- The best performing precious metal for the week was palladium, up 5.12%, despite hedge funds rolling out of palladium and into platinum according to the latest data. Silver futures on the Comex jumped as much as 13% on Monday and pushed prices above $30 an ounce briefly.

- Demand for physical precious metals remains strong. Gold coin sales at the U.S. Mint hit 220,500 ounces in January, the highest monthly total since 2009. The Mint also reported silver coin sales of 4.775 million ounces in January, a 24% increase and the highest for a January since 2017. On Tuesday, approximately $1.7 billion flowed into the iShares Silver Trust, flying past the all-time high set last Friday. Citigroup said silver could reach $33 an ounce by next week and possibly $36 to $38 an ounce in March if strong inflows continue into ETFs backed by the metal.

- The London Bullion Market Association (LBMA) released its annual price forecast report, and all four precious metals are expected to see double digit gains. LBMA analysts forecast the following: gold up 11.5%, silver up 38.7%, platinum up 28.2% and palladium up 11.2% for the year. With the gold market expected to be relatively tame through 2021, the LBMA said it expects all eyes to be on silver.

Weaknesses

- The worst performing precious metal for the week was gold, down 1.82%. Both gold and silver traded lower this week on a strengthening U.S. dollar and a steepening yield curve.

- Early in the week, silver spiked with the Reddit-fueled rush. Silver fell more than 5% after the CME Group increased margin requirements for futures. Margins were raised by 18% on Comex futures to $16,500 per contract.

- According to preliminary data released by the U.S. Geological Survey, gold output in 2020 fell for the first time in 12 years to around 3,200 metric tonnes, or 3% less than 2019. The production drop was largely caused by pandemic related shutdowns of mining operations. Kitco News notes the report found nine of the top 10 largest gold producing countries saw a decline.

Opportunities

- Turkey’s sovereign wealth fund (TWF) plans to invest $15 billion in energy, petrochemicals and gold mining as a part of a program designed to reduce the economy’s vulnerabilities, reports Bloomberg. The fund hopes to ramp up gold exploration in 20 license areas and plans to boost domestic gold production to as much as 150 tons per year, up from just 42 tons now.

- Zambia isn’t looking to take over more mining companies, nor is the government planning to nationalize the industry, according to Finance Minister Bwalya Ng’andu and as reported by Bloomberg News. The government has previously acquired Glencore and Vedanta’s local operations. This is positive news for other operators in Zambia such as First Quantum Minerals and Barrick Gold which have large copper mines.

- Northam Platinum, South Africa’s fourth largest platinum producer, is considering bidding for the Bokoni mine, which is jointly owned by Anglo American Platinum and Atlatsa Resources. Northam is hoping to boost output amid a bullish demand and price outlook for platinum group metals. This is positive for South Africa, which saw several mines close as producers struggled to contain costs.

Threats

- Bloomberg’s Jake Lloyd-Smith wrote this week that the outlook for gold is diminishing. “At the year’s outset, I was positive on gold… Such a view now looks misguided. With a test of $1,800 soon in the offing, bullion may be about to lose more altitude.” Llyod-Smith points out that gold has been left out of the broad rally in commodities so far in 2021.

- Burgeoning mining hotspot Ecuador is voting on Sunday, alongside presidential and legislative elections, to decide whether to ban major mining projects within municipal limits. Bloomberg reports there are no big mines operating in Cuenca in the southern Andes mountains, but the referendum threatens to derail more than 40 concessions seeking to mine gold, silver and copper reserves.

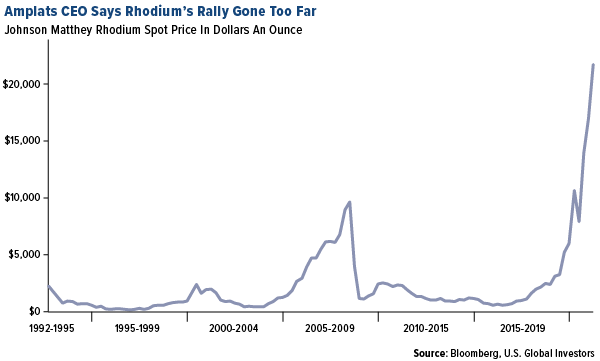

- Rhodium has skyrocketed to a record $21,900 an ounce, making it the world’s most expensive metal. Anglo American Platinum CEO Natascha Vilkoen says the 25% increase so far this year is unsustainable. “Even though we love the additional income, that’s not where we prefer it to stay,” Viljoen said in an interview on Wednesday. Rhodium has surged due to strong demand out of China for vehicles and water leaks shutting down processing facilities in South Africa several times last year, reports Bloomberg, creating a deficit.