Gold’s standing relative to cyclical markets continues to improve, thus, so does the macro backdrop for gold mining equities

Without digging up too much theory and analysis from the past, let’s simply note that gold has more counter-cyclical character than most any other asset other than Treasury bonds and the US dollar. That is because when economic stress increases (and little about today’s August Payrolls report indicates otherwise) and cyclical, risk ‘on’ markets start to react to that stress, refuge-seeking herds tend to flock into the world’s reserve currency (to the extent the world has not yet de-Dollarized) and US Treasury bonds (to the extent that the world has not yet de-Treasuryized).

Next up in the liquidity refuge sweepstakes? Why, it’s the heavy lump of value that goes nowhere and does nothing other than retain its status through boom and bust economic/market cycles. Gold tends to be a measure of collective investors’ confidence or lack thereof. Today we are in the ramp-up process of a “lack thereof” phase, as gold’s ratios to cyclical markets clearly show.

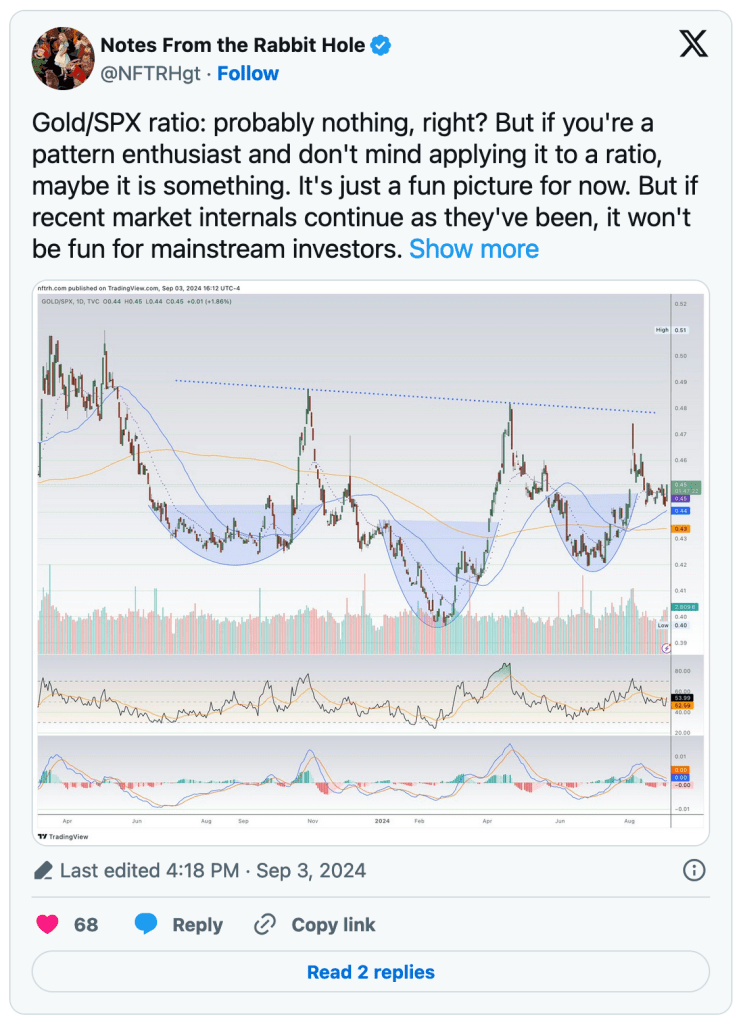

Gold/S&P 500

Somewhat for fun, I noted gold’s Inverted H&S pattern vs. SPX on September 3.

Today the handle off of the right side shoulder is breaking upward. This as players wrongly sell gold stocks because they wrongly bought gold stocks* along with the cyclical stuff. In other words, it is as we’ve been noting for months now; the gold stock sector will be vulnerable to correction in the broad markets simply because of their heretofore positive correlation to those markets. On the plus side, this corrective activity is not coming from some nosebleed highs, and so I think the sector will only be vulnerable very short-term, not in any sort of ‘bull-killer’ fashion.

* I’m not saying it was wrong to buy gold stocks, but I am saying it was wrong to buy them unthinkingly, as part of the global asset market party.

