Strengths

- The best performing precious metal for the week was silver, up 4.78%. A more bullish investment scenario is surrounding the white metal’s industrial uses, such as for solar. Franco Nevada reported second quarter 2022 results this week that were slightly ahead of expectations. Production was 191,000 ounces (5% higher than consensus), resulting in earnings per share (EPS) of $1.02 (above consensus of $0.98). Earnings were supported by lower depreciation and lower share-based compensation.

- Overall, Endeavour Mining reported a solid production beat that was partially offset by higher operating costs with EBITDA slightly ahead of consensus. First half production and costs are tracking well to 2022 guidance and the company increased its dividend. Endeavour reported second quarter production that was ahead of consensus. Cash costs of $824 per ounce for the quarter were 4% above consensus of $793 per ounce, driven by waste stripping and mine sequencing ahead of the rainy season.

- Aya Gold & Silver reported a rise in earnings on Friday, along with a 5% increase in silver production from the prior quarter due to improved grades, strong recoveries, and record throughput for the mill. Advancement and refurbishment of existing operations to expand production are reported as on time and on budget. Exploration is still vital to unlocking the potential of the historic land package which is seeing its first systematic evaluation.

Weaknesses

- The worst performing precious metal for the week was gold, but still up 1.44%. Equinox Gold reported a weaker-than-expected second quarter, reflected in an adjusted EPS loss of $0.16 per share versus expected street consensus of $0.00 per share. Although gold production was in-line with expectations, higher costs pushed the company into the red. In addition, Equinox has guided production lower and costs materially higher for the remainder of 2022.

- Centerra Gold updated its 2022 guidance to reflect the suspension of stacking and leaching activities at Oksut and the shutdown of the gold room at Oksut’s ADR plant. Revised 2022 gold production guidance is 255,000 ounces (versus 425,000 ounces previously), well below the 401,000-ounce consensus, with Oksut now expected to produce 55,000 ounces. As a result, 2022 company-wide cash costs and AISC guidance was revised higher to $700 per ounce and $1,025 per ounce, respectively.

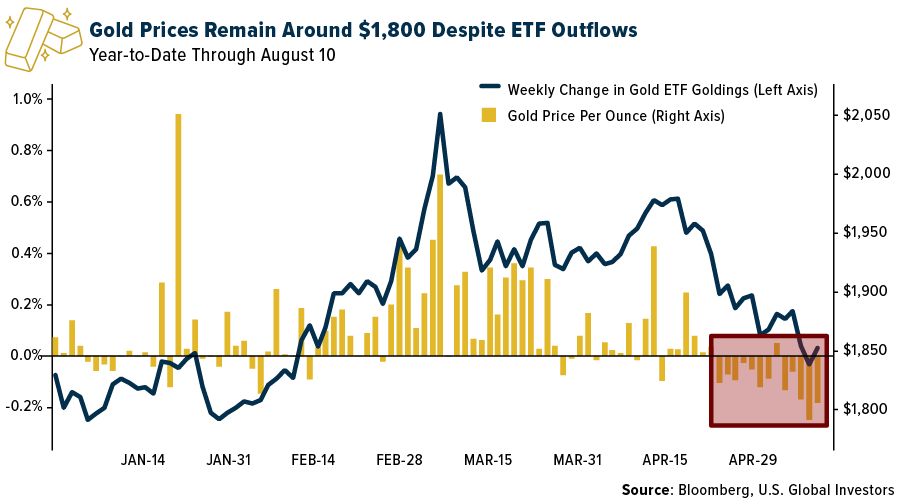

- Gold’s brief rally after cooling U.S. inflation data on Wednesday was lackluster, reports Bloomberg, suggesting that prices might continue to ebb and flow around $1,800 while traders assess recessionary concerns against price pressures. Spot gold has pared all its post-CPI gains, reports Bloomberg, unable to break through the $1,800 level. ETFs have also cut gold holdings for a seventh straight day, but the yellow metal has held near the same price.

Opportunities

- Investor feedback has turned slightly more bullish for gold, citing a combination of factors. These include Fed hikes slowing/peaking, which is mathematically supportive for gold, continued inflation risk, particularly with comments out of the EU overnight, and a continued geopolitical safe-haven bid, (with recent saber rattling in China, ongoing Russian war, and overall economic uncertainty in the EU/China).

- According to JPMorgan, while the real yield correlation with gold prices has broken down in recent weeks, the bank expects a return to the trend over the coming weeks as confidence grows. Geopolitical tensions also continue to support the case for gold, with prices having moved higher by $40 per ounce since U.S. House Speaker Pelosi’s visit to Asia was announced at the end of July.

- Silver has been the worst performer among major precious metals in 2022, but prices may have fallen far enough to spark a modest recovery. The white metal has lost about 11%, weighed down by the stronger U.S. dollar, rising interest rates and slowing growth. But prices could turn higher from later this year as the electronics and photovoltaics sectors support industrial consumption, while retail and jewelry demand look strong, James Steel, chief precious metals analyst at HSBC Securities USA Inc., said in a note.

Threats

- RBC lowered its Equinox Gold price target to C$8 (from C$11) on weaker near-term operations and lower target multiples given elevated execution risk. In RBC’s view, lower output and higher costs across the portfolio could strain the balance sheet amidst construction at Greenstone, where investors are intensely focused on potential for capex overrun given industry-wide inflation.

- Barrick Gold CEO Mark Bristow is sticking with his cost guidance for now, despite inflationary headwinds at mines around the world. He said the idea that industry costs have peaked is wishful thinking. “I don’t think this inflation is going away in a hurry,” Bristow said in an interview after the release of earnings, citing Covid-related nationalism, the lingering impacts of pandemic stimulus and a “completely disparate” geopolitical environment. “Everyone is just wishing inflation away.”

- According to Canaccord Genuity, for IAM Gold, the key focus for investors, in the group’s view, is on progress in addressing the funding gap in the wake of the significant Côté capex increase that was announced with the company's first quarter results. Canaccord continues to see few desirable options to plug the funding gap. The company is looking at various alternatives to increase liquidity, including asset sales (complete and/or partial), JV partnerships, debt (secured, unsecured, convertible), equity, and extending the gold prepay arrangement.