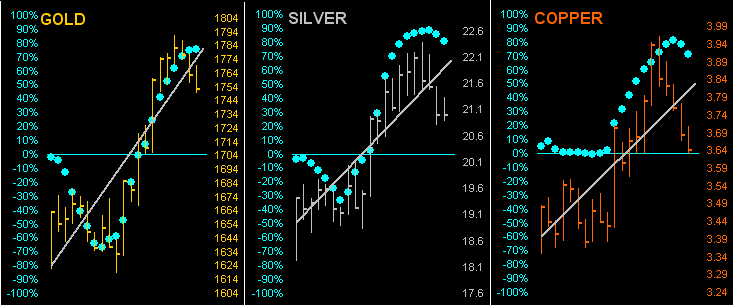

Following their prior robust trading week (07-11 November) wherein Gold gained +5.3% across a 109-point trading range and Silver +4.2% in spanning 1.70 points, the precious metals this past week went from molten to frozen. Gold settled yesterday (Friday) at 1752 -1.3% for the week, its 43-point span just 36% that of the prior week, whilst Silver for same finished at 20.98, -3.8x%, (albeit it maintained some volatility in a week's span of 1.60 points). Yet, neither could Cousin Copper escape the metallic cooling. Here is our metals triumvirate across the past 21 trading days (one month), each component clearly in an uptrend, but with the tell-tale "Baby Blues" of trend consistency commencing downside rollovers. Such downturns in the blue dots do not necessarily mean the uptrends are at their end; rather, they are (for the present) weakening:

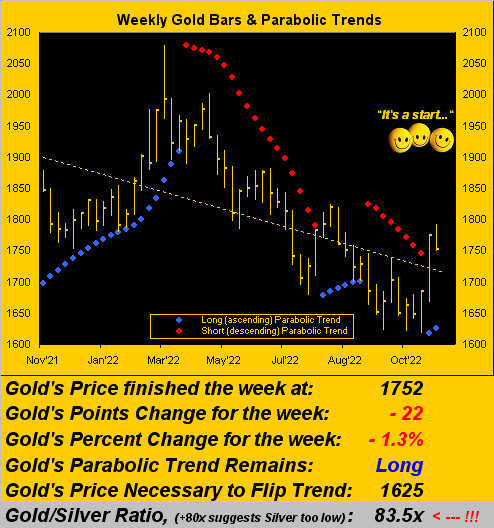

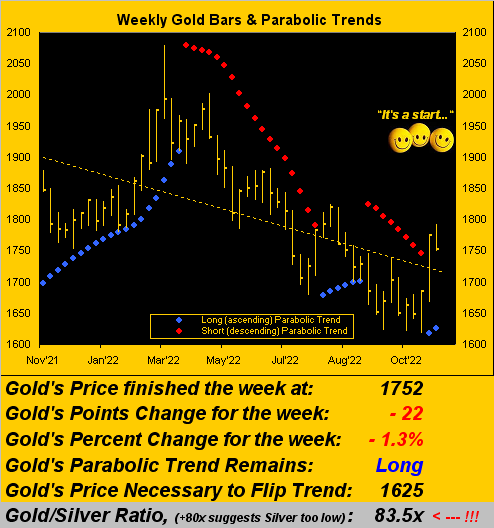

Gold's good news 'natch is the positive stance of its fresh parabolic Long trend as we below see, which as noted a week ago by like historical Long trends makes the iconic 1923 level achievable on this run. However: rotating that dashed regression line across the year's worth of weekly bars from negative to positive requires significant price ascension, indeed toward taking out the geo-political RUS/UKR spike 'n fade which topped at 2079 this past 08 March. Again structurally, the 1800s suggest a thicket of resistance, but at some point (which by now ought fundamentally have already happened), "resistance is futile" upon Gold eventually making its currency debasement catch-up move toward 4000:

