The market’s demolition that I’ve been talking about has begun. Zero Hedge asked the question on Thursday, “How bad is it?” and provides Morgan Stanley’s answer:

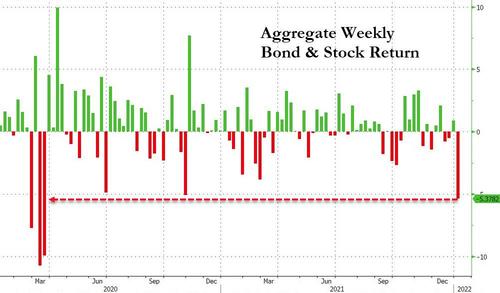

Just how bad was yesterday’s market rout [Thursday’s]? According to quants at Morgan Stanley, it was worse than every selloff in the past 5 years, including the March 2020 crash….

…Flows were aggressively for sale post 2pm when the FOMC Minutes hit, with signs of selling from both institutions and retail…. S&P 500 futures Trade Pressure hit negative $13 billion, the most for sale since at least 2016.

Morgan Stanley’s quants write that whether investors overreacted today or there is more to come will depend on whether yields continue to rise… and if rates do move higher, the drawdowns in equity indices could only be 40 to 50% done if history is a guide.

Of course, the numbers in that last line about how much more stocks may fall are based on how high Morgan Stanley thinks bond interest rates might rise. I think they will rise more than Morgan Stanley thinks over time as the Fed continues to taper and moves away from being the solitary whale that has long rigged treasury bond prices.

Or as MarketWatch put it:

It has been a withering start for government debt so far in 2022, but the extent to which bonds have come under pressure to start the young year is, perhaps, best exemplified by the downturn in the exchange-trade funds that offer exposure to fixed-income…which seems relatively mild until you considered the decline would amount to the steepest slump to start the first five sessions of a calendar for the ETF since it was launched nearly two decades ago. The previous worst start to the year for the fund was 2009.… the 10-year yield…rose to as high as 1.8% on Friday, adding to a roughly 24-basis point gain in the prior four trading sessions.

2009. Not exactly an auspicious year. Regardless, here you see the exact securities/equities tug-o-war playing out that I have been saying would kill the stock market bull as inflation forced the Fed to taper and then taper faster, and the Fed has BARELY BEGUN to back out of treasury purchases, thereby freeing up real market forces to price inflation into bond interest rates. So, the ride has just begun!

The recent rise in rates…follows minutes from the Federal Reserve’s December gathering that signaled the central bank’s intention to take a more hawkish tack in monetary policy…. Fixed-income investors are penciling in prospects for an interest-rate increase by the Fed starting in March, when the central bank is on track to have fully wound down its monthly asset purchases…. On top of that, San Francisco Fed President Mary Daly on Friday said she could imagine starting to shrink the balance sheet after “one or two hikes.”

Then, as ZH wrote again on Friday,

Well, we are finally here: 2022 has arrived and the rate shock that BofA’s bearish chief investment strategist Michael Hartnett has prophetically been warning about arrived right out of the gate, and with a bang as both nominal and real yields spiked sharply higher in just the first week of 2022. And unfortunately, if Hartnett’s vision for the rest of 2022 is as accurate as it has been so far, it’s going to get much worse.

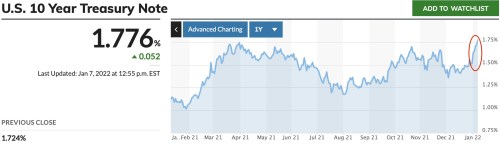

So, even though the taper has barely begun, you can see that the benchmark 10-year US treasury bond is already repricing upward at the fastest clip we’ve seen in a long time:

Hitting 1.8% intraday, the 10-year struck its highest mark in two years.

With the Fed still consuming around $100 billion in bonds a month, there is still a long way to go before we are entirely back to actual market pricing, free of the Fed’s rigging, where the bond market can price in all the inflation it believes is coming. (And shorter-term treasury notes and bills are likely to feel the pinch in rising yields (falling prices) even harder, as most investors will likely believe inflation is a story for the next year or two, not for the next ten.)

