Investors have been slower than a tank of turtles swimming in molasses when it comes to grasping reality, but they may be getting the message on inflation and the Fed’s fight ahead at last. That said, one should never underestimate the resolve of people to enshrine their wishes as unholy doctrines in order to continue chasing the phantasms of their greed like drunken gamblers in a smoke-clouded casino. This bear market — now well over a year long — has produced many rallies that were exemplary in demonstrating that unattractive quality of the human condition.

News stories across multiple categories of The Daily Doom last Friday screamed the message of inflation — how the Fed’s fight is far from over and how the rising flames of inflation have just turned the market’s Fed-pivot fantasy to falling ashes and how interest rates are likely to rise higher still and for longer, but especially about how much the stock market hates all of that. And, so, the market began to thrash in those paroxysms that finally hit the mainstream press and has begun to descend from its dreams.

In this article, I’ll capture those realizations in the financial media that showed investors were speculating on ghosts of better times and even that the bottom may be falling out again just as we’ve seen with all past bear rallies. These validate the following statements from The Great Recession Blog pushed recently and throughout last year just as stubbornly as the bets that were placed in the stock market, countering a broad current of writers, investors, analysts and economists and even one or two followers of this blog who said the opposite through a good part of the year:

As with Valentine’s Day, the market opened sharply down today on the news of high producer inflation (which drives consumer inflation because costs get passed along), and it is now trying to recover as it did on Valentine’s Day, pretending this won’t engage Pope Powell into further fighting with inflation that will damage stocks with even more interest hikes that make bonds more competitive…..

You may recall … my prediction for a return to rising inflation rates in the early months of 2023 … predicting that a relapse into a double-dip recession this year is virtually inevitable.…

So, there you have it. The Fed is likely, as I’ve been saying for months, to, ONCE AGAIN have to move (not just to larger rate increases like 50 basis points) but to run them out longer because inflation is sticky and will not be backing down as easily as the delusional stock market thinks.

“Stocks Seek New Religion in Effort to Rise from their Decline, but Where’s the Beef?” (February 16, 2023)

Inflation will not resolve to the level the Fed needs to see to back its key interest rate down to a neutral level…. Inflation may rise again in the first few months of the year, pressing the Fed, once again, to tighten to a higher level than either the market or Fed expects.

“2023 Economic Predictions” (January 31, 2023)

I’ve bet my blog on my prediction that inflation will crash both the economy and the stock market, saying I believe with enough conviction that I’ll stop writing on economics if it fails to happen.…

Stocks could be the first car in this great train wreck…. While the Fed is the locomotive in this inflationary disaster, stocks may be the first car behind the Fed to jump the rails….

What I can say with certainty is that inflation will not back down to where the Fed believes it has won the inflationary war as easily as stock investors keep believing.

So, if you are (as would be unlikely for my readers) still in the camp that thinks the Fed will pivot, GET OUT OF IT! It’s a fool’s paradise. The Fed knows better. It knows it cannot, and it has stated it cannot. The inflation war will continue deep into this year.…

“2023 Prediction: The Fed’s Inflation Fight is FAR from over!” (January 24, 2023)

The financial experts didn’t see that inflation was growing…. They didn’t see that inflation was not transitory, even as it kept rising. They didn’t see that failing to predict inflation’s non-transitory rise would force the Fed to tighten even faster and harder…. They didn’t see that reversing QE and sucking money back out of the monetary system would create problems in the bond market. They didn’t see that the combination of inflation fighting and of bond interest soaring would drive the stock market relentlessly into a bear market…. They didn’t see ALL SUMMER LONG that there was no way the Fed would pivot back to loose financial policy…. So, they all kept believing stocks were going to go back up due to a Fed pivot, even as the money that got pumped into stocks got sucked out the financial system….

All of these things they have missed entirely … and are still missing. And that’s a LOT of MAJOR errors! The Fed and all of its pocket politicians and nearly all the writers in financial media and the banks and the brokers keep stumbling along the same horribly mistaken path….

2022 has, in fact, been the boldest display of proven Fed error, as well as stock-market error and greed and delusional thinking we’ve seen in decades. And, when it all comes down, they will, again, say, “No one could have seen all of this coming….”

I’m showing there is ample evidence to believe my broader prediction about this market remaining firmly in a bear market that has a lot further to fall remains fully intact so far.

“The Bear is Uncaged … Again” (December 6, 2022)

And, so, I say again, as others joined in last week, this market has plenty of room to fall again.

