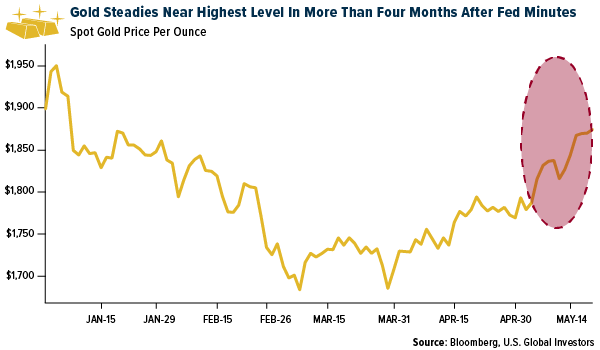

- The best performing precious metal for the week was gold, up 2.05%. The metal rose to a three-month high as lower bond yields helped to improve gold prices. Continuing concerns about rising inflation are buoying the metal as well. Flows in gold ETFs are continuing to increase. Gold ETFs recorded inflows of 442,000 ounces. Net long gold positions increased by 29,000 to 204,000 contracts. In addition, according to J.P. Morgan, investors have been pulling money out of bitcoin and buying gold as a replacement. China’s gold imports tripled from the prior month. In a recent note, BMO Capital Markets indicates that gold does well in inflationary environments and producers may have record cash flow over the next year.

- Anglo American’s De Beers business sold $380 million of rough diamonds at its fourth auction this year. The third sale was for $450 million. Only $56 million of diamonds were sold in all of 2020. Demand from India may be down in 2021 due to the COVID surge.

- The World Platinum Investment Council (WPIC) said the global platinum market will be more undersupplied this year than it previously thought as economic recovery fuels a surge in demand from industry. The roughly 8 million ounce a year market will see a shortfall of 158,000 ounces in 2021, the third consecutive annual deficit, the WPIC said in its latest quarterly report. Three months ago, it forecast undersupply of 60,000 ounces in 2021. Additionally, UBS increased its forecasts for platinum based on these same trends. ETF flows into platinum are up 3% this year.

- Despite the positive forecast from the WPIC, the worst performing precious metal for the week was platinum, down 4.66%. Centerra Gold said on Sunday it has initiated binding arbitration against Kyrgyzstan government after the parliament passed a law allowing the state to temporarily take over the country’s biggest industrial enterprise, the Kumtor gold mine operated by Centerra. Given these restrictions, Centerra is no longer in control of the mine. Centerra has suspended its 2021 guidance and three-year outlook relating to Kumtor. Kumtor earnings are being removed from Centerra and estimates are being reduced. Most investors who have traded Centerra in the past, based on past government interventions, seem to expect a more reasonable outcome as the share price of Centerra is up nearly 17% since the initial ownership dispute was brough to light a couple weeks ago.

- American Gold and Silver reported disappointing first quarter results: a loss of $0.08 per share versus a consensus of $0.06 loss per share. Relief Canyon production of gold was 1,300 ounces, as opposed to an 8,200-ounce consensus. Additionally, the company took an $83 million write-down on this property. Its share price finished the week off nearly 25%.

- St Barbara Ltd. said that it has lowered its full-year production guidance but increased its all-in sustaining costs forecast due to guidance adjustments at its Leonora and Simberi operations. The company lowered its consolidated gold production guidance to between 330,000 ounces and 360,000 ounces from the previous guidance of between 370,000 ounces and 380,000 ounces, and increased its all-in sustaining costs forecast to a range between A$1,547 per ounce and A$1,695 per ounce from the previous estimate of A$1,440 per ounce to A$1,520 per ounce.

Opportunities

- Arizona Metals reported the discovery of a new high-grade gold and zinc zone at its 100% owned Kay Mine property in Arizona. In a sure sign of the project’s potential to add significant tonnage, potentially at improved grades, most of the mineralized intervals in the drilled holes are in an area that has historically seen very little exploration. Arizona Metals is funded for 75,000 meters of drilling to infill and expand the resource footprint.

- Platinum may be increasingly used instead of more expensive palladium in vehicles, according to Johnson Matthey. Platinum is about half the price of palladium. Chinese automakers appear to be taking the lead with this shift. Platinum supply will fall short of demand again this year, the World Platinum Investment Council said in a report. The market may have a shortage of 158,000 ounces.

- Diamond inventories have dropped to cycle low levels, which creates a positive environment for pricing towards the end of this year. Easing Covid restrictions in the U.S. and Europe may release pent-up demand from weddings, which may drive strong jewelry demand in the second half of the year.

Threats

- Rising labor costs may begin to occur at many mines. This is most acute in Australia and Brazil, according to the CEOs of Newmont and AngloGold Ashanti. In addition, South Africa’s Union of Mineworkers has asked for a 15% annual wage increase through 2023. Citi’s Economic Surprise Index, which measures whether economic data is missing or beating expectations, is now at its lowest level in a year. This implies that the strength of the economy is no longer running above expectations. Any new economic misses might surprise the market on “Where’s the post-pandemic growth?”

- When China’s Zijin Mining paid $1 billion to buy an extensive gold mine in the Colombian Andes in late 2019, security risks were a top concern, despite an operation by the military which had beat back illegal miners. Illegal extraction by wildcat miners in tunnels either within or adjoining its concession has increased. The tunnels are controlled by the Clan del Golfo crime gang, known locally as “The Ten” for the 10% cut they take off the illegal miner’s output.

- UBS initiated coverage of platinum miners with a neutral stance, as they see supply demand imbalances easing in the next two years on supply increases from South Africa and Russia. The bank sees prices for palladium easing to $2,000 in the longer term. UBS analysts have kept their yearend forecast for gold at $1,600 an ounce, saying they “expect fading inflation surprises, higher U.S. government bond yields, rising vaccination pace to reduce uncertainty and the U.S. dollar to peak.” Consumers certainly feel inflation now as rents for single-family homes in the U.S. have risen to their highest level since 2006, with a 4.3% jump from the prior year.