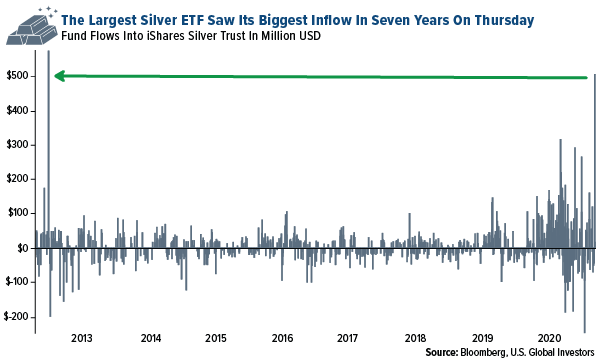

- The best performing precious metal for the week was silver, up 2.92%. Global holdings in silver-backed ETFs hit the highest ever on Wednesday, according to Bloomberg calculations. The iShares Silver Trust took in half a billion dollars in inflows on Tuesday, the biggest inflows in seven years. Despite silver dropping more than 4% so far this year, investors are piling into the precious metal.

- Spot gold rose 1.7% on Wednesday as Joe Biden was sworn in as the 46th U.S. President. Gold is now trading above last week’s high and is finding support above its 200-day moving average. The dollar weakened amid signs that interest rates may remain low for the near future.

- Anglo Asian Mining shares rose 10% in U.K. trading on Thursday on the news of a ceasefire agreement in Azerbaijan. There had been a military conflict between Armenia, Azerbaijan and Russia over the enclave of Nagorno Karabakh, where Anglo Asian has three contract areas.

Weaknesses

- The worst performing precious metal for the week was palladium, down 1.21% on little market-moving news. Gold and silver were both down sharply Friday morning after U.S. PMI flash readings came in stronger than expected, signaling a strengthening economy.

- GlobalData estimates global gold production final figures will show a drop of 5.4% in 2020 to 108 million ounces, largely due to pandemic disruptions. The biggest decline is expected out of China of 933,800 ounces lower than 2019.

- An explosion at a Chinese gold mine on January 10 trapped 22 workers and has killed one, reports Xinhua News. Workers remain trapped in the Hushan Gold Mine in Shandong province and the rescue team warned their efforts face several challenges due to the hard rock.

Opportunities

- Sibanye Stillwater’s CEO and well-known dealmaker Neal Froneman said he wants to double the size of the South African miner before retiring in two to three years. Froneman grew Sibanye to a market cap of $11.9 billion through mine acquisitions. “M&A is what we are good at. We have created value and we are going to continue to create value in the right way at the right time.” The company is exploring deals in battery metals projects.

- Eldorado Gold and QMX Gold Corporation announced a friendly acquisition. Eldorado, which owns 17% of QMX, will acquire all remaining outstanding shares of QMX at a 39.5% premium. Following the completion of the agreement, QMX shareholders will own 2.8% of the issued and outstand shares of Eldorado.

- Gold Fields has hired former Anglo American Platinum chief Chris Griffith as its new CEO as the company hopes to restore its last gold mine in South Africa, the iconic and challenging South Deep mine. Gold Fields shares rose as much as 6.2% in South African trading on the news. Griffith who left Anglo American Platinum on a high point for the company last year will start in April at Gold Fields.

Threats

- Billionaire investor and Oaktree Capital Management cofounder Howard Marks questioned gold’s worth in a CNBC interview this week. Marks said “gold’s value is almost like a superstition” since it depends on people believing it’s worth something.

- Georgette Boele, senior precious metals strategist at ABN AMRO, adjusted her outlook for gold and said its price has peaked. Boele predicts the gold market struggling this year as rising inflation could force the Federal Reserve to tighten monetary policy faster than expected. Improving economic conditions will push nominal yields higher, which would raise real interest rates, Boele added.

- British Prime Minister Boris Johnson said on Thursday it is still too early to say when the national COVID lockdown in England will end as deaths from the virus keep rising. The U.S. hit a grim milestone of 400,000 COVID deaths this week. Newly sworn in President Joe Biden said another 100,000 Americans could die over the next month as the pandemic will worsen before it improves.