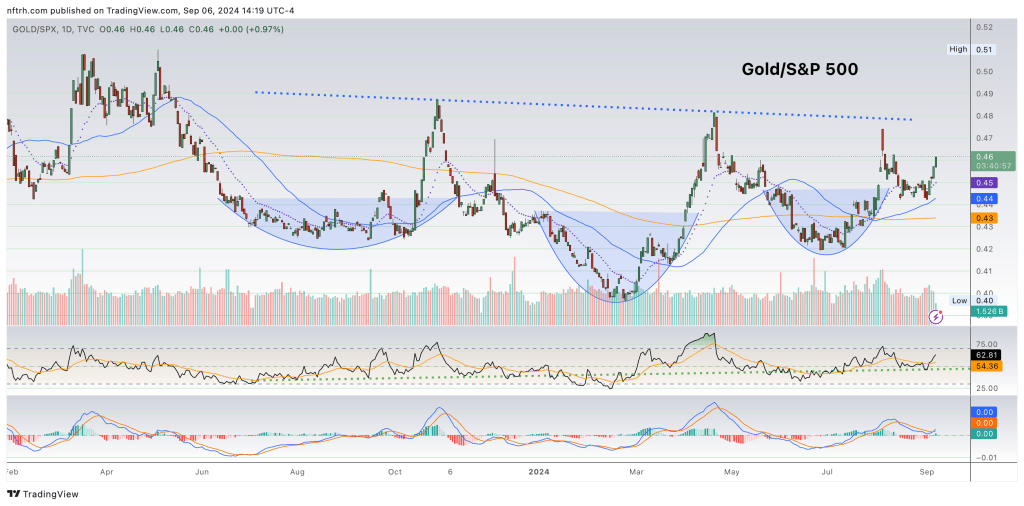

Gold/Global (ex-US)

SPX is the US headliner and it has been rotating its sectors in order to remain somewhat stable. However, a real bear or a hard correction will eventually hunt down most of its sectors, eventually. Gold has already been trending up vs. several US sub-markets (e.g. Small Caps) all year.

As for global, you can see a fairly young but established uptrend here as well.

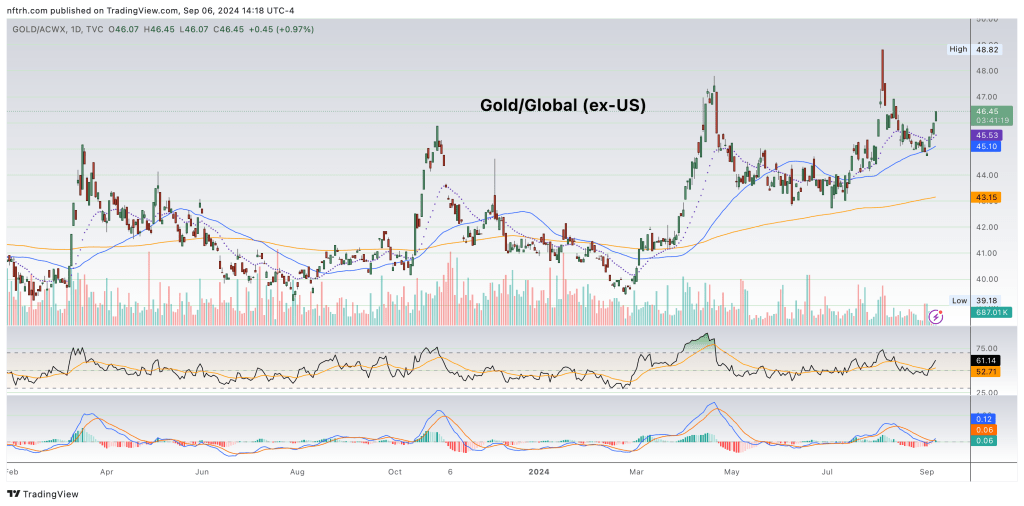

Gold/Commodities

Gold is trouncing the S&P Goldman Sachs Commodity index. This has been against the disinflationary macro signaling we’ve been describing all year, and well back into 2023. Commodity super-cyclers are just going to have to wait. Disinflation and a likely oncoming deflation scare will not help.

