Gold, silver, and their miners’ stocks suffer their weakest seasonals of the year in early summers. With traders’ attention normally diverted to vacations and summer fun, interest in and demand for precious metals usually wane. Without outsized investment demand, gold tends to drift sideways dragging silver and miners’ stocks with it. Long feared as the summer doldrums, they’ve actually moderated in recent years.

This doldrums term is very apt for gold’s traditional summer predicament. It describes a zone surrounding the equator in the world’s oceans. There hot air is constantly rising, spawning long-lived low-pressure areas. They are often calm, with little prevailing winds. History is full of accounts of sailing ships getting trapped in this zone for days or weeks, unable to make headway. The doldrums were murder on ships’ morale.

Crews had no idea when the winds would pick up again, while they continued burning through their limited stores of food and drink. Without moving air, the stifling heat and humidity were suffocating on these ships long before air conditioning. Misery and boredom were extreme, leading to fights breaking out and occasional mutinies. Being trapped in the doldrums was viewed with dread, it was a very trying experience.

Gold investors can somewhat relate. Like clockwork trudging through early summers, gold starts drifting listlessly sideways. It often can’t make significant progress no matter what trends looked like heading into June, July, and August. As the days and weeks slowly pass, sentiment deteriorates markedly. Patience is gradually exhausted, supplanted with deep frustration. Plenty of traders capitulate, abandoning ship.

June and early July in particular have often proven desolate sentiment wastelands for precious metals, devoid of recurring seasonal demand surges. Unlike most of the rest of the year, the summer months simply lack any major income-cycle or cultural drivers of outsized gold investment demand. Yet several recent summers have proven big exceptions to these decades-old seasonals, and 2022’s could still be another.

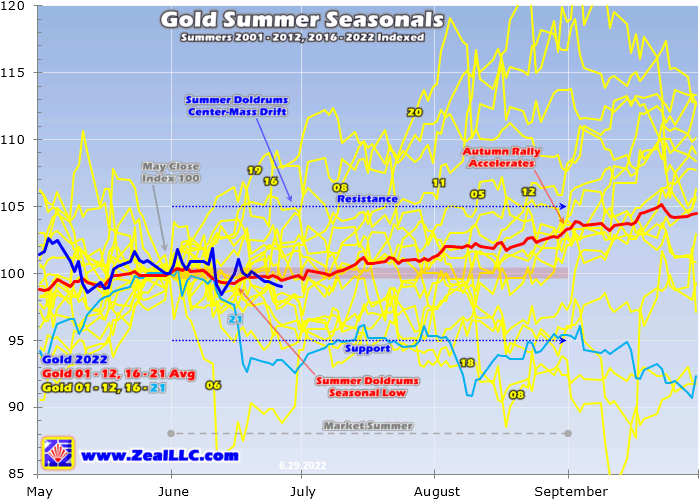

Quantifying gold’s summer seasonal tendencies during bull markets requires all relevant years’ price action to be recast in perfectly-comparable percentage terms. That is accomplished by individually indexing each calendar year’s gold price to its last close before market summers, which is May’s final trading day. That is set at 100, then all gold-price action each summer is recalculated off that common indexed baseline.

So gold trading at an indexed level of 110 simply means it has rallied 10% from May’s final close, while 95 shows it is down 5%. This methodology renders all bull-market-year gold summers in like terms. That’s necessary since gold’s price range has been so vast, from $257 in April 2001 to $2,062 in August 2020. That span encompassed two secular gold bulls, the first soaring 638.2% over 10.4 years into August 2011!

While that previous mighty bull ran from 2001 to 2011, 2012 was technically a bull year too since a 20%+ drop back into formal bear territory wasn’t yet seen. That came in Q2’13, where gold plummeted 22.8% in its worst quarterly performance in 93 years! The Fed’s unprecedented open-ended QE3 campaign was ramping to full-speed, levitating stock markets which slaughtered demand for alternative investments led by gold.

