Strengths

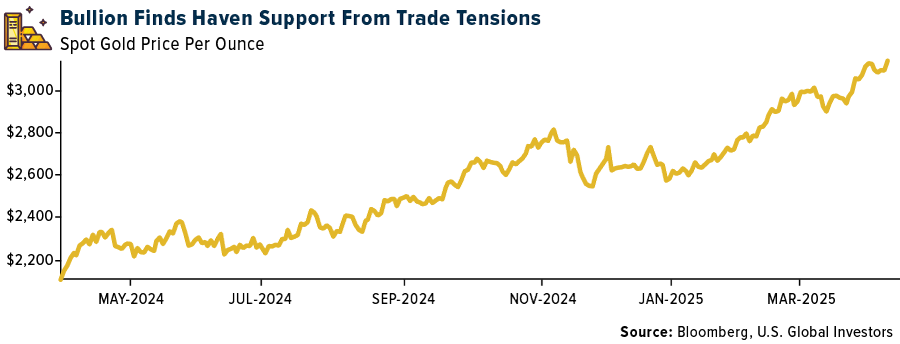

- The best performing precious metal for the past week was gold, off 184%. Despite a temporary dip from record highs due to market pessimism over new tariffs, gold's safe-haven status remains strong amid an increasingly uncertain global economic environment. With robust demand and central bank support, gold is poised to benefit from trade volatility, macroeconomic concerns, and geopolitical tensions, continuing its impressive performance this year.

- Gold hit a record at the start of the new quarter as a major escalation in U.S. President Donald Trump’s trade tariffs due this week heightened concerns about the global economy and fanned haven demand. Bullion neared $3,150 an ounce, on pace for a fourth day of gains. Gold initially plunged over 2% due to a risk-asset rout but has since pared back losses, as analysts believe its long-term outlook remains bullish, especially in a stagflation scenario. The recent tariffs are expected to heighten recession and inflation risks, which historically benefit gold.

- Gold traded at another record high early last Wednesday as the dollar and Treasury yields fell ahead of the implementation of fresh U.S. tariffs that threaten to slow the country's economy, boosting safe-haven demand. Gold for June delivery was last seen up $14.60 to $3,160.60 per ounce, topping Monday's previous record high of $3,150.30, reports Bloomberg.

Weaknesses

- The worst performing precious metal for the past week was silver, down 14.82%. Yesterday, ETFs increased their gold holdings by 100,493 troy ounces, while reducing their silver holdings by 833,192 troy ounces, indicating a preference shift toward gold as its price remains elevated. Overall, this year, ETFs have significantly increased their gold holdings by 6.3%, reaching the highest level since September 2023, leaving silver in the dust – Bloomberg reports.

- SSR Mining production and cost guidance for 2025 was weaker than expected versus RBC forecasts and consensus estimates, with some impact from the timing of the close of the Cripple Creek & Victor transaction and ongoing cleanup, care and maintenance costs at Copler.

- Equinox announced it is indefinitely suspending operations at its Los Filos mine in Guerrero, Mexico, following the expiry of its land access agreement with the community of Carrizalillo on March 31, 2025, according to Canaccord.

Opportunities

- For the end of the month and quarter, we have seen a +A$718 per ounce move in the gold price in the last three months and this should translate into significant free cash flow (FCF) prints in April for the gold names that are able to deliver operationally, reports Canaccord.

- In a weakening market, the presence of eight precious metals names on IBD's 50 highlights opportunity amidst uncertainty. Specifically, royalty companies like Wheaton Precious and Osisko are gaining favor for their limited capex and stable cash flows, awarding them a position in Investor Business Daily’s top 50 stocks.

- Endeavour Silver announced that it has entered into a definitive share purchase agreement to acquire all the outstanding shares of Compañia Minera Kolpa S.A. and its main producing asset located in Peru, the Huachocolpa Uno Mine, for a total consideration of $145 million, consisting of $80 million payable in cash and $65 million in EDR shares, according to CIBC.

Threats

- According to Raymond James, for Centerra in 2025, they continue to expect lower gold production and sales, as Oksut benefited from the sale of in-process inventory in 2024. They also expect gold production in the first quarter to be one of the weaker production quarters for the year at both Mt. Milligan and Oksut.

- Precious metals refiner Heraeus notes that “the tariffs that were confirmed last week on U.S. automotive imports are likely to crimp new vehicle production and sales and negatively impact U.S. automotive palladium demand this year.” In 2024, the U.S. imported more than 8 million new light vehicles.

- A massive arbitrage trade that has drawn tens of billions of dollars’ worth of gold and silver to the U.S. came to an abrupt halt with Wednesday’s announcement that precious metals would be exempt from Donald Trump’s sweeping tariffs. For several months, prices in New York have traded at large and unusual premiums to global benchmarks as traders weighed the risk that precious metals could be caught up in tariffs. The differential created an incentive for banks and traders to load planes and ships with so much bullion that it distorted U.S. trade data in the process, Bloomberg reports.