Strengths

- The best performing precious metal for the week was platinum, up 8.29%, on a falling dollar and a pullback in yields. Partially driven by recent deal activity, gold M&A has become more topical. Many companies suggest they are open to the right opportunities but remain disciplined. There are fewer non-core assets flagged for divestment. Companies are growing mindful of hanging on to everything in the pipeline, considering limited organic growth opportunities otherwise.

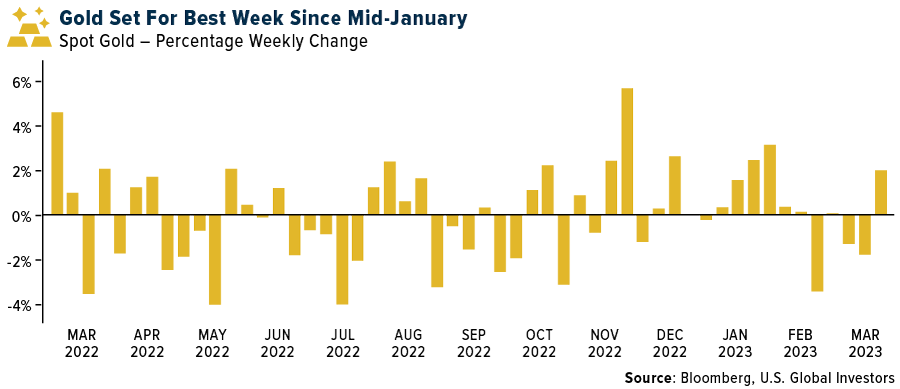

- Gold is poised for its best week since mid-January, reports Bloomberg, as the dollar weakens on signs that China’s economic recovery is gathering pace. Bullion climbed higher Friday as a gauge of the dollar extended what would be its first weekly decline in five, making the precious metal cheaper for most buyers. China’s economy is rebounding rapidly, the article explains, while Euro-area inflation is proving hotter than expected, raising the prospect of more tightening from the bloc’s central bank.

- Lundin Gold provided a reserve and resource update for its Fruta del Norte (FDN) mine, and it was ahead of consensus. Since the operation achieved its first production in 2019, a total of 1.38 million ounces of gold has been depleted through mining and milling operations. With this update, Lundin added 1.58 million ounces to reserves, more than replacing all the mining depletion to date.

Weaknesses

- The worst performing precious metal for the week was silver, but still up 1.91%. Argonaut Gold released fourth quarter 2022 financial results with adjusted EPS of -$0.05 (versus consensus of -$0.01) driven by lower production and higher costs, slightly offset by higher realized selling prices. Production during the quarter was 42,500 ounces with AISC of $2,266 per ounce.

- K92 Mining provided an operational update for its Kainantu Gold Mine. During the month of February, the process plant has experienced two notable unplanned maintenance events that together, management says, will have an impact on February and first quarter 2023 production. One of the mill trunnion bearings failed, requiring immediate replacement. Then, a limited electrical fire in a cable tray resulted in damage to several cables feeding the wet section of the process plant. The processing plant has now successfully restarted.

- Sibanye Stillwater’s 2022 production and earnings (headline EPS of 40 cents per share versus consensus of 44 cents per share) missed estimates on the back of a challenging year for the company. AISC for the year was high, reflecting lower metal outputs and inflationary pressures.

Opportunities

- Superior Gold (SGI) has entered into an all-share agreement with Catalyst Metals (CYL) where SGI shareholders will receive 0.3571 of one Catalyst share for each SGI share. The deal values SGI at C$0.44 per share, which represents a 62% premium. This transaction would result in SGI shareholders receiving an immediate bump in value but potentially missing out on some benefit due to accepting the deal after reporting a challenging year in 2022.

- Newmont sees the NEM/NCM combination providing the following advantages: 1) ESG – being a leader in this field, 2) creating a world-class portfolio (gold/copper) with the optionality for portfolio rationalization and project sequencing, 3) synergies to be gained from scale, global supply chain, access to talent and technology and 4) driving capital allocation (disciplined strategy).

- RBC expects a relatively neutral reaction from I-80 Gold following the announced acquisition of Paycore Minerals for C$60M in total implied consideration. Paycore owns the FAD property, which lies immediately south of I-80's Ruby Hill project in Nevada, helping to consolidate the property land package. I-80 had previously indicated potential for increased emphasis on Ruby Hill within the asset portfolio following up on recent high grade polymetallic drill results and potential for gold/base metal processing via existing infrastructure on-site.

Threats

- Most companies under coverage are assuming inflationary pressures seen in 2022 will persist into 2023, but slowly taper off thereafter. Newmont's five-year outlook, which saw long-run cash costs increase $50 per ounce or around 7% from the prior guide and sustaining capex up $175 million annually (or up around 14%) from the prior guide. Higher gold prices will be needed to offset this.

- RBC sees a negative reaction from Argonaut shares following 2023 guidance, with the announced suspension of the company’s Mexican operations in part due to higher costs and pending resolution of land access/permitting issues. At Magino, capex was increased modestly by C$60M as anticipated with first gold targeted in mid-May and appears to be funded with $243 million in liquidity at year-end.

- St Barbara has received requests for information from the Nova Scotian Minister of Environment and Climate Change in response to the environmental assessment of the proposal to deposit tailings into the Touquoy open pit. As stated in the second quarter report, any delays in approvals to in-pit tailings would trigger cessation of production early in fiscal year 2024. The compilation of the information required to answer the Minister’s questions would indeed take more time than is available before the capacity of the existing tailings management facility is reached in early 2024.