The resulting gold-bear years ran from 2013 to 2015, which need to be excluded since gold behaves very differently in bull and bear markets. That ultimately pounded gold to a 6.1-year secular low in December 2015, which helped birth today’s gold bull. It has gradually powered higher on balance ever since, never suffering any bull-slaying 20%+ selloffs. So 2016 to 2022 have proven gold-bull years to add into this analysis.

When all gold’s summer price action from these modern gold-bull years is individually indexed and thrown into a single chart, this spilled-spaghetti mess is the result. 2001 to 2012 and 2016 to 2020 are rendered in yellow. Last summer’s action is shown in light-blue for easier comparison with this summer. Seeing all this perfectly-comparable indexed summer price action at once reveals gold’s center-mass-drift tendency.

These summer seasonals are further refined by averaging together all 18 of these gold-bull years into the red line. Finally gold’s summer-to-date action this year is superimposed over everything else in dark-blue, showing how gold is performing compared to its seasonal mean. A third of the way through this summer, gold has generally meandered around its seasonal trend. But that could change fast in these crazy markets.

Some strong counter-seasonal surges in recent years are contributing to gold’s “summer” doldrums being something of a misnomer. The “June” doldrums might now be more accurate! During all these modern bull-market years before 2022, gold averaged a slight 0.1% loss through June. That flatlined performance resulted from gold recovering from its summer-doldrums seasonal low typically seen earlier in mid-June.

On average at June’s 11th trading day, the yellow metal has been down a modest 0.7% month-to-date. Interestingly that arrived June 15th this year, the day the Fed fired that huge 75-basis-point rate hike at the markets to attempt to fight red-hot inflation. While gold surged 1.6% on that, its prior-day $1,807 close was down 1.6% MTD. That was roughly in-line with seasonal precedent despite big gold-futures selling.

June’s slight grind lower actually flags summer doldrums’ ends. Buyers begin nibbling in July, which has enjoyed much-better average seasonal gains of 1.3%. The red seasonal-average line turning higher mid-summer is readily evident in this chart. Those gains swell again in August to a strong 2.1% as gold’s major autumn rally accelerates! That excellent run extends from summer-doldrums lows to late September.

In these same modern gold-bull years of 2001 to 2012 and 2016 to 2021, gold’s autumn rally averaged strong 5.8% gains over that span! That handily bests gold’s spring rally averaging +4.1%, but remains well behind the champion winter rally’s powerful 8.3% gains. Assuming gold’s recent $1,807 closing low leading into mid-June’s Federal Open Market Committee meeting holds, a 5.8% rally would carry gold to $1,912.

But with June, July, and August averaging fast-improving gold performances of -0.1%, +1.3%, and +2.1%, again June usually proves the worst of the summer doldrums. And after just drifting lower this latest June with gold slumping 1.0%, its gains are poised to mount this month. Odds are this summer will see bigger gold gains than usual, with several super-bullish factors converging to catapult gold to summer escape velocity.

The last time that happened was summer 2020, when gold rocketed higher out of that year’s pandemic-lockdown stock panic. Across June, July, and August, gold soared 13.7% in a very-strong summer rally! This current summer-2022 setup for gold is exceptional, way superior to that rally-spawning one a couple years ago. This dreadful inflation super-spike fueled by the Fed’s epic QE4 money printing is the main reason.

Between mid-October 2019 and mid-April 2022, the Fed mushroomed its balance sheet by a ludicrous 127.0% or $5,016b in just 30.1 months! That effectively more than doubled the US-dollar supply in just a couple years, unleashing today’s raging inflation. The latest Consumer Price Index headline-inflation print just hit a new cycle high soaring 8.6% year-over-year in May, the hottest CPI inflation since December 1981!

