Strengths

- The best performing precious metal for the past week was silver, up 6.60%. Montage Gold announced their 2024 short-term incentive plan which highlights the aligned interests of the management and the shareholders to drive forward the Koné project's construction and development. Compensation is dependent on rapidly achieving stated milestones to put Koné into construction in the first quarter of 2025, according to Stifel.

- West African Resources seeks to raise A$120 million via a single tranche placement at A$1.37 per share, according to the Australian Financial Review (AFR). Citing a term sheet, the AFR reports that funds raised will go towards funding construction of the Kiaka gold project, mining pre-production capital, exploration programs and working capital. Total proceeds of A$150 were secured as the placement was heavily oversubscribed.

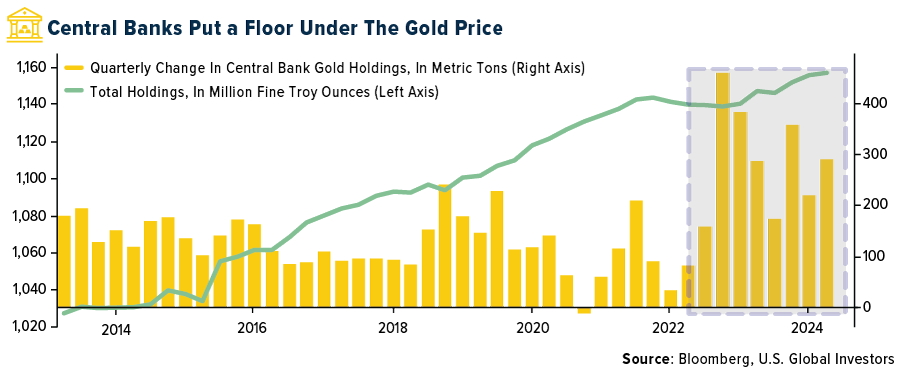

- Central banks, led by Turkey, China and India, put a floor under the gold price in the face of outflows from exchange-traded funds (ETFs) in the recent past. The sector uses gold as a dollar-diversification play, making it popular in nations with large U.S. currency holdings. China bought the metal for 18 months straight before pausing in May, according to data from the International Monetary Fund (IMF). China’s pause in purchases may just be from buying their gold from international markets. Fred Hickely of the High-Tech Strategist newsletter noted that China did indeed buy gold, but it was sourced from domestic production.

Weaknesses

- The worst performing precious metal for the week was gold, but still up 2.48%. Costco reported their first delivery of 100-gram gold bars this week, but they sold out in less than a day. The gold bars fetched $7,599.99 each. Calidus Resources has collapsed with its main financier, Macquarie, calling in receiver Korda Mentha. It remains unclear why Macquarie called time on the company, which runs the Warrawoona gold mine near Marble Bar, according to Canaccord.

- Endeavour Mining says it is studying the damage from the leak of poisonous liquid at its second-biggest mine located in southern Ivory Coast. Early reports show that a broken valve leaked 3,000 liters of mud containing cyanide into a canal within the perimeter of the mine, according to Bloomberg.

- According to BMO, Ascot Resources has faced commissioning challenges throughout its processing plant, particularly in the areas of the elution circuit boiler, carbon management, thickener flocculation and metallurgical sampling and estimation. These issues have slowed production and sales below expectations. Additionally, global supply chain challenges and limited vendor support have caused some delays. There is likely a capital shortfall that will need to be addressed in the near term.

Opportunities

- Excessive government spending in the U.S. and geopolitical uncertainty are underpinning calls from some investor heavyweights to buy gold as a hedge against sovereign debt risks. Schroder Investment Management and UBS Global Wealth Management are bracing for a rocky second half, and gold has emerged as a preferred trade to navigate the volatility, according to Bloomberg.

- Citigroup expects rising investment demand to absorb almost all gold mine supply over the next 12-18 months, it said in a report. That underpins the bank’s base case for a price of $2,700-$3,000 an ounce during next year.

- Canaccord views the Red 5-Silver Lake merger as logical with clear benefits for both companies, namely absolving Silver Lake's relatively short mine life overhang, and rectifying Red 5's single asset exposure and net debt position. Red 5’s large reserve base and Silver Lake's strong balance sheet marry neatly, giving the enlarged entity the opportunity to aggressively pursue internal optimization initiatives as well as potential inorganic opportunities.

Threats

- According to Mining.com, the Ivory Coast is planning to revise its mining code to increase state profits, the country’s mines minister Mamadou Sangafowa Coulibaly said on Monday. The country is seeking to develop its long-neglected mining sector to diversify its income sources. The west African country’s mining code was last revised in 2014.

- According to BMO, Ascot Resources' cash balance at the end of the second quarter was C$12 million, representing a decrease of C$35 million since the first quarter. Additionally, Ascot reported that it has received a waiver for non-compliance with the covenants set forth in its financing package, which is due to expire on July 31, 2024.

- Bloomberg reports that Vale Base Metals has chosen Sean Usmar as its CEO. Sean Usmar founded Triple Flag Precious Metals in 2016 and currently serves as the company's CEO and director. Sources within the article note that the selection is not yet confirmed and "it's possible things could change." As of the end of the week, there appears to be no confirmation on the rumor.