- Policy Error

- Demand-Side Inflation and Helicopter Money

- Supply-Side Problems

- The Limitations of Monetary Policy

- Fiscal Tightening

- Rare Opportunity

- The Holidays and Washington DC

Milton Friedman famously said inflation is “always and everywhere a monetary phenomenon.” He was right but that short statement doesn’t fully explain how inflation works. It has other causes, too. The period in which he did his most famous research showed inflation was clearly a monetary phenomenon, but I’m not sure he would make the same assertion today.

Last week’s What Really Caused Inflation letter generated an unusual number of questions and comments. That tells me I need to go a little deeper. We know inflation by the higher prices it generates, but exactly how it flows through the economy isn’t always obvious.

Before we begin, let me note we have reopened the Alpha Society to new members, as we do once a year. You can read more about it at the end of this issue. Now, on to our topic.

The current episode of inflation we have is unlike anything we’ve seen in modern history. It has three component causes, all equally culpable.

First, there is the Federal Reserve’s easy monetary policy. Quantitative Easing caused asset price inflation in both financial assets and home prices. Low interest rates have spurred increases in home prices, rental property prices, new/used cars, and have clearly contributed to the financialization of the economy.

Low interest rates encouraged investors, both small and large, to reach for yield and take more portfolio risk. Small investors in particular have moved into riskier stocks. If we have a bear market in an inflationary cycle, it will devastate the retirement portfolios of many retirees and those who are close to retirement.

Pretty much no one (except frustrated buyers) is upset when their home or stocks go up in price. Clearly, the Federal Reserve has made that a feature of their policy. They think of it as financial stability.

The problem is that there are many aspects of inflation monetary policy can’t control. We will continue seeing headline CPI and PCE inflation numbers well above their 2% target (which is in and of itself destructive) which means that if the Federal Reserve wants to maintain its inflation-fighting credibility, it will have to go further than anyone thinks now, or lose that credibility. And that risks (gasp!) a recession.

Below is from a Washington Post editorial by Larry Summers on that very point (emphasis mine).

“A recognition of the need to change direction, as manifest in the Federal Open Market Committee statement and Chair Jerome H. Powell’s news conference Wednesday, was necessary but not sufficient for successfully achieving price stabilization and sustained growth. I see grounds for substantial concern in both the intrinsic difficulty of the task at hand and in misconceptions that the Fed still seems to hold.

“There have been few, if any, instances in which inflation has been successfully stabilized without recession. Every U.S. economic expansion between the Korean War and Paul A. Volcker’s slaying of inflation after 1979 ended as the Federal Reserve tried to put the brakes on inflation and the economy skidded into recession. Since Volcker’s victory, there have been no major outbreaks of inflation until this year, and so no need for monetary policy to engineer a soft landing of the kind that the Fed hopes for over the next several years.

“The not-very-encouraging history of disinflation efforts suggests that the Fed will need to be both skillful and lucky as it seeks to apply sufficient restraint to cause inflation to come down to its 2 percent target without pushing the economy into recession. Unfortunately, several aspects of the Open Market Committee statement and Powell’s news conference suggest that the Fed may not yet fully grasp either the current economic situation or the implications of current monetary policy.”

Summers is quite bold in pointing this out. He reminds me of the running trope in the Harry Potter series where one cannot utter the name of Voldemort out loud. Using the “R” (recession) word is just not done in polite circles. But Summers (and other lesser lights) is right to call attention to the risk of Federal Reserve policy.

To be clear, I think the first policy error happened late last year when the Fed didn’t begin to reduce quantitative easing and prepare for gradual rate increases. Now they’re well behind the curve. Their belief that inflation is transitory rhymes with Arthur Burns’ beliefs back in the ‘60s and ‘70s. Summers points out the poem’s final stanza may be a recession, just as it was back then.

