Gold’s latest pullback in May short-circuiting strong seasonals frustrated plenty of traders. It was driven by heavy gold-futures selling in response to a sharp US-dollar rally, which in turn was partially fueled by hawkish comments from top Fed officials. When they advocate for more rate hikes, the dollar catches a bid spawning gold-futures selling. But traders weight Fedspeak way too highly given its dismal track record.

In my line of work as a professional speculator and financial-newsletter guy, I closely watch the markets all day every day. For a quarter century now I’ve studied real-time price action and newsflow, focusing on what is moving markets and why. As each trading day unfolds, I actually type up notes including links to relevant articles and charts. Running up to a couple pages a day, these are later used to write newsletters.

This play-by-play knowledge is essential for successful trading, as price trends are built on causal chains of newsflow. Understanding their cause-and-effect progression is necessary for gaming whatever is likely coming next. It’s not enough to know that gold or the benchmark US Dollar Index moved significantly on any given trading day, why they moved is more important. Fedspeak has played an increasing role lately.

Gold’s current upleg was really strengthening in early May, powering up 26.3% in 7.2 months to $2,050 on the 4th! That was within spitting distance of the yellow metal’s nominal all-time-record closing high of $2,062 in early August 2020. Gold’s latest high-water mark came the day after the Fed’s Federal Open Market Committee hiked its federal-funds rate by another 25 basis points to a range midpoint of 5.13%.

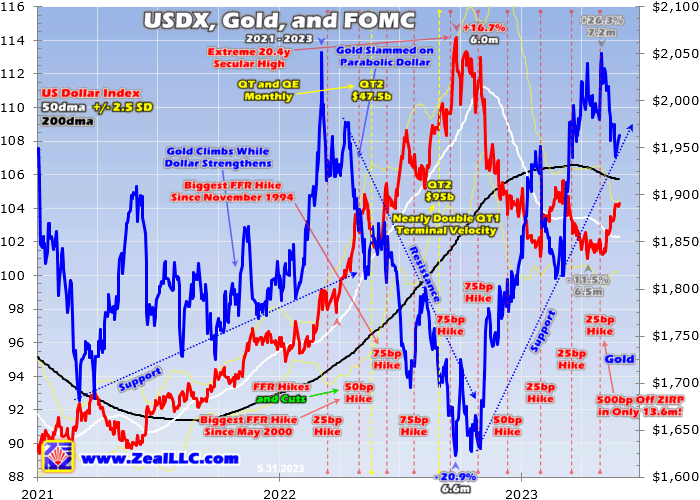

Gold’s short-term price action is dominated by speculators’ gold-futures trading, because of the extreme leverage inherent in that realm. They look to the US dollar for their primary trading cues. As gold surged in early May into and after that latest FOMC meeting, the USDX was drifting along near recent lows. In a bear market after shooting parabolic last year on the Fed’s extreme rate hikes, it hit an 11.7-month low in mid-April.

Hawkish Fedspeak sure wasn’t the only reason gold and the dollar reversed hard since. Gold was really overbought then, stretched way up to 1.132x its 200-day moving average. Even though that remained well under upleg-slaying extremes above 1.160x, serious overboughtness greatly ramps odds for healthy pullbacks to rebalance sentiment. And the USDX was oversold at 0.956x its own 200dma, arguing for a bounce.

FOMC monetary-policy meetings are held about every six weeks, with decisions released Wednesdays at 2:00pm. Interestingly leading into those, top Fed officials are subject to formal blackout periods where they can’t speak publicly or grant interviews. Those run from the second Saturdays before meetings to the Thursdays immediately after. So from April 22nd to May 4th, there was no Fedspeak during the latest blackout.

Gold’s counter-seasonal May pullback ignited on Jobs Friday the 5th with a 1.6% loss. That was mostly driven by another big upside surprise in April’s monthly US jobs report, with 253k jobs reportedly added compared to +180k expected. But a late-day gold rebound was scuttled by comments from the St. Louis Fed’s president. The Federal Reserve is actually a central-bank system comprised of twelve regional banks.

That afternoon he told reporters, “the aggressive policy we pursued in the last 15 months has stemmed the rise in inflation, but it is not so clear we are on” a path to the Fed’s 2% inflation target. He declared he would need to see “meaningful declines in inflation” to convince him more rate hikes weren’t necessary. Traders carefully listen when top Fed officials speak, moving futures-implies rate-hike odds accordingly.

The USDX’s technical bounce really accelerated a week later, surging a big 1.2% across the 11th and 12th which pushed gold a proportional 1.0% lower. That was mainly due to mounting fears Congress would fail to reach a US-debt-ceiling deal in time to avert a technical default, Fedspeak wasn’t a factor. Those worries flared again on the 16th, driving safe-haven dollar buying slamming gold 1.3% lower to $1,989.

