Strengths

- The best performing precious metal for the week was platinum, but still down 1.20%. Dundee Precious Metals reported fourth-quarter earnings per share (EPS) of $0.18, above consensus of $0.14. The beat to consensus was driven by a combination of lower-than-expected costs in the quarter as well as higher revenue, driven by higher realized metal prices, which averaged $1,752 per ounce gold and $3.65 per pound copper in the quarter.

- Northern Star announced an $0.11 per share interim dividend, representing 27% of cash earnings and a slight increase from the $0.10 per share dividend in the first half of fiscal year 2022. With the payment of this dividend on March 29, 2023, Northern Star will have paid approximately A$1.1 billion back to shareholders since fiscal year 2012, demonstrating its commitment to returning capital to its shareholders.

- Newmont, the world’s top gold miner, announced this week that in 2022, the company produced 6 million gold ounces and 1.3 million gold equivalent ounces from other metals, reports Kitco News. This means the company achieved its original production guidance range set in December 2021.

Weaknesses

- The worst performing precious metal for the week was palladium, down 7.10%. Overall, investors are likely to view Agnico Eagle’s recent fourth quarter 2022 release as disappointing. While the quarterly results were a slight miss versus consensus, largely on higher costs, the company’s 2023 and 2024 gold production guidance is 6% below consensus and below its previous guidance.

- Sibanye Stillwater released a trading statement guiding to a 46%-51% decline year-over-year in its fiscal 2022 earnings per share, to between R6.19 and R6.84, missing consensus EPS by 29% (based on the midpoint of its guided range). Management highlighted that the company's earnings were negatively impacted by the industrial action related to wage negotiations in the South African gold sector and severe weather at the U.S. PGM operations, which resulted in a seven-week shutdown.

- Pan American Silver reported fourth-quarter adjusted EPS of negative $0.02, below consensus of $0.05. The earnings miss to consensus was driven by higher-than-expected taxes, depreciation and expensed exploration in the quarter. Pan American expects the closing of the Yamana transaction later in the first quarter, subject to the receipt of approval from the Mexican Federal Economic Competition Commission.

Opportunities

- Management reiterated that Royal Gold’s main priority is to allocate cash for acquisitions that add value for shareholders and increase cash value from 1x NAV to over 2x NAV. The current pipeline for M&A transactions is primarily for gold assets; however, the company is also looking at assets with precious metals by-products as these have the potential for longer mine lives.

- According to JPMorgan, Northam Star Resources’ underlying net profits after taxes (NPAT) of $55 million came in 5% better than its estimate on lower D&A (underlying EBITDA was a miss). The dividend of $0.11 per share represented a solid 27% cash earnings payout. Over the next 18 months, NST will realize tax synergies from the merger with Saracen.

- Resource Capital Funds announced plans to raise $250 million for a new fund to invest in mining companies as it sees a shortage of capital deployed to active money managers to back up and coming mining companies and new sector opportunities. A predecessor fund dedicated to the same strategy wrapped up in 2018 with $106.3 million. The firm invested that fund across 38 deals, with 15 exits as of last September, and says the vehicle has so far produced a net internal rate of return of 20.9% and returned 1.6 times invested capital. Smart money is coming back for another opportunity to profit.

Threats

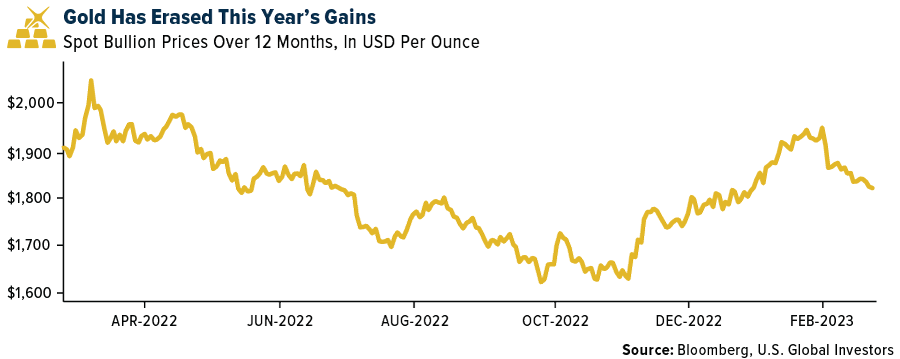

- As reported by Bloomberg, gold extended its decline to the lowest level this year as traders assessed the Federal Reserve’s interest-rate path. “Gold remains anchored as investors anticipate the market is getting close to agreeing on how high the Fed will take rates,” said Ed Moya, senior market analyst at Oanda. “The risk that the Fed could do more is elevated” after the data prints. “That should prevent gold from mustering up any significant rallies” until next month’s jobs and inflation data releases.

- Sibanye Stillwater management has cited the following as its rationale in acquiring New Century: 1) concerns about current New Century management and the change in the strategic direction, diverting focus away from its tailings reprocessing business; 2) consideration that New Century’s balance sheet may struggle with the repayment of its A$180M environmental bond facility and potential project funding requirements for Silver King and Mt Lyell, in addition to general low shareholder liquidity.

- As Bloomberg reported, Newmont Corp, as well as the other major miners, is struggling to maintain at least a flat production profile, and that even seems out of reach, which continues to put pressure on the major gold miners to accomplish growth through an acquisition. Newcrest Mining Ltd. just rebuffed Newmont’s offer and early next week is the BMO Global Metals, Mining & Critical Minerals Conference which is often a launchpad event for major mining deals. The analysts will be watching the industry to see if smarter deals materialize.

For more on gold and other market insights from Frank Holmes and the Investment Team, subscribe to the Investor Alert newsletter for free -- click here!