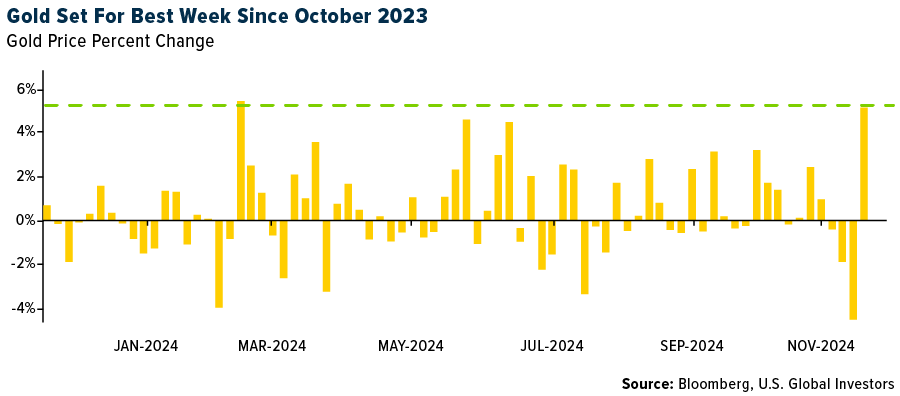

- The best performing precious metal for the past week was palladium, up 6.96%, after getting shellacked 13% in the prior week’s election turmoil. In the prior week, gold posted its biggest weekly drop since 2021, only to have its biggest weekly surge this past week since March of this year as tensions escalate around the Russia-Ukraine conflict. Longer-range missiles are now being deployed, with Russia asserting that countries that supply these long-range missiles are fair targets for Russia to attack.

- Pan African Resources was the best performing gold stock in the major gold stock indexes with European buyers bidding up the stock over 22% this week on the risk of elevated conflict with Russia. OceanaGold and IAMGOLD both gained more than 15% with the rebound in gold stocks.

- According to Bank of America, the increase in gold of over $450 per ounce over just a six-month period is historically rare and is, in their view, emblematic of the importance of investment buying, particularly by western investors, which they think is very well captured by global gold ETF holdings of gold.

Weaknesses

- The worst performing precious metal for the past week was platinum, but still up 2.62%. According to Bank of America, 10 of the 17 precious metals stocks covered underperformed the S&P/TSX Global Gold Index, despite most delivering solid Q3'24 numbers. Helping to explain the average underperformance, those that missed or reduced guidance experienced more significant underperformance than those that beat or improved guidance experienced outperformance.

- Ramelius Resources COO Duncan Coutts stepped down to pursue other opportunities, but he will remain at the company until early December. Peter Ganza has been appointed acting COO.

- Resolute Mining said Chief Executive Officer Terry Holohan and two other employees have been released from detention in Mali, just days after the gold mining company agreed to pay about $160 million to resolve a tax dispute with the government. Holohan and his colleagues were detained more than a week ago after he traveled to the country for meetings with tax and mining authorities, according to Bloomberg.

Opportunities

- MicroStrategy shares tumbled after Andrew Left’s Citron Research said in a post on X that it’s betting against the software company, which has effectively transformed itself into a Bitcoin investment fund. The stock fell as much as 10% in intraday trading Thursday, reversing a gain of nearly 15% from earlier in the session, according to Bloomberg. The company has become a serial issuer of debt and now equity to buy more Bitcoin. With each equity issue the price of Bitcoin gets bid up to higher levels and then the cycle is repeated. Also, short interest is rising in this name, and this will eventually be an opportunity for gold.

- Newmont agreed to sell its Musselwhite gold mine in Ontario to Orla Mining for up to $850 million as part of a divestment campaign designed to boost shareholder returns. The deal will raise Newmont’s gross proceeds from sales of non-core assets to more than $2 billion, it said in a statement on Monday.

- Silver presents a compelling opportunity as resilient ETF holdings signal strong investor confidence, despite recent price volatility. With bullish outlooks for gold and increasing ETF inflows during price pullbacks, silver appears poised for further gains, building on its impressive 30% year-to-date growth.

Threats

- Bank of America notes the 1.1-million-ounce decline in global gold ETF holdings of gold since the recent peak of 84.1 million ounces, a decline that accelerated with the conclusion of the U.S. election.

- According to Bloomberg, hedge fund managers have cut their bullish bets on gold to a 15-week low in light how resilient stock markets and in particular Bitcoin have performed as of late.

- The discovery of a massive gold deposit in China’s Hunan province could poses a potential threat to global gold markets as the discovery is estimated at 300 tons but is at a depth of around 2,000 meters. It could disrupt supply dynamics if China is able to produce more gold domestically, especially if development proves feasible. Three hundred tons of gold is roughly 9.6 million ounces which is slightly more than 1/10 of the all the gold held in ETFs.