Despite the gold price declining for several months, its performance is extremely strong considering sharply rising real interest rates. To measure gold’s performance against real rates (TIPS yield) I’m introducing the “Gold Price–TIPS Model Tracker” to improve our understanding of how the gold price is set and its future potential.

Introduction

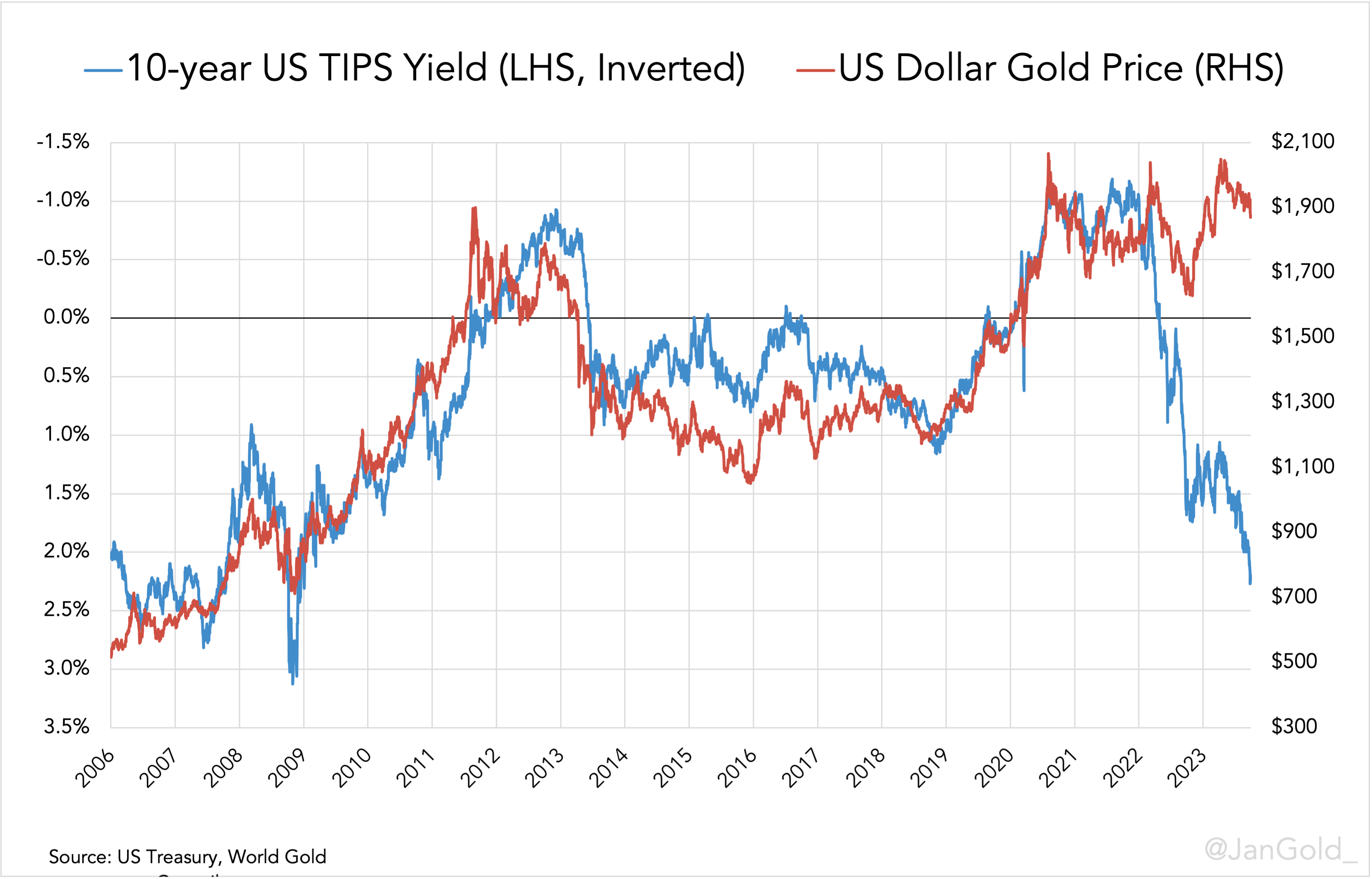

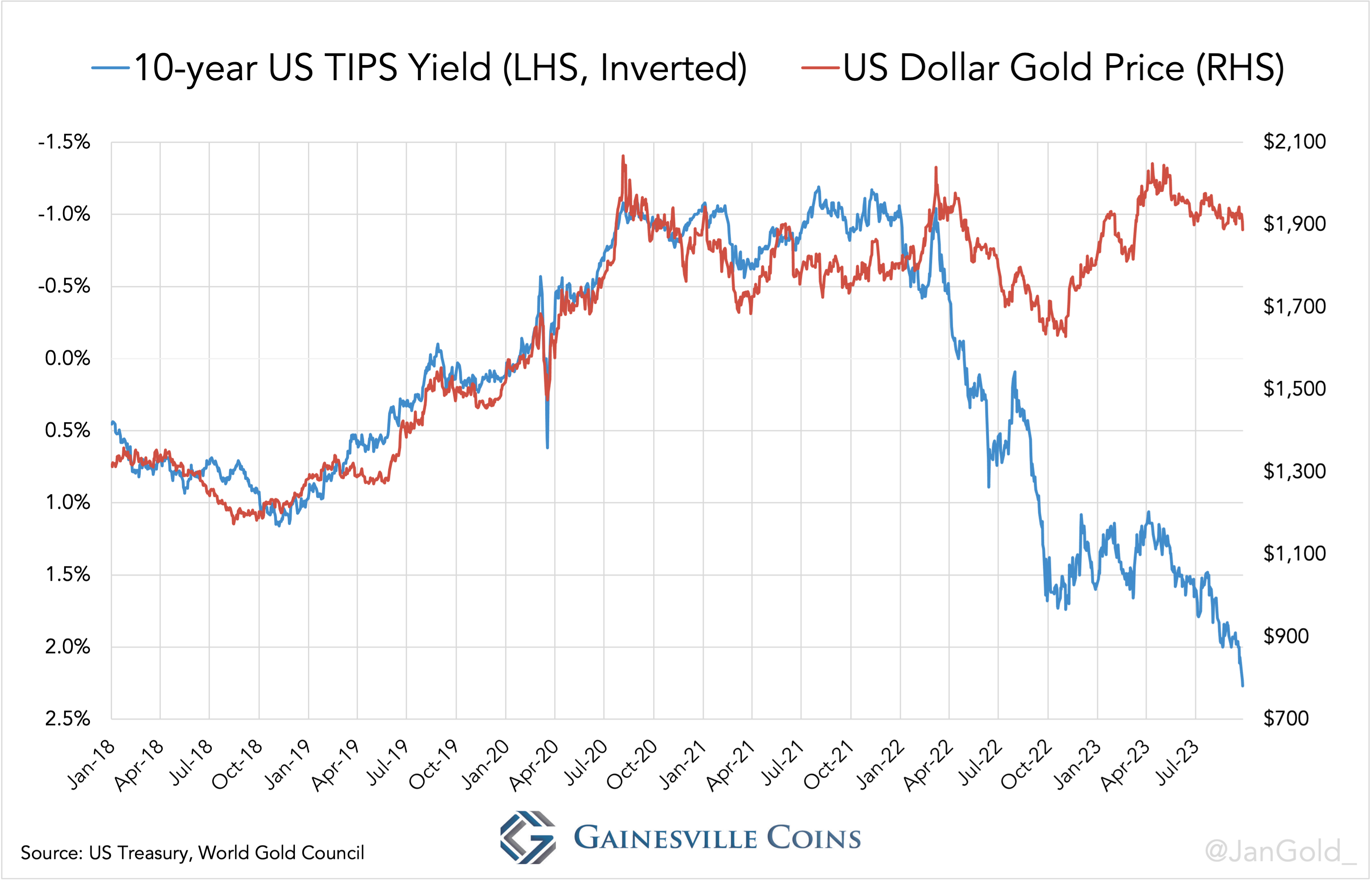

As we have discussed repeatedly on these pages, the gold price has been set by Western institutional money for nearly a century, and from 2006 through February 2022 there was a tight inverse correlation between the price of gold and the yield of 10-year Treasury Inflation Protected Securities (TIPS), which reflect real interest rates.

Then, early 2022, things started to change.

Chart 1. Note the TIPS yield axis is inverted.

Chart 2.

The Gold Market in Motion

At the outset of the Ukraine war early 2022, when the West froze Russia’s dollar assets, the gold price started drifting higher than the price previously suggested by the “TIPS model.” Dollar assets had become more risky—next to the fact the TIPS model wasn’t sustainable to begin with—pulling investors into gold.

Initially I was cautious to say the change in how gold was priced was permanent. After a few months, though, in November 2022, I wrote gold was in a transition phase. War, inflation, and insolvency risk had changed the market's perception of how gold should be priced. To the upside, that is.

In July I reiterated gold was showing momentous strength against real rates.

Additionally, in August I demonstrated that the West was losing control over the price of gold. For ninety years the gold price was set in wholesale markets such as London and Switzerland, but the East started to overrule the West in late 2022 and early 2023.