Demand-Side Inflation and Helicopter Money

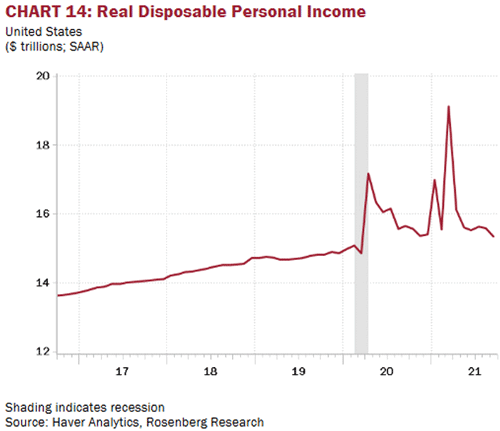

Governments around the world responded to COVID-19 in different ways. Many provided support to workers who lost pay because their employers had to close. The US did so in a particularly haphazard way. It wasn’t exactly helicopter money, but we launched a bunch of different programs that gave some people more than they needed. Hence the spikes in this chart.

Source: Rosenberg Research

If we had simply kept everyone stable through the crisis, the line would have continued on the pre-COVID trend. Instead, the government created three peaks which correspond to stimulus payments sent to each American (except certain high-income earners) in April 2020 ($1,200 per person), January 2021 ($600), and March 2021 ($1,400).

Now the line is roughly back where it should be, but those injections had giant effects. This year’s jump in inflation followed the third and largest spike. Let’s also note this was a bipartisan effort in 2020. The first two payments passed a Democratic House and Republican Senate, and were signed by President Trump. Indeed, he wanted that second one to be $2,000. Senate Republicans forced him to settle for $600. Democrats then took the Senate and added $1,400 to reach the $2,000 they and Trump originally wanted.

Note that in February as the bill was being discussed, Larry Summers was the skunk at the spending picnic, just as he is now. He was all over the media saying the $1.9 trillion bill would cause inflation, as it did, which causes me to consider his current op-ed more carefully. He isn’t saying tighter Federal Reserve monetary policy will cause a recession, but the Fed will have to be very skillful (read: lucky) to make a soft landing.

This is one reason why Sen. Joe Manchin is holding up the Democrats’ “Build Back Better” legislation. It has some good features, but with inflation already severe and worsening, now is not the time to throw more fuel on the fire.

A recent analysis by the nonpartisan Committee for a Responsible Federal Budget pointed to both inflationary and deflationary features within the latest BBB version, finding them on balance mildly inflationary.

“Overall, Build Back Better includes elements that will boost inflation and elements that will contain inflation. On net, we and other experts believe the most likely effect will be a small and temporary increase in inflation.

“However, there is a risk the modest inflationary effect of Build Back Better would build on existing inflationary pressures, potentially de-anchoring expectations and increasing the economic cost of bringing inflation back under control.

“It would be unwise for policymakers to take these risks at a time when inflation is so high already. Policymakers could reduce these risks by modifying the Build Back Better Act with an eye on its inflationary impact, especially by ensuring it is fully paid for in the short and medium terms.” (Emphasis mine.)

CRFB suggests several BBB modifications they think would help. Manchin’s pressure already chopped some of the most problematic features. By the time anything passes—which as of now looks unlikely until spring, if then—it may be even smaller. I hope so, because excessive and poorly planned spending is what created much of this inflation. We don’t need more of it.

That said, I am by no means letting the Federal Reserve off the hook. Repeating myself from earlier, because it is important: The Fed’s Treasury bond purchases and interest rate manipulations facilitated the excess spending. Similarly, their mortgage security purchases propelled the housing boom that is adding to inflation, even if it’s not (yet) showing up in CPI. It’s good they are now slowing the pace but they should have done it a year ago.

We will never know “for sure” the true extent of whether or not the $1.9 trillion stimulus package (financed entirely by deficit spending) contributed to the current inflation problems. That is because of the very unique set of circumstances (at least historically) that led to the supply-side/chain crunch.

Basically, the COVID-19 pandemic caused manufacturers around the globe to shut facilities and/or drastically reduce output. At the same time, the additional payments plus assorted other programs distributed enormous amounts of money to people with a high propensity to spend it on consumer goods. That wasn’t a side effect. It was the intent.

That combination alone would have created giant distortions, but it also came in a situation where spending patterns changed. COVID concerns and restrictions pushed the spending away from services and toward goods, many of which were already in short supply and became more so as demand grew.

Many industries are again producing at full capacity. The problem is that demand, while normalizing, is still robust and producers have to catch up. One way they do this is by increasing prices and passing on price increases they receive. It becomes a vicious spiral.