So, the good news for stocks is, they may have a little time left (but a volatile time) because there will be three months of tapering plus time to unwind Fed gimmicks, such as their $2 trillion in reverse repos, before real market setting of bond interest (true price discovery in bonds) is fully back in play. However, each step along the way allows more true pricing for inflation without Fed rigging. And there, the bad news is, we’ve just started moving back to real market pricing for bonds, and already the stock market is trembling like a building ready to collapse, due in large part to the slight amount of bond yield adjustment for inflation that has already begun.

Bonds pay a lot of attention to inflation. Bonds compete against stocks. Bonds have months to go before they are fully free of Fed interference in order to fully price in inflation that already exists. So, there is a lot of room left to fall, but the repricing has begun.

The tipping point has been reached

As I wrote back in November,

We have just entered those days of heady inflation that I have said will kill the stock market and bond funds. There is a tipping point at which inflation and the interest changes that respond to inflation matter, but it has never been a clearly defined point.

Inflation has now hit the level that is forcing the Fed to respond, as I’ve argued it would, and the Fed’s response will be a game changer, but it is a graduated response, so it has no clear tipping point. If the Fed simply ended its massive QE, the market would tip right away, but the Fed is tapering its response to inflation, as we all knew it would. The taper has begun and will continue because the Fed cannot back down due to inflation. The market, however, is still blind from years of believing the Fed always has its back to all that really means.

“The Stock Market Does Have a Tipping Point Where Bond Interest and Inflation Both Matter A LOT“

We have already reached that point that “matters a lot.” The Fed didn’t have to get more than barely started on its taper, and we are already seeing how just a little repricing of inflation into bond interest — even when the Fed is still the major treasury buyer — is enough to start tipping the bond market and stock market over.

As I clarified in that article and will say again now,

I’m not saying the market will crash right away. Inflation and the Fed tapering that inflation forces into place do their work over time, and the tapering show has only just begun.

That is to say, the crash will likely play out over a longer time frame than the steep crash we saw in 2020, so it will be awhile before you can call this a “crash.” Yet, we are seeing things start to tip abruptly already. How,, then, can one estimate how long the crash will play out?

As suspected, the stock meltdown has begun in the market’s highest-flying (most out-of-touch) sector. Tech stocks and the Tech-heavy NASDAQ are the parts of the market going over the waterfall. As I wrote a couple of days ago in my comments to Lindy, one of the regular readers here, just before the NASDAQ made its sharp turn downward:

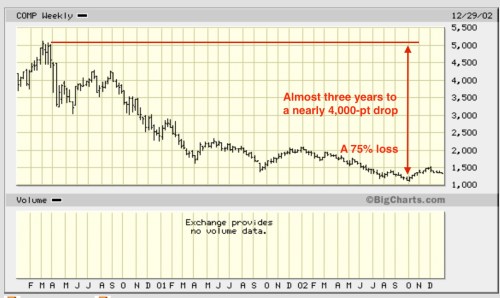

I have been thinking for some time stocks will most likely unwind as they did in 2000 with the high-tech, high-fliers coming down first and worst (hence, my calling that out in the article title). in 2000 and following we saw the gravity of those deeply descending top stocks eventually pull the whole market down; but the biggest crash zone was, by far, in the NASDAQ.

Comments to “Bonds Buckle, Top Stocks Stink“

I also wrote in the “Tipping Point” article,

Sentiment is still highly charged with mind-numbing testosterone and blind faith in the Fed. Being effectively braindead doesn’t mean investors won’t maintain their bullheaded stampede uphill awhile longer, but inflation will still relentlessly continue to pull like gravity on the market, and its gravity will keep increasing. No bull can run uphill against increasing gravity forever. Their run only means the market will have all the further to fall in order to catch down to reality.