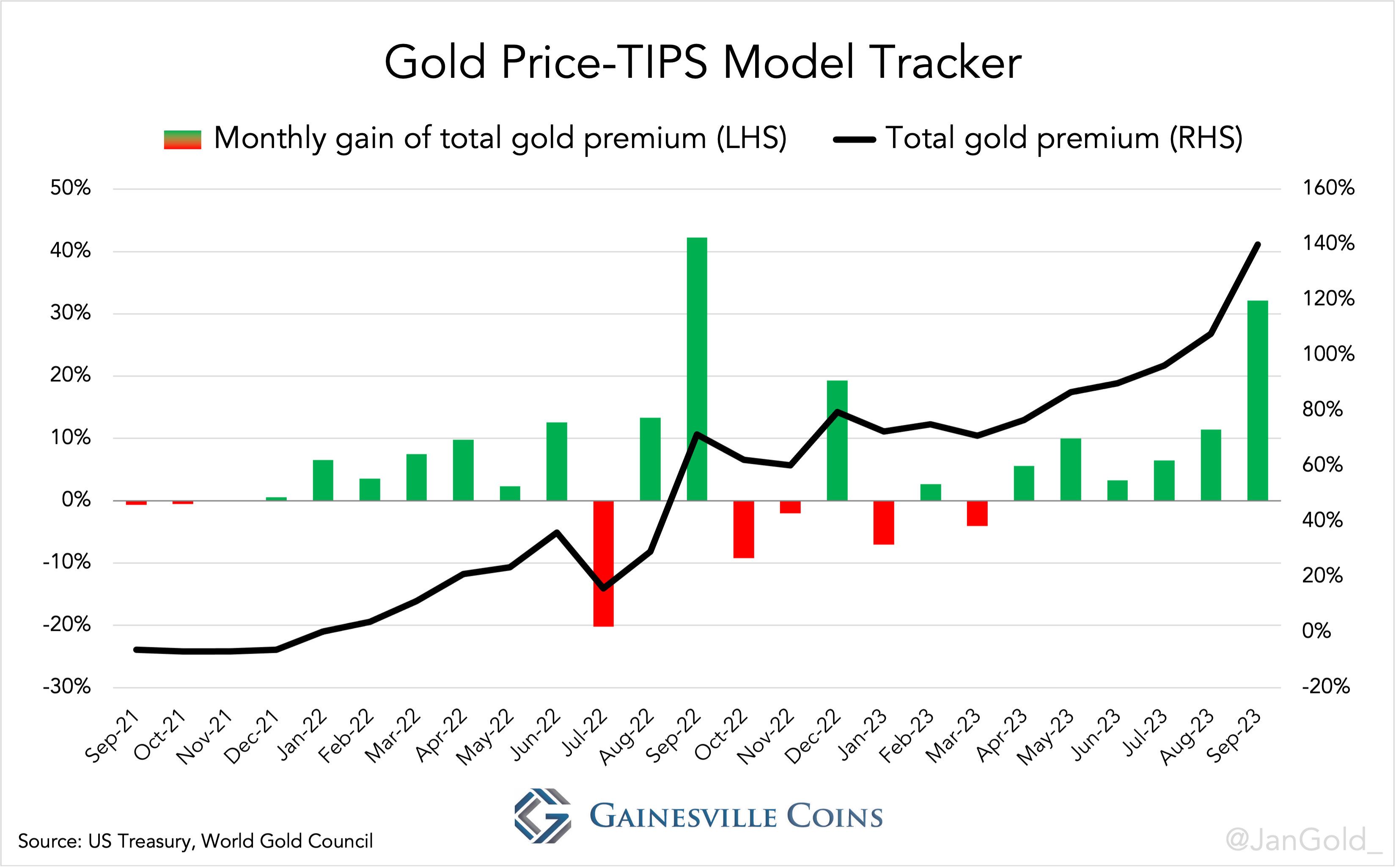

The Gold Price–TIPS Model Tracker

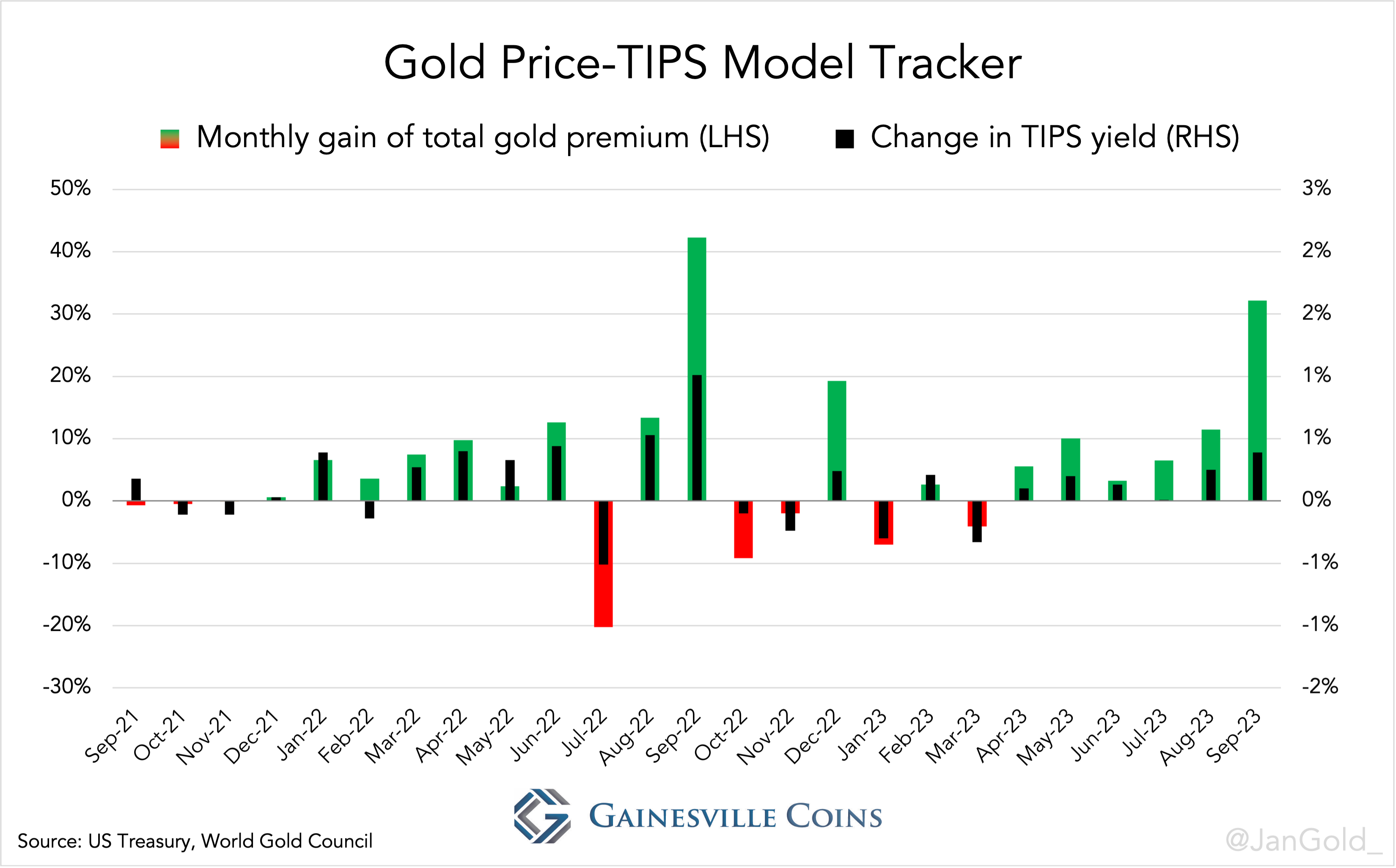

To get a better grip on gold’s fate going forward I created the Gold Price–TIPS Model Tracker that shows gold’s strength or weakness versus the TIPS model on a monthly basis. In the future we will add the Tracker to other parameters, like global cross-border trade statistics, to get a clearer view on what’s happening in the market and where it's heading.

The purpose of the Tracker is to learn how the gold price is performing against the price suggested by the TIPS model that ruled from 2006 until 2021. By measuring the difference between the actual gold price and the price suggested by the TIPS model, we can compute the total premium and the monthly increase or decrease of the total premium. The Tracker does not tell us if the price went up or down, but if it went up or down versus the TIPS model.

According to my calculations, the suggested gold price by the TIPS model at the end of September 2023 was $779 per troy ounce, while in reality an ounce changed hands for $1,871 (see chart 2). Consequently, by September the total premium had reached 140%.

Last month alone, in September, the Tracker indicates a whopping 32% was added to the total premium, a sign of extraordinary strength of the gold price relative to real rates.

Chart 3.

Conclusion

All of the above seems bullish for gold, as the trend of the total premium is up. Apparently, the market has altered its view and prices gold higher against real rates. A few observations to consider, though.

The Tracker doesn’t have a very long track record, and the total premium started accelerating at the start of a hiking cycle by the Federal Reserve in early 2022. Ever since, the total premium has been growing while real rates have been rising. Currently, we don’t know for sure how the Tracker will perform when rates fall.

What we do know is that in the few months since February 2022 that rates went down, the Tracker showed weakness—the total premium declined (see chart 4 below). If rates fall there is less gold buying strength as some investors still apply the old model.

Chart 4. When the TIPS yield falls, the Tracker goes down.

Up until now the Tracker has only shown strength when rates rise and the West sells gold that the East, mainly the Chinese central bank, is buying aggressively.

It’s hard to say how the Tracker reacts when rates truly reverse. For sure the gold price will rise from a higher base on falling rates, but it’s hard to say at this stage if the total premium will decline or increase in such a scenario.

This article was originally posted on Gainesville Coins.