Strengths

- The best performing precious metal for the week was platinum, up about 6.21%. Platinum strength continues as the metal hits a 52-week high, benefiting from its growing status as a designated critical mineral and rising strategic importance across clean energy, hydrogen and industrial applications. Investor demand has followed, with steady ETF accumulation reinforcing the rally and signaling sustained institutional interest despite already outsized year-to-date gains.

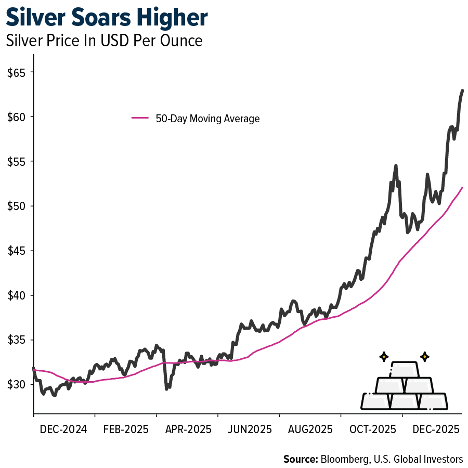

- Silver extended its speculative surge for a fourth straight session, hitting a record above $64/oz and heading for a ~10% weekly gain as ETF inflows, momentum trading and tight physical supply collided. The rally has been amplified by aggressive call-option buying and a weaker-rate backdrop, with silver now sharply outperforming gold despite growing warnings of blow-off-top risk.

- Kinross Gold’s early repayment of US$500 million in 4.50% Senior Notes continues its balance-sheet cleanup, reducing interest costs and lowering financial risk after retiring US$1.5 billion of debt across 2024–2025. While the move strengthens flexibility for future projects and shareholder returns, it doesn’t materially change near-term production or cost pressures, which remain the key drivers of the investment narrative.

Weaknesses

- The worst performing precious metal for the week was gold, still up about 2.04%, as the yellow metal pared earlier gains from hawkish-leaning comments from Fed officials cast doubt on the pace of further rate cuts in 2026, pushing long-end Treasury yields higher and weighing on bullion. The move was exacerbated by a broader risk-off tone, with equity losses prompting some investors to trim metals positions to cover declines elsewhere.

- Chow Tai Fook's shares fell as much as 2.5% after Jefferies cut its price target to HK$17 from HK$18.5 and reduced earnings estimates, citing weak consumer retail sales and a shift in gold and jewelry consumption from event-driven to discretionary spending. The analysts lowered FY26/27/28 net profit forecasts by 8%/11%/11%, assuming sales declines of 5%/5%/6%, while noting management's conservative stance on guidance despite positive same-store-sales trends, and maintained a buy rating.

- Bank of America notes that, in the past year, gold's rally has shown a lower correlation with other asset classes than it did throughout the entire post-COVID period. Its connection to Treasuries has also decreased. Additionally, although commodities typically gain when the dollar weakens, this trend has diminished in the current year. For example, crude oil prices have dropped year-to-date, mainly due to decisions by OPEC and geopolitical factors.

Opportunities

- Robex Resources is expected to exercise its matching rights imminently in response to Perseus Mining's rival offer for Predictive Discovery, following its initial merger proposal that was disrupted last week. The company, advised by Canaccord Genuity and Peloton Legal, is pitching to Predictive shareholders that a merger could lead to future takeovers by major players like AngloGold or Barrick, while funding development of the Bankan asset through cashflow without new equity, though the exact terms, including Robex's potential ownership reduction from 49% to as low as 36.5%, remain unclear.

- Goldman Sachs says its $4,900/oz gold forecast for end-2026 could see “significant upside” if U.S. investors increase their very low allocations to gold ETFs, noting that even a one-basis-point shift in portfolios would lift prices by roughly 1.4% due to the market’s small size.

- India will now allow its $177 billion National Pension System to invest in gold and silver ETFs for the first time, potentially unlocking around $1.7 billion of new demand for the metals. The move reflects growing global acceptance of precious metals as mainstream portfolio assets, coming alongside similar policy shifts in China and amid record rallies in both gold and silver.

Threats

- Restrictions on exporting gold bullion from Russia will enter effect in 2026, as stated by Deputy Prime Minister Alexander Novak during a meeting on strategic development and national projects. The measures also aim to prevent uncontrolled exporting of cash rubles of unknown origin from Russia, including to member states of the Eurasian Economic Union.

- Marex Group says the silver market has become “overexcited,” arguing prices are about 15% too high in the short term and due for consolidation or a pullback. While private wealth flows into precious metals remain strong amid concerns over debt and fiat currencies, Marex warns that silver’s recent surge has outpaced fundamentals even as long-term support for gold remains intact.

- Dozens of Tibetans were reportedly detained after staging a rare protest against a new gold mine in Sichuan’s Gayixiang township, with activists saying authorities have sealed off the area, cut communications, and tightened security. The incident highlights mounting tensions over resource extraction on the Tibetan plateau, where communities fear environmental damage and loss of traditional livelihoods amid broader crackdowns on cultural and religious freedom