LATEST GOLD CHARTS

When the gold price peaked at $2058 oz. in August 2020 it reflected a full ninety-nine percent loss in U.S. dollar purchasing power over the past century. The gold price has not been any higher since then.

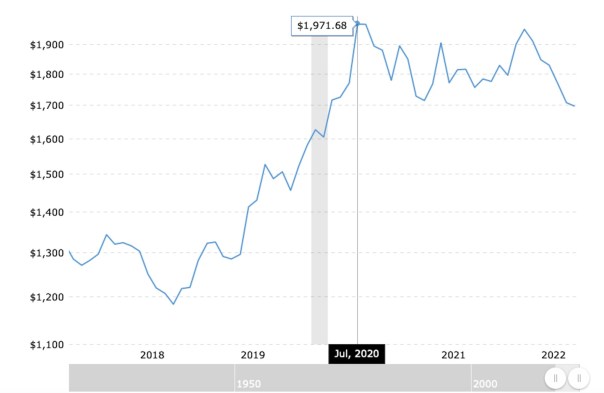

The chart (source) below uses monthly average closing prices and shows gold price action for the past five years…

Gold Prices – 5 Year Historical Chart

After peaking in the summer of 2020, the gold price has moved mostly within a narrow range of $200 oz. ($1700-1900), or ten percent. Essentially, the price has gone sideways within that range. (see Gold Going Nowhere Slowly)

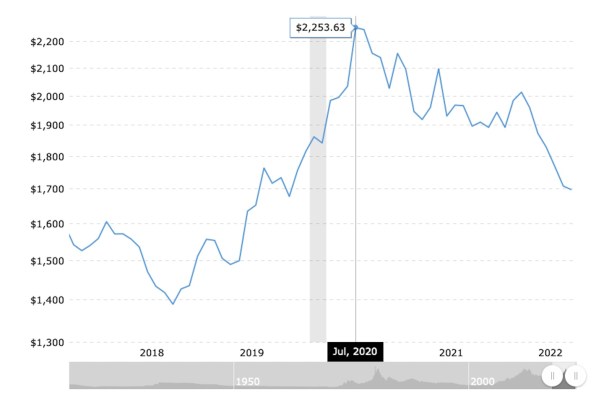

The picture changes materially when we view the same price action on an inflation-adjusted basis…

Gold Prices (inflation-adjusted) – 5 Year Historical Chart

In this chart we can see that the effects of inflation have altered the path of gold prices from sideways to down.

When the gold price surged higher earlier this year it stopped short of its previous all-time high, peaking at $2043 oz. on an intraday basis.

In the first chart the peaks in 2020 and 2022 seem to be nearly identical; and so they are, without allowing for the effects of inflation.

Because the effects of inflation have been more pronounced in the past year and one-half, the peak in March 2022 is now $250 oz. lower than the peak in 2020.

The original monthly peak on the first chart at $1971 (price is marked on the chart) is now $2253 in today’s cheaper dollar, nearly $300 more.

INFLATION-ADJUSTED GOLD PRICES – CONCLUSION

The gold price has been declining in nominal and real (inflation-adjusted) terms since its peak in the summer of 2020. Even if the nominal gold price were static, it would still be declining on an inflation-adjusted basis.

As I said in a previous article (Gold Charts – $1450)…

- Gold appears to have broken below short and mid-term support.

- Slowing of gold price descent could come somewhere between $1500-1600

- Longer-term support for gold could come in at $1450-1475 oz.

Expect the gold price to continue lower for an indefinite period of time.

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!