income of $1.7 million, or $0.07 per share. All-in sustaining cost of $687 per gold ounce, $2.9 million in dividends to shareholders, $3.7 million deployed to exploration all while increasing its cash balance to $42.2 million.

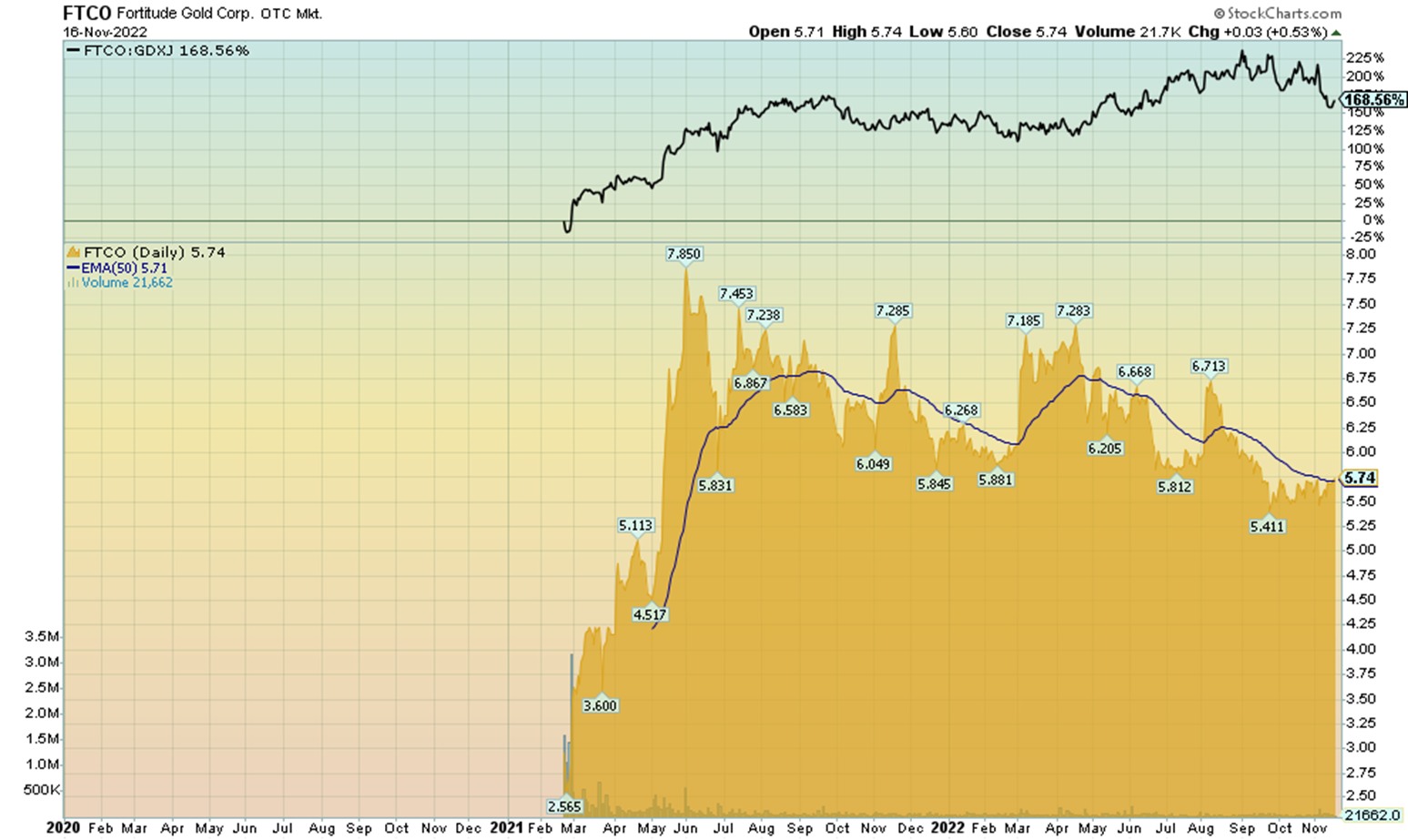

Mr. Jason Reid, CEO and President of Fortitude Gold, stated in a conference call ”I believe we continue to execute our strategic business strategy, which has resulted in Fortitude outperforming our industry peers on year-to-date valuations during this strong market pullback in the mining equities.”

Fortitude Gold, spun off in December 2020 as a separate company by Gold Resource (NYSE: GORO), generated $10.2 million in profits on revenue of nearly $54 million in 2020. That represents a huge turnaround from 2019, when Fortitude was still part of Gold Resource and lost nearly $3 million on revenue of $15.1 million.

The project produced its first gold in April 2019 just over 10 months after project groundbreaking. The company produced just 10,883 ounces of gold and 9,752 ounces of silver as it ramped up production and incurred significant startup expenses. Production nearly tripled in 2020, the first full year of the mine's operation, to 29,479 ounces of gold and 28,359 ounces of silver.

The company beat its increased target and exceeded its original 2021 gold production outlook by 15%, while increasing production year-over-year by more than 56%.

