Gold is on the cusp of its biggest breakout in 50 years.

Sure, the weak dollar has helped, but Gold is incredibly strong in real terms.

Gold against foreign currencies recently hit new all-time highs. Gold against Bonds is at multi-year highs, and Gold against the stock market recently hit a 2-year high.

Meanwhile, the risk of recession is dangerously high, and the Fed cannot tighten that much more. Inevitably, they will have to ease while the inflation rate remains well above 2%. The recent bank bailout was only the start.

The fundamental and technical setup for Gold could not be better.

Furthermore, the 2008 boogeyman is helping to keep sentiment in check.

The last major downturn has conditioned many Gold bulls to expect a major decline amid a recession and stock market decline.

I cannot begin to tell you how pervasive this sentiment is amongst gold bugs, well-known pundits, and money managers. They are bullish on Gold but with the caveat that there could be another 2008.

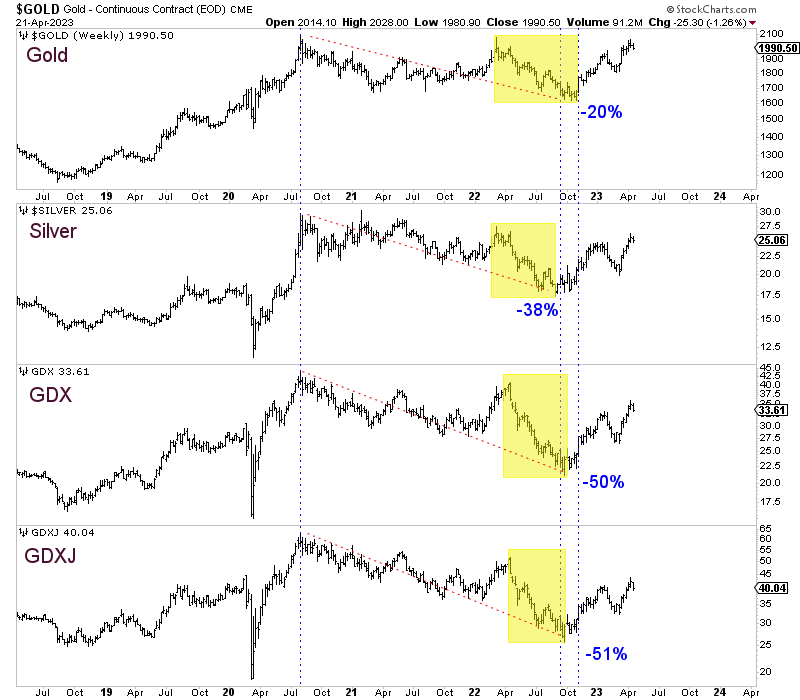

No one has mentioned the big correction or buying opportunity many are looking for has already happened. Precious Metals have been in a cyclical bear market for over two years, ending with a steep decline last autumn.

In the chart below, we highlight and note the steep decline that marked the end of the cyclical bear market.

There are three reasons why I do not expect another 2008.

First, policymakers enact new policies to avoid a repeat of past events. Changes were made after the 1930s to prevent a repeat, and changes were made after 2008 to prevent a repeat.

Second, the banking system is in better shape due to those changes. The major banks are far healthier than in 2008 and have limited exposure to commercial real estate.

The banking system could be in better shape. It certainly will be impacted by the coming recession, but not to the degree it was in 2008.

Third, recall that into 2008 precious metals had trended much higher and consistently so over the preceding seven years. Investors and institutions had far more exposure to the sector in 2008 than currently.

All this is not to say a severe recession and resumption of the bear market would not impact precious metals.

If precious metals accelerate to the upside in the weeks or months leading up to a sharp decline in the stock market, then I expect them to correct but not crash. A sharp decline in the stock market would temporarily hit Silver and gold stocks harder than Gold.

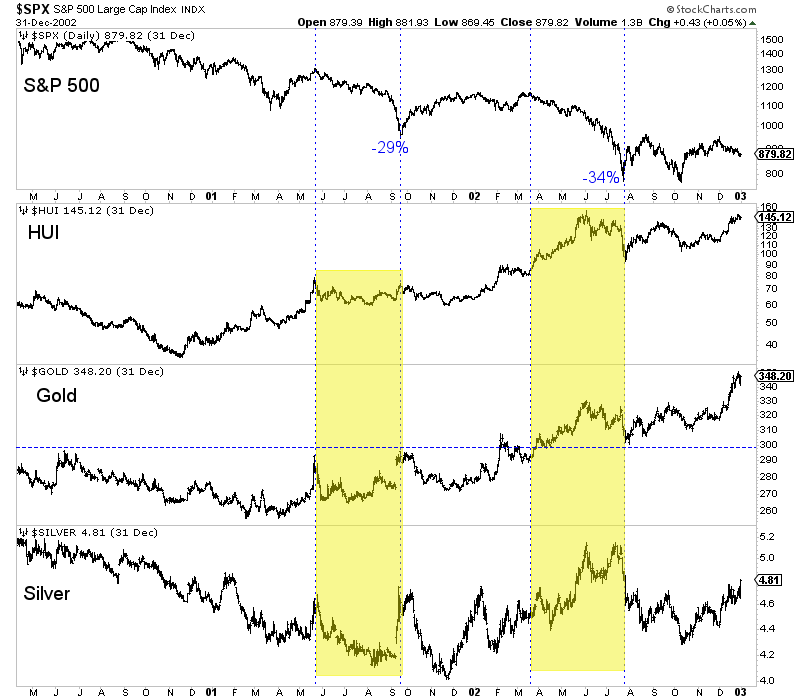

Furthermore, consider the 2001 to 2002 experience. Precious Metals corrected and consolidated during the S&P's 29% decline in the summer of 2001. However, during the S&P's 34% decline in 2002, Gold broke to a multi-year high, and Silver and gold stocks followed suit higher.

Gold is in the early stage of a new bull market that will be confirmed when it breaks past resistance at $2100.

These building worries about a repeat of 2008 are the foundation for a classic wall of worry that forms alongside a new bull market.

There will be a point when Gold and gold stocks correct significantly, but that may originate from higher prices.

I am looking for companies with a combination of fundamental value and huge upside potential over the next 12 to 24 months.

I continue to focus on finding high-quality gold and silver juniors with 500% upside potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential in the coming bull market, consider learning about our premium service.