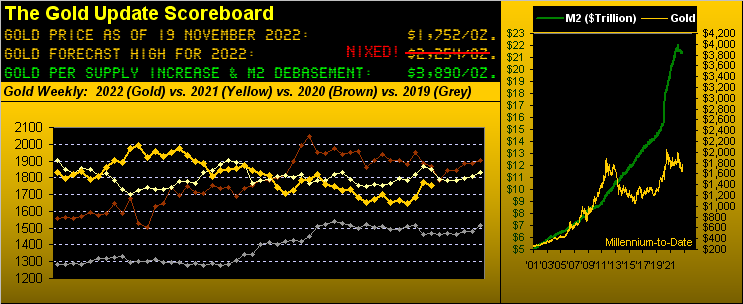

Gold's bad news is that price today (1752) now through 46 trading weeks of the year is -5.1% from where 'twas at this point last year, and similarly is -6.3% from this juncture in 2020. Yet on this day in 2020, the U.S. "M2" money supply was -11% lower than 'tis today. To be sure, such market dislocation makes no sense. But: never has opportunity knocked so hard for Gold! (And once you FTXers stop licking your wounds out there, if as a result you're not comprehensively destitute, you might consider investing in something that actually exists). Otherwise, ladies and gentlemen, the Investing Age of Stoopid continues.

Speaking of which, Q3 Earnings Season just concluded. Therein, one would expect for the 455 S&P 500 constituents that reported -- given less constraints from COVID than were present a year ago -- 100% of the bottom lines would have improved over Q3 of 2021.

"Still, mmb, 70% did beat estimates (ha-ha-ha)..."

Indeed the laughable stock broker marketing tool there Squire. Here's the Truth: only 58% did better, meaning 42% languished. And this year's Q3 Gross Domestic Product growth (+2.6% annualized) "ought" have benefited the whole bunch given the "recession is over!" Rather, this Earnings Season for the S&P was its fifth-worst across in at least the past 22 quarters, (three of which were very COVID-hampered). So insufficient are earnings that our "live" price/earnings ratio of the S&P 500 is now 36.7x versus the lifetime mean of 22.4x. Scary if you're in stocks. Especially with the three-month U.S. T-Bill yield now 4.135% and moreover with Gold priced (1752) at but 45% of its debasement value (3890). The market is never wrong, but the valuations inevitably don't lie.

As to our five primary BEGOS Markets, here are their percentage tracks from one month ago-to-date. Whilst Oil clearly has come off the boil, the general positive directional correlation continues, (which for you WestPalmBeachers down there means these markets are both rising and falling together, in recent times contra to Dollar direction). And as for "Oh that Dollar strength!", we've added its track per the dashed-green line, such "strength" being -6% vis-à-vis a month ago:

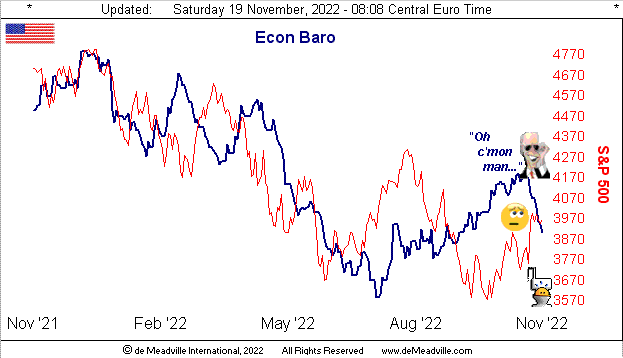

Indeed speaking of "strength" or lack thereof, suddenly 'tis really being sapped from the Economic Barometer. Is this an aberration? Or does it suggest a negative GDP reading for Q4? Obviously we've incoming metrics for Q4 through January so 'tis a bit early to opine; (26 January is the first Q4 read from the Bureau of Economic Analysis). But this abrupt lurch lower must be woe for Team Joe:

Not that all the past week's inputs were poor: the New York State Empire Index for November turned positive after having declined for each of the prior three months; October's Retail Sales improved; and September's Business Inventories were less of a burden. Contrarily though, November's Philly Fed Index took a further negative dive and the National Association of Home Builders’ Index slowed notably; in that same vein, October's Housing Starts, Building Permits and Existing Home Sales all were reduced; Industrial Production actually shrank; and the Conference Board's lagging indicator of Leading Indicators came in negative for the sixth time in the past seven months. Is this the resumption of The Great Flush? Remember: the Baro leads the S&P. On verra...

