Gold has largely spent the past half-year grinding sideways on balance. That lack of upside progress has sapped gold’s excitement and bullishness, leaving investors apathetic. Spawning something of a vicious circle, gold can’t go anywhere without sustained investment buying. But when gold isn’t powering higher, investors lose interest. This indifference dynamic should change soon with major gold-bullish catalysts aligning.

Secular gold-price trends are overwhelmingly driven by investment capital flows. While it doesn’t rival jewelry as gold’s largest demand category, investment is radically more variable. That volatility makes it the dominant driver of major gold uplegs and corrections. Global gold investment is opaque though, with comprehensive data only published quarterly in the World Gold Council’s fantastic Gold Demand Trends reports.

The latest covered Q3’21, where gold slumped a slight 0.8%. But that masks some large intra-quarter selloffs that were part of a broader 9.6% gold correction. Overall global gold demand proved weaker last quarter, falling 7.1% year-over-year to 830.8 metric tons. Investment demand was the sole culprit, plummeting 52.5% YoY to 235.0t! Yet traditional physical bar-and-coin demand stayed strong, surging 18.4% YoY.

Gold exchange-traded funds have overwhelmingly become this metal’s investment-capital-flows wildcard, the tail wagging the gold-price dog. They collapsed from a massive 273.9t build in Q3’20 to a 26.7t draw in Q3’21, an enormous 300.6t swing! That dwarfed last quarter’s mere 63.7t retreat in overall global gold demand. Gold-ETF capital flows have often proven gold’s dominant driver for lots of quarters over many years.

And two American behemoths command the lion’s share of the capital deployed in gold ETFs worldwide, the GLD SPDR Gold Shares and IAU iShares Gold Trust. The WGC tracks global physically-backed gold ETFs in its quarterly GDT reports. As of the end of Q3’21, GLD’s and IAU’s bullion holdings represented 27.6% and 13.9% of all the world’s gold ETFs’! Their collective 41.4% compares to a distant third place’s 6.7%.

Of that negative 300.6t swing in gold-ETF holdings comparing Q3’21 with Q3’20, GLD and IAU alone accounted for 214.8t or 71.5%! That’s not unusual, as GLD+IAU-holdings swings have weighed in at nearly all or even more than the entire global-gold-ETF space in plenty of recent quarters. Gold price trends are overwhelmingly driven by investment demand dominated by gold ETFs, and GLD+IAU are the biggest.

Instead of quarterly like the WGC’s data, GLD and IAU report their physical-gold-bullion holdings daily. That makes them the best high-resolution proxy for global gold investment demand. And that has proven weak since mid-June, when an unexpected catalyst prematurely killed a young gold upleg. After gold had just powered 13.5% higher in 2.8 months, mid-June’s FOMC meeting ignited huge gold-futures selling.

The Fed didn’t even do anything that day, maintaining its colossal $120b of monthly quantitative-easing money printing indefinitely with no hints of tapering. But top Fed officials’ unofficial individual federal-funds-rate outlooks in the accompanying dot plot proved hawkish. Merely 6 out of 18 of those guys saw maybe two quarter-point rate hikes way out into year-end 2023. That may as well be an eternity away in market time.

The US Dollar Index shot higher on that, unleashing panic among gold-futures speculators. Running with hyper-leveraged bets, they can’t afford to be wrong for long. Gold plummeted 5.2% in just three trading days on these traders puking out huge amounts of long contracts. That mid-summer shock first soured investors’ gold psychology, and it hasn’t recovered since. That resulting apathy drove gold’s sideways grind.