That was its first close below the psychologically-heavy $2,000 line in a couple weeks, really accelerating the pullback-fueled bearish sentiment shift. Then the USDX’s biggest daily surge in May up 0.7% ignited a couple days later on the 18th. The resulting huge gold-futures selling slammed gold another 1.3% lower to $1,957. More hawkish Fedspeak was responsible, extending gold’s total pullback to 4.5% in a couple weeks.

In addition to the dozen regional-Fed presidents, the FOMC also includes the Federal Reserve Board of Governors. It has seven members appointed by US presidents and approved by the US Senate for 14-year staggered terms. The Fed chair and vice chair are always two of these seven. That day there was a phalanx of hawkish comments from a governor and two regional Fed heads, which really moved markets.

The new Dallas Fed president spoke in San Antonio, warning “The data in coming weeks could yet show that it is appropriate to skip a meeting. As of today though, we aren’t there yet. We haven’t yet made the progress we need to make. And it’s a long way from here to 2% inflation.” Soon after a Fed governor at a different venue added “Inflation is too high, and we have not yet made sufficient progress on reducing it.”

“Outside of energy and food, the progress on inflation remains a challenge.” Then later that St. Louis Fed president, who is the most flamboyant and attention-craving top Fed official, chimed in again declaring “it may warrant taking out some insurance by raising rates somewhat more to make sure that we really do get inflation under control”. Futures-implied rate-hike odds at the FOMC’s mid-June meeting surged on all that.

After gold started bouncing, more hawkish Fedspeak turned it south again on the 22nd. Regarding hiking the FFR again at the FOMC’s next meetings, the Minneapolis Fed leader said “What’s important to me is not signaling that we’re done ... it may be that we need to go north of 6%”. That would require four more 25bp hikes this year, even after the Fed’s blistering 500bp of hiking off zero in just 13.6 months into early May!

Never one to be upstaged for long, that ostentatious St. Louis guy opined “I think we’re going to have to grind higher with the policy rate in order to put enough downward pressure on inflation and to return inflation to target in a timely manner ... I’m thinking two more moves this year ... I’ve often advocated sooner rather than later.” That uber-hawkish Fedspeak helped drive the dollar higher and gold lower for a few days.

By the 25th, gold’s total mid-May pullback deteriorated to 5.4% over several weeks. That sizable selloff was fueled by increasingly-big gold-futures selling spawned by the US Dollar Index’s parallel 2.8% surge in that same span. Both moves proved big reversals, as apparent in this chart. It superimposes Fed rate hikes over both the USDX and gold, which have been highly inversely correlated over the past year or so.

Again it’s important to realize that Fedspeak wasn’t the only driver of the dollar bouncing and gold selling off in May. Plenty of other newsflow contributed, particularly major US economic-data releases including monthly US jobs, consumer inflation, wholesale inflation, and retail sales. But futures-implied rate-hike odds really surged on the above and other hawkish comments from top Fed officials, driving gold-futures trading.

Thankfully this latest Fedspeak stretch is winding down, with the formal blackout period leading into the FOMC’s June 14th meeting starting this Saturday the 3rd! So for most of the next couple weeks, federal-funds futures, the US dollar, and gold are going to be trading without hawkish spewings from top Fed officials bullying them around. That should either slow or reverse the dollar’s bounce and gold’s pullback.

After intensely studying the markets for decades, I’m really surprised traders take Fedspeak so seriously. The vast majority of Fedspeak moving markets comes from those twelve regional-Fed presidents, which are a diverse and colorful lot quick to opine on Fed monetary-policy direction. The political-appointee governors in Washington are generally much quieter, speaking way less often and more reluctant to move markets.

The great irony of all this is those regional Fed heads driving Fedspeak newsflow are merely figureheads with no real power! The Federal Open Market Committee has twelve voting members who decide Fed monetary policy at each meeting. Those seven governors including the chair and vice chair always have seven of those twelve votes. They have an ironclad controlling majority by design, and always vote together.

So the remaining five FOMC votes held by regional Fed presidents are meaningless, always outgunned. The New York Fed president has a permanent vote due to its closeness with stock markets. That leaves an inconsequential four remaining votes to be split among the eleven other regional Fed heads! Those are rotated among those guys on an annual basis with Chicago, Dallas, Minneapolis, and Philadelphia in for 2023.

With all the monetary-policy power concentrated in the hands of the governors, why do traders even care what the regional Fed presidents are saying? Yes they all come to all monetary-policy meetings, sitting at the table participating in discussions. But with only a third of the FOMC votes, their opinions really don’t matter. By all accounts the Fed chair persuasively controls the meetings, and the governors vote with him.

So when he speaks, traders really do need to listen! If he says something implying a diverging monetary-policy path from what traders expect, markets need to move to adjust to that. But regional Fed heads talking are just noise. Those figureheads are powerless to sway the FOMC. Even worse, they have a dismal track record in predicting Fed rate decisions that should destroy their credibility as forecasters.

