Gold is really out of favor after suffering several sharp selloffs in recent months on Fed-tightening fears. Speculators trading leveraged gold futures have been mostly short selling, while investors have been ignoring gold exchange-traded funds. Driven by bearish herd sentiment, that groupthink is short-sighted. Gold demand and prices will ultimately follow the Fed’s money supply, which continues to surge higher.

The overwhelming reason gold has been considered valuable around the world for millennia is its limited supply growth. Mining gold at scale has always been time-consuming and capital-intensive. Even with modern technology, it usually takes over a decade after discovering a commercially-viable gold deposit to prove it out, permit it, construct a mine, and ramp that up to nameplate production. That process can’t be rushed.

And existing gold mines, which often have useful lives under a decade, are constantly depleting. When they get to the tail ends of their lifespans after tapping their best ores, their production rates tend to start declining dramatically. Thus maintaining global gold output is a huge ongoing struggle, which has worsened in the last decade. Investors’ apathy has left this sector starved of necessary expansion capital.

Because of all this and other factors, the world aboveground gold supply only grows around 1% annually. That rate may be even lower, with mounting fundamental evidence supporting the peak-gold thesis. After recent centuries’ intensive worldwide hunts for new gold deposits, the larger and easier-to-discover ones have already been picked over. So barring some technological alchemy, gold supply growth won’t recover.

Meanwhile the world’s central banks, led by the largest dominant ones, are rapidly expanding their fiat-currency supplies like there is no tomorrow. Excessive monetary growth is ubiquitous globally, which is classic monetary debasement. That leaves relatively-more money in the system to chase relatively-less gold, ultimately bidding its price levels much higher. As an American speculator, I’m going to focus on the Fed.

The Federal Reserve publishes weekly balance-sheet data, including the total assets it holds. Depending on the economist asked, that is either equivalent to or highly correlated with the base money supply. The Fed grows its balance sheet by buying bonds, mostly US Treasuries. To pay for them, it literally creates the necessary dollars out of thin air with a keystroke! That new money is injected into the economy as it is spent.

The latest Fed-balance-sheet data as I pen this essay is current to the end of September. During the year leading into that, the Fed expanded its total assets by 19.7% or $1,392b! So the US money supply is growing on the order of 20% annually, compared to just 1%ish for gold. That serious monetary inflation is a super-bullish omen for gold, which again is valuable because its supply growth is inherently constrained.

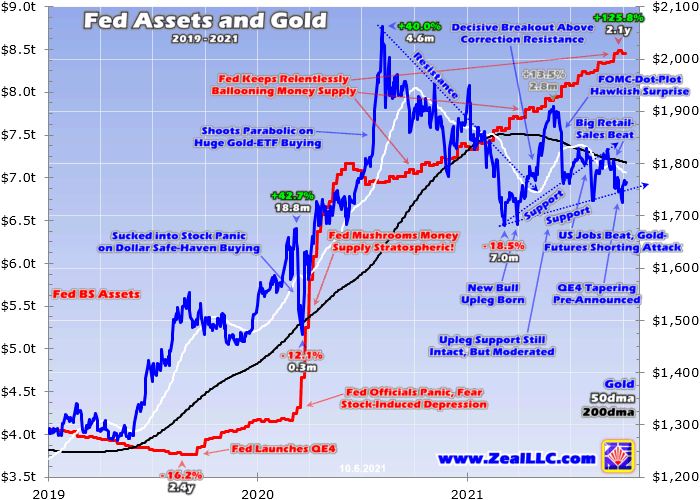

And this past year’s rapid monetary expansion is just the tip of the iceberg. This chart superimposes gold prices on the Fed’s weekly balance-sheet assets over the last several years. After March 2020’s stock panic fueled by pandemic lockdowns, the Fed mushroomed the US money supply stratospheric! Nothing like this had ever happened in US history, it is radically unprecedented. That deluge will force gold way higher.

COVID-19 was scary back in the early days of this pandemic, with much uncertainty over its virulence and lethality. Government officials responded with lockdowns to isolate people, which naturally hammered the underlying economies. So in just over a month into late March 2020, the benchmark US S&P 500 stock index collapsed a catastrophic 33.9%! That included a full-blown panic, a 20%+ plummeting in 2 weeks or less.

