A little discussion about this thing we call “inflation” after the January CPI report.

A vast majority of people see inflation as rising prices, wages and ‘pushed’ costs within the economy. In other words…

We are all, to varying degrees, taking bites out of the Fed’s excrement.

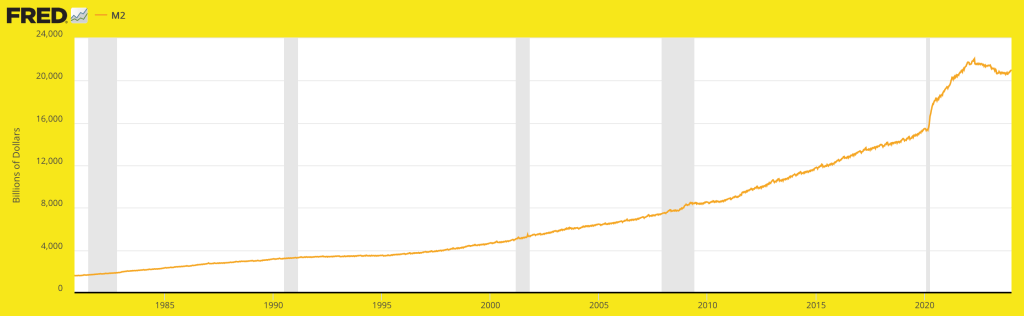

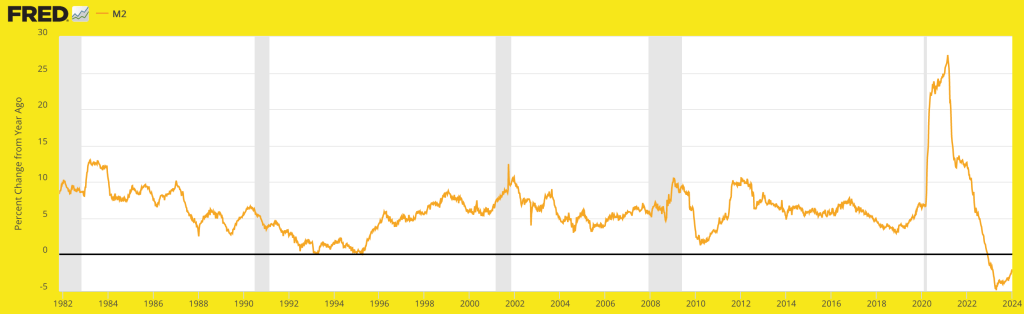

The headlines blare on about CPI, but the inflation problem was created by rapid increases in the money supply. That was the mechanics of inflation’s creation, with too many newly printed currency units seeking out a finite number of assets. That is inflation. Not today’s ‘cost effects’ headlines. This of course is the legacy of our dear monetary leaders, over-schooled in Keynesian theories and eggheads all.

Here is the continuum of the Fed’s legacy, a steadily increasing (M2) money supply that not coincidentally apes the perma-increasing CPI over the long-term; the most recent report for which is causing Tuesday’s market uproar amid intact confidence in (and/or submission to) the great and powerful Fed of Oz.

