Strengths

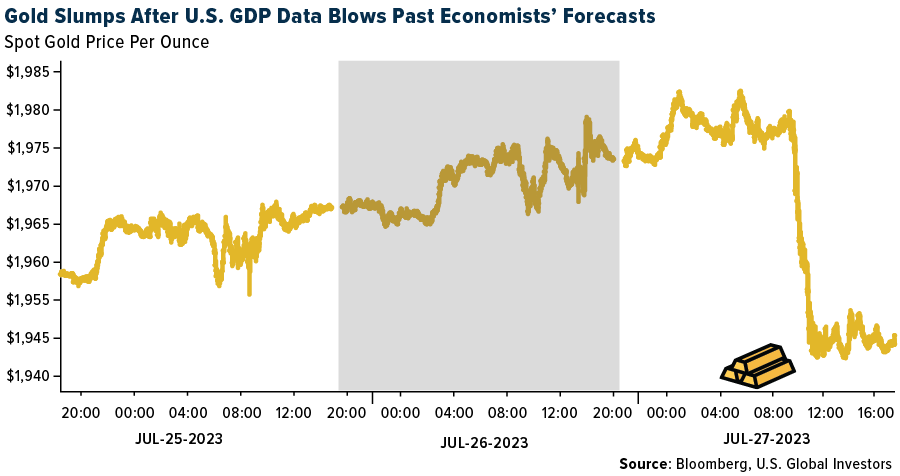

- The best performing precious metal for the week was gold, but still down 0.38%. U.S. GDP came in higher than anticipated and pushed the dollar up on expectations the Fed still has room to raise rates higher. K92 Mining has completed its tender process and was awarded the engineering, procurement, and construction contract for its 1.2 million tons per year Stage 3 Expansion Process Plant to GR Engineering Services Limited, an Australian engineering consulting and contracting company. The contract is fixed at a price of $81 million, resulting in 94% of forecast capital cost for the process plant being fixed, which puts total capital costs within 10% of the $177 million projected.

- Agnico Eagle reported second quarter 2023 EPS of $0.65, a meaningful beat versus $0.55 consensus. Against consensus, the EPS beat was driven fundamentally by higher production. Second quarter gold production was 873,000 ounces, a beat versus 854,000 ounces consensus. Second quarter was the first full quarter of 100% ownership of Canadian Malartic.

- MAG Silver released second quarter production results at its 44% owned Juanicipio project. Silver production of 5.27 million ounces versus consensus of 3.39 million ounces and gold production of 10.6k ounces versus the 8.3k ounce consensus. Overall tonnage was 38% above consensus. Silver grade came in at 498 grams per ton versus the 450 grams per ton consensus. The company continues the mill-ramp up and remains on track to achieve 100% of the 4,000 tons per day nameplate capacity in the third quarter.

Weaknesses

- The worst performing precious metal for the week was palladium, down 3.23%, perhaps on news that the world’s largest producer, Nornickel, reported first half of the year production was higher than projected due to higher grades and improved recoveries. Newcrest’s fourth quarter result was weak with gold slightly below expectations and AISC 15% above consensus. Higher sustaining capex was in part a contributor, as was lower gold sales versus production, but copper by-product credits were in-line.

- According to UBS, Amplats' first-half miss was primarily driven by a larger-than-expected loss on third-party purchases due to the adverse impact of a declining PGM basket price during the period. However, the mined operational performance was broadly in line with expectations, with medium-term production guidance unchanged and unit costs expected to moderate in the second half of the year.

- According to JPMorgan, De Beers’ cycle 6 sale of 2023 recorded $410 million of sales, down 10% versus cycle 5 of 2023 and down 36% versus cycle 6 of 2022. Cycle 6 sales track 13% below the $472 million average for cycle 6 over the 2016-2019 period.

Opportunities

- According to Stifel, K92 Mining’s share price is down 19% year-to-date, underperforming both the GDX and GDXJ. With the stock now trading at a P/NAV of 0.40x, despite having made substantial progress, the group views the current share price as an attractive buying opportunity.

- The North American Canaccord Genuity mining research team forecasts average AISCs up 3% to $1,343 per ounce in 2023 across its coverage universe (on a production-weighted basis), well below the 17% jump in 2022. Based on its 2023 forward-curve gold price of $1,942 per ounce, the research team forecasts AISC margins increasing by 21% to $599 per ounce, up from $496 per ounce in 2022.

- Analyst Giovanni Staunovo of UBS AG forecast that inflows into gold back ETFs will turn positive in the fourth quarter as consensus thought will conclude the Fed will be forced to cut interest rates by 25 basis points in December. Staunovo cites interest rates being the highest in 22 years and gold stockpiles in vaults backing the ETFs are at their lowest in three years. There is currently a significant spread between the correlation of the price of gold and the total know gold ETF holdings which manifests itself in November of 2022 as gold prices rallied 8.3% for the month while total known ETF holdings of gold actually fell 0.9% for the same period.

Threats

- The Globe and Mail published an article about how Russian cybercriminal group Clop targeted Barrick Gold as part of a global data theft incident in late May (in total, at least 376 organizations were impacted). Barrick has not revealed what effect the cyberattack has had, what data was stolen, or confirmed that an attack took place.

- Stifel is updating its model for Bear Creek Mining’s second quarter financials and Mercedes first-half production expectations. With weak production in the second quarter, Stifel now expects corporate FCF to come in at $7.4 million. Stifel is modeling second-quarter adjusted EPS of ($0.03) and operating CFPS pre-WC of ($0.06). The group’s modeling shows that Mercedes needs to consistently produce at head grade >3.3 grams per ton in order to work, so waste dilution is something it will be watching closely in the upcoming quarters.

- The number of so-called service-delivery protests in South Africa — demonstrations over the failure of municipalities to provide services such as electricity and water — may reach a new annual record. The country is suffering its worst-ever electricity blackouts and patience is fraying over the deterioration of municipal services, leading to 122 protests in the first six months of the year. At that rate, this year may overtake the 237 incidents of 2018, dwarfing the lull during the pandemic years.