Here’s the problem. Federal Reserve policy doesn’t help supply chain issues. The semiconductor maker producing mid-level chips is not going to spend billions on another plant for old technology if they believe it will sit idle once this short-term demand spike is satisfied. Ditto for many other industries.

It is going to take time to work through the supply chain issues. For some industries, that will be in 2022. Others will have supply problems into the next year and all of it is inflationary.

Further contributing to inflation and supply chain issues is the very tight labor market. Officially, unemployment is at 4.2%. But there are fewer workers available and they want higher pay. We are clearly in a wage-cost spiral that is only exacerbated by inflation. The average increase in labor costs is still underneath current inflation. If inflation averages 4%+ next year, which it very well could, that is going to mean continuing wage increases which is by definition a major inflation component.

The Fed wants full employment (whatever that is), which they see as duplicating the 50-year low of 3.5% we saw in 2019. I and I’m sure most of my readers remember a time when we thought 4% unemployment was exceptionally good.

The Limitations of Monetary Policy

Depending on your paradigm, rising prices are either a cause or a symptom of inflation. They matter in either case, so it’s important to notice any patterns. But doing so is a problem because we lack reliable, comprehensive data. Our main benchmark, the Consumer Price Index, has numerous limitations. I use it for lack of anything better.

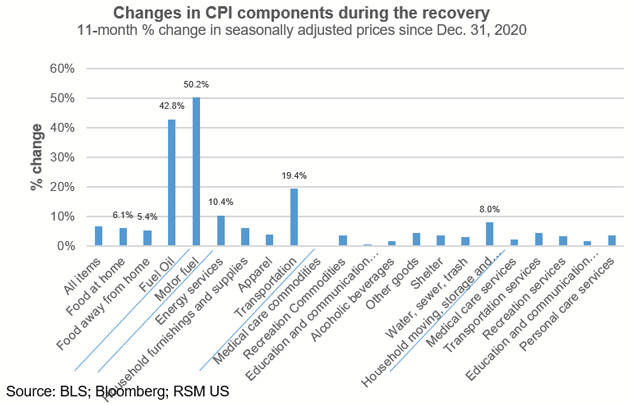

Here is an interesting chart showing CPI change by component for the first 11 months of 2021. Clearly rising energy stands out. But there is more to the story.

Source: RSM

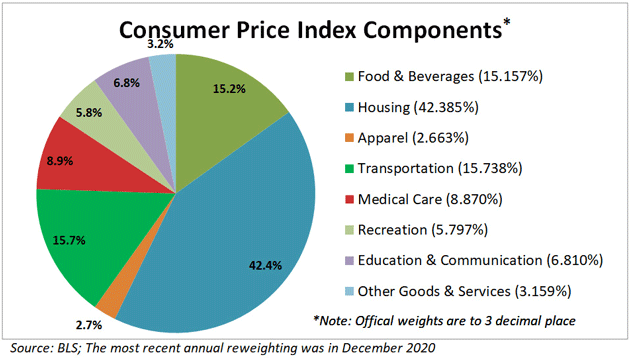

This chart from Doug Short at Advisor Perspectives shows the weighting of CPI components:

Source: Advisor Perspectives

Quoting Doug:

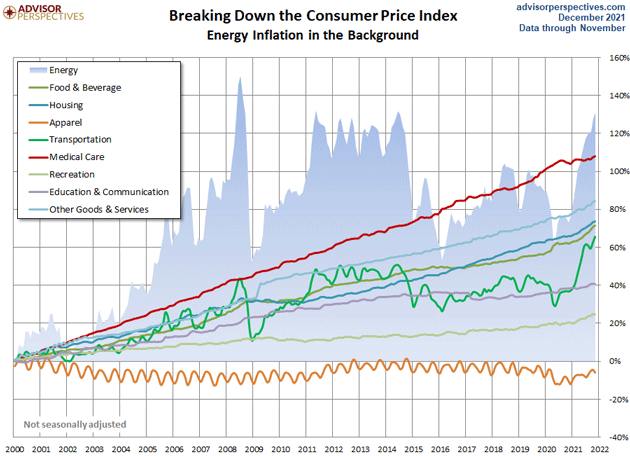

“The BLS does track Energy as a separate aggregate index, which in recent years has been assigned a relative importance of 6.155 out of 100. In other words, Uncle Sam calculates inflation on the assumption that energy in one form or another constitutes 6.2% of total expenditures, 2.8% goes to transportation fuels—mostly gasoline (this is included in the ‘Transportation’ category). The next chart overlays the highly volatile Energy aggregate on top of the eight expenditure categories. We can immediately see the impact of energy costs on transportation.”