Unfortunately that shocking inflation read wasn’t some one-off anomaly, with the CPI soaring 8.5%, 8.3%, and 8.6% YoY in the latest three reported months. And all dozen past-year reports averaged lofty 6.8%-YoY general-price surges! In the year before the Fed recklessly redlined its monetary printing presses to launch QE4, the headline CPI averaged mere 1.8%-YoY gains. That deluge of new money is bidding up prices.

Today’s first inflation super-spike since the 1970s is exceedingly-bullish for gold. The more high and fast-rising prices scare investors, the more gold investment demand grows. The more hot inflation scares Fed officials into tightening even faster with big rate hikes and QT, the deeper that hammers stock markets into their young bear. That too boosts gold investment demand for prudently diversifying stock-heavy portfolios.

These dynamics catapulted gold to stupendous gains during the last two inflation super-spikes both in the 1970s. In monthly-average-price terms from trough to peak YoY-CPI months, gold prices nearly tripled during the first before more than quadrupling in the second! Gold ought to at least double before today’s inflation super-spike gives up its ghost, which isn’t likely until the Fed unwinds the majority of that QE4 money.

This raging inflation boosting gold investment should amplify gold’s usual autumn rally marching higher in July and August. Right after mid-June’s FOMC meeting with that surprise huge 75bp hike, the Fed chair himself warned “either a 50 or 75 basis point increase seems most likely at our next meeting” in late July. More big rate hikes coming should continue pressuring stock markets, making gold more attractive to investors.

Gold’s near-term upside potential in these next couple summer months is also much greater than normal due to speculators’ gold-futures positioning. These hyper-leveraged traders aggressively dumped long contracts heading into that latest FOMC decision. Their major liquidation was fueled by a monstrous US-dollar rally on the Fed’s extreme uber-hawkish pivot to a big-and-fast rate-hike cycle and unprecedented QT.

Specs’ probable gold-futures-selling firepower was exhausted as that anomalous parabolic dollar surge left it extraordinarily-overbought and topping. As that lofty US dollar inevitably mean reverts back lower, speculators will flood back into gold futures driving strong upside gold momentum. That will help entice investors back, likely amplifying gold’s gains in this year’s autumn-rally months including July and August.

The recent drumbeat of scary inflationary news will certainly continue intensifying this summer. Political polling shows this raging inflation is American voters’ top issue by far heading into November’s midterm elections. The more speculators and investors think about inflation, the more examples they’ll perceive and the more they’ll worry about it. That will really strengthen gold investment demand in coming months.

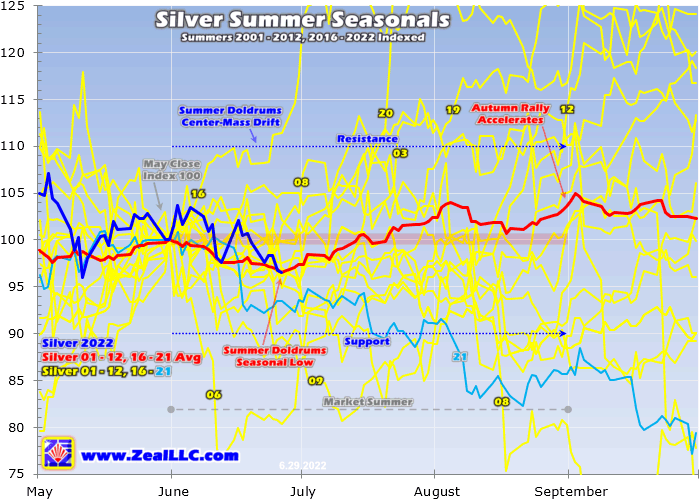

For many years I’ve thrown in silver and the gold miners’ stocks in my gold-summer-doldrums analyses. Gold’s fortunes drive the entire precious-metals complex. Silver and precious-metals miners’ stocks are effectively leveraged plays on gold. Their summer behavior mirrors and amplifies whatever is happening in gold. So if gold enjoys outsized gains later this summer, silver and their miners’ stocks should do better.

