Strengths

- The best performing precious metal for the week was platinum, up 6.26 percent, as hedge funds boost their net-long position to a two-year high on expectations platinum will find new demand in the green hydrogen space as the catalyst for electrolysis to liberate hydrogen. The World Platinum Investment Council projects a platinum deficit of 1.2 million ounces for 2020, the largest since records began. Pandemic-related mine closures by key producers is likely to keep the metal in deficit even as demand from autocatalysts, the biggest consumers of the metal, is forecast to drop by 16%. The metal could get a boost from the surge in green hydrogen interest. Platinum plays a key role in electrolysis and in the fuel cells used in hydrogen powered vehicles.

- Newmont is on the Dow Jones Sustainability World Index for the 13th year in a row, which represents the top 10% of the world’s largest 2,500 companies in the S&P Global Broad Market Index. Newmont was named the top global gold mining company for its leading environmental, social and governance (ESG) performance, reports Kitco News.

- Silver imports by China and India are expected to rebound over the next six months as de-stocking ends, according to Citigroup. Swiss gold exports to India rose almost fivefold in October as jewelers restocked ahead of Diwali, which is typically a strong time for purchases as gold gift giving is considered auspicious. BS sees palladium peaking at $2,600 an ounce in 2021 due to strong Chinese car sales and a COVID vaccine pushing the economic recovery and keeping the metal in deficit.

Weaknesses

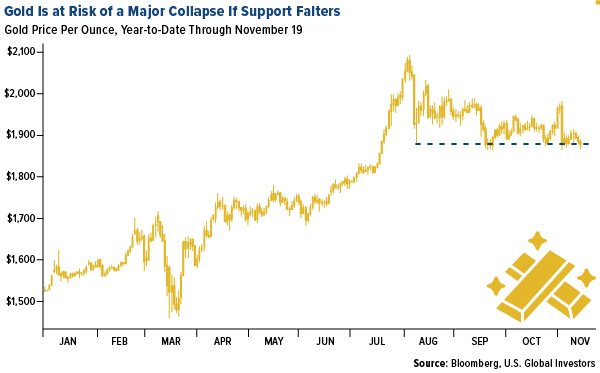

- The worst performing precious metal for the week was silver, down 2.00 percent, yet hedge funds have now taken their net-long position to a 17-week high. Gold fell for a fourth day as the U.S. dollar strengthened on positive vaccine developments. Gold-backed ETFs sold off for a fifth straight session on Wednesday and have lost 52 tons of gold since Pfizer announced its vaccine breakthrough last week. This is sparking fears that investors are “giving up” on gold as it potentially heads back down to $1,700 an ounce. Demand for haven assets has fallen as the news of a COVID vaccine nearing gives investors hope for an economic recovery.

- Money managers are also turning bearish on the yellow metal. Bullish gold bets decreased by 10,994 net-long positions according to weekly CFTC data on futures and options. This is least bullish net-long position in more than 17 months, according to Bloomberg

- Macquarie said in notes this week that “gold prices have already peaked at their August high of $2,075 an ounce.” The banks said prices are likely to remain around current levels then progressively move lower over 2021 as the 10-year Treasury yield rises toward 2%. Bloomberg notes Macquarie has lowered its price outlooks for coming quarters after saying gold is at “the end of the cyclical bull market.”

Opportunities

- After saying last week it was discussing a “merger of equals,” Endeavour Mining announced it has agreed to buy Teranga Gold for a 5.1% premium. According to Bloomberg calculations Endeavour has valued Teranga at $1.86 billion and the combined company will produce 1.5 million ounces of gold across West Africa. The company now seeks to list on the London Stock Exchange.

- Brixton Metals announced high-grade gold, silver, and copper content in 17 samples collected at its recently acquired Trapper Target on its Thorn Project. A total of 11 companies were granted new gold mining concessions in Egypt, according to the Oil Ministry, including Centamin, Barrick Gold and B2Gold.

- Gold jumped on Friday morning after Treasury Secretary Steven Mnuchin said his agency and the Fed have enough firepower to continue supporting the U.S. economy. Citigroup remains bullish on gold even as a COVID vaccine nears completion. The bank says gold’s advance back above $2,000 an ounce in 2021 looks inevitable as the vaccine would only slow the bull cycle.

Threats

- Bullion is at risk of a “major collapse” if support continues to falter. The 100-day and 50-day moving average for gold just crossed, also called a death cross, and this is indicative of a “sharp drop” down in price, according to Gary Wagner, editor of the GoldForecast.com.

- Applications for U.S. state unemployment benefits rose unexpectedly for the first time in five weeks, suggesting the labor market recovery is slowly due to spiking coronavirus infections, reports Bloomberg. Claims totaled 742,000 in the week ended November 14, up 31,000 from the week prior. The U.S. now has over 11.8 million cases and reported 187,428 on Thursday November 19. The CDC has strongly advised against traveling for Thanksgiving and to only celebrate with those in your household.

- BlackRock CIO of Fixed Income Rick Rieder said on CNBC that bitcoin could take the place of gold to a large extent because crypto is “so much more functional than passing a bar of gold around.” Rieder added that he thinks crypto is here to stay due to central banks developing their own digital currencies and millennials’ “receptivity” to technology.