Meanwhile from the "Confide in Confidence Dept." we've Kansas City FedPrez Esther "No Jester" George suggesting that efforts to contain inflation might lead to recession, (even as we "officially" exited that of Q1 and Q2). Too, Federal Reserve Vice Chair Lael "The Brain" Brainard cites ongoing rate hikes even added at a reduced pace nonetheless (in the words of Dow Jones Newswires) "...will slow the economy in ways that can’t be observed yet..." Clear as mud, there. Are you confident?

Then across the pond and beyond from the "Too Many Cooks Spoil the Broth Dept." the G-20 can't seem to get their collective act together on what to do about it all going wrong, (i.e. war, inflation, geo-political dictation, etc).

And ChinaSide from "The Gearbox is Stuck in Reverse Dept." we read of declining export demand, sinking realty values, and shrinking sales for retailers.

All-in-all, 'tis the perfect opportunity to reprise Bricusse and Newley's '61 Broadway musical "Stop the World – I Want to Get Off"... or at least get some Gold.

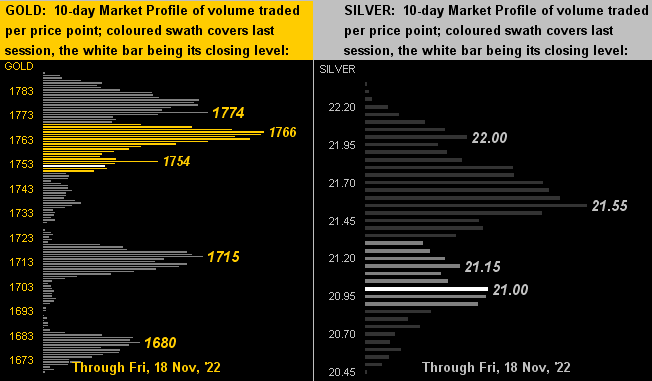

And Gold now a-dip within its broader Long trip, the 10-day Market Profile reveals below left a bit of immediate overhead price congestion for the yellow metal, whilst below right we've a similar status for Sister Silver, (the daily parabolics for the white metal having just flipped to Short). Near-term trading supporters and resistors are as labeled:

In summary, 'twould not be untoward to see both Gold and Silver recline somewhat, but we sense not materially. Indeed, we remain far more concerned about the over-valuation of the S&P 500 rather than the undervaluation of the precious metals. 'Tis just that Wall Street and the World have yet to wake up. But in due course, as always, they will.

Whilst we wait, let's wrap it here with this triple-take:

■ During the past week DJNW offered: "Why Inflation Has Lasted for So Long" What?? From our purview, (i.e. by actually doing the math), it kinda just started in April a year ago. Obviously that report was pieced together by an ostensibly well-paid financial journalist who hasn't been around very long. The average annualized StateSide rate of inflation (per the Bureau of Labor Statistics' Consumer Price Index) since April 2021 is 7.0%, By comparison for the nine years inclusive from 1973 through 1981 the average CPI rate was 9.0%, the peak reading being 14.8% in March 1980. We thus conclude that "So Long" is again indicative of today's LISAIGC (Low Information Short Attention Span Instant Gratification Crowd).

■ Also came this eye-opener from the UPI, (a shadow of its former self from when Grandpa Hugh ran the joint): 60% of U.S. folks are living "paycheck-to-paycheck". No too surprising, that. But then there is this stunner: 28% of those being paid over $200,000/year also are living "paycheck-to-paycheck". Puts us in mind of those SanFran high-techies who pay $100+ in the Mission District for a martini. "Hey Bud! Ya ever hear of a budget?" Good grief.

■ Finally we alluded earlier to the FTX fiasco. To be honest, we'd never even heard of FTX, but when billions are blown, one inescapably ends up hearing of it. 'Tis beyond us how anybody -- let alone bona fide financial entities -- would "invest" as such. But the best part from our standpoint was the name of the youngster who'd pulled it all together: Bankman-Fried. Perfect!! "You want mayo on that?"

Don't get fried by your bank man: get some Gold!

Cheers!

...m...