St. Louis Fed

St. Louis Fed

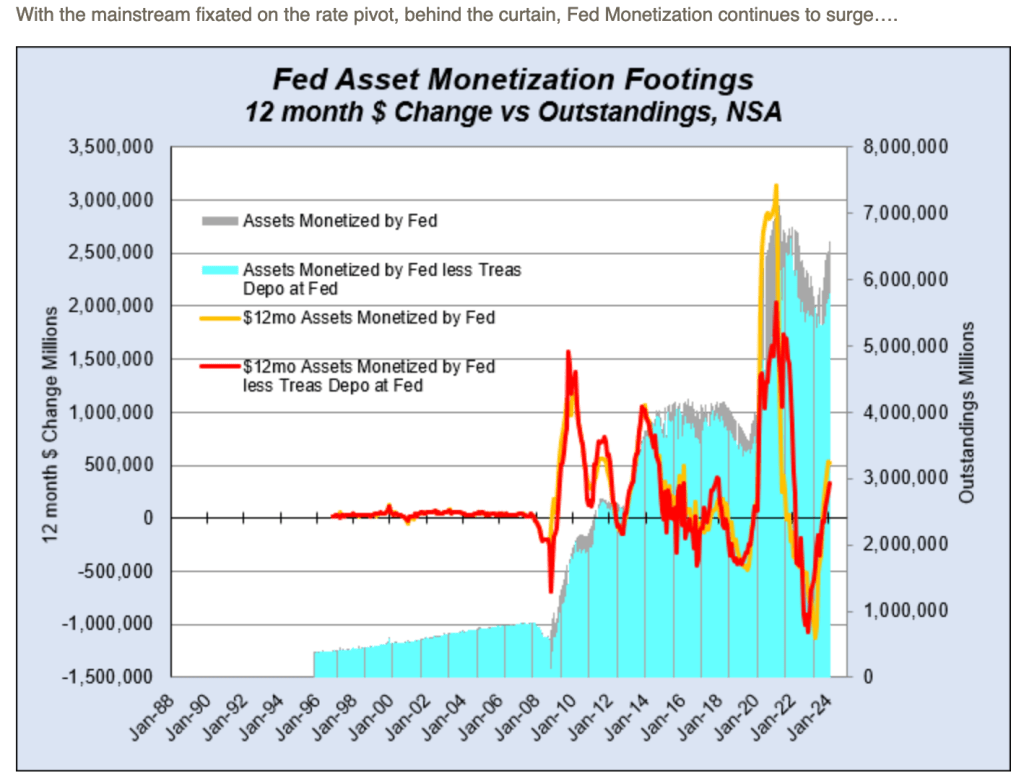

See the little hook upward in M2 of late? Well, consider this input, which was sent to me by NFTRH subscriber and Austrian monetary expert Michael Pollaro back in January:

The implication is that the Fed is dumping messages out of both sides of its orifice. On one side pretending to be stern and hawkish, and out of the other side ensuring that a precipitous decline in inflation does not manifest in an outright liquidity crisis (the other side of the boom/bust cycle that is the product of Keynesian economics gone too far).

Gee, do you think that maybe there is an election year political angle in play?

Aside from the hype of the day, the trend continues to be disinflationary, benefiting the Biden administration currently in power with its Goldilocks overtones, while behind the curtain the wizard regulates and adjusts his knobs and levers to try to steer the Good Ship Lollipop through a tricky maze of rocks just beneath the surface.

As a side note, the Fed is on the surface apolitical, as the same Fed chief oversaw the creation of the inflationary bailout under Trump. It’s actions have tended to benefit power, regardless of affiliation.

