Strengths

- The best performing precious metal for the week was palladium, up 3.12%. Anglo American Plc warned this week that production across its operations will be lower than expected over the next couple of years. Platinum group metals were hit especially hard as total output could fall as much as 12.5% by 2025. Earlier in the week, Glencore lowered its forecast for 2023 on most of its commodities.

- Gold steadied after touching the highest level since July as traders weighed more U.S. economic data and China’s relaxation of its strict zero-Covid policies. Bullion had been hurt by the Fed’s aggressive rate hikes this year, but recent indications that the central bank is becoming less hawkish have boosted the metal, pushing it past $1,800 an ounce last week.

- The world’s largest gold exchange traded fund (ETF) is to store some of its inventory outside London for the first time, in a move aimed at facilitating further expansion. The $52.5 billion SPDR Gold Trust (GLD) has held all of its bullion in HSBC’s London vaults since its inception as the first physically backed gold ETF in 2004. However, it is now adding a second custodian, JPMorgan, utilizing the U.S. bank’s vaults in Zurich and New York, as well as in London. It is believed to be the first time a gold ETF has had multiple custodians.

- The worst performing precious metal for the week was gold, off 0.15%. After last week’s near-2.43% gain in gold, bearish investors tried to send a message of weakness with the Monday open. Investors sold off 0.47% of total known gold ETF holdings, which is a significant quantity relative to normal daily flows. The selloff message didn’t resonate however, with gold climbing in price each subsequent day of the week.

- Gold’s rebound above $1,800 an ounce has been met with selling by some of the largest players in the market, raising questions about the sustainability of the rally. Bullion-backed ETFs cut their holdings by 13.7 tons, according to an initial tally by Bloomberg. The biggest daily drop in 20 months pushed down gold by the most since September.

- The Perth Mint reported sales of gold coins and minted bars back to 114,304 ounces in November from 183,102 ounces in October. Silver coins and bars fell concurrently. The Mint noted, despite the fall back, sales were still at their second highest level this financial year.

Opportunities

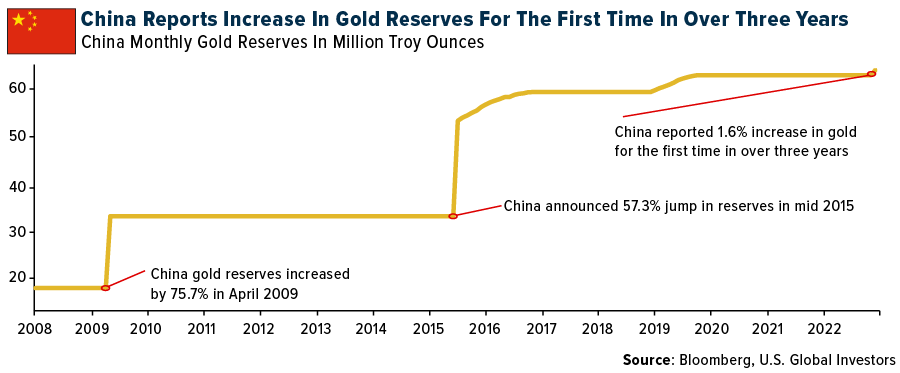

- China reported an increase in its gold reserves for the first time in more than three years, reports Bloomberg, shedding some light on the identity of the mystery buyers in the bullion market. The People’s Bank of China raised its holdings by 32 tons in November from the month before, according to data on its website on Wednesday. That brought its total to 1,980 tons, the sixth-biggest central bank bullion hoard in the world, the article continues.

- M&A will continue into 2023, with numerous senior companies having publicly commented on looking at M&A as part of their growth strategy. Transactions that provide diversification and less risk concentration would garner shareholder support. There may be further consolidations in the streaming space (between the smaller players).

- India’s trade ministry is discussing a reduction in import taxes on gold to rein in illegal shipments, according to people familiar with the matter. The world’s second-largest consumer of the precious metal, almost all of which is purchased from abroad, has asked the Finance Ministry to consider reducing the tariff to about 10% from 12.5%, two of the people said, asking not to be identified as the deliberations are private.

Threats

- Gold Field’s key rationale for its Yamana offer was an emerging “gap” of production decline to 2.0 million ounces by 2030, which was reiterated on November 28 as a reason to continue to look at M&A. The gap is not an urgent strategic weakness for Gold Fields; the company may have a production decline to 2.3 million ounces in 2029, but with $8 billion free cash flow 2023-2030E and a debt-free balance sheet to reinvest over the long term, it will be able to find new avenues of production.

- Google searches for “diamonds” in the U.S. appear to have decoupled from their historical trend of sharply rising into the holiday season. This could be indicative of weakening consumer appetite for these stones, as evidenced by the softening for polished prices across the size spectrum as well as the weaker-than-expected DeBeers’ site sales.

- Extortion is how mining executives in South Africa are describing “Mafia” like groups organizing to disrupt mining operations with a threatening letter, a derailed train, blocked roads, burned vehicles, and workers locked up, reports Bloomberg. In November, a train derailed on the main export route for coal miners. Transnet SOC Ltd, said the incident occurred “against a backdrop of threat and disruptions to the company’s operations by disgruntled groupings seeking business combinations.” South Africa is now ranked 75 out of 84 jurisdictions, compared to 40in 2019, by the Frazier Institute’s Annual Survey of Mining Companies.