Source: Advisor Perspectives

Almost every sector has some component of energy involved, in addition to the direct costs. Typically, those costs are passed on to the consumer in the form of higher (or lower) prices. Higher energy prices filter through the economy in varying ways contributing to spiraling inflation.

Go back and glance at the various components of CPI inflation. How many of those are susceptible to tighter monetary policy reducing their inflation contribution? Some, but clearly not all. A monetary policy reversal will have an impact on everything. That is why it’s going to take a great deal of skill and luck to navigate the economy to a soft landing and not a recession.

So where is all this going? Will high inflation last into 2022? Unfortunately, I think so. But there are a few reasons it could ease significantly.

For one, the year-ago comparisons will start to look better starting in April or so. That won’t mean inflation is actually any lower, of course. It will be purely a perception, but perceptions matter. The belief inflation is worsening motivates the behavior that causes inflation.

Moreover, quite a bit of the stimulus will disappear in the next few months. This week the Federal Reserve picked up the tapering pace. Jerome Powell said they won’t raise rates until the bond purchases get to zero, but some private lenders won’t wait that long. We will see credit card and other variable rates move higher long before the Fed raises its own overnight rates. This will have an immediate impact on consumer liquidity.

Similarly, the enlarged Child Tax Credit, which has been sending hundreds of dollars a month to millions of households, will likely expire at year end. So will certain Affordable Care Act subsidies that had been expanded in previous legislation. These will also reduce consumer demand.

I don’t foresee inflation returning to 2% anytime soon. More likely it will settle at 3%, maybe as much as 5%, with interest rates correspondingly higher. The Fed might tolerate it if real rates could still stay low or even negative. I hope they don’t do that, as it would be a major policy error leading to a more vicious inflationary cycle and eventually what would be a more serious recession.

Jerome Powell will have to make a very difficult choice at some point in 2022. Will he continue to fight the inflation that is affecting the vast majority of American citizens or will he choose to worry more about stock prices?

From the long view, the right choice is to fight inflation and then worry about the stock market. Stocks will recover over time. If Powell refuses to fight inflation he will lose both the inflation fight and the stock market fight. Stocks don’t thrive in inflationary periods (cf. the ‘70s).

Before I close, let me remind you that the window of opportunity to become an Alpha Society member this year is closing in a few days, on December 23.

The Alpha Society is our most exclusive membership service—and the one that is nearest and dearest to my heart.

It was born out of my desire to create an “inner circle” of serious investors. I have watched it grow over the years and mature into, in my opinion, the most diligently researched collection of investing advisories around.

I'm happy to say this year, the Alpha Society is now stronger than ever before.

The Holidays and Washington DC

The next week or so will see several parties in the neighborhood as Puerto Ricans take the holidays seriously. If you are on the island, Shane and I will be throwing a New Year’s Day afternoon party with black-eyed peas, ham, and all sorts of Southern comfort food. Just drop me a note at business@2000wave.com and let me know.

I will be going to the Washington DC area in mid-January for a corporate board meeting where I will sing for my supper. Should be fun.

Next Saturday is Christmas and I plan to send out a short inspirational piece. There will be no issue on January 1 (unless I find something not written by me) and then my first Thoughts from the Frontline will be January 8.

It is the holiday season and typically that means gifts. I hope you enjoyed my “gift” of my weekly letter throughout the year and let me sincerely thank you. Your attention is a far more precious commodity than merely writing. Your gift inspires me and I try to honor it by giving you my best.

It is time to hit the send button and begin thinking about the end of this year and the beginning of next. I always enjoy this time of year as it encourages me to contemplate more deeply than usual.

Have a great week and holiday season! And follow me on Twitter. Here’s to friends and families…

Your hoping Jay Powell gets lucky analyst,

|

|

John Mauldin |

P.S. Want even more great analysis from my worldwide network? With Over My Shoulder you'll see some of the exclusive economic research that goes into my letters. Click here to learn more.