Analysis:

Wave i ended at the 103.65 high and we are falling in a lengthy and complex wave ii correction.

Within wave ii, we have updated our initial wave count to suggest that wave ii has become a double 3 wave corrective pattern.

Within our second three wave abc pattern, wave a ended at 67.71 and wave b at 87.67. We should be falling in our second wave c, which looks to have become and ending diagonal triangle formation.

Our retracement levels for all of wave ii are:

50% = 68.50.

61.8% = 53.87.

Our minimum target for the end of wave c is the wave a low of 63.57.

After wave ii ends, we expect a very sharp rally in wave iii!

In the long term we are rallying in wave C and that has the following projections:

C = A = 153.77!

C = 1.618A = 244.78!

Trading Recommendation: Go long crude with puts as a stop. Go long Suncor.

Active Positions: Long crude with puts as a stop! Long Suncor!

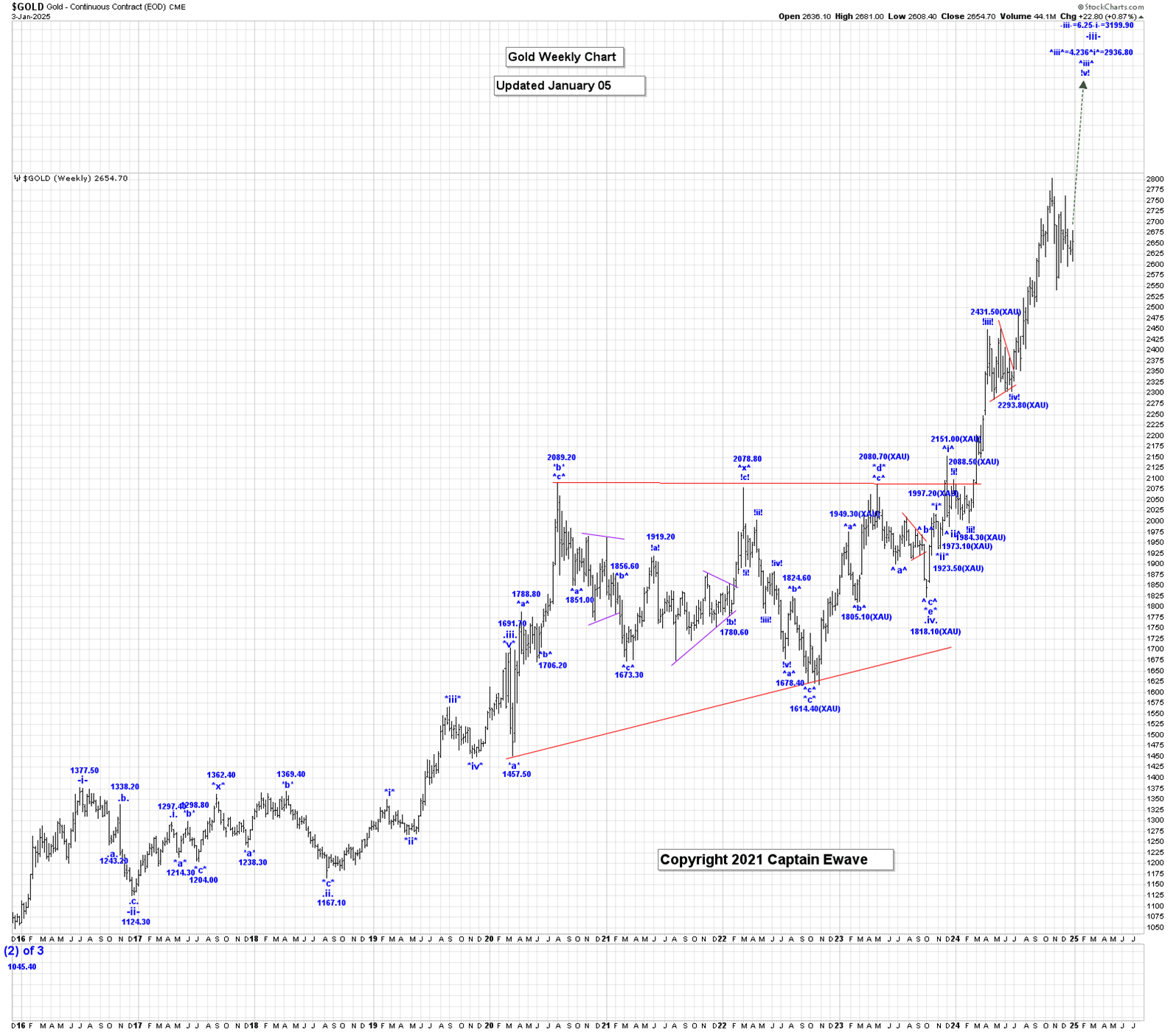

Gold

Analysis:

We continue to rally in wave ^iii^, which has a projected endpoint of:

^iii^ = 6.25^i^ = 3101.20!

After wave ^iii^ ends we expect a wave ^iv^ correction that retraces between 23.6 to 38.2% of the wave ^iii^ rally.

Basis the weekly chart: Our very large wave .iv. the bullish triangle pattern is complete at the 1810.10 low, and we continue to thrust higher in wave .v. of -iii-.

Within wave .v., wave *i* ended at the 1997.20 high and all of wave *ii* ended at the 1929.50 low. We are rallying in wave *iii*, which has a final projected endpoint of:

*iii* = 6.250*i* = 3042.30.

Our current projected endpoint for the end of wave -iii- is:

-iii- = 6.25-i- = 3199.90!

Trading Recommendation: Go long gold. Use puts as stops.

Active Positions: Long gold, with puts as our stops!

Thank you!

Captain Ewave & Crew