Strengths

- The best performing precious metal for the week was palladium, up 10.46%. Allied Market Research published a report outlining 5.8% compounded growth for global palladium markets through 2031. Barrick Gold reported third quarter 2022 adjusted earnings per share (EPS) of $0.13 versus consensus of $0.11. The beat versus consensus was on lower depreciation, corporate costs, exploration, interest as well as slightly lower copper costs. Cash costs of $891 per ounce were largely in line with consensus of $892 per ounce, while all-in sustaining costs (AISC) of $1,269 per ounce was slightly below consensus of $1,271 per ounce on lower corporate allocated overheads.

- AngloGold Ashanti’s third quarter 2022 results were better than forecast due to an improved production and unit cost performance, which resulted in a 10% beat on EBITDA (earnings before interest, taxes, depreciation and amortization). Cash generation for the period was $203 million better than forecast, with management highlighting that it continues to generate strong cash flows from the Kibali JV, while the outstanding value-added tax (VAT) balance in Tanzania was further reduced through corporate tax offsets.

- Central banks bought almost 400 tons of gold in the third quarter, the largest quarterly increase on record. Year-to-date purchases are already at the highest level since 1967, and there have been eight consecutive quarters of net buying. In particular, the World Gold Council (WGC) noted a big increase in unreported buying, while reported purchases were predominantly at emerging market banks.

- The worst performing precious metal for the week was silver, but still up 4.65% and is the strongest performer so far this quarter. Sibanye-Stillwater's third quarter 2022 operating results disappointed, with production missing consensus by 6% at the SA PGM operations, 11% at the SA gold operations and 23% at the Stillwater mine. Group adjusted EBITDA for the period declined 51% year-over-year to $496 million and missed consensus by 46%.

- Equinox Gold reported third quarter adjusted EPS loss of $0.09 against consensus of a gain of $0.01, and the Street estimate of a loss of $0.02. The disappointing quarter was punctuated by lowered production guidance and increased cost guidance for the full year 2022.

- Franco Nevada reported adjusted EPS of $0.83 versus consensus of $0.85; EPS was lower than consensus on lower revenue performance from precious metals offset by stronger performance from the energy division (Marcellus and Haynesville) versus consensus.

Opportunities

- Pan American Silver and Agnico Eagle delivered a definitive binding offer to acquire Yamana, topping the bid from Gold Fields. This consolidates 100% ownership of the Canadian Malartic mine, one of the world's largest gold mines. The transaction would also create the leading precious metals producer in Latin America. The consideration consists of 153,539,579 common shares in the capital of Pan American; $1 billion in cash contributed by Agnico Eagle; and 36,089,907 common shares in the capital of Agnico Eagle. Under the offer, each Yamana share would be exchanged for approximately US$1.04 in cash, 0.1598 Pan American shares and 0.0376 Agnico Eagle shares, for an aggregate value of $5.02 per Yamana share.

- On Sunday evening, SolGold announced that it had entered into an agreement with Osisko Gold Royalties for a $50 million royalty financing on SolGold’s Cascabel copper-gold project located in northern Ecuador. Osisko has a 5% net smelter return (NSR) royalty on the Canadian Malartic mine and 3-5% NSR royalties across the Odyssey underground project. In addition, Triple Flag Precious Metals agreed to buy Maverix Metals for $606 million, elevating its profile and increasing the liquidity of their shares with the purchase.

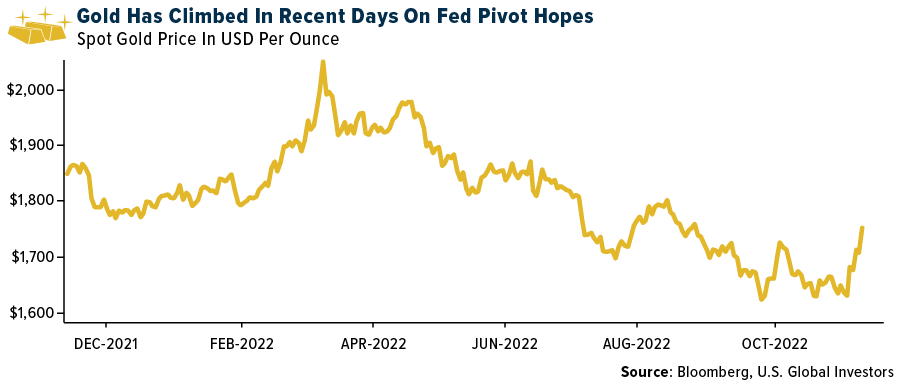

- With another jumbo rate hike last week, gold and the markets rebuked Powell’s hawkish tone last Friday and continued their narrative of defiance throughout the past week with further price gains fueled by China reopening steps. The adage that the Fed will raise rates until something breaks may have seen the first shoe to drop with trillions eviscerated from crypto since the Fed changed policy. Less than a week after the most recent hike, FTX collapsed in a matter of days, wiping out customer accounts and another $5 billion in essentially vapor assets from companies associated with crypto. This may be part of why gold is now getting a firmer bid as investors ask… “Where is my money safer?”

Threats

- Argonaut Gold reported roughly in line adjusted EPS of $0.00 but achieved lower-than-expected production (45,900 ounces gold) and higher-than-expected costs in the third quarter of 2022. Weaker results at La Colorada and Florida Canyon were largely what led to the consolidated production miss. For the second quarter in a row, the company has raised its cash costs and AISC guidance by approximately $100 per ounce.

- Gold Fields has rescinded its offer for Yamana Gold after two Canadian rivals teamed up with an unsolicited $4.8 billion bid to break up an earlier merger agreement with the South African miner. Gold Fields CEO Chris Griffith noted that the company is still interested in assets in Canada and is not deterred by its experience in trying to acquire Yamana. Companies like Wesdome Gold Mines or Fortuna Silver Mines might be more palatable to acquire.

- Petra announced that the eastern wall of the tailings storage facility at its Williamson mine in Tanzania was breached. No fatalities or injuries have been confirmed. All mine production has been suspended pending further investigation into the breach. While Williamson only represents 3% of Petra’s total asset valuation, this is unfortunate news from an environmental perspective and in terms of potential impact to nearby communities.