In 2021, the company produced a record annual 46,459 gold ounces in 2021, including 8,866 gold ounces during the fourth quarter. The company's original 2021 annual production outlook targeted a high-end range of 40,000 gold ounces which was increased to 45,000 gold ounces in July 2021.

With the 2022 production results so far, the company maintains its 2022 gold production outlook of 40,000 gold ounces which lies in the range of 36,000 to 40,000 ounces.

In part the success of this quarter was because of an improvement of grade, the companies previous nine months mined at an average grade of 3.30 g/t while in this quarter the average grade was 5.69 g/t, and compared to the same quarter last year of only 1.42 g/t.

This grade improvement is large in part due to removing the bulk of the overburden and processing the higher grade open pit ore and blending it with lower grade stockpiles. The goal of the blending is to extend mine life at Isabella Pearl which under the current proposed 40,000-ounces of gold production per year, would reach the end of its mine life in mid 2025.

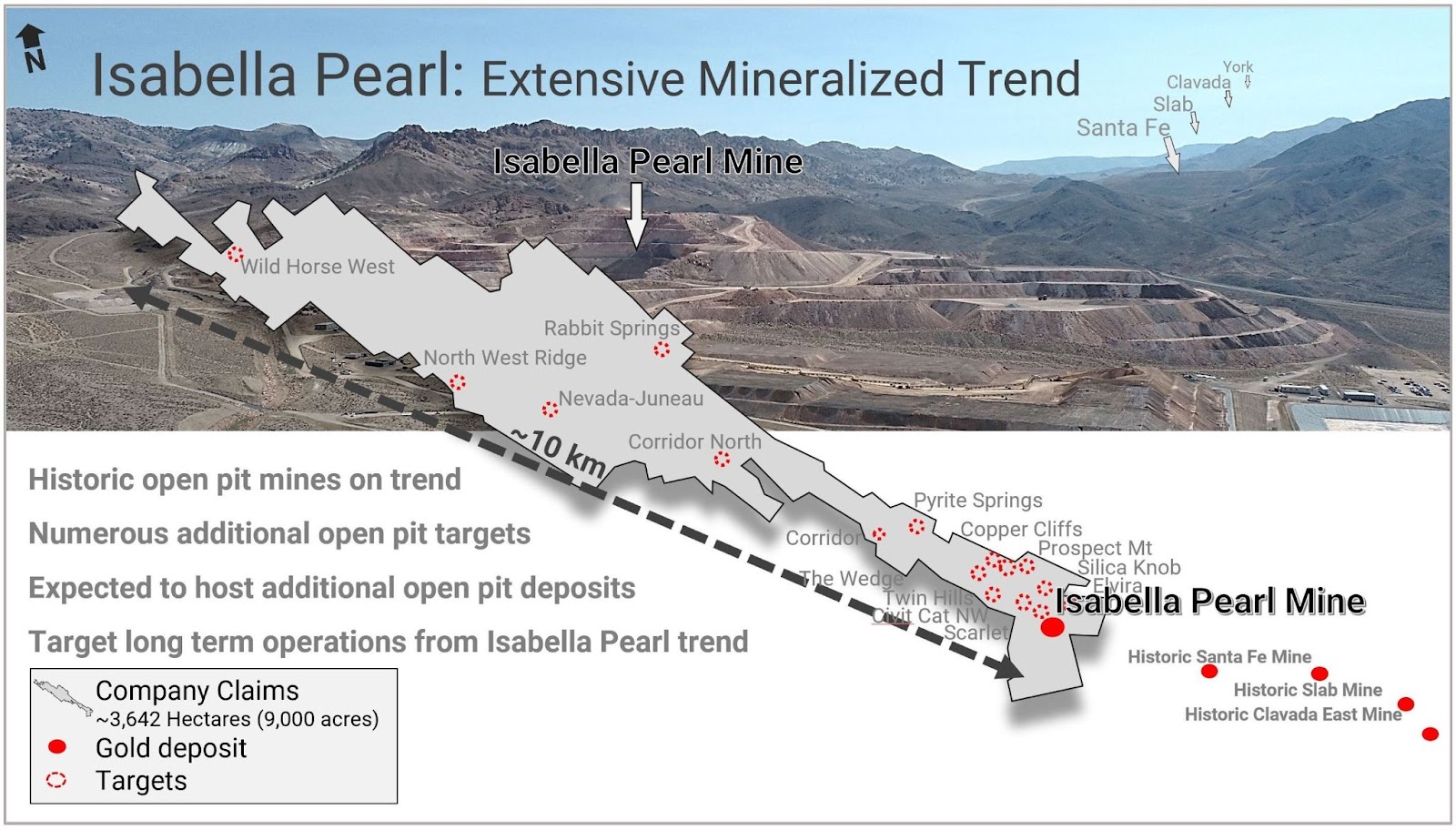

The Isabella Pearl property covers approximately 9,000 acres. The operation is an open-pit heap leach project, located at the southeast end of the Isabella Pearl property.

