- The best performing precious metal for the week was palladium, up 1.47% with supplies expected to remain tight with Norilsk Nickel reduced production. There is a precious metal outperforming Bitcoin so far this year – have you heard of it? Iridium, which is a byproduct of producing platinum and palladium, is up 131% since the start of January, outpacing Bitcoin’s 85% gain. Demand for the metal, one of the rarest precious metals, has surged over the past 12 months for use in electronic screens. Iridium, which is also used in spark plugs, has climbed to $6,000 an ounce, according to Johnson Matthey Plc data.

- GV Gold PJSC, a Russian gold miner that BlackRock owns 18% of, set a price range for its IPO in Moscow that values the company at as much as $1.5 billion, reports Bloomberg. Trading is expected to begin on March 30. GV Gold, also known as Vysochaishy, said on March 15 that a group of shareholders including BlackRock planned to sell shares. They offered a combined stake of about 37%, which would mean a sale of as much as $555 million.

- Gold steadied on Wednesday after two days of declines after Fed Chair Jerome Powell played down concerns of out-of-control inflation. “From a technical perspective, the medium term remains negative but the pressure from sellers is slowing down,” wrote Carlo Alberto De Casa, chief analyst at ActivTrades. Spot gold rose 0.2% to $1,731.28 an ounce by 12:06 p.m. in London, after falling 1% over the prior two days.

Weaknesses

- The worst performing precious metal for the week was silver, down 4.52% on little news. Gold continues to lose investors. Total gold held by ETFs has fallen 6% this year to 100.3 million ounces after 67,509 ounces of outflows on Thursday. According to Bloomberg data, ETFs also cut silver from their holdings for the fourth straight day.

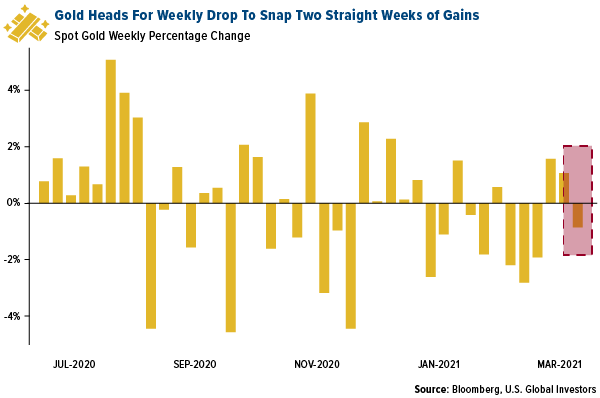

- Gold prices are down 9% so far this year and saw a weekly loss after two weeks prior of gains. The yellow metal still fell for the week even as bond yields halted their advance, under pressure from a dollar strengthening on the success of the U.S. vaccine program.

- Credit Suisse lowered its gold price estimate for 2021-2022 as bullion faces continued pressure from rising Treasury yields, writes Fahad Tariq. The 2021 forecast was lowered to $1,900 an ounce from $2,100 and the 2022 price was cut to $2,100 from $2,300 an ounce.

Opportunities

- Platinum-group metals mining executives and investors gathered for a virtual conference to discuss the industry’s future this week, reports Bloomberg. Anglo American Platinum CEO Natascha Viljoen said rhodium demand will remain strong in the short-term due to the metal’s ability to cut emissions from vehicles. Impala Platinum Holdings CEO Nico Muller said many of South Africa’s underground mines may be closed over the next decade, which would strain supply and further boost prices.

- Sibanye Stillwater’s CEO Neal Froneman said in an interview this week that “the gold industry needs to be consolidated, so you can either lead the consolidation or you will be consolidated.” Froneman says he wants to refocus Sibanye back toward gold and that other South African miners AngloGold Ashanti and Gold Fields would both fit with the company’s acquisition strategy. Sibanye hopes gold to get back to 40% to 50% of its earnings to ensure sustainable dividends.

- Metalla Royalty & Streaming announced two separate royalty acquisitions this week. Metalla completed the acquisition of an existing 0.5% NSA royalty on a portion of Barrick Gold’s Alturas-Del Carmen project and an existing 0.45% NSR royalty on Agnico Eagle Mines’ and Kirkland Lake Gold’s North AK property in Kirkland Lake, Ontario. Wheaton Precious Metals announced it will purchase 100% of the payable gold production at the Santo Domingo project owned by Capstone Mining Corp. until 285,000 ounces have been delivered.

Threats

- Peru’s front-runner for the presidency said they are ready to take a tougher stance against mining companies to ensure more of the revenue generated from its mineral wealth stays in the country, reports Bloomberg. “Unfortunately, they are not leaving us the resources that they should,” Yonhy Lescano said of the mining sector, “and that has been hurting us.” This is a major threat to miners operating in Peru.

- Jaguar Mining, a Canadian gold producer and explorer in Brazil, said it expects production to be disrupted due to a surge in COVID cases limiting contractors. The company said in a statement that “the current increase in the intensity of our Covid-19 measures, as dictated by government guidelines and the pandemic, may also limit production in the near term.” Bloomberg notes that Brazil has seen the highest level of COVID cases in the first quarter of 2021. This is a reminder that the global pandemic is not over and there is still potential for disruptions.

- The London Metal Exchange (LME) is facing backlash after issuing a consultation document to participants recommending permanently closing its open-outcry, reports Kitco News. Traders have been using hand signals and face-to-face “ring” trading for 144 years, but due to the pandemic the exchange was temporarily closed with all trading done over the phone or online. Most major exchanges have moved toward this direction of online trading through a platform for some time and many are asking how long the traders at the LME can hold out.