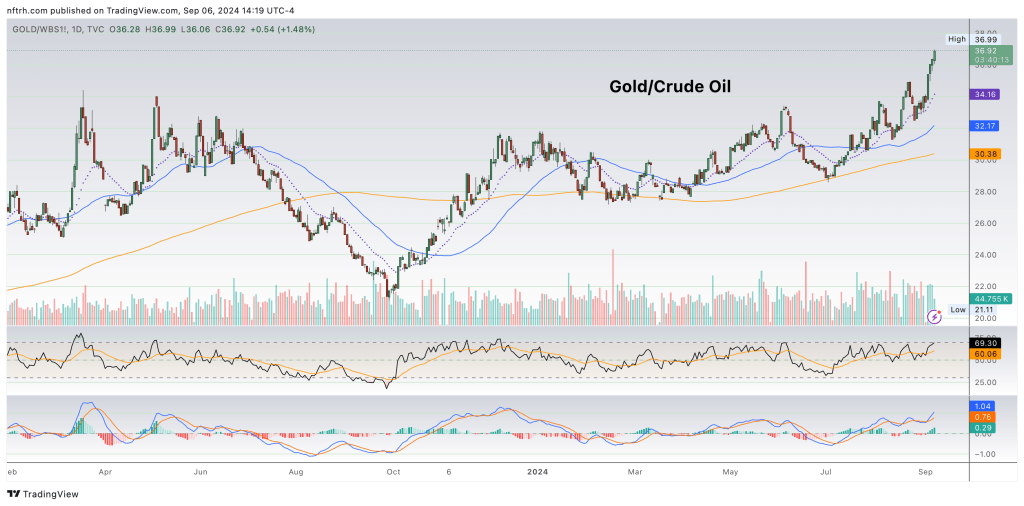

Gold/Oil

Meanwhile, if gold has a counter-cyclical character, the gold mining sector is flat-out counter-cyclical in its best fundamental suit. Today we are weeding out inflationists and broad markets MOMOs and FOMOs, as they sell the miners with the cyclical stuff. But the Gold/Oil ratio simply shows the gold mining product trouncing the gold mining cost input. Do the math.

To fully grasp the messages of these ratios and the true fundamental picture beneath them, you need to put aside any obsession you may carry about the nominal gold price. It can weaken and still ramp hard in relation to the cyclical stuff.

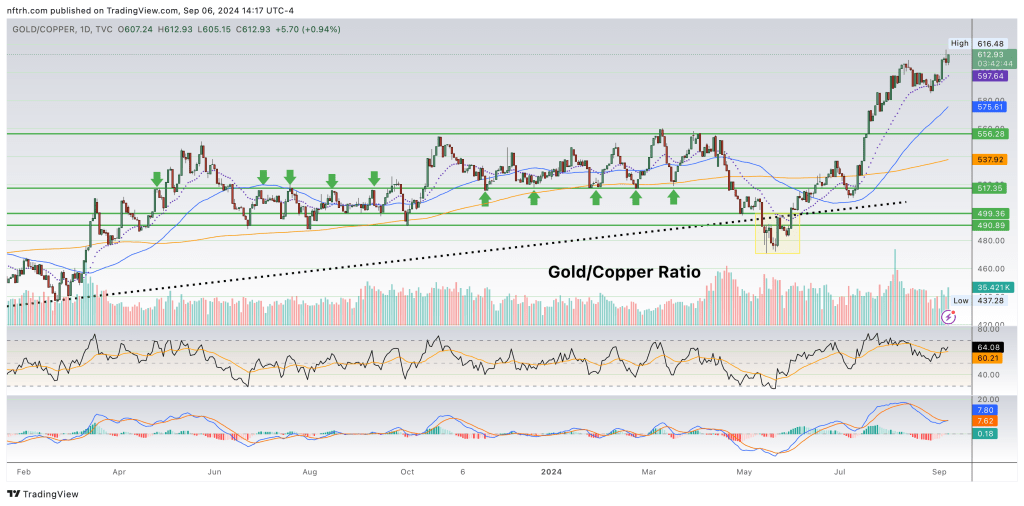

Gold/Copper

We have been noting for quite some time the negative economic signal that the Au/Cu ratio has been flashing. That not only remains the case but has intensified.

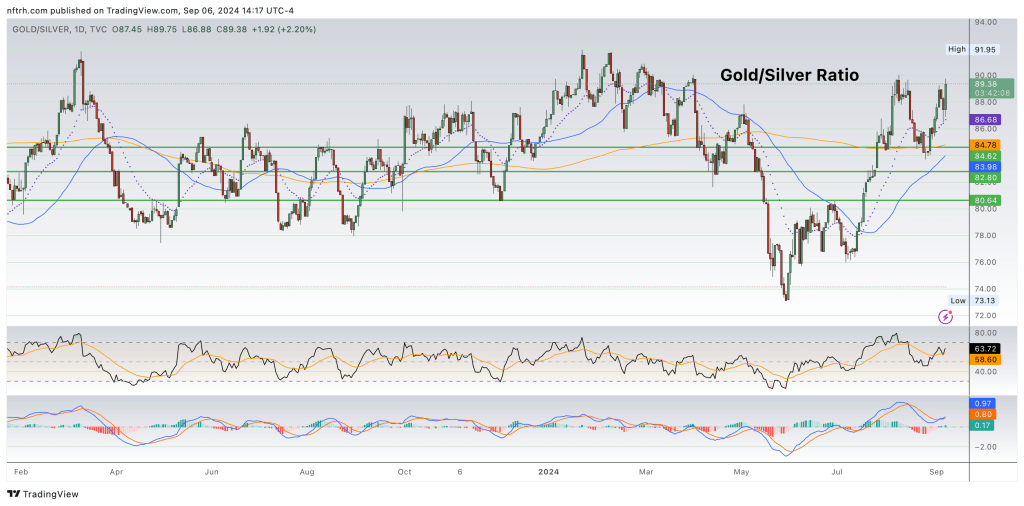

Gold/Silver Ratio

Finally, the Gold/Silver ratio (GSR) has been firm and counterintuitively, which has been a signal of pressure on the gold mining sector along with inflation trades like commodities, resources, and many global areas. There are a lot of moving parts to GSR analysis, but if the day comes that Silver takes back leadership from its sour old dad, the correction in the gold mining sector (at least), would be indicated to be over.