In the dark heart of that brutal selloff, the S&P 500 cratered 23.8% in just eight trading days! That risked spawning a terrible economic depression from the negative wealth effect. With Americans’ hard-saved investment capital ravaged, they would greatly slow their spending. That would slash corporate revenues and earnings, forcing widespread layoffs. Job losses and lower demand would spiral, torpedoing the economy.

Fed officials panicked, slashing their Fed-controlled federal-funds rate with two emergency cuts. 50 basis points in early March were followed by another 100bp in mid-March as stock markets plummeted! That left the FFR at zero, thus the Fed was out of conventional easing ammunition. So it started to spin up its monetary printing presses to dizzying speeds, directly monetizing bonds through so-called quantitative easing.

In late February 2020 before those massive rate cuts back to a zero-interest-rate policy, the Fed’s total assets were running at $4,159b. Just twelve weeks later, that balance-sheet monetary base had skyrocketed parabolic by 69.2% or $2,879b! In only several months after March’s stock panic, the Fed ballooned the US-dollar supply by over 2/3rds! Such crazy-extreme monetary inflation had never happened in the US.

Gold got sucked into that pandemic-lockdown stock panic too, plunging 12.1% in a slightly-offset eight-trading-day span. That surprised many traders, but it shouldn’t have. When stock markets roll over into super-scary freefalls, terrified people rush for the exits. They seek the relative safety of cash, so the US dollar tends to soar as stock markets collapse. The benchmark US Dollar Index blasted up 8.1% in that span!

Such colossally-huge moves for this reserve currency are only witnessed during stock panics. Big-and-fast dollar rallies hammer gold because hyper-leveraged gold-futures speculators who dominate gold’s short-term price action watch the dollar for trading cues. That same phenomenon happened recently, but at a much-slower pace. Back in early June 2021, gold had rallied 13.5% over 2.8 months in a solid upleg.

But that bull-market uptrend was interrupted in mid-June by a Federal Open Market Committee meeting, where Fed officials set monetary policy. Their unofficial individual rate outlooks showed a chance of a couple quarter-point rate hikes way out into year-end 2023. That slightly-more-hawkish-than-expected outlook ignited a dollar rally, which unleashed massive gold-futures selling pounding gold sharply lower.

Gold soon started recovering, but another wave slammed it again in early August. An upside surprise in monthly US jobs increased perceived odds the Fed would have to soon start slowing the pace of its epic fourth quantitative-easing campaign. That again goosed the US Dollar Index, unleashing even more gold-futures selling. That culminated in a brazenly-manipulative gold-futures shorting attack on a Sunday evening!

Gold again bounced sharply, actually surging back above its 200-day moving average. But another bout of heavy gold-futures selling erupted in mid-September after a better-than-expected print on US retail sales. That left traders even more convinced the Fed’s QE4 tapering would be announced soon, leading speculators to again flee gold futures. I analyzed these three episodes in depth in a mid-September essay.

While most of speculators’ gold-futures-selling firepower was expended before the late-September FOMC meeting, the expected pre-announcement of QE4 tapering coming shook loose the remainder. So gold again was forced modestly lower. Over the 3.9-month span between early June to late September, gold fell 9.6% on Fed-tightening fears. The driving gold-futures selling was fueled by the USDX’s parallel 5.0% surge.

Heavy-to-extreme gold-futures selling triggered by big-and-fast US-dollar rallies occasionally happens, as that March 2020 stock-panic episode proved. But these are always short-lived, as the capital commanded by gold-futures speculators is very finite. When frenzied, their selling quickly exhausts itself. That paves the way for enormous gold rebounds. Just look what happened after last year’s stock panic, gold soared.

With that stock panic itself and thus the resulting US-dollar safe-haven buying quickly climaxing, so did the gold-futures selling. That reversed to buying, helping gold mean revert sharply higher. Over the next 4.6 months after its anomalous stock-panic nadir, gold rocketed 40.0% higher to an all-time nominal record of $2,062! The initial post-panic bounce corresponded with the Fed mushrooming the US money supply.

While gold-futures buying ignited and initially fueled gold’s last massive bull-market upleg, it wasn’t the driver. Interestingly by the time that upleg grew unsustainably overbought and ready to give up its ghost in a healthy correction, the gold-futures speculators had become net sellers. Over that upleg’s life, they actually sold 25.4k contracts through shorting. That’s the equivalent of 78.9 metric tons of gold dumped.

