Gold’s turn to shine again is nearing, with major bullish drivers aligning heading into this new year. The Fed’s vast deluge of new money remains intact despite QE tapering, continuing to fuel raging inflation. A new rate-hike cycle to fight that is looming, but gold has thrived during past cycles. This Fed tightening will weigh heavily on QE-levitated bubble-valued stock markets. As they fall, gold investment demand will surge.

Gold mostly spent 2021 grinding sideways-to-lower in a high consolidation. That lack of upside progress left this leading alternative asset increasingly out of favor with speculators and investors alike as the year marched on. Heading into year-end midweek, gold was down 4.9% year-to-date. While psychologically-grating, maybe big gains needed to be digested after gold surged 18.4% in 2019 then another 25.1% in 2020.

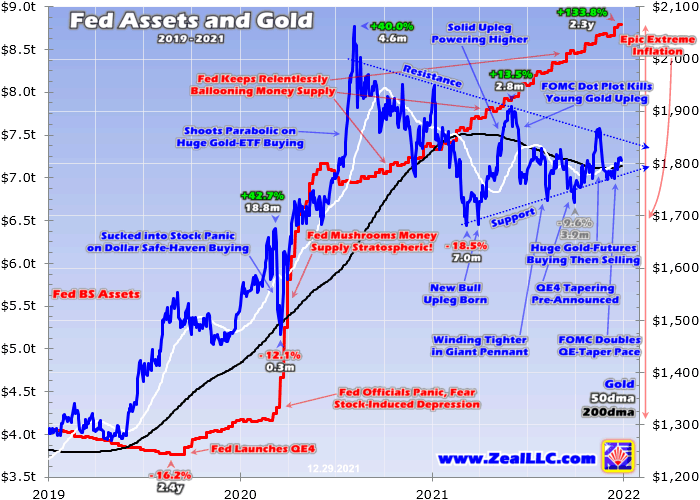

After two massive 42.7% and 40.0% gold-bull uplegs crested in 2020 alone, the next one began gathering steam in early 2021. Over several months into early June, gold powered 13.5% higher in a solid young upleg. But unfortunately that was prematurely killed by gold-futures speculators’ supremely-irrational fears of Fed tightening. Hawkish FOMC meetings and economic data spawned serious bouts of selling.

Over the past half-year, Fed-hawkish catalysts ignited several heavy-to-extreme gold-futures pukings slamming gold. I analyzed them all a couple weeks ago in an essay about gold weathering this hawkish Fed. Those periodic big gold-futures selloffs really damaged sentiment, leaving investors apathetic about gold. They won’t migrate back in with their vast pools of capital before gold upside momentum attracts them.

With leveraged gold-futures speculators periodically fleeing in terror and investors missing in action, gold couldn’t make any significant headway. But with traders finally coming to accept the Fed’s new tightening paradigm, gold’s vexing drift should be ending. As speculators and investors return, gold’s interrupted bull upleg should resume with a vengeance. Several major bullish factors are aligning to supercharge demand.

All three are inseparably intertwined with the Fed, starting with its epic money printing. This central bank birthed its fourth quantitative-easing campaign way back in October 2019. It was radically expanded in March 2020 during the pandemic-lockdown stock panic, which Fed officials feared would trigger a full-on depression due to the negative wealth effect. So they redlined the Fed’s monetary printing presses to crazy extremes.

The Fed monetized a wildly-unprecedented $4,632b in bonds in the short 21.9 months since then! All that new money conjured out of thin air to inject into the US economy catapulted the Fed’s balance sheet a terrifying 111.4% higher! This profligate central bank has essentially more than doubled the monetary base in about a year-and-a-half! That epic deluge of new dollars directly fueled the raging price inflation since.

When money supplies grow faster than the goods and services on which to spend them, inflation is the result. Relatively-more money competes for and bids up the prices on relatively-less everything else. Fed officials constantly try to downplay this ironclad historical relationship, deflecting and obscuring by claiming supply-chain problems are driving this devastating inflation. They don’t want to accept their just blame.