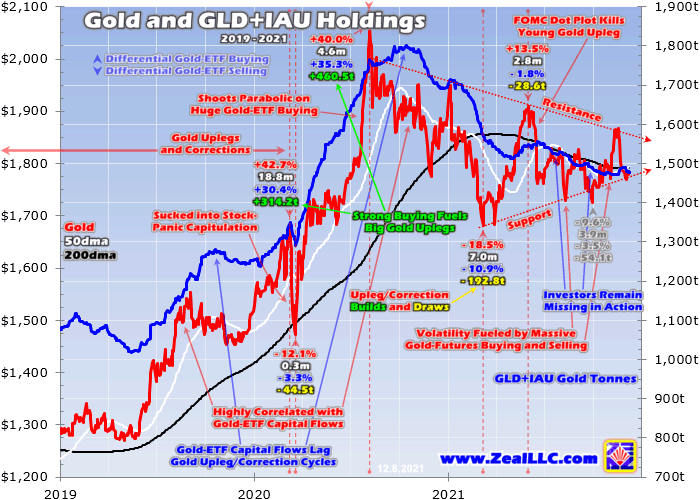

This chart superimposes GLD+IAU holdings over gold prices during the last several years. Major gold uplegs and corrections are tagged, along with the GLD+IAU builds or draws in those spans. Ever since that mid-summer FOMC dot plot derailed that young gold upleg, investors have been missing in action. They are indifferent to gold until it exhibits sufficient upside momentum to attract them, which hasn’t happened.

Gold price trends are highly correlated with gold-ETF capital flows, particularly GLD+IAU holdings. Prior to this latest Fed-truncated upleg squib, gold’s previous two uplegs both maturing in 2020 were massive. Gold powered 42.7% and 40.0% higher on enormous GLD+IAU builds of 314.2t and 460.5t! Strong gold-ETF buying fuels major gold uplegs. The basic mechanics of physically-backed gold ETFs explain why.

Their mission is to mirror the gold price, but the supply and demand for gold-ETF shares is independent from the gold-futures trading driving gold’s global reference price. So differential buying or selling of GLD and IAU shares relative to gold will soon cause their prices to decouple from the metal’s that they need to track. These gold ETFs’ managers avert these failures by issuing new or buying back gold-ETF shares.

When GLD and IAU share prices are being bid higher faster than gold, their managers have to sell shares to offset that excess demand. They use the proceeds to buy more physical gold bullion. So rising GLD+IAU holdings, which are called builds, reveal stock-market capital flowing into gold. These monster gold ETFs are effectively conduits for the vast pools of American stock-market capital to slosh into and out of gold.

Conversely when GLD and IAU shares are being sold faster than gold, their prices will soon disconnect from gold’s to the downside. ETF managers have to absorb that excess supply by buying back their own shares. They raise the necessary funds by liquidating some of their physical-gold-bullion holdings. So falling GLD+IAU holdings or draws show stock capital shifting back out of gold, which we’ve seen since June.

Gold-ETF capital flows tend to lag gold upleg-and-correction cycles, because investors are momentum players. They aren’t interested in buying anything including gold until after it has been rallying persistently and considerably for some time. So even though gold’s last correction after mid-2020’s massive upleg bottomed in early March 2021, GLD+IAU holdings didn’t hit their own trough of 1,512.8t until late April.

But with gold decisively powering higher again, the investors started returning to chase that momentum. By mid-June shortly after that fateful FOMC dot plot, GLD+IAU holdings had climbed a modest 2.9% or 44.0t. But gold’s distant-future-rate-hikes-scare plunge, and several subsequent bouts of heavy-to-extreme gold-futures selling, shattered investors’ nascent bullishness. They’ve been gradually fleeing since.

While the GLD+IAU draws since mid-June have been fairly-mild, they’ve proven relentless. Gold itself bottomed in late September after a 9.6% correction fueled by that outsized gold-futures dumping. Yet GLD+IAU holdings kept grinding lower into early November, clocking in at a substantial 5.5% or 85.7t total draw. With investment capital migrating out of gold, even big gold-futures buying couldn’t spark an upleg.

Major gold uplegs like last year’s are three-stage affairs. Their initial sharp gains out of deep lows are fueled by speculators buying to cover profitable gold-futures short contracts. The resulting gold surges soon attract in other gold-futures specs on the long side. But despite their big influence over short-term gold prices due to the huge leverage inherent in gold futures, these traders’ capital firepower is very finite.

That stage-one short covering and stage-two long buying can only run for a couple-few months before it exhausts itself. That needs to drive gold high enough for long enough to convince investors to return. Their vastly-larger stage-three buying can run for many months or even years, ultimately catapulting gold way higher. Fleeting gold-futures buying acts like the necessary trigger to spin up sustained investment buying.