Talking heads chime in

Last week it finally seemed everyone started to say the latest rally was built on fantasy about the Fed’s inflation fight ending soon, so rally was destined to crumble into dust. Some said it more strongly than others:

The market finally recognizes inflation is not going away, says David Rubenstein.

Stock market reversal shows shift in sentiment that will be difficult to weather, says Katie Stockton

JPMorgan CEO Jamie Dimon on the Fed: We lost control of inflation…. “There’s been a sea change.”

They join the smaller chorus of regulars who understood all along

Others who are often, though not always, on the same page as I am also said it seemed clear the market was changing due to inflation relentlessly beating against its head:

“Disinflation” Hoopla Sunk by Spiking Prices in January….

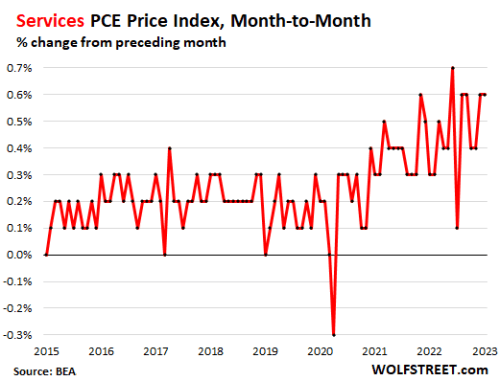

Powell has been pointing at the services components of the PCE price index as a hotbed of inflation. And the PCE price index for January, released today by the Bureau of Economic Analysis, was a horror show on all counts.

Not only did all the relevant measures get a lot worse in January, but the prior three months, October through December, were revised higher…. The whole thing throws a lot of cold water on the “disinflation” hoopla…. There is just absolutely no slowdown in sight. This is the center of the horror show:

Wolf Richter goes on to also note,

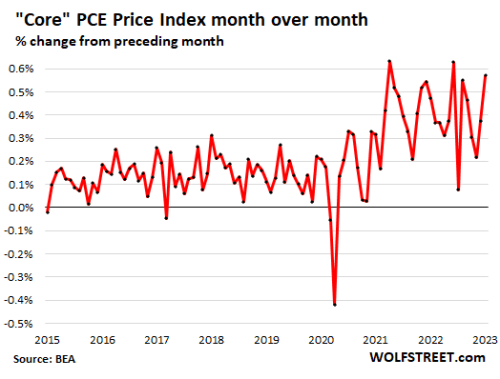

The Core PCE price index turned red-hot again.

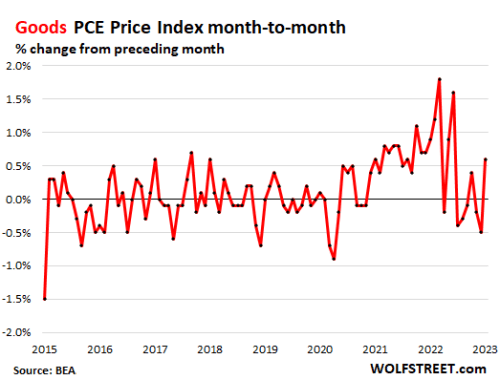

This jump was largely driven by red-hot inflation in services. But this time, goods prices rose too, after having declined in prior months.

The month-to-month down-trend in October and November was just a classic inflation head fake:

Goods prices had been the force that had pushed down on inflation, while services pushed up inflation. But what we’re now seeing is that goods prices are rising again, and they no longer push down on inflation, and services are pushing up inflation unopposed:

And, so, the market is once again getting its head turned around with a strong dose of reality, and that’s not likely to end well for the intentionally delusional, particularly the retail investors who drove most of the last rally.

Both the headline and core PCE Deflators printed hotter than expected, rising 5.4% YoY and 4.7% YoY respectively ( +5.0% and 4.3% exp respectively)….

So much for that ‘smooth’; ride lower in inflation that everyone hoped for.

Finally, we note that the market has dramatically repriced its inflation expectations (inflation swaps) in recent weeks, now at their highest for mid-2023 since November….

It seems the market may be on to something… and that’s not good for markets.

I don’t suppose this means the market morons have finally gotten the point for good about the durability of the Fed’s inflation fight and its continuing impact on markets, but it provided a noteworthy turning point for the moment where, once again, these rally rioters got a lump on the head for being so unrealistic. The lumps from ceiling bumps will continue until they finally settle down and get real. The market will catch down to the reality of this badly damaged and still-falling economy … whatever it takes.

Liked it? Take a second to support David Haggith on Patreon!

![]()