Those many trillions of new dollars the Fed force-fed into the economy artificially boosted demand for goods and services, directly driving the snarled supply chains. Way back in 1963, legendary American economist Milton Friedman warned “Inflation is always and everywhere a monetary phenomenon.” Price levels don’t universally and persistently rise unless excessive money-supply growth is bidding them higher.

Gold has always been the ultimate inflation hedge because its above-ground supply growth is naturally-constrained. Global gold mined supply only adds on the order of 1% per year, far behind leading fiat currencies’ double-digit inflation rates. All that new money ultimately competes for limited gold, driving up its price until a new proportionally-higher equilibrium is reached. That guarantees far-higher gold prices ahead.

This chart superimposes gold over the Fed’s balance sheet during the last several years. Monetary growth rocketed stratospheric after March 2020’s stock panic, and has remained very high ever since. Gold’s huge 40.0% upleg in mid-2020 reflected that flood of freshly-evoked US dollars, but in 2021 gold fell way behind. Gold needs to power much higher in coming years to reach equilibrium with this flood of money.

Through all 26.5 months of QE4, the Fed’s balance sheet has mushroomed a shocking 122.5% higher or $4,841b! Gold needs to soar dramatically higher to reflect this crazy new world with an $8.8t Fed balance sheet. In the year before QE4 was born, the balance sheet averaged just $3.9t. So the Fed’s effective monetary base underlying the US-dollar supply is now 2.2x higher. That’s super-bullish for gold going forward.

During that same pre-QE4-year, gold averaged $1,337. To rise proportionally with that colossal flood of new money, gold would have to soar up near $2,980! That’s a heck of a lot higher from recent prevailing $1,800ish levels. And don’t tell gold-futures speculators, but tapering is not tightening. This recently-doubled QE4 tapering just slows the pace of monetary growth, it doesn’t unwind a single dollar of QE4.

When the Fed buys bonds with QE, that money is literally created from nothing on purchase. The bonds move to the Fed’s balance sheet, while that new money paid is transferred to the bond issuer. In QE4’s case, 2/3rds of that new money was used to monetize US Treasuries. The US government immediately spent that $3,528b, injecting that money into the US economy which fueled the raging price inflation today.

Slowing and stopping QE bond buying leaves all that new money still sloshing around the economy. QE can only be reversed through quantitative tightening, which means the Fed actually sells the bonds that it previously bought. The money paid to the Fed is destroyed, reducing its balance sheet and the monetary base. This Fed won’t risk unwinding its trillions of dollars of QE4 through QT, as that would crash the stock markets.

Several years after QE3 bond monetizations ended, the Fed tried QT starting in Q4’17. The FOMC had $3.6t of new QE money to reverse, and gradually accelerated QT over the following year. But QT is the death knell for QE-levitated stock markets. Mostly in Q4’18 when QT hit full-speed, the flagship S&P 500 stock index collapsed 19.8%! Unable to stomach a healthy rebalancing bear market, the Fed capitulated.

It soon started slowing QT, which was fully stopped years ahead of schedule by September 2019. Then just a month later, the Fed spun up QE4. QE3’s prematurely-truncated QT only added up to $825b, less than a quarter of the $3,618b of QE the Fed should’ve unwound. The Fed won’t risk collapsing the stock markets by trying QT again. So that colossal $5.0t of freshly-conjured QE4 money will stay in the economy.

Way too scared to start unwinding QE4 through QT, Fed officials are instead telegraphing tightening by hiking rates while the Fed’s mammoth balance sheet remains intact. At mid-December’s uber-hawkish FOMC meeting, individual Fed officials’ federal-funds-rate projections soared dramatically higher. They went from expecting barely one rate hike in 2022 three months earlier to forecasting fully three starting next spring.

And those three in 2022 are followed by three more in 2023, making for a full-on rate-hike cycle! Fed officials are finally worried enough to start fighting this rampaging inflation beast their extreme money printing unleashed. So gold more-than-likely faces a new rate-hike cycle over the next couple years or so. But this cowardly Fed will halt rate hikes fast if the stock markets fall far enough, probably near 20% like during QT.