With every-other FOMC meeting, the Fed publishes a Summary of Economic Projections detailing where top Fed officials expect key metrics to head in the future. Individual forecasts from all FOMC members including both governors and regional Fed presidents are aggregated and anonymized. Those guys all project where they expect US GDP, core PCE inflation, and the federal-funds rate to go in coming years.

The latter is summarized in the famous dot plots, which traders foolishly take as gospel even though the Fed chair himself periodically argues against putting too much stock in them! Just like traders betting with mature price trends, Fed officials’ forecasts are almost always wrong near major turning points in rates. The FOMC’s maiden rate hike in today’s monster hiking cycle arrived almost 15 months ago in mid-March 2022.

Since then the FOMC hiked that epic 500 basis points to that midpoint target-range FFR level of 5.13%. Yet at that very meeting when the Fed birthed this rate-hike cycle, those same top Fed officials who did all that hiking predicted the FFR exiting 2022 at just 1.88%. But the actual FFR midpoint at the end of last year was radically higher at 4.38%! These are mere mortals with no crystal balls, and often change their minds.

The latest dot plot was released at the FOMC’s second meeting ago in late March 2023. Then these top Fed officials expected the FFR to remain at its current 5.13% at year-end 2023. After seeing the dot plot fail miserably to predict future FFR levels for years, it would be shocking if this latest one proves correct. Traders now think the Fed will have to start cutting soon, to combat a recession fueled by its aggressive hikes.

There are many examples of top Fed officials’ FFR outlooks in those quarterly dot plots proving wildly inaccurate compared to what actually happened. I’ve written extensively about them in our newsletters over the years, as dot plots can really move the dollar and gold. Given the Fed guys’ terrible track record for actually forecasting future FFR levels, traders really shouldn’t care much about what they’re saying.

Gold’s sizable 5.4% May pullback was driven by heavy gold-futures selling in the face of a parallel big 2.8% surge in the US Dollar Index. All that was mostly fueled by rising futures-implied Fed-rate-hike odds at coming FOMC meetings. Hawkish Fedspeak played a big role in driving traders’ shifting expectations like usual. And most of that came from the regional Fed presidents who are a permanent minority on the FOMC.

Collectively they have no power to set or alter the Fed’s monetary policy unless the controlling governors want to. And that phalanx of aggressive Fedspeak is ending as the next blackout period ahead of the FOMC’s upcoming mid-June meeting starts Saturday. So there’s a good chance May’s gold pullback and USDX bounce both driven by that Fedspeak will stall or reverse in coming weeks, which is bullish for gold.

While gold’s sizable pullback last month did ramp bearish sentiment, it really wasn’t a big deal in the grand scheme. Back in February, gold suffered a bigger 7.2% pullback triggered by an epic upside surprise in monthly US jobs. But that didn’t last long, and gold soon reversed hard to power 13.2% higher into early May almost achieving that new nominal record close! But unfortunately gold-stock traders still freaked out.

During May’s several weeks when gold fell 5.4%, the leading benchmark GDX gold-stock ETF plunged 15.2%! That made for 2.8x downside leverage to gold, on the high side of the major gold miners’ usual 2x-to-3x range. That overdone gold-stock dumping is leaving some great bargains in its wake, even in fundamentally-superior smaller mid-tier and junior gold miners. So gold-stock traders should be preparing to buy.

This powerful gold upleg is due to resume soon with the Fed running out of room to keep hiking. That will lower the efficacy of Fedspeak jawboning to move markets. With June being the peak summer-doldrums month for both gold and its miners’ stocks, the timing of gold’s reversal may drag out a bit. But traders need to be ready with a great-gold-stocks shopping list. Once gold-futures buying returns, it should multiply fast.

Successful trading demands always staying informed on markets, to understand opportunities as they arise. We can help! For decades we’ve published popular weekly and monthly newsletters focused on contrarian speculation and investment. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks.

Our holistic integrated contrarian approach has proven very successful, and you can reap the benefits for only $12 an issue. We extensively research gold and silver miners to find cheap fundamentally-superior mid-tiers and juniors with outsized upside potential. Sign up for free e-mail notifications when we publish new content. Even better, subscribe today to our acclaimed newsletters and start growing smarter and richer!

The bottom line is gold’s hawkish-Fedspeak-driven May pullback has likely mostly run its course. Top Fed officials have been talking tough on future rate hikes, but now they have to quit with the next FOMC meeting nearing. That should help reverse recent heavy gold-futures selling into buying, reigniting gold’s interrupted upleg. Battered gold stocks will fly higher with gold, earning fast gains for smart contrarians.

Futures traders really ought to stop worrying about Fedspeak anyway. Top Fed officials have a dismal track record of predicting rate trends, especially near turning points. And the regional Fed presidents who are responsible for most market-moving Fedspeak collectively have no real voting power in the FOMC. As traders figure this out and the Fed runs out of room to keep hiking, Fedspeak’s impact on gold should dwindle.

Adam Hamilton, CPA

June 2, 2023

Copyright 2000 - 2023 Zeal LLC (www.ZealLLC.com)