GOLD PRICE TARGETS

Almost everyone else continues to focus on the next upside leg for gold. In this article I will show some charts that allow for possible downside targets within the prevailing half-century uptrend.

There are four charts. I will provide some commentary after each chart. After that, I will add some final comments. The first chart follows…

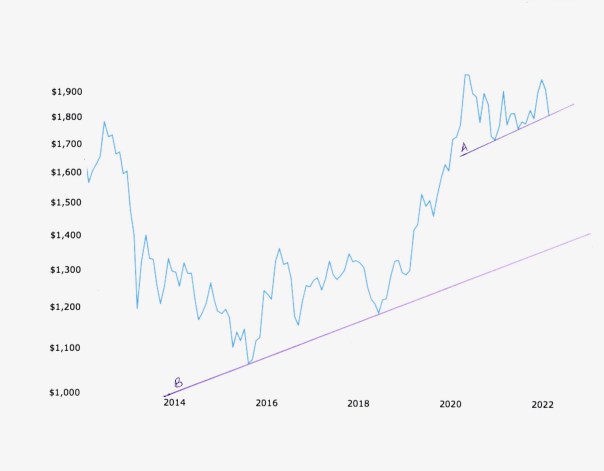

GOLD PRICES 7-YEAR UPTREND (Chart No. 1)

There are two possible support lines drawn on the chart above. The primary support line (B) dates back to the gold price low in December 2015.

Based on monthly average closing prices gold is currently touching a shorter support line (A); which, if it breaks down from here, does not appear to have much to keep it from falling back to as low as $1350-$1400 oz.

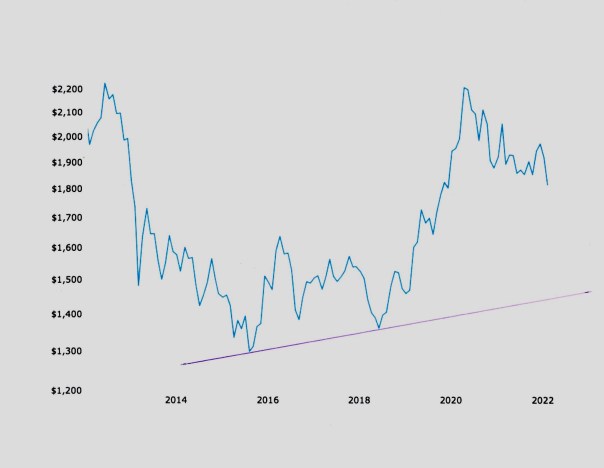

The second chart is virtually the same as Chart No. 1 above except that the prices have been adjusted for inflation…

GOLD PRICES 7-YEAR UPTREND – Inflation-Adjusted (Chart No. 2)

The support line drawn touches the same points as support line (B) in Chart No. 1. In this chart though, I have not drawn in support line (A). It should be apparent why not.

In Chart No. 2, we can see that the gold price has already broken down and is in a clearly-defined downtrend dating back to its high in the summer of 2020.

The next potential support is in the same area as indicated in Chart No. 1; i.e., $1350-$1400 oz.

Immediately below is the third chart…

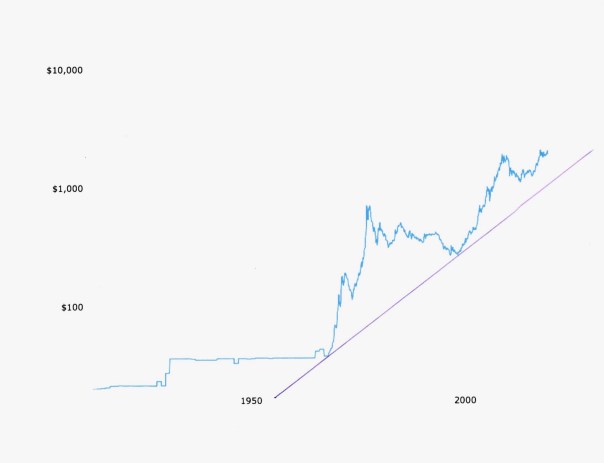

GOLD PRICES 50-YEAR UPTREND (Chart No. 3)

In Chart No. 3 there is a basic long-term uptrend dating back to 1970. At that time the price of gold was $36.56 oz. The other point of connection for the uptrend line was in March 2001 at $263.00 oz. This was the low point for the gold price after peaking twenty-one years earlier in 1980.

On the downside, the gold price could drop to about $1200.00 oz. without violating the price uptrend line dating back to 1970.

The next (and last) chart is, again, the same as the chart just above (No. 3), and once again, the prices have been adjusted for inflation…

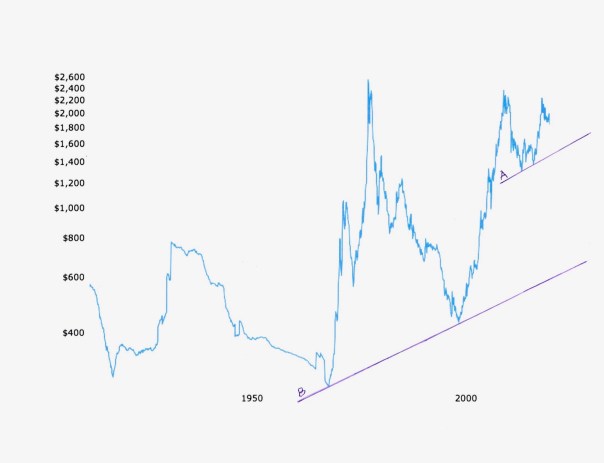

GOLD PRICES 50-YEAR UPTREND – Inflation-Adjusted (Chart No. 4)

In Chart No. 4 above, the support line (A) is similar to that drawn in Chart No. 1, however, the potential support on a short-term basis comes in at $1450-$1500 oz., about $100 oz. higher than indicated earlier.

The biggest difference in Chart No. 4 versus what appears to be possible in the previous charts, is that the gold price could drop to as low as $700 oz. (ouch!) and still remain within its well-established long-term uptrend dating back to 1970.

GOLD – $700 or $7000?

Five years ago, in January 2017, I published the article Gold Price $700 Or $7000?. Two years later, in January 2019, I revised and republished the article as Gold Price – US$700 Or US$7000?

In the article I discuss various scenarios that could bring about or accompany either of those gold price possibilities. I believe the article is just as pertinent today – maybe more so.

lf you have any interest in gold at all, I suggest you read it. You might learn something that will help you navigate what is ahead for gold and the world economy.

(also see Gold Has Lots Of Potential Downside)

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!