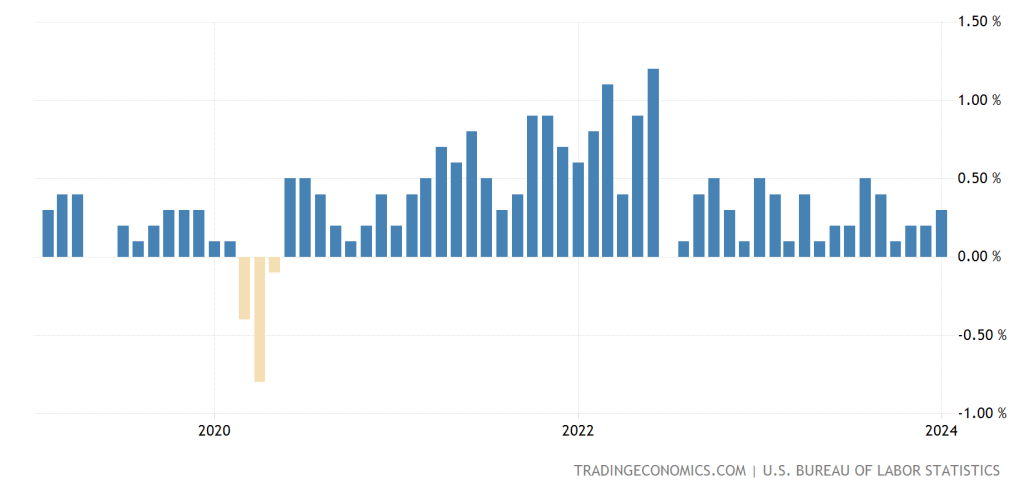

Here is the MoM view of the CPI situation. To see what a liquidity crisis looks like, cast your eyes upon the 2020 situation. That was the trigger that sprang the Fed into (inflationary) action. Period. We called it – and the forthcoming inflation trades – back then in real time and sure enough, inflationary effects, so despised and fretted over to this day, also manifested out of that inflationary action.

TradingEconomics.com

TradingEconomics.com

What action, you ask? Well, the action of M2’s panicked percentage change from the previous year. That’s what action.

St. Louis Fed

St. Louis Fed

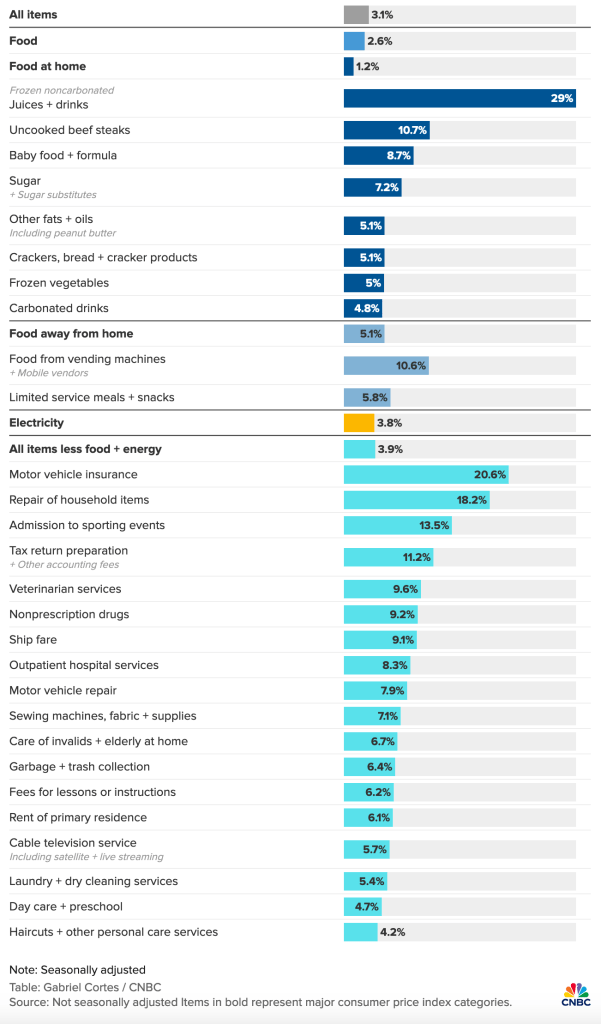

So here we are with the culprits being all the stuff lagging within the economy long after the great and powerful Fed of Oz has apparently (but maybe not really) shifted its focus to inflation fighting. Personally, I have lucked out! I no longer need haircuts because I shave my faulty head of hair myself. Also, I got rid of my garbage contractor because they were such a pain in the ass, service wise, that going to the dump once a week is much easier (and way cheaper). I’m on easy street, I tell you!

All joking aside, this (January CPI components) is the stuff of lag. This is the dreck that clings to the economy years after the Fed rode to the rescue of asset owners by inflating the money supply in epic and historic fashion in 2020.

CNBC.com

CNBC.com

I am not going to sermonize, lecture or screed on. You likely already know the deal if you stay away from mainstream (academic, political and otherwise) brainwashing and simply view the indications of the truth. It’s an election year. Much noise will emanate out of the media’s orifice just as the Fed is discharging contradictory noises out of its orifice.

Central banks (with a big assist from governments’ fiscal actions) created the post-2020 inflation problem. Period. Now as the Fed tries to clean up its huge share of it, not all is as it appears. Not in the headlines and not in the machinations behind the curtain. That goes for government too, obviously.