That gold-bullish flywheel dynamic almost spun back to life in November. Enormous spec gold-futures long buying drove gold a sharp 8.2% higher between late September to mid-November. That started to break though investors’ festering apathy, leading to the biggest GLD+IAU holdings build since May when gold was surging. But unfortunately the necessary gold-buying handoff from speculators to investors failed.

The baton was dropped when specs’ gold-futures long buying exhausted itself before enough investors started migrating back into gold. The primary trigger failed to ignite way-larger secondary buying in time. Speculators’ upside bets on gold were so overextended that another bout of heavy gold-futures selling erupted, the fourth since mid-June. Investors were demoralized enough to stop differentially-buying gold-ETF shares.

Gold has spent the past-half year grinding sideways on balance because apathetic investors are missing in action. Note in this chart that gold’s 200-day moving average, which illuminates its short-term trend, is closely following GLD+IAU holdings lower. The next gold upleg again depends on gold-futures buying forcing gold high enough for long enough to convince investors to return. That is probably coming soon.

Several major gold-bullish catalysts are coalescing around a common linchpin of raging inflation. As this comes to a head, investors’ vexing gold apathy will be shattered. Facing a situation never before seen in market history, they will likely flock back to gold with a vengeance. This leading alternative asset is an essential portfolio diversifier, tending to rally when stock markets swoon. It is also the ultimate inflation hedge.

Back into March 2020 US stock markets plummeted 33.9% in less than five weeks in a full-blown panic on pandemic-lockdown fears. Fed officials freaked out, redlining their monetary printing presses like there was no tomorrow. Radically accelerating the already-underway QE4 campaign, the Fed’s balance sheet skyrocketed. As of its latest read last week, it had soared a terrifying 108.0% higher in just 21.2 months!

The Fed effectively doubled the US monetary base in just over a year-and-a-half, wildly unprecedented. That deluge added up to an insane $4,492b of new dollars injected into the system in that span. That left relatively-far-more money competing for and bidding up the prices on relatively-less goods and services in the economy. This profligate Fed’s extreme monetary excess directly drove the raging inflation rampant today.

Back in the early 1960s, legendary American economist Milton Friedman warned “Inflation is always and everywhere a monetary phenomenon.” Today’s Fed officials blaming the soaring prices on supply-chain disruptions is a red herring. Demand for everything is artificially-high because the Fed monetized an epic $3,118b in US Treasuries since March 2020! Ports are snarled because excess money drove excess demand.

The Fed’s much-hyped accelerated QE4 tapering will do nothing to address inflation. Even if the FOMC doubles the monthly pace of slowing its money printing, QE4 will still total $4,940b by March! All that new money remains in the economy, and can only be removed through quantitative-tightening bond selling. The Fed has no intention of unwinding QE, as big QT would tank these lofty stock markets triggering a depression.

Stock prices initially benefit from extreme monetary excess, as evident in the flagship US S&P 500 stock index soaring 110.3% higher from late March 2020 to mid-November 2021. It’s no coincidence that those huge gains closely match the Fed’s disturbing 108.0% balance-sheet ballooning! Those money-growth-driven gains left the S&P 500 dangerously-overvalued, and thus ripe for a serious bear market as the Fed tightens.

The 500 elite stocks in that leading benchmark entered December trading at average trailing-twelve-month price-to-earnings ratios way up at 32.7x! That’s well into formal bubble territory, which starts at 28x earnings. That in turn is double the century-and-a-half fair-value of 14x. Corporate profits still don’t support prevailing stock prices even with artificially-boosted demand, and inflation will wreak havoc on earnings.

The Fed’s doubling of the monetary base has unleashed massive price inflation in corporations’ input costs necessary to make their products. Eating these higher costs directly cuts into bottom-line profits, which will force bubble valuations even higher. Alternatively companies can raise selling prices to pass along their cost inflation to customers. But higher prices retard sales, which also weighs heavily on earnings.

