- The best performing precious metal for the week was platinum, down just 0.27%. Gold surged above $1,900 an ounce on the first day of trading in 2021, building on its 2020 advanced due to lower U.S. real yields and a weaker dollar. The precious metal rose to a 2-month high even as stocks are at all-time highs. Investors concerned about inflation are looking to assets that could health protect their wealth.

- Platinum rose on Tuesday to reach its highest price in more than four years as fears mount about rising virus cases in top producing South Africa. Potential supply disruptions such as a flight ban out of the country also pushed palladium to a 10-month intraday high.

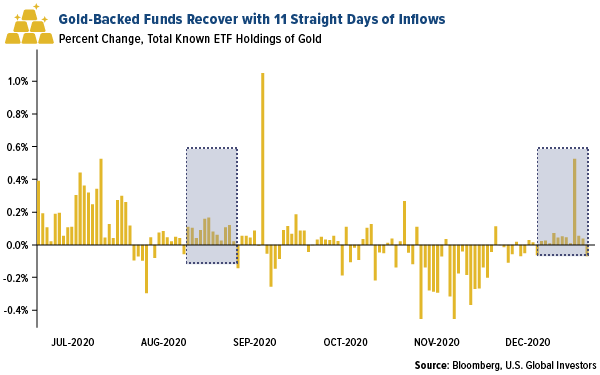

- Inflows into gold-backed ETFs could be recovering after 11 straight days of positive flows as of Thursday. This marks the longest run of gains since late August after the end of 2020 was marked with big outflows. Gold ETF assets climbed to 3,341.1 metric tons on Wednesday, the highest since November, according to Bloomberg data.

Weaknesses

- The worst performing precious metal for the week was silver, down 3.71%, typically being the most volatile precious metal. Gold’s early week rally faded on Wednesday, falling 2.2% for the day, as U.S. Treasury yields broke above 1% for the first time since March, reports Bloomberg. Bullion fell back below $1,900 an ounce on Friday.

- India’s gold imports in 2020 fell to the lowest since 2009 of just 275.5 tons as higher prices along with coronavirus disruptions kept buyers away. However, imports in December rose 18% from a year earlier to 55.4 tons, reports Bloomberg.

- South African authorities arrested three suspected smugglers after discovering 162 pounds of gold bars worth $4.5 million in their hand luggage at the airport in Johannesburg, reports Bloomberg. Investigations are underway to determine the origin of the bars and the legitimacy of certification papers, as well as the destination of the gold.

Opportunities

- Bloomberg Intelligence’s Mike McGlone says gold will be the asset to beat in 2021. McGlone predicts bullion will outperform stocks and views the 2020 rally as sustainable. "Our bias is that the greater potential for quantitative easing (QE) and debt-to-GDP levels to keep rising should keep metals prices -- notably gold and silver -- going up," McGlone said.

- Agnico Eagle Mines acquired TMAC Resources in an all-cash offer. The deal is a premium of 26% to the offer price Shandong Gold previously bid and a 66% premium to TMAC’s 20-day volume-weighted average price on January 4. TMAC’s takeover by Shandong was rejected by Canada two weeks ago. Jason Neal, TMAC President and CEO, said “Agnico Eagle is one of the strongest gold producers internationally, a Canadian champion and has been operating in Nunavut for more than a decade with a great track record with communities, employees and the environment."

- Mike Novogratz, billionaire and Galaxy Investment Partners CEO said on Bloomberg TV this week he believes both bitcoin and gold are going higher, with gold “easily” going up 30% in 2021. Many view bitcoin’s surge as a headwind to gold by taking away its demand. The popular crypto topped $40,000 this week. Novogratz believes both assets could rise due to fears of fiat currency debasement.

Threats

- The U.S. reported 4,000 COVID-related deaths on Thursday – the most in a single day. The country also reported 274,703 new cases the same day as labs catch up on processing test results and the post-Christmas surge is realized. The pandemic shows no signs of slowing even as vaccines roll out globally. The U.K. imposed a strict lockdown after Prime Minister Boris Johnson announced 1 in 50 Britons have the virus.

- Despite the political turmoil that rolled into the capital mid-week, the broader equity markets still remained rather buoyant while gold sagged. Perhaps some volatility premium for gold has been lowered for the future with the expected departure of President Trump. However, with the recent mass hack of government/ business computer networks across America, and laptop computers missing from the White House, this week it’s difficult to grasp the scale of the data breach and what are the consequences in the future.

- The price of bitcoin topped $40,000 for the first time this week. Many investors believe bitcoin is taking investors away from gold as a hedge against risk in portfolios. JPMorgan says the popular crypto could surge to $146,000 in the long term. Bullion fell back below $1,900 an ounce this week after rising above.