Traders often assume Fed rate hikes are bearish for gold, primarily because they tend to boost the US dollar which gold-futures speculators often trade in lockstep opposition of. But historically gold has fared really well during Fed-rate-hike cycles. The last one ran from December 2015 to December 2018, when the Fed hiked its federal-funds rate nine consecutive times for 225 basis points total! Yet gold climbed anyway.

Over that exact span it rallied 17.0% higher. Some years ago I did a research project analyzing how gold performed through all rate-hike cycles since 1971. There were 11 preceding this latest one, which was the 12th. During the exact spans of all 11 earlier ones, gold averaged great 26.9% absolute gains! But the majority 6 of those 11 where gold climbed were far better, with gold averaging huge gains of 61.0% each!

While gold did fall during the remaining 5, its average losses were asymmetrically way smaller running just 13.9%. I last updated that research thread in a March 2017 essay, analyzing gold’s performance during Fed-rate-hike cycles in depth. That depended on two key factors, how gold is priced leading into rate-hike cycles and how fast the Fed tightens. Gold entering relatively-low and gradual hikes are the most-bullish.

This coming 13th Fed-rate-hike cycle of the modern era should tick both boxes. Gold remains relatively-low compared to its August 2020 peak of $2,062, and is far from overbought after mostly grinding sideways-to-lower ever since. The FOMC is scared of being blamed for tanking these fragile stock markets, so it won’t hike fast. Fast means individual hikes over a quarter-point, or acting between normal FOMC meetings.

At worst these coming rate hikes will hit at a fairly-slow once-per-FOMC-meeting cadence. And they will exclusively be the smaller quarter-point increases in the federal-funds rate. Quarter-point hikes done at consecutive FOMC meetings aren’t a problem for gold. That last late-2015-to-late-2018 rate-hike cycle saw streaks of three and later five consecutive rate hikes, yet gold still had no problem rallying on balance.

Fed rate hikes are generally bullish for gold because they are bearish for stock markets. As stocks roll over on Fed tightening, gold investment demand surges for prudent portfolio diversification. Gold usually rallies on balance during material stock-market selloffs, making it an essential counter-moving portfolio stabilizer. And these lofty stock markets are in a world of hurt when the FOMC finally starts hiking rates again.

That gargantuan $5.0t of money printing during QE4 enormously boosted the stock markets. At best in late December, the S&P 500 had skyrocketed 114.2% since March 2020’s stock panic. It is certainly no coincidence those massive gains nearly exactly mirrored the Fed’s 111.4% balance-sheet ballooning during that timeframe! The stock markets depend on the excess liquidity spawned by Fed-balance-sheet expansion.

Because the S&P 500 was rapidly catapulted higher on the Fed’s monetary largesse, corporate earnings didn’t have the chance to catch up with lofty stock prices. Entering December, the 500 elite stocks in that leading benchmark averaged trailing-twelve-month price-to-earnings ratios way up at 32.7x! That is well into bubble territory, which starts at 28x historically. It is twice the century-and-a-half average fair-value at 14x.

Dangerously-high bubble valuations in record-high stock markets are exceedingly-risky entering a Fed-hiking cycle! Even though the Fed’s balance sheet won’t be shrinking through QT, higher prevailing rates squeeze both earnings and multiples investors are willing to pay. Corporations are deep in debt after the Fed ran a zero-interest-rate policy for seven years before that last hiking cycle then again since March 2020.

Higher federal-funds rates drive the interest carrying costs of debt higher, eroding profits. That in turn forces valuations even deeper into bubble territory. And with that $5.0t of QE4 money printing remaining in the economy even after this turbo taper ends, serious inflation will persist. That is even more damaging to overall corporate earnings, as it shrinks them universally regardless of debt loads companies are carrying.

Rising general price levels force input costs higher, leaving corporations with two bad choices. They can eat higher costs, which directly cuts into their bottom-line profits. Or they can attempt to raise their selling prices to pass along their higher costs. But customers can balk at price hikes, choosing to buy less or looking elsewhere for suitable substitutes. That results in lower sales which are amplified by lower earnings.

So these already-bubble-valued stock markets face fierce fundamental headwinds from Fed rate hikes and the terrible inflation unleashed by the Fed more than doubling its balance sheet. That means a major S&P 500 correction approaching 20% or a long-overdue bear market exceeding that is highly-probable during the Fed’s next rate-hike cycle. Weaker stock markets fuel much-stronger gold investment demand.

