Strengths

- The best performing precious metal for the week was silver, up just 0.19%. Lab-grown diamond trade data indicates that it continues to gain market share. The value of rough lab grown diamond imports and polished exports increased month-over-month and came in above their three-year average. This suggests that lab-grown diamonds are gaining market share both at mid-stream and end markets.

- Asian ETFs bought $132 million of gold in July, largely propelled by surging Japanese demand with inflows totaling $170 million. The influx of Japanese demand to ETFs can be attributed to local investors seeking refuge in the metal amid concerns of persistent inflation. The World Gold Council (WGC) separately reported that the People's Bank of China purchased 23 tons of gold in July, the ninth consecutive month of purchasing. June data indicated total central bank gold purchases were net positive in June after several months of net selling.

- Agnico Eagle Mines believes its 2023 production will come in above the midpoint of its guidance range (3.24 million-3.44 million ounces). Additionally, Agnico is confident it will be able to get its costs below the midpoint of its guidance range (all-in sustaining cost: $1,140-$1,190 per ounce). For the third quarter, the company is expecting higher costs due to mine sequencing and grade with the costs expected to decline into the fourth quarter. Management noted that costs are stabilizing with the easing of inflationary pressures due to fewer supply chain issues and the return to normal after the pandemic. Additionally, Agnico is benefiting from the weakness of the Canadian dollar and from lower diesel prices relative to forecast.

Weaknesses

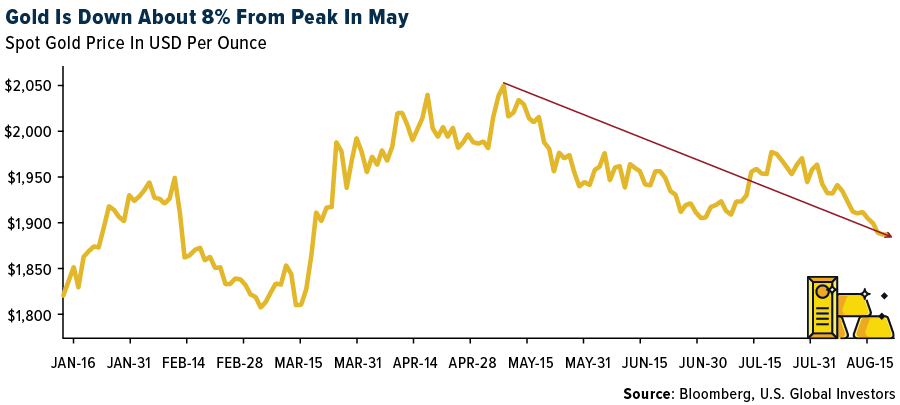

- The worst performing precious metal for the week was palladium, down 4.09% in contrast to money managers reducing their net bearish positions to a three-week low. Spot gold was on track for a positive gain this week in its price, but the Federal Reserve Minutes from the July meeting suggested they are more likely to continue to raise rates to push inflation down further.

- Impala Platinum Holdings published a weak trading statement, supplementing its previous update. Impala guides FY23 earnings per share (EPS) Rc2,117-2,352 per share, a miss to company-compiled consensus Rc2,642 per share. Earnings have been impacted by lower achieved metals prices (-18% year-over-year), partly offset by a weaker South African rand. In addition, load curtailment resulted in 147,000 ounces lost refined volumes, which has negatively impacted sales. Cash costs in FY23 have been impacted by higher inflation and a weaker rand impact on translated costs. Basic earnings have been impacted by impairments at Impala Canada (R7.8bn due to a weaker palladium price profile plus inflation) and RBPlat (R4.2bn goodwill impairment related to RBP acquisition).

- Gold fell below $1,900 an ounce as the minutes of the Fed’s July meeting showed that more interest rate hikes are likely to come. Fed officials at their last meeting largely remained concerned that inflation would fail to recede and suggested they may continue raising rates. The dollar rose to a fresh two-month high while Treasury yields held gains after the release, weighing on bullion.

Opportunities

- The new IamGold CEO highlighted the following priorities for the company: (1) the successful completion of the Côté Gold Project, including production starting early in the first quarter of 2024 and the successful ramp-up into 2024; (2) continuing to operate safely and turning the corner at Essakane; (3) building and growing a strong Canadian platform, including positioning Westwood to achieve free cash flow toward the end of 2023; (4) returning to its full 70% interest in the Côté Gold project; and (5) utilizing future cash flow to optimize and have a more balanced capital structure. Despite the string of positive news, IamGold share price has fallen for nine consecutive days, its longest streak in 23 years, according to Bloomberg.

- Orexplore Technologies is a mineral scanning technology company that is trying to disrupt the months of lost time wasted by mining companies that rely on conventional lab assaying, which destroys half of the drill core, to determine metal concentrations within the rock. Orexplore scans the surface of the entire core to measure metal concentrations and can determine ore grades for a one-meter length of core in 15 minutes. This dramatically improves the productivity of mineral exploration and resources estimation. BHP Group signed an agreement with Orexplore to deploy the technology at their Carrapateena mine in South America this week.

- Silvercorp Metals acquired 84% of the Nyanzaga project in northwestern Tanzania, a high-grade construction-ready project in a proven gold mining jurisdiction. The implied $160 million transaction value represents just 0.23x NAV, and as such, this project is extremely accretive.

Threats

- Production at Victoria Gold Corp. is expected at the lower end of guidance with recent wildfires. The Eagle Mine was recently evacuated twice due to the East McQuesten wildfire. Operations are expected to fully resume shortly as personnel are starting to return to site. Production is now expected at the lower end of annual guidance (160,000-180,000 ounces), which has been reiterated but may be adjusted depending on the situation. Victoria’s share price slid to its lowest close since April 2020, according to Bloomberg.

- Goldman’s rates strategists believe that if growth next year is near potential, and the unemployment rate close to lows, the Federal Open Markets Committee (FOMC) may not view preemptive easing as prudent. Furthermore, while the central banks have returned as net buyers in June following three months of selling, ETF holdings have continued to fall on better U.S. growth data. Near term, they remain neutral on gold, with their strategists arguing for stickier yields and dollar levels given U.S. outperformance in clear display against a backdrop of limited foreign monetary policy support and weak Chinese economic data.

- Fed officials at their last meeting largely remained concerned that inflation would fail to recede and suggested they may continue raising interest rates. “Most participants continued to see significant upside risks to inflation, which could require further tightening of monetary policy,” according to minutes of the U.S. central bank’s July 25-26 policy meeting published Wednesday in Washington. “Some participants commented that even though economic activity had been resilient and the labor market had remained strong, there continued to be downside risks to economic activity and upside risks to the unemployment rate,” the Fed said.