Proven and probable reserves included in the Isabella Pearl reserve report (with a drill data cutoff date of December 31, 2019) include 2,247,400 tonnes grading 3.05 grams per tonne (g/t) gold and 18 g/t silver, equating to 220,100 gold ounces and 1,310,700 silver ounces.

Total mine life of the Isabella Pearl deposit was estimated at 4.5 years at an average ~40,000 ounce per year gold production run rate, after the initial twelve month production ramp up.

But more ore for the Isabella Pearl operation is close at hand, while the company also delineates a new deposit farther away but still in the Walker Lane Trend.

Project Pipeline Moving Forward

The company owns 100% interest in the County Line property, located, approximately 14 miles northeast, of the Isabella Pearl Project. The plans for the property are to define sufficient mineralization to provide ore feed for Isabella Pearl operation. The proximity of the two properties could enable trucking ore from the County Line property to the Isabella Pearl Project's heap leach pad for gold processing.

However, with the prospect of zero capital expenditures for construction of a new plant at County Line with the bulk of any start-up costs devoted to mining and shipping ore to the already-paid-for Isabella Pearl operation, County Line is an option to extend production at Isabella Pearl.

While this property presents the nearest opportunity the company has not begun permitting there. The company's Golden Mile property is further through the permitting process and the company has stated it is still a priority project.

Fortitude Gold owns 100% interest in the Golden Mile property located in Nevada’s Walker Lane Mineral Belt. The property covers an area of approximately 9,300 acres comprising 451 unpatented and 5 patented claims.

The company is pushing forward its Golden Mile project towards a production decision by taking drilling results into an updated resource. The company could not provide a specific timeline for the delivery of the mineral resource in the conference call. However, the company has been drilling the property for over a year.

Mr. Reid said if Fortitude was a normal company we would wait five years to drill out but we are not going to do that.” With $3.7 million for exploration allocated for 2022, the company expects the exploration budget to be the same in 2023, advancing its plans at Golden Mile.

Fortitude Gold released an initial mineral resource for its Golden Mile property in November 2021, which included 78,500 ounces at a 1.13 g/t gold grade in the indicated category, and 84,500 ounces at a 1.10 g/t gold grade in the inferred category. During the first half of 2022, the Company released fifty-one reverse circulation drill results focused on both infill and expansion drilling at Golden Mile.

Here are some of the most recent results:

|

Hole# GMRC-119: |

19.81 m of 1.03 g/t gold including:

|

|

Hole# GMRC-120: |

12.19 m of 4.86 g/t gold incl.

|

|

Hole# GMRC-121: |

13.72 m of 0.84 g/t gold incl.

|

|

Hole# GMRC-122: |

44.20 m of 0.86 g/t gold incl.

|

Headline results so far have been focusing on converting resources into reserves with the most recent results showing mineralization near the edge of a conceptual phase 1 pit shell, showing the potential for further mineralization and a phase 2 conceptual shell.

With two properties in the near term exploration pipeline, the company still has one more earlier stage project it can work on.

In addition, during the most recent conference call Mr. Reid emphasised that while there are no current advanced discussions for acquisition, the company is always keeping an eye out.

Production is in line with guidance after a successful ramp up, money keeping the drills turning while rewarding shareholders with a high paying dividend yield of 8.44%, which is being paid to shareholders monthly ($0.04/share), Fortitude Gold really stands out in the gold industry!

Fortitude Gold (US: FTCO) has some of the best attributes of a junior gold miner and has led it to outperform most of its peers since its spin-out. Low production costs fed by its high-grade ounces, its excellent share structure, perhaps the highest dividend yield in the sector, while mining in one of the top jurisdictions in the world, has made this highly successful company my top junior gold miner investments.

To continue your research and learn more about Fortitude Gold, please visit https://www.fortitudegold.com/

This report’s analysis was produced with the work of Nicholas LePan, GoldSeek.com

To Stay Connected:

- Twitter: @GoldSeek

- E-mail List: Sign-Up Here

Disclosure: GoldSeek.com employees own shares of Fortitude Gold Corporation. and the company is a sponsor of this website.

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. GoldSeek.com, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; GoldSeek.com makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of GoldSeek.com only and are subject to change without notice. GoldSeek.com assume no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.

Additional Disclosure: The owner, editor, writer and publisher and their associates are not responsible for errors or omissions. The author of this report is not a registered financial advisor. Readers should not view this material as offering investment related advice. Authors have taken precautions to ensure accuracy of information provided. Information collected and presented are from what is perceived as reliable sources, but since the information source(s) are beyond our control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The information presented in stock reports are not a specific buy or sell recommendation and is presented solely for informational purposes only. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise outside of the trading timeframe listed above. Nothing contained herein constitutes a representation by the publisher, nor a solicitation for the purchase or sale of securities & therefore information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The companies mentioned herein may be sponsor of GoldSeek.com. Investors are advised to obtain the advice of a qualified financial & investment advisor before entering any financial transaction.