Either way inflation is going to erode corporate profits with stock markets already trading well into bubble territory! That will force valuations even higher, amplifying the odds a major bear market will awaken to forcibly reconnect stock prices with underlying corporate earnings. The bear-ignition risk is exaggerated by the FOMC and Fed officials talking tough on accelerating their QE taper and starting to hike rates soon after.

Investors haven’t been interested in gold because it lacked sufficient upside momentum. But a big factor in that apathy was the stunning record-high stock markets. Since November 2020, the Fed’s deluge of new money has catapulted the S&P 500 to an astounding 76 new all-time-record closing highs! That has bred extraordinary complacency, leaving stock traders convinced the Fed has eradicated market cycles.

If stocks do nothing but rally on epic central-bank money printing, then why diversify into counter-moving gold? Gold investment is virtually zero, as evident in a leading proxy. Exiting November, the total value of GLD+IAU holdings was $85.4b. That was just 0.2% of the collective $41,932.8b market capitalizations of all the S&P 500 stocks! All-in Fed-goosed stocks, American investors aren’t prepared for an overdue bear.

But one is looming as the Fed ends its easy-money gravy train, first by slowing its epic money printing and then by hiking rates. That still leaves $4.9t of new QE4 money in the system, continuing to directly fuel raging inflation. That will ravage corporate profits, leaving these bubble-valued stock markets even more dangerously-overvalued. The more the Fed tightens or threatens to, the more selling pressure will mount.

As investors watch this train wreck play out, they’ll remember gold. Their apathy will thaw when the central-bank-conjured illusion of perpetually-high stock markets fades then vanishes. Even a slight shift in portfolio allocations back into gold will catapult its price way higher. For millennia the prudent standard for gold was considered 5% to 10% of investment portfolios. That is 25x to 50x above today’s implied levels!

So overlooking gold in this environment will prove a big mistake. The Fed has never before doubled its balance sheet in a year-and-a-half! Without that epic deluge of freshly-conjured money, stock markets can’t remain at bubble valuations. The more the Fed fights the inflation unleashed by its own monetary excess, the more downside pressure stock markets will face. That will greatly boost gold investment demand.

Gold’s day in the sun is coming, there’s no doubt. Technically since last summer it has been in a giant pennant formation, as evident in this chart. Rising upleg support since March 2021 is converging with falling correction resistance since August 2020. Breakouts from these continuation patterns usually happen in the same direction they were entered, which was upwards during 2020’s massive gold uplegs.

The biggest beneficiary of returning investment capital flows driving gold much higher remains the gold stocks. The larger majors tend to amplify gold’s upside by 2x to 3x, while the smaller mid-tiers and juniors often do much better. Like the metal that drives their profits, the gold stocks are really out of favor today. They are deeply undervalued relative to the earnings they are generating, and those will soar with higher gold.

If you regularly enjoy my essays, please support our hard work! For decades we’ve published popular weekly and monthly newsletters focused on contrarian speculation and investment. These essays wouldn’t exist without that revenue. Our newsletters draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks.

That holistic integrated contrarian approach has proven very successful. All 1,247 newsletter stock trades realized since 2001 averaged outstanding +21.3% annualized gains! Today our trading books are full of great fundamentally-superior mid-tier and junior gold, silver, and bitcoin miners to ride their uplegs. This week their realized gains were already running as high as +63.3%. Subscribe today and get smarter and richer!

The bottom line is gold has mostly ground sideways for a half-year because investors are apathetic. As momentum players, they aren’t interested in gold until it powers high enough for long enough to convince them its gains are sustainable. With that not happening, gold has suffered gradual-yet-persistent capital outflows since mid-summer. Recent gold-futures buying didn’t last long enough to spark investment buying.

But this gold indifference will end. Inflation is raging due to the Fed more than doubling its balance sheet since the stock panic. That monetary deluge inflated a gigantic stock-market bubble, and soaring input costs are increasingly eroding corporate profits. The Fed is trying to fight its own inflation by talking tough on slowing QE and hiking rates. Tightening will force stock markets to roll over, quickly returning gold to favor.

Adam Hamilton, CPA

December 10, 2021

Copyright 2000 - 2021 Zeal LLC (www.ZealLLC.com)