Strengths

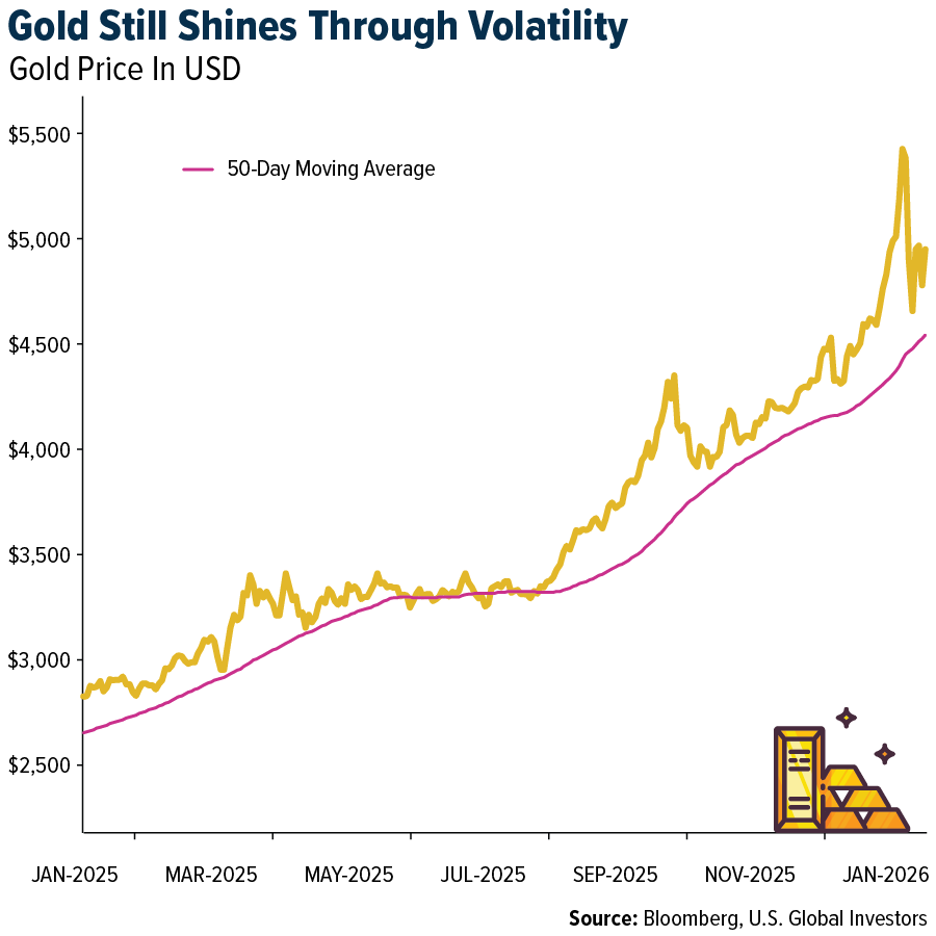

- Gold was the best-performing precious metal of the past week, up 4.97%. Prices rebounded sharply from late-week weakness, briefly reaching $4,950 before ending higher despite a CME margin hike that raised COMEX gold futures margins to 9%, underscoring resilient investment demand.

- Scotiabank analysts say the core silver bull case remains intact despite recent volatility, supported by strong industrial demand and limited high-quality mine supply. Solar remains a key structural driver, with Tesla’s 100-gigawatt U.S. solar manufacturing target potentially adding significant incremental silver demand.

- JP Morgan expects central banks to purchase 800 tons of gold in 2026 and remains encouraged by renewed buying from Brazil in late 2025, its first since 2021. Brazil added 43 tons between September and November but still holds only about 7% of reserves in gold, while Poland, which bought roughly 100 tons in 2025, is now targeting total gold reserves of 700 tons.

Weaknesses

- Silver was the worst-performing precious metal of the week, down 1.67%. Prices remain under pressure as volatility and tighter trading conditions weigh on speculative demand, although CME Group’s shift to percentage-based margins has modestly eased relative margin pressure as prices fall.

- Danish jeweler Pandora A/S plans to shift roughly half of its production from silver to platinum-plated jewelry as rising silver prices pressure margins. Given Pandora’s annual purchase of more than 300 tons of silver, the move could reduce silver demand by around 150 tons, though that supply could be absorbed by solar demand.

- Gold’s recent 14% correction already exceeds the median 8% pullback seen during bull markets over the past 50 years. According to RBC, a more severe two- or three-standard-deviation correction would imply a downside of roughly 18%, or $4,441 per ounce, and 22%, or $4,208 per ounce, respectively.

Opportunities

- Eldorado Gold Corporation and Foran Mining Corporation announced a definitive agreement under which Eldorado will acquire all outstanding Foran shares in a cash-and-stock deal valued at C$3.8 billion. Eldorado said the transaction will drive growth, increase copper exposure, improve jurisdictional balance through Canada, and support a valuation re-rating, although its shares fell nearly 9% on the week, potentially creating a buying opportunity.

- Alamos Gold shares rose 8% for the week following the release of its Island Gold District Expansion Study. The update lifts long-term throughput to 20,000 tons per day from 12,400 tons per day starting in 2028 and increases reserves by 30% to 8.28 million ounces, supporting a net asset value of $12.2 billion at a $4,500 per ounce gold price assumption.

- Barrick Mining Corp. plans to spin off its top North American gold assets through an initial public offering as part of a strategic reset. The company expects to sell a minority stake in the new unit, complete the IPO by late 2026, and has appointed interim chief Mark Hill as chief executive officer, according to Bloomberg.

Threats

- In silver, since about $80 per ounce in late December, the drivers of the continued rally have become harder to pinpoint, leaving JP Morgan more cautious. Without central banks acting as structural dip buyers, as they do in gold, the bank remains concerned about the risk of a deeper near-term shakeout in silver relative to gold.

- Gold has had a highly volatile start to the year, rising rapidly from $4,350 per ounce in January to $5,600 per ounce, up 30%, before falling back to around $4,600 per ounce in recent days. Goldman’s commodities team attributes the initial sell-off partly to liquidity factors and remains constructive on gold.

- The recent sell-off following speculation that Kevin Warsh could lead the Federal Reserve highlights policy uncertainty, with Bank of America noting that changes in rate expectations or perceptions of Fed independence could reduce support for gold.