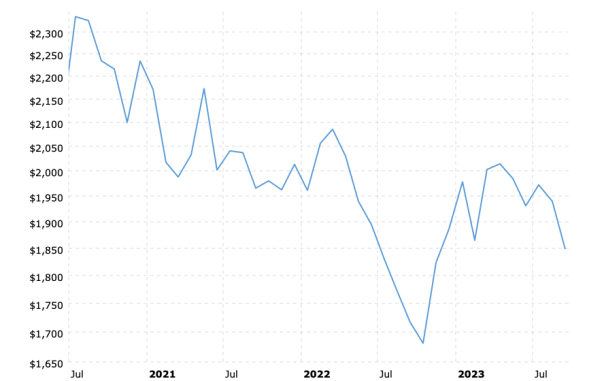

Gold continued its downward path this past week and all but confirmed that lower prices are ahead. Below is a chart of price action dating back to the peak in 2020…

Gold Prices (inflation-adjusted) 2020-23

The nominal price peak for gold at $2058 oz. in 2020 represented a one hundred-fold increase over its original convertible price of $20.67 oz. Since the summer of 2020, though, gold has declined in both nominal and inflation-adjusted terms.

INFLATION-ADJUSTED PRICING

Gold is real money. The U.S. dollar and other paper currencies are substitutes for real money.

Over time the inflation created by expanding the supply of money and credit cheapens the value of all the money in circulation which results in a loss of purchasing power for the dollar.

The loss of purchasing power shows up in higher prices for goods and services. Today it costs one hundred dollars to buy what could be bought a century ago with only one dollar.

That is a ninety-nine percent decline in U.S. dollar purchasing power which is reflected in a gold price of $2000. At $2000, the gold price is one hundred times higher than it was a century ago.

The continually higher gold price over time reflects the continuing loss of purchasing power in the U.S. dollar. In other words, the price of gold tells us nothing about gold. It tells us only what has happened to U.S. dollar purchasing power.

A higher gold price tells us how bad the effects of inflation have been; NOT how bad they could be.

Since it is real money and a store of value, holding gold helps protect against the destructive effects of inflation.

Most people own gold for that reason – to hold real money that doesn’t lose purchasing power.

By using inflation-adjusted pricing we get a more accurate picture of gold’s price action and how it relates to inflation’s effects on the U.S. dollar.

GOLD PRICE HISTORICALLY SPEAKING

All of the price increase for gold over the past century is attributable to the effects of inflation.

The increase has nothing to do with more demand for gold, higher or lower interest rates, social unrest, economic instability, wars, etc.

It all boils down to this: at $2000 oz. today, gold is worth exactly the same as it was at $20 oz. during the depths of the Great Depression.

Another way to say it is that if all of the effects of inflation were wiped away, gold would still be at or near $20 oz.

GOLD PRICE TODAY – CONCLUSION

At $1850 oz currently, gold is two hundred dollars below its $2058 price peak in August 2020; but, the effects of inflation have continued to exact their toll on the U.S. dollar.

In today’s cheaper dollars, gold would need to be $2336 oz. to match the 2020 high of $2058; hence, gold is almost five hundred dollars below its 2020 peak.

The gold price will eventually reflect the latest effects of inflation in a higher inflation-adjusted price. We just don’t know when. Nor does anyone else.

As long as the U.S. dollar remains strong, it won’t likely happen soon.