While gold futures’ crazy leverage often over 25x lets those speculators bully gold prices around, they are the mice playing while the cat’s away. Investors’ capital dwarfs that of the futures guys, so when they are buying or selling gold in quantity it easily overpowers futures trading. The best proxy for gold investment demand is the combined holdings of the leading and dominant GLD and IAU gold exchange-traded funds.

Gold soared 40.0% higher in 4.6 months out of March 2020’s stock panic mostly because American stock traders bought GLD and IAU shares so fast that they forced a colossal 35.3% or 460.5t holdings build! Gold-ETF holdings rise when their shares are being bid higher faster than gold. That forces these ETFs’ managers to shunt that excess demand into physical gold bullion, buying it with cash raised from issuing shares.

Gold needed to correct after shooting parabolic to extremely-overbought levels, as I warned in a mid-September essay soon after it peaked. So the subsequent 18.5% correction over 7.0 months into March 2021 was totally righteous. Fundamentally gold’s bull-market trajectory is a rising straight line, but gold prices oscillate around that based on popular greed and fear. Excessive fear spawns major uplegs after corrections.

Gold’s fifth upleg of this secular bull was off to a good start by early June 2021, rallying 13.5% over 2.8 months, before these recent bouts of serious gold-futures selling on Fed-tightening fears. Odds are gold is near a fear trough now kind of like it was during March 2020’s stock panic. Speculators and investors alike are so caught up in herd fear and apathy that they have lost sight of gold’s overall bullish big picture.

While gold corrected hard after its fourth upleg and suffered the indignity of this interrupted fifth one during recent months, the Fed’s massive money-supply growth continued unabated. Even after stock markets rocketed out of their own panic lows thanks to the Fed’s extreme money printing, worried Fed officials kept on ballooning the US-dollar supply since. That means far more dollars to chase relatively-less gold.

Since late February 2020 on the eve of that pandemic-lockdown stock panic, the Fed’s total assets have skyrocketed a mind-boggling 103.1% or $4,289b in just 19.1 months! You read that right, in only a year-and-a-half or so the Fed has literally doubled the US money supply! That’s why Americans are suffering raging inflation everywhere, with prices soaring. Far more money is competing for comparatively-limited goods.

The supply-chain issues are a minor driver of this red-hot inflation, almost a red herring compared to the overwhelmingly-dominant impact of the Fed’s insane monetary excess. QE4 was actually born before the pandemic in mid-October 2019, after the Fed capitulated early on quantitative tightening trying to unwind its vast money printing after October 2008’s stock panic. Most of QE4 came after that next March 2020 one.

As of the latest official Fed balance-sheet data, QE4 has swollen to an unthinkably-colossal $4,498b over 23.7 months! That exploded the Fed’s total assets 113.9% higher in that span! Nearly 3/4ths of that QE4 bond buying or $3,310b was the direct monetization of US Treasuries to help “finance” the US government’s gargantuan deficit spending. QE4 still has a long ways to run yet despite the Fed’s tapering tidings.

Based on what the Fed chair said in his press conference after the FOMC’s late-September meeting, Wall Street expects the QE4 taper to start in December and happen at a $15b-per-month pace. If the Fed can hold to that timeline, that means another $660b of money printing is still coming before QE4 formally ends in June 2022. Thus in the best-case scenario QE4 is still going to grow another 1/7th bigger over 9 months!

Gold will ultimately follow the money supply, powering higher on balance as it keeps growing. And with universal inflationary price surges thanks to the Fed’s gross monetary excess, investors can’t ignore the fact the Fed just more than doubled the US dollars in existence. As inflation erodes purchasing power, and thus corporate sales and profits, investors are increasingly going to diversify their portfolios into gold.

This ultimate inflation hedge against monetary debasement though all of history is radically underheld by investors. Consider a quick proxy. In late September, the collective market capitalization of the 500 elite S&P 500 stocks ran $39,382b. But the combined holdings of those dominant GLD and IAU gold ETFs which are the primary way American stock traders invest in gold were worth less than $83b that same day.