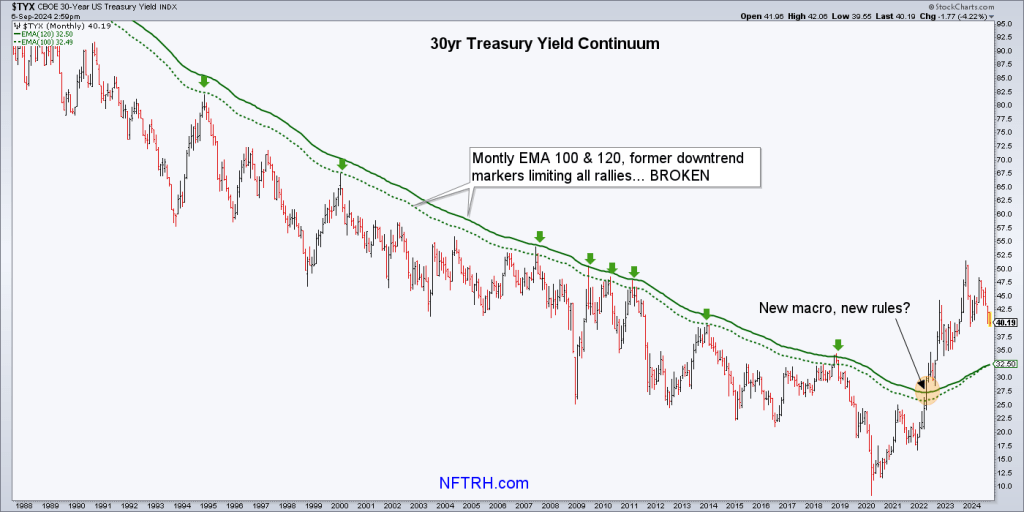

Although in this new macro the rule that ‘a rising GSR = bearish gold mining’ does not necessarily need to apply. For historical evidence, refer back to the 2000 to 2003 period when the GSR and the HUI Gold Bugs index both rose. It is no coincidence that that was the last gasp before Alan Greenspan’s Age of Inflation onDemand took hold and rigged the macro through inflationary bubble-making ever since, as his methods were studied and amplified by subsequent Fed chiefs.

I continue to claim that age ended with 2022’s spike upward in Treasury yields. That bond market rebellion has changed the macro dynamics in play and in my strong opinion, will hog-tie the Fed from business as usual on the upcoming downturn. That, in turn, will be the proper “post-bubble” gold mining macro. And I am not only accounting for the current decline in Treasury yields, we (NFTRH) expected it and planned for it.

I continue to claim that age ended with 2022’s spike upward in Treasury yields. That bond market rebellion has changed the macro dynamics in play and in my strong opinion, will hog-tie the Fed from business as usual on the upcoming downturn. That, in turn, will be the proper “post-bubble” gold mining macro. And I am not only accounting for the current decline in Treasury yields, we (NFTRH) expected it and planned for it.

But this decline in yields is not going to put the Genie back in his bottle. The bond market has changed and is adversarial to our policy heroes, both at the Fed (monetary) and in government (fiscal). Bubbles will no longer be effectively blown and so the thing that impaired the precious metals and especially the miners, cyclical asset market bubble-making, has been removed from the picture.

Dog gone it, this article went further afield than originally intended. Sometimes that happens. Be ready not to think in linear fashion. Be ready not to listen to the “experts” served up on mainstream platforms. Be ready to tune out the media, the promoters, the grifters, and know-it-alls. Be ready to listen to the markets. They are telling a profound story of what is ahead, and it’s going to catch a majority by surprise. All in my not overly humble opinion, of course. You can bet NFTRH will continue to actively and effectively manage the process in the exciting times ahead.

Dog gone it, this article went further afield than originally intended. Sometimes that happens. Be ready not to think in linear fashion. Be ready not to listen to the “experts” served up on mainstream platforms. Be ready to tune out the media, the promoters, the grifters, and know-it-alls. Be ready to listen to the markets. They are telling a profound story of what is ahead, and it’s going to catch a majority by surprise. All in my not overly humble opinion, of course. You can bet NFTRH will continue to actively and effectively manage the process in the exciting times ahead.