Silver’s summer-doldrums seasonals are similar to gold’s but exaggerated. Silver also tends to carve a major seasonal low in June, but a couple weeks later than gold’s towards month-end. On average during these same modern gold-bull years, silver dropped 3.5% summer-to-date by then. This summer silver’s June nadir hit right on schedule and target this week, with the white metal down 3.4% MTD this Wednesday!

Because silver usually bottoms later in June, it doesn’t have much time to recover before month-end. So silver has averaged 2.6% seasonal losses that month. But like gold its fortunes really improve in July, where average gains soar to 5.2%! Yet that big surge apparently pulls forward much of silver’s summer momentum, leaving August with smaller 1.1% gains. That all nets out to 3.6% average full-summer rallies.

Unfortunately that isn’t much leverage relative to gold, which averaged similar 3.3% gains through June, July, and August. Silver acts like a gold sentiment gauge, which generally remains softer through most of market summers. Even though gold’s seasonals turn favorable in mid-June, its autumn rally needs to build for a month or two before traders notice enough to start chasing. Silver languishes until psychology turns.

But when gold is enjoying outsized summer gains like a couple years ago, the resulting bullish sentiment catapults silver sharply-higher. While gold blasted 13.7% higher through June, July, and August 2020, silver skyrocketed up 58.1% in that summer-doldrums span! Once gold really gets moving generating real herd greed, silver explodes higher. That is likely to happen again soon in this terrible inflation super-spike.

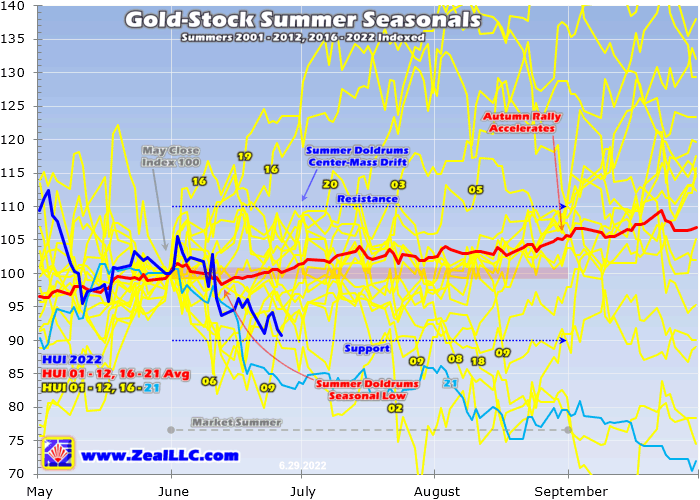

The gold miners’ stocks are also big beneficiaries of gold strength, which their earnings and stock prices amplify to big gains. For gold-stock summer seasonals, I’m using the older HUI gold-stock index which closely mirrors the GDX VanEck Gold Miners ETF more popular today. GDX’s price history is insufficient to match these modern gold-bull years, since it was only born in May 2006 deeper into gold’s last secular bull.

The major gold stocks’ summer-doldrums low mirrors gold’s, averaging out to June’s 10th trading day at a 1.6% MTD loss. But last month’s gold slump ramped bearishness, leaving GDX down a disheartening outsized 10.4% MTD this week! Gold-stock sentiment is also heavily dependent on gold’s fortunes. With traders really down on the yellow metal’s prospects, they’ve capitulated and fled battered gold stocks this summer.

Nevertheless the major gold stocks have enjoyed a nice summer uptrend on average through these same modern gold-bull-market years of 2001 to 2012 and 2016 to 2021. That older HUI gold-stock index saw average monthly gains of 1.3%, 1.0%, and 3.2% in June, July, and August! Amplifying gold, its miners’ stocks grow more popular later in summers as gold’s autumn rally accelerates. Traders love chasing momentum.