That implies American investors have a gold portfolio allocation around 0.2%, which may as well be zero! For centuries the minimal prudent gold allocation was considered 5% to 10%, and that would shoot over 20% in challenging stock-market times. So there is vast room for investment capital to flood back into gold in coming years even if it only claws back to 1% or 2% of portfolios. Huge investment buying is likely.

Gold will ultimately follow the money supply higher as it always has over the long term. As Fed officials like to say, tapering is not tightening. It is just slowing the pace of money printing, not even starting to unwind the trillions of dollars of new money unleashed in the past year-and-a-half or so. Reversing some of that actually requires the Fed to sell bonds, quantitative tightening that would wreak havoc in the markets.

So even if the Fed follows through on ending QE4 by the middle of next year, the US-dollar supply will remain more than doubled keeping upward price pressure on everything tangible with far-slower-growing supplies including gold. But I’d be surprised if the QE4 taper actually happens, as Fed officials will panic and prematurely kill it if the stock markets swoon deep enough. Nearing a 20% bear, everything would change.

Again terrified of a negative-wealth-effect-induced depression, the Fed would not only stop slowing QE4 but rapidly ramp it back up again. If the stock selloff was sharp enough and the Fed was getting enough of the blame, it would likely blast QE bond monetizations back over their current $120b-per-month pace. And a serious stock-market selloff is long overdue with these Fed-levitated markets trading at bubble valuations.

As September ended, the S&P 500 stocks averaged dangerous 32.9x trailing-twelve-month price-to-earnings ratios. That is way above the 14x fair value over the past century-and-a-half or so, and twice that at 28x is where formal bubble territory begins. This Fed won’t tolerate a normal healthy stock bear to mean-revert valuations back down to reasonable levels relative to corporate earnings without a big fight.

With interest rates at zero, more quantitative-easing bond monetizations are the only weapon the Fed has left. And the more money the Fed conjures out of thin air, the more bullish the secular outlook for gold. This classic inflation hedge will ultimately follow the money supply up, as its own supply growth is very limited by the difficulties of mining. Given the extreme monetary excesses, gold is destined to power way higher.

In 2019 when the Fed’s balance sheet averaged $3,930b, gold averaged $1,394. Year-to-date in 2021, that money supply has doubled up 101.2% to average $7,907b! Yet this year’s average gold price so far is only up 29.0% to $1,798. Gold has a long ways to run yet to catch up to these extreme monetary excesses, with potentially a lot more still coming. The biggest beneficiary of higher gold prices will be gold stocks.

A massive mean reversion higher is overdue in the gold miners’ stocks, which have been beaten down to deeply-undervalued levels by the recent bearish gold sentiment. The major gold stocks tend to leverage gold upside by 2x to 3x, while smaller fundamentally-superior mid-tier and junior miners often see gains well outpacing that. Our newsletter trading books are full of these great stocks priced at incredible discounts.

At Zeal we walk the contrarian walk, buying low when few others are willing before later selling high when few others can. We overcome popular greed and fear by diligently studying market cycles. We trade on time-tested indicators derived from technical, sentimental, and fundamental research. That has already led to realized gains in this current young upleg as high as +51.5% on our recent newsletter stock trades!

To multiply your wealth trading high-potential gold stocks, you need to stay informed about what’s going on in this sector. Staying subscribed to our popular and affordable weekly and monthly newsletters is a great way. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. Subscribe today while this gold-stock upleg remains small! Our recently-reformatted newsletters have expanded individual-stock analysis.

The bottom line is gold will follow the money supply higher. The yellow metal’s prices are depressed now after the recent bouts of heavy gold-futures selling on Fed-tightening fears. Yet despite the Fed implying distant-future rate hikes and slowing QE money printing, its monetary spigots are still spewing vast deluges of new US dollars at torrential speeds. More monetary excess is still coming even if the QE4 taper happens.

But if these bubble-valued stock markets threaten to roll over into a new bear, Fed officials will panic. The tapering won’t only be stopped cold, QE4 money printing will resume with a vengeance. Either way, this gold bull has a long ways to run before this ultimate inflation hedge reflects the colossal monetary excesses from around the world. Far-more money available to chase relatively-much-less gold guarantees big gains.

Adam Hamilton, CPA

October 8, 2021

Copyright 2000 - 2021 Zeal LLC (www.ZealLLC.com)