Yet, Zero Hedge wrote today,

What is remarkable is that we are already seeing deep selloffs (recall that more than 40% of the Nasdaq is down more than 50%)...… and yet the Fed is yet to hike rates.

For the NASDAQ 100, in fact, this has been the worst start to a year since the 2000 dot-com bust. For stocks and bonds combined, it was the worst week since the crash of March 2020.

On the bond side of the world, it was a bloodbath with the belly clubbed like a baby seal.

So, the nova has begun, but bear in mind that the huge dot-com bust of 2000 was really the huge crash of 2000-2002. It took a almost three years for the NASDAQ find its bottom with a number of big jolts and a few bear-market rallies along the way. One domino hits another, maybe one of them wobbles a bit before it tips into the next, etc. It’s a complex interwoven system with a lot of massively heavy parts. They don’t always break down like the stock market did in 2020 when a tiny virus hit the earth like an asteroid, taking out a lot of parts at once because of how we responded by shutting down the most of the national economies of the world.

How deep can this fall go if it does all slide at once?

As I wrote in the Patron Post that I eventually shared with all readers because of its key importance on this very matter that is now playing out before your eyes,

As you ponder where the stock market could wind up when this mess blows apart, here is one possible landing point to keep in mind based on the most recent points of truly hard support:

“The Big Blindspot that Will Bite Bonds and Stocks in the Butt“

That was for the S&P 500. The NASDAQ, of course, has further to fall. Just take a look at what it did when it was this ridiculously overprice in a similar melt-up back in 2000:

It took almost three years to shake all the nonsense out of the high tech back then, and the market is full of just as much frothy nonsense now as it was then. Think about Tesla being valued as the largest car maker by far by value, when it is one of the smaller makers with the least experience and least capital in factories, patents, etc. Think about all those NFTs selling dreams that are less substantial than a puff of air or a baseball card for tens of thousands of dollars. We essentially have celebrities selling their farts as tradable assets.

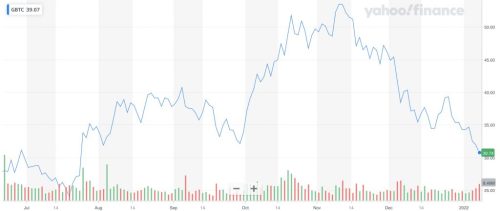

Just look at the roller coaster ride crypto currencies are taking right now, which are traded on the market as ETFs where they have pushed up market values. It’s been a bloodbath for these exchange-traded funds since November:

Bitcoin ETF on Yahoo Finance

Bitcoin ETF on Yahoo Finance

Already in another one of their own bear markets, cryptos have proven to be highly speculative vehicles. Many of them, like those promising tech companies that made no actual profits or merchandise back in 2000 will nova into their own collapsing cores. A few companies survived the rumble and the tumble in 2000 and went on to do very well, but most disappeared in the dust of time and space. The same will likely be true this time for the hoard of crypto currencies.

In terms of how far all of this can fall, I’m not suggesting the Fed will ever let its beloved stock market, in which its board and committee members are highly and infamously invested, fall that far without trying to rescue it; but the Fed is in a tougher spot than it has been in for decades because it can’t leap back into QE this time without increasing inflationary pressures. Interest rates are rising on their own, and the Fed can’t suppress them just by speaking targets into being if it remains out of major bond purchases, which have been its heaviest stimulus and interest-management tool. Soaring interest in treasuries will affect interest in many things, and this long bull market for stocks has been largely built on cheap credit for funding buybacks. Those days are now rapidly winding up due to inflation’s effects on bonds and on the Fed.

Anything the Fed does to save the stock market in this situation makes inflation worse. That, as I pointed out in that patron post is the key reason this time is different. That is the trap the Fed set for itself over time. When do you remember a time when the Fed was tapering or tightening as the economy declined when the Fed also had to battle scorching-hot inflation?

The emphasized part in that last line is the key difference between now and any “then.”

Liked it? Take a second to support David Haggith on Patreon!