- The best performing precious metal for the past week was gold, up 1.11%. Despite a sharp selloff this past Thursday, gold still finished the week higher, reclaiming the $5,000 level as cooler U.S. inflation data lifted expectations for Federal Reserve rate cuts and pressured Treasury yields lower. The rebound highlights resilient underlying demand for bullion, with easing rate expectations continuing to support the metal even after January’s volatility, according to Bloomberg.

- China continued to purchase gold for its official reserves to hedge geopolitical and U.S. dollar risks, the official securities newspapers report. China's central bank’s small-scale gold purchases over several months help with asset diversification while cushioning volatile price moves in gold, Securities Times reports, citing Pang Ming, Distinguished Research Fellow at National Institution for Finance and Development. The purchases will continue, Pang says.

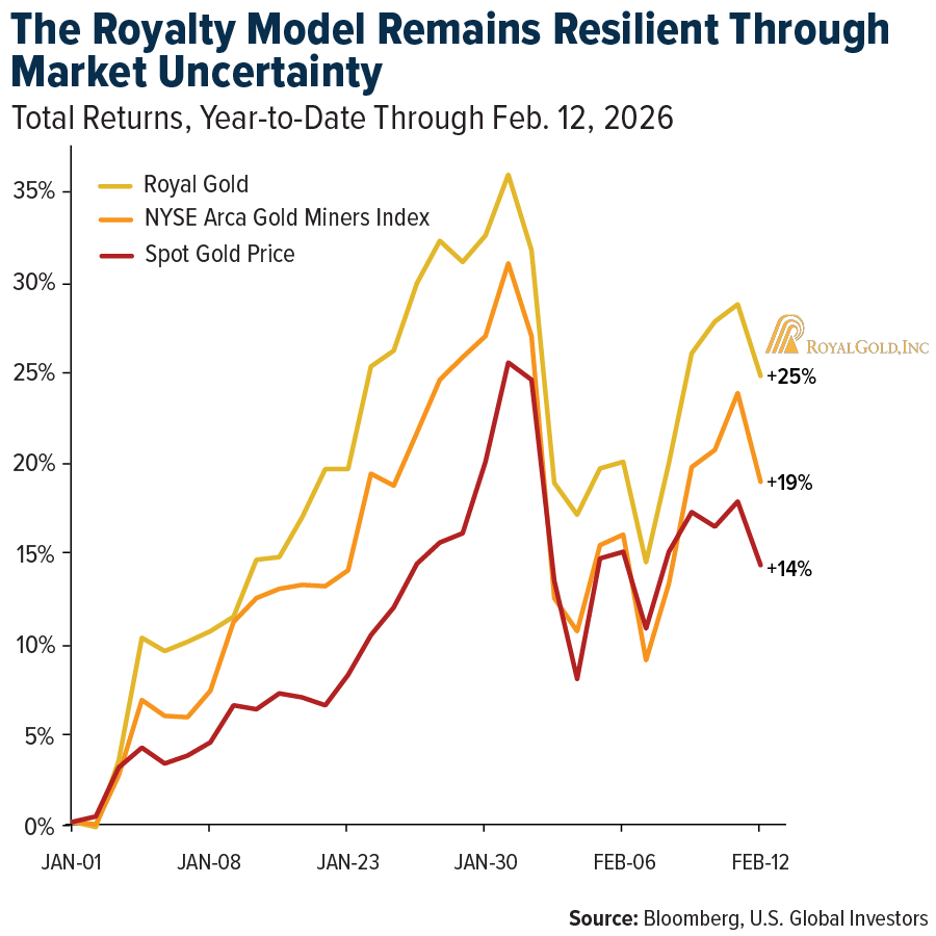

- Royal Gold (RGLD) showed notable strength this week despite heightened volatility in gold prices, as investors positioned ahead of the company's February 18 earnings report with expectations running high following its transformational October 2025 acquisitions. CIBC's bullish $330 price target—raised from $250 on February 4—reflects optimism that the expanded portfolio from the Sandstorm Gold and Horizon Copper deals will deliver accelerated growth in gold equivalent ounces (GEOs), with the capital-light royalty model providing defensive cash flow generation even during commodity price turbulence.

Weaknesses

- The worst-performing precious metal for the past week was palladium, down 2.62%. Palladium faced renewed downside risk this week after the Commerce Department backed preliminary anti-dumping duties of nearly 133% on Russian imports, escalating trade uncertainty in a market already grappling with volatile demand. While intended to support domestic producers, the move adds pricing instability and highlights palladium’s vulnerability to geopolitical shocks and uneven automotive-sector consumption, Bloomberg reports.

- Ten silver miners working for Vizsla Silver were found dead in a Mexican mass grave after being kidnapped on January 23 from a mining project near Concordia in Sinaloa state—a cartel-controlled area—with media reporting that as many as 2,000 military personnel have been deployed to the region with heightened security measures in response to the tragedy. The incident underscores the severe security risks facing Mexican mining operations in high-risk jurisdictions, the security response by the government will bring some stability to the region.

- Titan Co., India’s top jewelry maker, sees shoppers turning cautious as record-high gold prices weighed on demand in the world’s second-largest bullion market. Sales growth is being driven more by price increases than by volume, with customer growth remaining “muted,” Chief Financial Officer Ashok Kumar Sonthalia told Bloomberg TV on Wednesday.

Opportunities

- According to BMO, Franco Nevada is providing $250 million in royalty financing to i-80 Gold in exchange for a 1.5% LOM NSR royalty across i-80’s Nevada portfolio, increasing to 3.0% in 2031. The transaction supports i-80’s recapitalization and phased redevelopment plan and secures Franco’s position on prime Nevada “gold” real estate.

- Stifel believes underlying gold fundamentals are supported by four themes: (1) monetary easing cycles; (2) strategic central bank accumulation; (3) increasing institutional asset allocation; and (4) gold’s role as an essential hedge against fragmentation in regional economic and financial markets and as a necessary defensive hedge against "Big Tech" cyclical growth exposure in 2026.

- Stifel notes that, unlike previous cycles when pro-cyclical behavior was defined by aggressive and dilutive mergers and acquisitions (M&A), pursuit of marginal internal rate of return (IRR) projects and vast underestimation of the fluidity of unit operating costs, sustaining capital requirements and capital intensity of new projects, which effectively neutralized the benefits of a rising gold price, the current environment reveals a gold sector prioritizing margins and return on invested capital (ROIC) over production growth.

Threats

- Cost drift has been a feature in recent gold markets, with producers increasingly chasing incremental, lower-margin material and production growth, albeit at higher unit costs. With margins overall remaining strong given elevated gold prices, the sector appears steadfastly focused on growth, with cost control a lower priority, according to UBS.

- Indian module manufacturers who rely on Chinese solar cells are facing difficulties as prices from China continue to rise. Unstable silver prices, along with the upcoming Chinese New Year holiday, are causing suppliers to either hesitate in providing quotes or demand higher rates. As a result, module makers and solar developers may need to postpone projects or temporarily shut down their plants until costs decrease.

- Newmont, a partner with Barrick in its most important mines, wants the Canadian company to improve the operations before it spins off the assets and believes it has the power to potentially block the initial public offering, according to people familiar with the matter. Barrick last week announced plans to sell 10% to 15% of those operations through a late-2026 IPO, according to Bloomberg.