Every investment portfolio should have some gold exposure for diversification. For many centuries if not millennia, the minimum recommended allocation to gold has been 5% to 10%. Given stock markets’ risky outlook, 20% would probably be more prudent today. But thanks to the hyper-complacency driven by the Fed’s huge QE4 stock-market levitation, American stock investors’ collective gold allocations are close to zero.

Entering December, the combined holdings of the leading and dominant GLD SPDR Gold Shares and IAU iShares Gold Trust gold exchange-traded funds were worth $85.4b. That was just 0.2% of the collective $41,932.8b market capitalizations of all S&P 500 stocks! This proxy reveals radical underinvestment in gold. If the coming market turmoil even pushes that to 2.0%, gold would soar on those huge capital inflows.

When stocks seemingly do nothing but rally forever on endless Fed money printing, investors don’t care about prudent portfolio diversification. But when stocks start falling significantly, investors seek safe-haven alternative assets led by counter-moving gold. And interestingly the odds of stock markets falling sharply in coming months are surging. Traders are going to test the Fed to see how much selling it can bear!

Fed officials are always worried major stock-market selloffs will slow consumer spending enough to drive recessions or even depressions. As stock prices fall, people feel poorer and pull in their horns. That cuts into corporate sales and profits, eventually forcing layoffs and exacerbating that downward spiral. So the Fed has a long history of halting tightening once stocks fall far enough to risk a cascading negative wealth effect.

Over this past decade, the Fed has stepped in to stabilize stock markets once they sold off between 10% to 15%. That included both jawboning about easing and actually changing policies to be easier. The March 2020 stock panic where the S&P 500 plummeted 33.9% in less than five weeks scared the Fed so much it launched QE4, the biggest money-printing binge in world history! The so-called “Fed put” is alive and well.

Sizable stock-market selling is likely in coming months until Fed officials abandon tightening, revealing the strike price in SPX-drawdown terms for the Fed Put. That could mean pausing the QE4 turbo taper, delaying the imminent rate-hike cycle, putting it on hold if it is already underway, or maybe even ramping back up QE4 bond monetizations. Any of these easings will hammer the US dollar, fueling massive gold buying.

The biggest beneficiaries of much-higher gold prices ahead are the fundamentally-superior mid-tier and junior gold stocks. They rallied sharply with gold into mid-November, but were dragged back down to their stop losses by a bout of heavy gold-futures selling. Our stoppings averaged out to neutral, fully recovering our capital. So we’ve been aggressively redeploying buying back in low in our weekly newsletter.

If you regularly enjoy my essays, please support our hard work! For decades we’ve published popular weekly and monthly newsletters focused on contrarian speculation and investment. These essays wouldn’t exist without that revenue. Our newsletters draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks.

That holistic integrated contrarian approach has proven very successful. All 1,247 newsletter stock trades realized since 2001 averaged outstanding +21.3% annualized gains! Today our trading books are full of great fundamentally-superior mid-tier and junior gold, silver, and bitcoin miners to ride their uplegs. Their recent realized gains into stoppings have run as high as +63.3%. Subscribe today and get smarter and richer!

The bottom line is gold’s turn to shine is coming. This leading alternative asset’s secular bull is set to resume with a vengeance in 2022 and beyond. The Fed is leaving all the many trillions of new dollars it conjured up during QE4 in the economy, where they will continue to bid up prices driving raging inflation. Gold will ultimately rise proportionally to reflect a more-than-doubled money supply, climbing to way-higher prices.

Fed-rate-hike cycles are no threat to gold either, as it has averaged strong gains through all dozen during modern times. Rising rates really damage stock markets, where persistent weakness fuels strong gold investment demand. And stock-market downside risks are serious with these bubble valuations driven by all that QE4 money printing. This is a fantastic environment for gold to return to favor as the best portfolio diversifier!

Adam Hamilton, CPA

December 31, 2021

Copyright 2000 - 2021 Zeal LLC (www.ZealLLC.com)