But overall gold-stock leverage to gold is still relatively-weak on average through market summers. The HUI averaged a respectable 5.6% gain between the ends of May and August, which is pretty impressive for the long-dreaded summer doldrums. But gold’s own modern-bull-year summers again enjoyed nice 3.3% gains on average. That only makes for 1.7x upside leverage to gold, well under GDX’s normal 2x to 3x.

Gold stocks’ relative summer underperformance is probably partially driven by lack of interest. Summer doldrums exist because traders’ focus on the markets wanes as they enjoy warm sunshine, long daylight hours, and vacations with their families. If they aren’t paying close-enough attention to see gold’s autumn rallies marching higher, the gold miners’ stocks will stay off their radars. But big gold surges overcome that.

A recent example was summer 2019, where gold bucked weak seasonals to blast dramatically higher in June, July, and August. That summer the yellow metal powered 16.7% higher in that short span driven by strong investment demand! Those big gains proved exceptional-enough to catch traders’ eyes, so they poured back into gold stocks despite the doldrums. GDX soared 38.3% that summer, for 2.3x upside leverage!

Gold stocks still have big potential to outperform again this summer, but only if gold surges fast-enough in July and August to make financial-market news. Capital will pour back into this battered sector if gold is sufficiently exciting to generate popular greed. That’s possible with gold needing to power way higher on this new inflation super-spike. Gold stocks need big gold gains in July and August to buck the summer doldrums.

This sector could win some late-summer bullish visibility and capital inflows in August as the new Q2’22 earnings season unfolds. The gold miners’ earnings that quarter are likely to grow considerably proving fat, making gold stocks look even more undervalued. In the previous Q1, the top-25 GDX gold miners averaged all-in sustaining costs of $1,133 per ounce. That made for implied sector unit earnings of $746.

Gold averaged $1,879 in Q1, and is holding near those levels averaging an excellent $1,873 in this latest Q2. But the major gold miners generally forecast improving outputs as 2022 marches on, spreading the big fixed costs of mining across more ounces lowering AISCs. The GDX top 25’s full-year-2022 AISC guidances at the end of Q1 averaged 7.0% lower than its AISCs! So they could retreat near $1,054 in Q2.

If that comes to pass, the major gold miners’ implied profitability could soar 9.8% sequentially from Q1! Big earnings growth could really stand out in this Fed-bludgeoned general-stock bear suffering weakening corporate profits. Strong gold-stock fundamentals with gold rallying on balance would increase the odds of outsized gains later this summer. The gold miners’ stocks can surge in the summer doldrums if gold does.

If you regularly enjoy my essays, please support our hard work! For decades we’ve published popular weekly and monthly newsletters focused on contrarian speculation and investment. These essays wouldn’t exist without that revenue. Our newsletters draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks.

That holistic integrated contrarian approach has proven very successful. All 1,296 newsletter stock trades realized since 2001 averaged outstanding +20.0% annualized gains! While we suffered a mass-stopping during gold stocks’ May plunge, we’ve rebuilt our trading books with cheap fundamentally-superior mid-tier and junior gold and silver miners to ride their coming upside. Subscribe today and get smarter and richer!

The bottom line is the gold summer doldrums in modern bull years have usually proven much milder than feared. The seasonal weakness tends to be compressed into early June, with gold and its miners’ stocks carving summer lows in mid-June on average. From there gold and gold stocks usually rally on balance in July and August, with gains really accelerating into summer-end as gold’s big autumn rally gathers steam.

That has much-bigger potential than normal this summer with inflation raging out of control. Gold soared during the last similar inflation super-spikes in the 1970s, and likely will again in this one. Speculators are positioned for big gold-futures buying as the overbought US dollar mean reverts lower. And this mounting stock bear driven by aggressive Fed tightening will really boost gold investment demand to diversify portfolios.

Adam Hamilton, CPA

July 1, 2022

Copyright 2000 - 2022 Zeal LLC (www.ZealLLC.com)